- Two new MicroStrategy ETFs launched on Wednesday.

- They are approximately 15 times more volatile than the S&P 500.

- The funds immediately saw higher-than-normal demand from traders.

There are two new crypto exchange-traded funds in town, and they’re the most volatile exchange-traded funds in US history, according to Bloomberg Intelligence ETF analyst Eric Balchunas.

“Tuttle just re-broke the volatility barrier,” he said, in reference to ETF issuers Rex and Tuttle Capital Management, who launched the two leveraged MicroStrategy ETFs on Wednesday.

One of the ETFs is for bets that the stock will go higher, and one for bets the stock will go lower.

The funds give investors leveraged exposure to MicroStrategy, meaning that if the stock goes up or down by 5%, the ETFs will go up or down by 10%. This also means that investment vehicles are about 15 times more volatile than the S&P 500, Balchunas said.

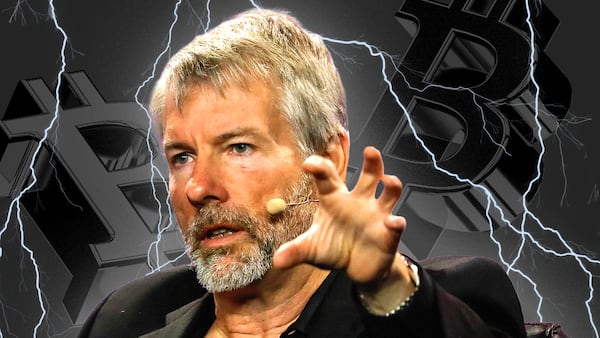

Though MicroStrategy is a cloud services business, it’s morphed into a proxy for investing in Bitcoin due to the firm’s billion-dollar investments in the digital asset.

While analysts argue that the launch of spot Bitcoin ETFs jeopardises the proxy role, its co-founder and chair, Michael Saylor, has said the company still has several advantages going for it. He said the company doesn’t take high fees and develops technology.

The most volatile ETF in the US

The long MicroStrategy ETF saw $2 million in volume on launch day and by midday on Thursday was on track to hit $10 million, Balchunas posted on X.

“Only 1-2% of ETF launches see this kind of volume this early,” Balchunas wrote. “It helps that it is up 17%.”

The success of the ETF is particularly notable in that it isn’t the first leveraged MicroStrategy fund to launch.

Another ETF firm, Defiance ETFs, launched a 1.75x MicroStrategy ETF on August 15. The fund crossed the $200 million mark on Wednesday. That puts the fund in the same ballpark as most spot Ethereum ETFs in terms of assets.

“Hot sauce arms race in effect,” Balchunas said. “Just that little extra bit of leverage moved the needle,” Balchunas said about T-Rex’s fund.

MicroStrategy isn’t the only crypto firm getting its own ETFs.

ETF issuer YieldMax ETF launched an inverse Coinbase ETF in July, enabling traders to profit from the crypto exchange Coinbase’s stock going down while earning a yield at the same time.

Crypto market movers

- Bitcoin is up 1.6% over the past 24 hours to trade at $63,490.

- Ethereum is up 4.5% to $2,548.

What we’re reading

- BlackRock’s new laser-eyed Bitcoin screed lays out why to invest in ‘flight to safety’ asset — DL News

- Louisiana Leads the Way: Bitcoin Now Accepted for Utility Bills — Milk Road

- Trump’s Crypto Project May Attract Hackers. That’s Why This Security Expert Joined — Unchained

- Ethena Domain Registrar Hacked, Users Warned to Stay Away — Milk Road

- Axie Infinity founder wants everyone to work in his games: It’s ‘not dystopian’ — DL News

Tom Carreras is a Markets Correspondent for DL News. Got a tip? Email at tips@dlnews.com.