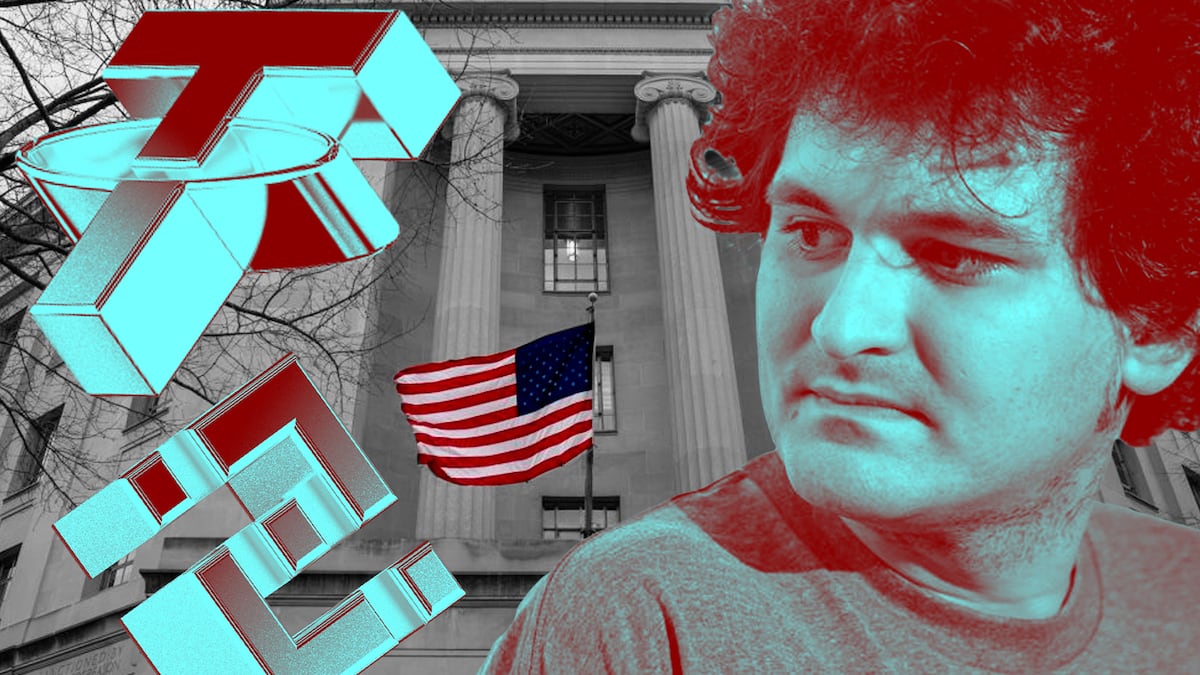

- SBF's guilty verdicts were not the catharsis everyone thinks they were.

- The trial showed crypto has a lot of work to do to build credibility and transparency.

- All eyes now turn to Binance as it girds for its own legal crucible.

Maybe it wasn’t the hazy den of iniquity portrayed in a New York Magazine headline, but the overflow Manhattan courtroom of Sam Bankman-Fried’s trial was buzzing the morning of October 30.

It was our mid-morning break. As people chatted in the wooden pews, another reporter, a veteran of trial coverage, came over to my seat and gestured toward a live video feed of the courtroom three floors above.

“Can you believe this?” he asked. “Where are his lawyers? He’s going into round four with Rocky Balboa and he’s all alone.”

Indeed, Bankman-Fried, minutes from cross-examination, was sitting alone at the defence table. In that moment, I pitied the man whose conviction was widely considered a foregone conclusion.

‘Stronger than ever’

Looking back over a five-week trial I covered along with reporters from the crypto and traditional media, I realised it wasn’t just about a slovenly crook.

Almost no one doubted he had taken the money of FTX customers to plug a multibillion-dollar hole at his failing hedge fund, Alameda Research.

After the exchange failed in November 2022, the crypto industry wanted Bankman-Fried’s head on a spike. And its bloodlust was no surprise: There was a stretch where informed people seriously believed the market would never recover.

Crypto bros’ hatred of him ran so deep that The New York Times published a story about it.

When bestselling author Michael Lewis dared to equivocate on the question of Bankman-Fried’s guilt, the condemnation was so widespread that the writer suffered the worst reviews of his career and became a punchline on social media.

Less than an hour after the jury read its verdict, I and the rest of the SBF press corps stood in the cold outside the courthouse in Lower Manhattan, massed like penguins, hoping Mark Cohen, Bankman-Fried’s attorney, would come down for a news conference.

Meanwhile, Crypto Twitter rejoiced.

“SBF DECLARED GULITY,” Ryan Sean Adams, co-host of the podcast Bankless, wrote that night. “We’re rid of him.”

Surprisingly, a rocket emoji and the word “bullish” were nowhere to be found.

“As we cast away the frauds let’s take a moment to thank the ones who’ve stayed true to crypto values,” Adams continued. “Crypto is stronger than ever.”

Really?

The crypto industry hasn’t fully reckoned with the cavalier ethos that enabled his fraud to go on as long as it did, and to get as big as it did.

The thing is, for all the excitement over seeing the greatest crypto fraudster face justice, this isn’t over.

The crypto industry hasn’t fully reckoned with the cavalier ethos that enabled his fraud to go on as long as it did, and to get as big as it did.

And even as token prices surge on anticipation of a spot Bitcoin ETF, the structural problems are still there, as are the conditions for more spectacular failures. This was the upshot of the trial.

You could see it in the testimony of one witness who didn’t receive the attention paid to Caroline Ellison, Gary Wang, or other members of SBF’s inner circle.

Zac Prince, founder of crypto lender BlockFi, took the stand and made a rather prosaic statement: “The traditional firms often had audited balance sheets,” Prince testified.

“I would say the majority of balance sheets that we received from cryptocurrency firms were unaudited,” he continued. “We always relied on the information that we were given by counterparties as being truthful and accurate.”

Eight balance sheets

The line was telling because Alameda never provided audited financials to BlockFi, Prince said. Instead, the lender got unaudited balance sheet statements every three months or so.

The problem, as we learned during the trial, was that the financials were doctored.

Ellison, afraid of sending lenders Alameda’s true ledger, drafted eight different balance sheets at Bankman-Fried’s request, and sent those to lenders instead.

Audited financials are optional

In the end, the fund was unable to repay hundreds of millions in loans it had taken from BlockFi, and the lender went bankrupt.

Prince’s testimony begs the question: What’s changed in crypto when it comes to accounting? The answer, it appears, is not much. Audited financials are still optional and the industry’s credibility is still very much an open question.

Today, two of the most important companies in crypto — Tether and Binance — tower above their competitors, handling billions of dollars worth of transactions every quarter. By the standards of traditional finance, however, they remain deeply mysterious, almost defiantly so.

Take stablecoins. These dollar-pegged instruments have emerged as a useful form of cryptocurrency, especially in struggling economies such as Lebanon and Nigeria, where consumers use them to protect their wealth and to do business.

‘Attestations’

For six years now, Tether has pledged to show that USDT, the most valuable stablecoin in the world, is adequately supported by real assets such as US dollars and “cash equivalents” like government bonds.

We’re still waiting for a proper audit.

Last week, we got another one of its “attestations,” which Tether says are a “testament to our unwavering commitment to transparency, stability, and responsible financial management.”

But these reports do not have the same level of credibility as the audits traditional companies use to report their financials. Those audits hew to generally accepted accounting standards recognised by investors and regulators around the world. Attestations do not.

Meanwhile, Binance, the world’s biggest crypto exchange, came up in the trial and brought to mind another issue still bedeviling crypto — transparency.

Archrivals

Bankman-Fried testified about a trip he made to the Middle East with Anthony Scaramucci, the well-connected money manager and conference impresario, who introduced him to movers and shakers in the Gulf region. SBF said a colleague was worried Binance and CEO Changpeng “CZ” Zhao, who’s done a lot of business in the region, might think he was “stepping on their turf.”

SBF and CZ, of course, were archrivals as their exchanges jockeyed for supremacy in crypto. Now, Binance is girding for its own legal test as US regulators pursue lawsuits against the exchange.

As long as Binance’s practices are subject to regulatory action, the crypto market at large may continue to feel the heat, such is the exchange’s scale.

Binance exemplifies the kind of byzantine, everywhere-but-nowhere business model popular in crypto. Zhao designed the firm to operate as a new type of free-floating, remote working operation, with no home base and business units and employees distributed worldwide.

Yet Binance is a bourse investors use to buy and sell assets, and normally such exchanges are heavily regulated to protect consumers from losing their savings, and from triggering financial crises in the capital markets.

Binance’s “opaque” model is Exhibit A in the lawsuits brought against the firm and Zhao earlier this year. Binance is “so effective at obfuscating its location and the identities of its operating companies that it has even confused its own Chief Strategy Officer,” said the US Commodity and Futures Commission in a complaint.

Binance and Zhao have denied the allegations and have vowed to defend themselves in court.

As long as Binance’s practices are the target of regulatory action, the crypto market at large may continue to feel the heat, such is the exchange’s scale. It handled $19 billion in daily trading volume in the last 24 hours, according to CoinGecko.

Leaked balance sheet

And if there’s a lesson to heed in the trial and speedy conviction of SBF it’s this: Transparency and accurate numbers still matter.

Remember what sank FTX? Relatively innocuous details from a leaked balance sheet, published by CoinDesk. When customers got a glimpse at what was really going on at FTX, they ran for the hills. Ultimately, so much of what happened in the trial sprang from that hoariest of clichés — the defendant cooked the books.

500 Pearl

When you enter the Daniel Patrick Moynihan US Courthouse at 500 Pearl Street in Manhattan, you have to surrender your phone and laptop, unless you’re a lawyer. (Even attorneys must silence their phones when they enter the courtroom.)

One day during the final week of the trial, Judge Lewis Kaplan heard a beep in the courtroom.

“Sorry, that’s my computer, not my phone,” Assistant US Attorney Danielle Sassoon quickly said.

“You’re lucky, not having brought your toothbrush,” Kaplan quipped.

A marshal popular with the SBF press corps later told me that Sassoon would have been held in contempt of court and spent the night in prison had that beep come from her phone.

All of which is to say I had to kill time the old-fashioned way as I waited for jurors to return their verdict last Thursday: by reading New York Magazine’s list of the “most powerful New Yorkers you’ve never heard of.” They included one Randall Jackson, an attorney for executives in “SBF-level peril.”

“He’s also said to have a preternatural ability to connect with juries,” the story read. “He’s one of those individuals that engages you in rapture,” a former client was quoted as saying.

Scribbling furiously

I couldn’t help but think about Mark Cohen, Bankman-Fried’s soft-spoken lead attorney. The day before, his closing argument literally put me to sleep. (Admittedly, I would have struggled either way, having awakened just after 3am to nab a coveted spot in the courtroom.)

Later that night, as the forewoman read the verdict, I stared at the felon’s distraught parents, and scribbled furiously: “JB has his head in his hands. BF gripping the pew in front … now sits back and wipes away tears.”

I imagined the triumphant roar of Crypto Twitter, and wondered how Bankman-Fried would have fared had he hired this Randall Jackson.

I also wondered what would have happened if his business partners had insisted on audited balance sheets, rather than taking Bankman-Fried at his word.

At the beginning of his closing argument, Assistant US Attorney Nicolas Roos said the trial was “not about complicated issues of cryptocurrency.” It was about deception, lies, stealing, and greed, he said.

But its lesson was very crypto indeed: Don’t trust, verify.

Aleks Gilbert is DL News’ New York correspondent and covers DeFi. Have a tip? Contact the author at aleks@dlnews.com.