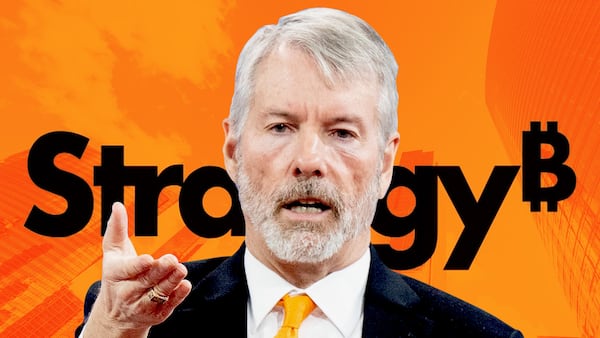

- Jim Chanos continues taking shots at Michael Saylor.

- Saylor is touting a new preferred stock scheme.

- Chanos has called it “complete financial gibberish.”

Short seller Jim Chanos says anyone buying into Michael Saylor’s latest move must “be crazy.”

He made the comments after Saylor touted Strategy’s new preferred stock scheme to fund its Bitcoin buying programme.

“Who in their mind institutionally would buy these preferreds?” said Chanos on Wednesday in his latest salvo against the software company.

He has shorted Strategy, formerly known as MicroStrategy, in the past.

According to Saylor, the preferred shares offering has already attracted $1 billion in investments.

Preferred shares typically pay a fixed dividend, but unlike bonds, they have no date for when the loan has to be repaid.

“We borrowed money that we never have to pay back,” said Saylor to Bloomberg on Tuesday. “We could suspend the dividend if we needed to.”

“It’s essentially risk-free.”

Chanos’s comments mark the latest warning about Strategy and its growing number of copycats who have added Bitcoin and other cryptocurrencies to their treasuries.

Coinbase warned on Thursday that the trend presents systemic risk to the entire crypto market.

Sweet deal

Saylor’s latest trick takes direct aim at the $100 trillion corporate bond market.

By issuing preferred shares, Saylor opens access to billions in capital without creating debt that comes due or requires refinancing — unlike bonds, which have a fixed maturity date.

And because the dividends aren’t cumulative — which means if Strategy suspends a payment, they’re simply skipped — the company isn’t on the hook to make up missed payouts later, Saylor argued.

In short, Saylor said it’s a sweet deal. There’s no looming repayment schedule, no legal obligation to keep paying dividends if things get tight, and no dilution of voting control like common stock would create.

For Strategy, it’s cheap, flexible capital that can be used to keep piling into Bitcoin, while shifting most of the long-term risk onto the investors buying these preferred shares.

Chanos counters

Chanos slammed the new scheme as “complete financial gibberish” on X.

In the interview with Bloomberg, Chanos argued that Saylor saying that it could suspend the dividend meant that, “he makes the case that you have to be crazy to buy these preferreds.”

“He will pay a dividend, maybe,” Chanos told Bloomberg. “It’s not redeemable. It’s perpetual. If I don’t pay the dividends, they are not cumulative.”

Chanos has form when it comes to picking stocks to short. He gained fame decades ago for being the first to call out fraud at Enron, which collapsed in bankruptcy in 2001.

Lately, he’s been eyeing crypto firms. In 2023, he told DL News he’d been shorting Coinbase since 2022.

Copycats galore

To be sure, Saylor’s strategy has been profitable.

The company has invested $35 billion to buy Bitcoin, and those holdings have ballooned to $63 billion. The company’s shares trade at tenfold their price when it began accumulating Bitcoin back in 2020.

The success has incentivised a wave of copycats.

More than 220 firms now hold about 820,000 Bitcoin worth around $87 billion. Some, like Metaplanet, have foregone their core business model in favour of the Bitcoin treasury approach.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.