- Stablecoin giant elbowed its way into Bitcoin mining with plants in Latin America.

- 'We are first focusing on building renewable energy stations,' Ardoino told DL News.

- Tether is taking advantage of concentration of the sector in the US.

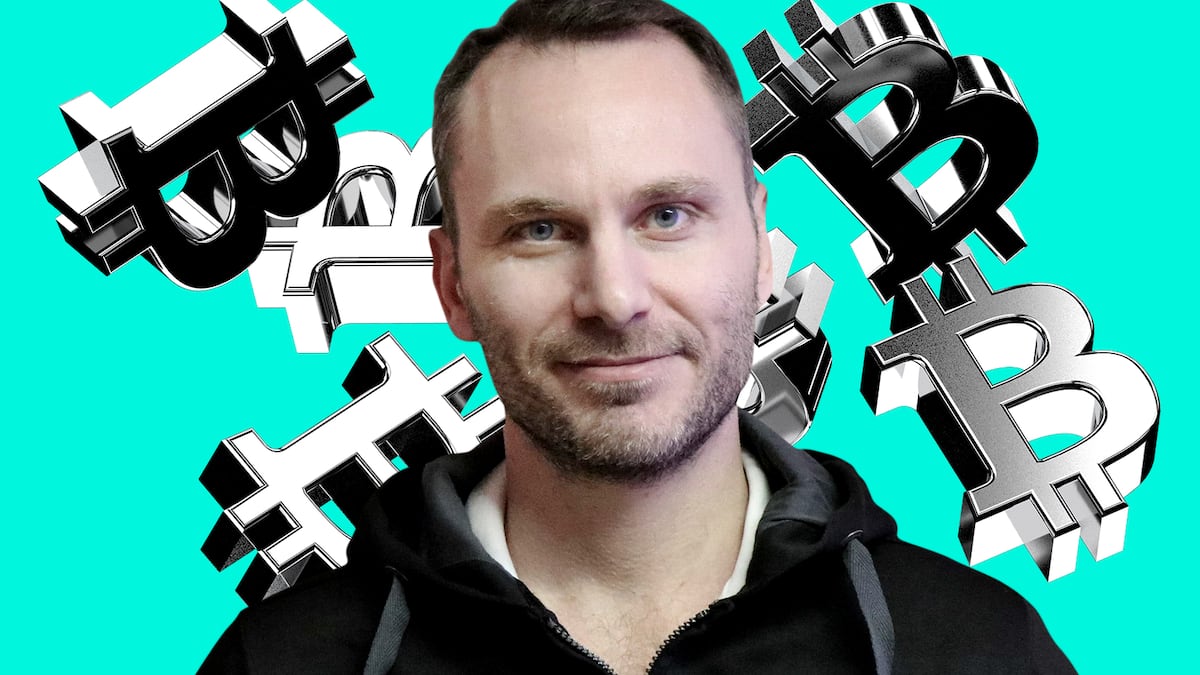

In a move that may shake up the global Bitcoin mining industry, Tether CEO Paolo Ardoino said the stablecoin issuer’s $500 million buildout in the sector is nearly complete.

Speaking with DL News on the sidelines of the Paris Blockchain Week, Ardoino said the capital investment has financed construction of mining facilities and energy stations in Uruguay, Paraguay, and El Salvador.

“In El Salvador, there is a set-up phase,” he said. “We are first focusing on building renewable energy stations. Starting from solar and wind, and then moving towards geothermal.”

Volcano energy

In June 2023, Tether said it was participating in a $1 billion initiative in El Salvador to capture the country’s geothermal energy production.

“Volcano energy” is expected to power a 241 megawatt energy station, which in turn will help run Bitcoin mining rigs.

Tether manages the industry’s largest cryptocurrency pegged to the US dollar, USDT. With more than $107 billion worth of coins issued, USDT is the largest cryptocurrency after Bitcoin and Ether.

Tether first announced its ambitions to enter the mining business, a vastly different niche from stablecoins, last November.

The reason for the move into mining? Decentralisation, says Ardoino.

“Bitcoin mining was first centralised in China and now it’s centralised in the US,” he told DL News. “Of course, the US is more open than China, but we shouldn’t allow one single geopolitical jurisdiction to be so important.”

China, with its vast amounts of cheap energy, was home to the majority of the network’s hashrate — the computer power that backs the Bitcoin network.

Beijiing banned the activity in 2021 and spurred an exodus to the US. Local governments in Kentucky and Texas attracted mining firms with lucrative tax rebates and energy deals.

“It’s not great for Bitcoin. We need more diversity,” said Ardoino, who was the chief technology officer at Bitfinex before taking the same role at Tether in December 2017.

He was appointed Tether CEO in October.

Halving on the horizon

The $500 million investment in the mining industry comes just two weeks before Bitcoin’s next halving event.

Every four years, the reward doled out to miners every 10 minutes for maintaining the blockchain is slashed in half. This time around it will drop to 3.125 Bitcoin.

It’s an unsteady moment for most miners, because while their operational costs remain the same, their main revenue stream is halved.

The least efficient operations are expected to suffer from the crunch, while major companies like Marathon Digital have signalled they are looking to acquire distressed assets.

The previous halvings have, however, been an enormous boon for the price of Bitcoin. The cryptocurrency rose more than 600% in the months after the 2020 halving.

Liam Kelly is DL News’ Berlin correspondent. Contact him at liam@dlnews.com.