- Fundraising in 2025 broke $25 billion and shattered analysts’ expectations.

- The top raises show a fusion of crypto and traditional finance.

Fundraising by crypto businesses reached over $25 billion in 2025, shattering analysts’ expectations that companies would raise just north of $18 billion.

The top 10 raises alone brought in over $10 billion, DefiLlama data shows.

Leading investors this year include not only tech-centric firms like Paradigm and Sequoia Capital, but also white-shoe stalwarts BlackRock, JP Morgan, and Goldman Sachs.

The blockbuster deals underscore the convergence between crypto and traditional financial institutions, according to Charles Chong, VP of strategy at crypto investment firm BlockSpaceForce.

“The line between fintech, TradFi, and crypto will continue to blur,” Chong told DL News.

“Blockchain rails will increasingly sit in the background, improving settlement, custody, and programmability, while most crypto-specific complexity is abstracted away from end users,” Chong said.

In the converging environment, the main dynamic is companies with a big client base splurging to buy infrastructure firms, regardless of whether they started as fintech or crypto, he said.

“Stablecoins and tokenised assets will keep growing because they solve obvious problems for banks, funds, and corporations,” he said.

Here are the top 10 biggest raises in 2025.

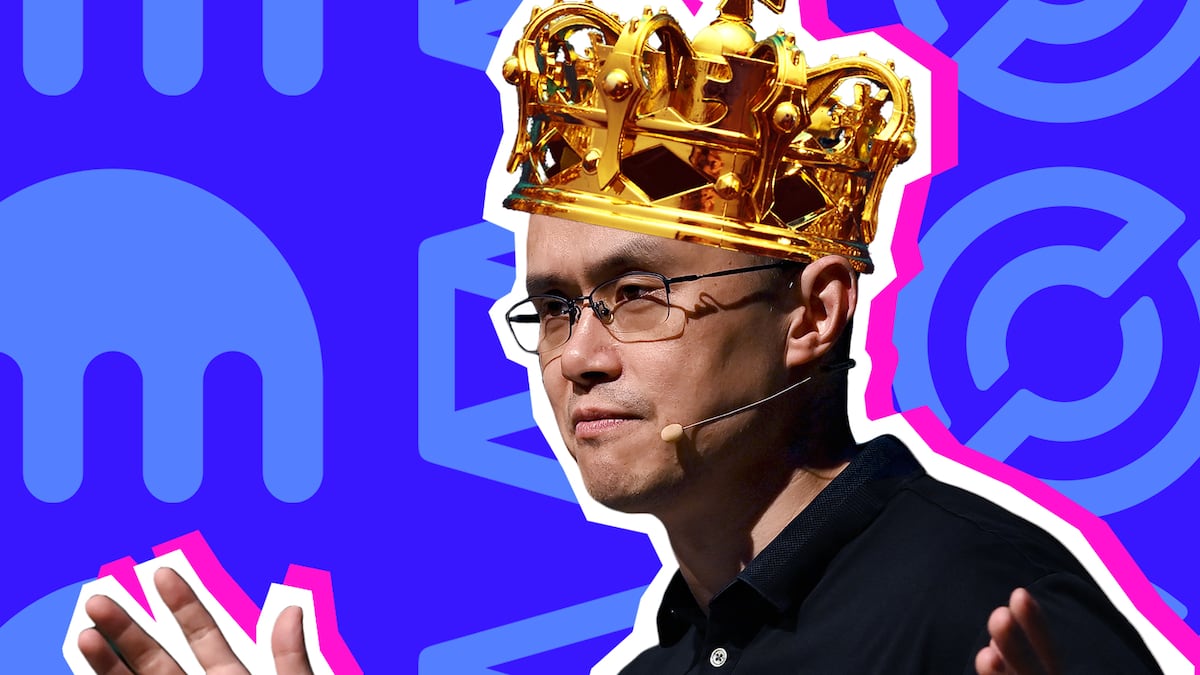

Binance, $2 billion

In March, crypto exchange Binance raised $2 billion in a strategic round led by Abu Dhabi-based fund MGX.

The raise is the largest single investment in crypto history and marks a key milestone in Binance’s post-regulatory transformation, as it doubles down on institutional services and compliance infrastructure.

In October, US President Donald Trump pardoned Changpeng Zhao, the former Binance CEO who served a four-month prison sentence in 2024 after pleading guilty to violating US laws by failing to do enough to prevent criminals, sanctioned entities and other bad actors from laundering billions of dollars in dirty money, according to court filings.

White House Press Secretary Karoline Leavitt told DL News that Zhao was “prosecuted by the Biden Administration in their war on cryptocurrency.”

Polymarket, $2 billion

In October, Prediction platform Polymarket locked in a $2 billion strategic raise led by the New York Stock Exchange’s parent company ICE.

“Our investment blends ICE [with] a forward-thinking, revolutionary company pioneering change within the decentralised finance space,” said Jeffrey Sprecher, ICE CEO.

The $2 billion dollar investment certainly raised a few eyebrows, but Michael Blaugrund, vice president of strategic initiatives at Intercontinental Exchange, said in November that Zohran Mamdani’s New York City mayoral election win vindicated the sale.

Bettors had given Mamdani overwhelming odds to win.

“I was so nervous,” Blaugrund said at an event. “Because regardless of where my politics are, if Mamdani didn’t win, we would have overpaid for Polymarket.”

Circle, $1.1 billion

In June, Stablecoin issuer Circle raised $1.1 billion in its August public offering in one of the most high-profile crypto raises on Wall Street.

Now trading at just over 150% above IPO price, Circle is trying to position as critical dollar infrastructure for digital payments by focusing on global rollout, public sector partnerships, and expanding its compliance-based treasury rails. The raise underscores how stablecoins are entering Wall Street.

Bullish, $1.1 billion

In August, Peter Thiel-backed crypto exchange Bullish debuted on public markets raising $1.1 billion.

Its automated market maker-style trading model and regulated-first positioning made it attractive to institutional investors seeking exchange exposure with minimal counterparty risk.

The firm said it will use the funds to grow in Asia and Europe while doubling down on proprietary trading and data services.

It currently trades near $39 per share at time of reporting, or just slightly above its IPO price.

Kalshi, $1 billion

In December, betting platform Kalshi announced it closed a $1 billion Series E led by Paradigm and a16z.

The Polymarket rival, focused on real-world event contracts, said it aims to become the Nasdaq analogy of prediction markets.

As demand for hedging against macroeconomic, weather, and politics grows, Kalshi is launching hundreds of new tradable events and lobbying for further regulatory clarity.

Figure, $788 million

In September, blockchain lender Figure Technology raised just over $787 million in an IPO.

Legendary investor Stanley Druckenmiller’s Duquesne Family Office alone invested $50 million, Reuters reported.

Built on the Provenance Blockchain, the firm tokenises home equity loans and other credit instruments. Institutional investors see Figure as a gateway to real-world asset tokenisation.

Kraken, $600 million

In September, Kraken pulled in $600 million in a pre-IPO round to prepare for a 2026 public offering.

Previous report had stated that the crypto exchange had raised a $500 million round, but the company only confirmed the actual number in November as it not only officially announced plans to go public in 2026, but that it had also secured another $200 million in a strategic investment from Citadel Securities at a $20 billion valuation.

The raise is “a milestone that reflects years of work, discipline, and conviction,” co-CEO Arjun Sethi said on LinkedIn. “I am proud of our team and grateful for the partners who chose to join us.

Pump.fun, $500 million

In July, memecoin launchpad Pump.fun stunned markets with a $500 million initial coin offering. The platform lets users mint new tokens instantly.

Often dismissed as retail froth, Pump.fun’s raise shows investor appetite for high-risk, high-speed protocols remains relevant. The team has said it is investing in security upgrades and social trading features.

Tempo, $500 million

In October, Stripe-incubated layer 1 blockchain Tempo raised $500 million to build a high-speed payments chain for USDC and USDT. Tempo targets global payroll and remittances with low-latency infrastructure.

In December, Tempo released its first public test network. Tempo has lured several well-respected crypto researchers, executives, and software engineers, such as former Ethereum Foundation researcher Dankrad Feist, former Optimism Labs CEO Liam Horne, and Rice University Professor Mallesh Pai.

Rapyd, $500 million

In September, fintech-as-a-service firm Rapyd closed a $500 million Series F round backed by BlackRock and Fidelity.

Known for powering crypto-fiat APIs and stablecoin rails, Rapyd says it is now working on a multibillion-dollar acquisition strategy.

It’s become critical middleware for businesses bridging traditional finance and DeFi.

You’re reading the latest instalment of The Weekly Raise, our column covering fundraising deals across the crypto and DeFi spaces, powered by DefiLlama.

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.