- Binance has been buffeted by new challenges after guilty plea last year.

- Many customers are unfazed by Zhao’s absence and marketshare is holding.

- Teng is confronting a dramatically different era for crypto as Wall Street moves in.

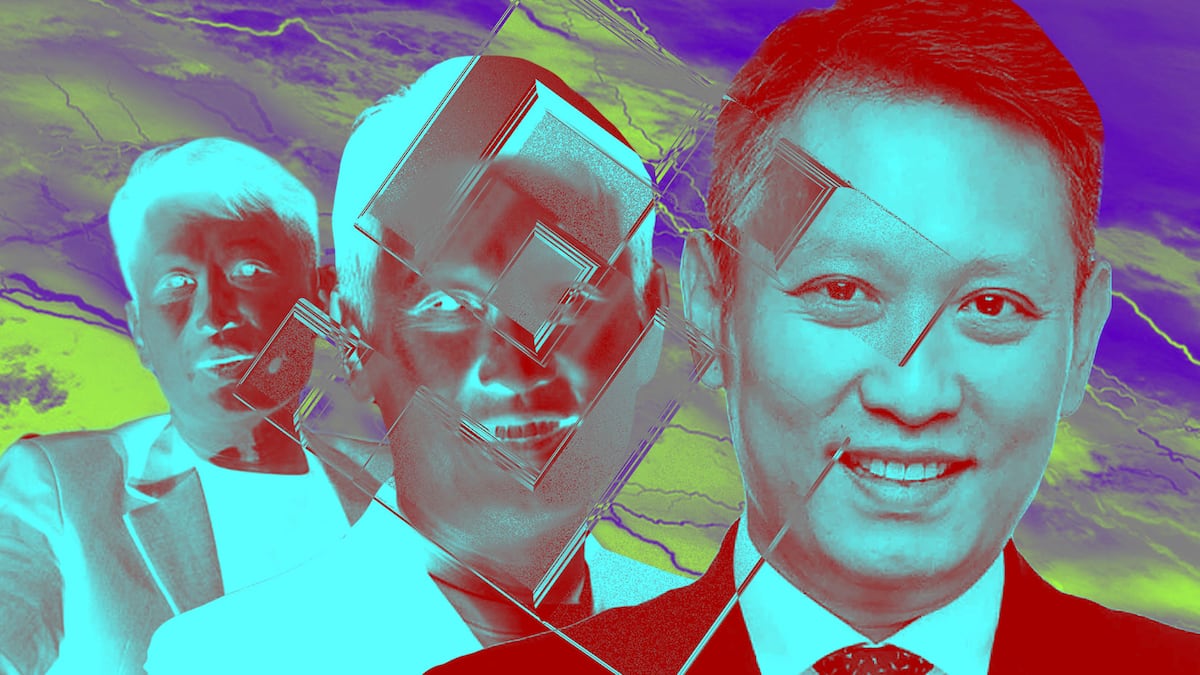

Richard Teng was only a few weeks into his new job when he was asked to reenact Changpeng Zhao’s famed “four” pose for a photo.

Zhao, the co-founder of Binance, was fond of holding up four fingers and urging crypto investors to “ignore FUD, fake news, and attacks.”

Yet Teng, who took over the top crypto exchange after Zhao resigned in disgrace in November, demurred.

“I need my own thing, so I’ll do the three instead,” he said after a Twitter spaces event in December.

He held up three fingers to signify his pledge to put users first, work with regulators, and collaborate with partners on web3.

100th day

Doing his own thing as Binance’s second CEO is proving to be a challenge as Teng confronts the problematic legacy of his predecessor.

Marking the 100th day of his tenure on Thursday, Teng is labouring to address a number of issues: Can he get Binance right with regulators? Will rivals seize on Binance’s troubles to take market share from the exchange?

And can he adapt Binance’s loose business model for a more buttoned-down era?

‘A complete review and revamp of the entire program from risk assessment to policies and procedures to training is necessary.’

— Christina Rea, former Binance.US executive

For all his pledges to repair Binance, sceptics question whether Teng understands the enormity of the task before him, especially on regulatory issues.

“Teng’s words echo the words of CEOs past in promising to be different, but he doesn’t detail what, exactly, is different,” Christina Rea, Binance’s interim chief compliance officer from 2021 to 2022, told DL News.

“A complete review and revamp of the entire programme from risk assessment to policies and procedures to training is necessary,” added Rea, who did not work directly with Teng.

Meanwhile, more challenges keep coming.

Binance still dominant

This week, Binance has been struck by a crisis in Nigeria after authorities detained at least two company staff members amid a market manipulation investigation.

At the same time, Bitcoin’s new bull run and Wall Street’s push into crypto with ETFs are reshaping the marketplace. Binance is still the big dog in the space. It handled around $50 billion in trading volume in the last 24 hours, according to data from CoinGecko. And Binance has more customers than the population of Japan.

Even after all the legal drama of the last year, Binance is such a dominant force that nearly half of all Bitcoin and Ethereum trades on centralised exchanges are executed on the platform.

But staying dominant isn’t going to be easy.

Rivals chip away

Rivals are already chipping away at Binance’s Ethereum volumes. Since last year, Bybit’s share has almost tripled to 14%, and OKX’s portion has jumped to 11% from 7%, according to Kaiko, a market data provider.

“This could probably be the true reflection of what was happening with Binance,” Clara Medalie, the head of growth at Kaiko, told DL News.

She said developments such as a loss of confidence probably made Binance look like a riskier platform for investors.

Then there’s Binance’s unorthodox business model.

Though Zhao called the shots at Binance, he described the exchange as a “decentralised” enterprise and an improvement on traditional corporate structures.

In practice, that meant not establishing a home base the way normal companies do. And, according to US officials, it also meant Binance disregarded the know-your-customer and anti-money laundering rules that govern the financial world.

The approach backfired in November when Binance agreed to pay $4.3 billion in penalties for failing to prevent sanctioned entities, including Hamas, from using the platform. Zhao, too, pleaded guilty and is scheduled to be sentenced later this year.

A court-approved independent monitor will scrutinise Binance from the inside as it labours to comply with US banking laws.

Now it’s fallen to Teng, a middle-aged, one-time central bank official, to turn the page on the CZ era and write a new chapter for Binance. He declined to be interviewed for this article.

Thorny complexities

Some crypto experts have given Teng high marks so far.

Danny Lim, a core contributor at decentralised derivatives exchange MarginX, said Teng has demonstrated he can juggle the exchange’s marketing efforts and maintain Binance’s new self-custodial crypto wallet.

He told DL News that Teng’s tenure so far is commendable, given the thorny complexities of the industry. “Richard’s performance at Binance is commendable given the complexities of managing a large corporation in a rapidly evolving industry,” Lim told DL News.

Then again, Binance’s global sprawl is producing major headaches.

On February 26, two Binance executives, an American and a British citizen, were detained by Nigeria’s Department of State Security as part of a probe into the exchange for its alleged role in the country’s currency crash.

On Tuesday, Olayemi Cardoso, Nigeria’s central bank governor, criticised Binance’s Nigerian operation for passing $26 billion “from sources and users who we cannot adequately identify.”

Binance declined to comment on the Nigerian crisis.

The exchange is also in hot water in the Philippines as authorities mull taking action against the exchange for a number of alleged infractions, including using a legion of salesmen, brokers, and enablers to hook investors.

In both instances, Binance is facing blowback for not obtaining operating licences or complying with other registration procedures. The company has simply opened its online exchange to all comers.

To be sure, this has been normal in crypto since the early days of Bitcoin. And regulators in many nations have been slow to set up licencing regimes for this new asset class.

Binance is one of scores of crypto ventures that are struggling to meet regulatory requirements that are only now being enacted.

Yet Teng has yet to lay out a blueprint of exactly how Binance is planning to adjust its model and comply with licencing measures cropping up across the globe, say compliance experts.

Tense interview

So far, Teng has seemed as uncomfortable as Zhao in pulling back the curtain on Binance’s workings.

At a Financial Times conference in London in December, Teng bristled when pressed on where Binance’s headquarters is located. Teng didn’t get why traditional finance types were so hung up on the idea.

“Why do you feel so entitled to these answers?” he asked the FT reporter interviewing him via video link. “Is there a need to share all this information publicly?”

It was a jarring comment coming from a man with deep experience in traditional finance.

Teng started his career as a director of corporate finance at the Monetary Authority of Singapore, the city-state’s central bank.

After a 13-year tenure, he was named chief regulatory officer at SGX, a securities exchange, and then took a post as CEO of Abu Dhabi Global Market, an international market zone in the UAE capital.

In 2021, he joined Binance as CEO of its Singapore unit and, by 2023, had become head of regional markets.

Freedom of money

Teng was ready when Zhao resigned in November. In a tweet, he vowed to “continue to meet and exceed the expectations of stakeholders while achieving our core mission, the freedom of money.”

His first week was a whirlwind. Teng met soccer legend Ronaldo and mixed martial arts champ Khabib Nurmagomedov. The new Binance chief also shepherded a flashy marketing campaign with Formula F1 racer Pierre Gasly.

Meanwhile, depositors pulled more than $2.4 billion from the exchange that week, according to DefiLlama data.

‘The most notable point is that market share hasn’t tanked.’

— Clara Medalie, Kaiko

Binance stemmed the outflow. Since November 21, Binance’s share of Ethereum trading volume has ticked up to 50% from 35%, according to data from Kaiko.

“The most notable point is that market share hasn’t tanked,” Kaiko’s Medalie said. “It has stayed pretty steady since the change.”

Teng also handled a dustup when Binance put privacy tokens Monero, Firo, and Zcash on a monitoring list. These tokens permit holders to conceal their identities and have drawn scrutiny from regulators.

“Binance doesn’t want to touch any funds from sources that have an unidentified source,” said Firo’s project steward, Reuben Yap.

The exchange ultimately moved to delist Monero but not Zcash and Firo after those projects added a technical workaround.

Binance’s nimble management of the issue scored points among many in the crypto privacy community. It also demonstrated that Binance, under Teng, took regulatory obligations seriously.

Legal vulnerabilities

But another episode on his watch showed how wary Binance’s leadership has become about potential legal vulnerabilities.

On February 6, Yi He, Binance’s co-founder who also has the title of “chief customer service officer,” dropped a long Twitter thread in Mandarin warning Binance employees not to trade on inside information ahead of token listings.

She also offered bonuses up to $5 million for anyone who blew the whistle on such activity.

New fabric

It may take more than bounties and Twitter threads to retool Binance’s compliance problem.

When global banks such as HSBC, Citigroup, and Deutsche Bank were swept up in a wave of cases penalising them for inadequate compliance programmes, they spent billions on staff and software to prevent illicit sums from moving via their accounts. And it took years.

That’s the task on which Teng may ultimately be judged.

“It’s not a matter of just throwing bodies at the problem — they likely have to rip the seams apart and use new fabric,” said Rea, who is now the co-founder and CEO of RayCor Consulting, a compliance advisory firm.

“Binance’s biggest hurdle, aside from repairing ruptures in trust, is understanding the enormity of how much work it takes to rehabilitate a compliance programme.”

Liam Kelly is a Berlin-based DL News’ correspondent. Contact him at liam@dlnews.com. Edward Robinson is DL News’ story editor. Contact him at ed@dlnews.com.