- Tron’s low fees and speed — as well as its ties to Tether and Binance — have made it the dominant blockchain in Lebanon.

- Retail users and brokers alike, the vast majority using Binance, pass each other Tron addresses as a matter of course.

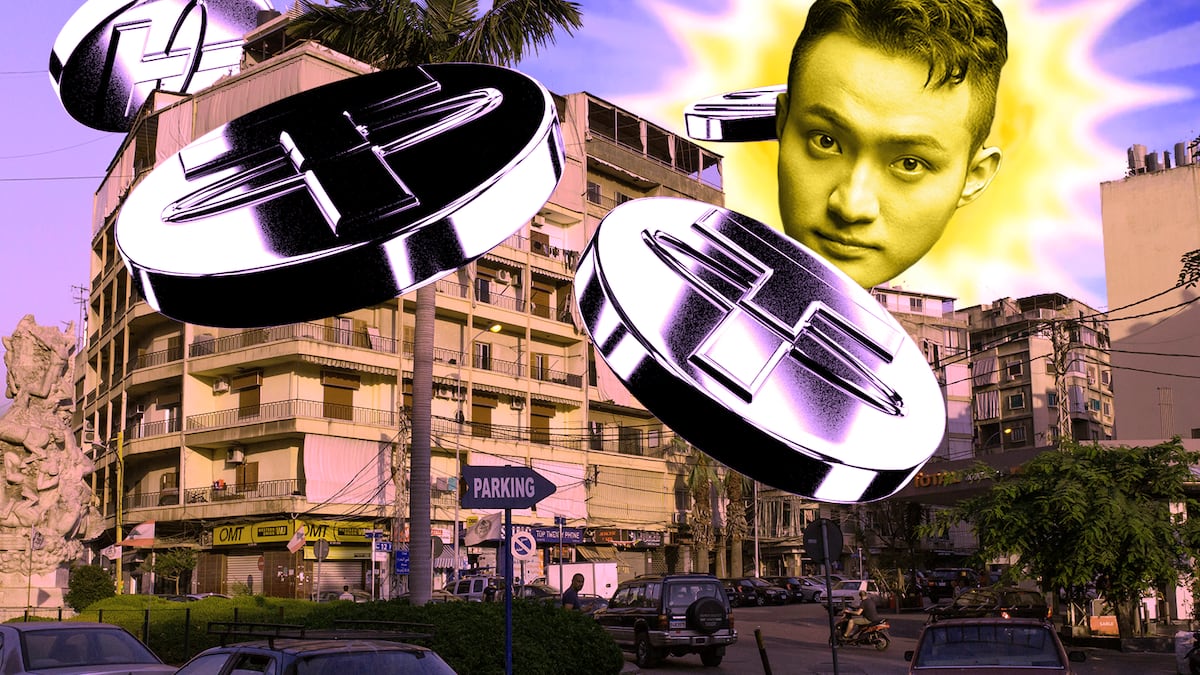

- Worries over Justin Sun, Tron’s controversial founder, don’t register in Lebanon, where “99% of people don’t know who he is.”

In Lebanon, the vast majority of transactions in dollar-pegged stablecoin Tether — USDT for short — are carried out on the Tron blockchain, despite controversy surrounding its founder Justin Sun and other, cheaper options being available.

About 49% of all Tether in circulation is on Tron, according to data from DefiLlama. Down from 52% earlier this year, it’s still the largest share of any chain. The statistics find reinforcement in the real-life case of Lebanon’s vibrant crypto market.

The country-specific stablecoin data is non-existent, but several Lebanese stablecoin brokers and crypto users in Lebanon who spoke with DL News confirm a widespread preference for Tether on Tron. Almost all of them attributed Tron’s popularity to low fees and speed.

But Tron’s hold on the market is also tied to the popularity of centralised crypto exchange Binance in the country, most of them said. An apparent preference for Tron on the part of Binance early in Lebanon’s adoption curve set the stage for the network to become embedded as the default choice.

NOW READ: Archblock CEO ousted during talks to sell TrueUSD to Justin Sun, lawsuit says

“The popularity of Tron is 100% mixed up with the popularity of Tether,” Nader Dirany, co-founder of brokerage Buy Bitcoin Lebanon, told DL News.

But the popularity of Binance the exchange doesn’t translate into preference for BNB Chain, affiliated with Binance.

“We have clients sometimes that ask us to send to them on BNB Chain,” added Nasim Dirany, his brother.

“Then at some point something happens like they get confused over the address format or something and they switch back to Tron.”

Tether is big business in Lebanon

Tether’s massively popular in Lebanon, a country riddled with a banking crisis.

Adnan Rihani, a Tether broker, told DL News that the majority of his volume comes from clients moving money into Lebanon. He said he has around ten clients who transfer $20,000 weekly.

NOW READ: Lebanon’s crypto brokers dodge turmoil and masked gunmen to serve clients

For others, transfers run up to millions of dollars.

During an interview with DL News in April, Mario Awad, a mid-level supplier based in Byblos, a town north of Beirut, received a call from a man seeking to transfer $1 million to Lebanon. The client explained to Awad that he had not used crypto before but wanted to try it after losing money in the banking crisis.

In a conversation heard by DL News in April, a top-tier supplier of Tether told Dirany he was processing about $20 million in transactions every month. The dealer, who wanted to remain anonymous, said eight to ten other individuals were handling similar volumes.

Tether’s rise on Tron helped by Binance

Although analysts have long held concerns over a lack of transparency in Tether’s reserve management, in Lebanon it is seen as the most independent and reliable stablecoin.

In a country with a dysfunctional banking system and severe hyperinflation, Tether often stands in as a digital dollar. Many Lebanese use Tether for money transfer and remittances without ever interacting with other parts of the crypto market.

Launched in 2018 by entrepreneur Justin Sun, Tron has established an extensive ecosystem of DeFi protocols, stablecoins and tokens — many named after him like lending protocol JustLend or decentralised exchange SUN.

However Tron’s reputation has suffered from controversy brought about by its sometimes flamboyant founder. The US SEC sued Sun in March for selling unregistered securities and he has been the subject of numerous allegations of market manipulation.

The dominance of Tron and Tether, both in Lebanon and much of the global south, highlights patterns in crypto adoption where people are seeking to insulate themselves from economic volatility.

NOW READ: ‘Tether is next’ says short seller who bet against Silvergate and Signature Bank

Lebanon underwent a wave of crypto adoption as its financial system collapsed in late 2019, slashing GDP by 50% and plunging about three-quarters of the population into poverty. The decline coincided with the bull market of 2019-20, creating a dual incentive for adoption.

A 2022 Chainalysis report noted that Lebanon had received cryptocurrency valued at $60 billion in the year ending June 2022, second only to Turkey in the region.

Early in Lebanon’s adoption curve, sending Tether on Tron was free with Binance, which had marketed itself aggressively in Lebanon and quickly became the go-to exchange for new users. Binance didn’t respond to DL News’ request for comment.

Developer Simon Dorvil explained, “Customers aren’t inclined to bridge their assets, so central exchanges favouring a network is enough to set a precedent.” Dorvil is co-founder of Canadian blockchain payments app Sinbad, which leverages Polygon and is currently launching in Lebanon and leverages the Polygon network.

“It’s interesting that although Tron tokens incur fewer gas fees than Ethereum tokens, they are still not the cheapest. Sending Tether over Polygon is consistently cheaper in terms of network fee,” he said.

But by the time Tether became available on Polygon last year, years of zero or cheap fees had already entrenched Tron as the favourite network in the minds of Lebanese crypto users. Retail users and brokers alike, the vast majority using Binance, pass each other Tron addresses as a matter of course.

NOW READ: Binance controls 90% of TrueUSD’s supply amid increased pressure on the stablecoin

“We can recognise a Tron address just by looking at it,” said Nader Dirany. “Some things you can’t really explain but intuitively it’s a case of going with the flow.”

Tether is ‘the most stable, unstable stablecoin!’

Despite the concerns around Tether’s reserve management, it is seen in Lebanon as the most independent and reliable stablecoin. Tether briefly lost its peg in May 2022 to as low as $0.95 right after TerraUSD’s collapse, and it continues to suffer from criticism of its poor auditing record.

Nasim Dirany, Nader’s brother and partner in brokerage Buy Bitcoin Lebanon, isn’t deterred by any of that. “Tether proved itself through the bear market, while all the others suffered in some way,” he told DL News. “It’s the most stable, unstable stablecoin!”

Although other stablecoins and chains may be cheaper to use, in Lebanon they often suffer from association, real or perceived, with certain brands.

“BNB tokens are cheaper,” Nader Dirany said. “But people can’t escape the idea that it is owned by Binance, that it isn’t decentralised.”

BNB Chain, which Binance says is short for Build & Build, was previously called the Binance Smart Chain. BNB Chain was launched by Binance, which the exchange continues to help develop but claims to no longer control.

As for USDC, said Dirany, “many people think that the ‘C’ in ‘USDC’ stands for ‘Coinbase.”

Who is Justin Sun anyways?

The fact that Lebanese users are not put off by the concerns that dog both Tether and Tron in wider crypto circles points to fundamental differences in use case.

NOW READ: Justin Sun’s stUSDT dominates real-world asset DeFi as the sector doubles

Crypto engagement in affluent countries where there is a functional financial infrastructure is usually discretionary and pursues profit. Users tend to go ‘down the rabbit hole,’ engaging with different tokens, protocols and communities.

In Lebanon, crypto adoption has arisen out of necessity and, although there are many highly sophisticated users, many seem indifferent to behind-the-scenes machinations of the crypto world.

For example, worries over Justin Sun, Tron’s trouble-courting founder, simply don’t register in Lebanon, where “99% of people don’t know who he is,” Dirany said.

Some, especially among older users, may not be fully aware of what distinguishes cryptocurrency from other forms of money transfer. Most Lebanese users need to move money as reliably, cheaply and quickly as possible. Tron was cheap and worked and that was all most cared to know about it.

“Tron was the cheapest in 2019, 2020,” said Jihad Rizk, a Beirut based developer. “Most of us got used to using it and got familiar with it. Also, you’re not talking about people who are really technically proficient.”

For Dorvil, “It’s something of a mystery why centralised exchanges favour Tron. They shouldn’t but they do.”

NOW READ: North Korea accelerates nuclear missile programme with ‘treasure sword’ — $1.7bn from crypto heists

Once that favouritism was established though, the popularity of both Tron and Tether in Lebanon fed itself until they achieved an unquestioned dominance in the market.

“There’s a saying in Arabic,” said Nader Dirany. “The powerful will always be right.”