- Kaiko analysts broke the bull run down into 10 charts — here is our five faves.

- Ether's late year surge is charted.

- Trump and memecoins drove big market moves.

What a year.

Starting with the advent of Bitcoin exchange-traded funds, cycling through the memecoin explosion, and culminating with the top cryptocurrency’s surge to $100,000, investors played in a number of bullish scenarios in 2024.

In 10 charts, Kaiko analysts marked the milestones in this “monumental year.”

Here’s our top five picks:

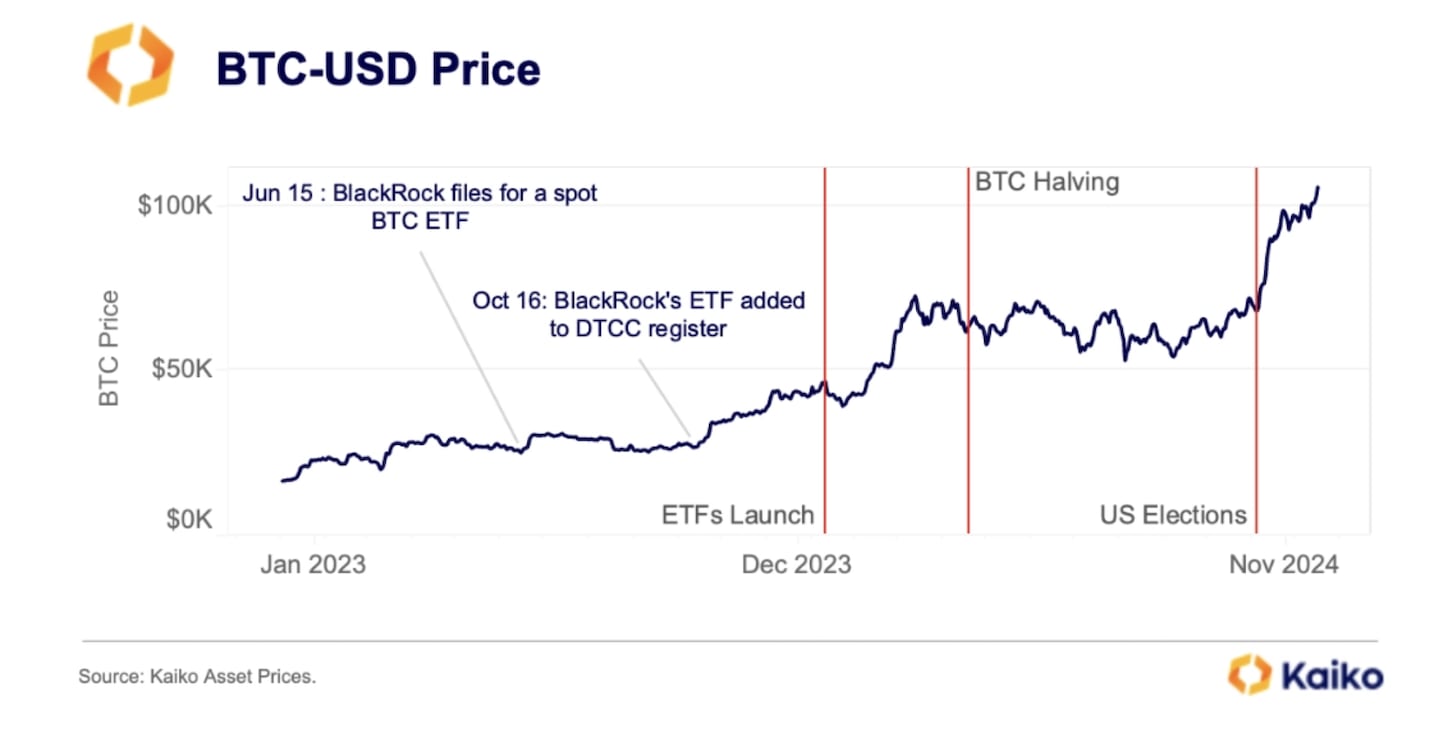

Bitcoin hits $100,000

Kaiko said the launch of spot Bitcoin ETFs signaled the evolution of an instrument into a mainstream asset with plenty of room to further grow.

Bitcoin ETFs now hold more than $105 billion in Bitcoin on behalf of clients.

The asset wraps up 2024 with a $106,000 all-time high and a 120% price rise.

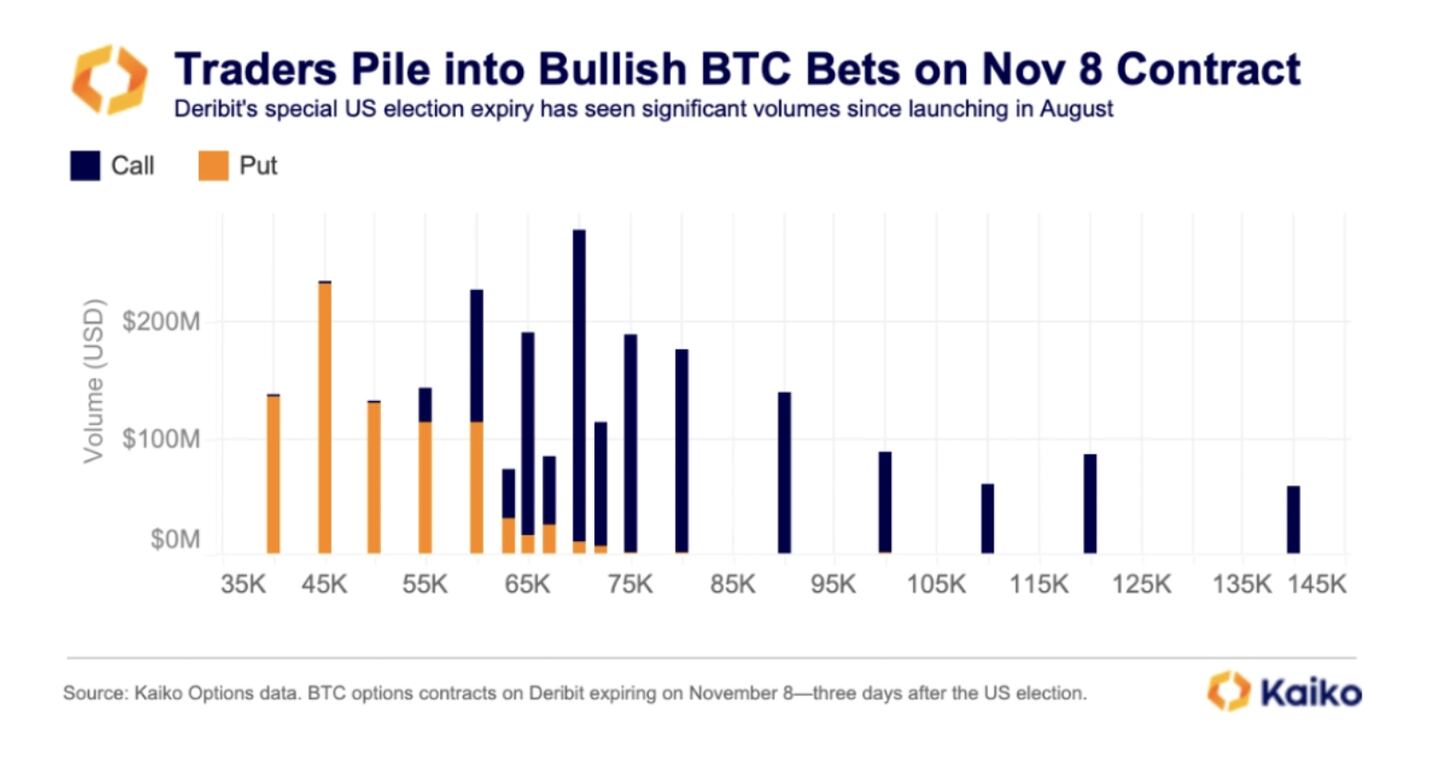

Crypto election

Crypto became a force in the 2024 election cycle, which resulted in the victory of pro-crypto Donald Trump.

“Never before have Bitcoin or digital assets commanded such attention on the world stage — at least not such positive attention,” said Kaiko analysts.

The so-called Trump trade pushed investors to pour billions into the market ahead of the election, with most betting on new all-time highs on derivatives exchange Deribit.

Bitcoin soared to record-highs of $75,000 just days after Trump was elected, and the bullish momentum hasn’t stopped.

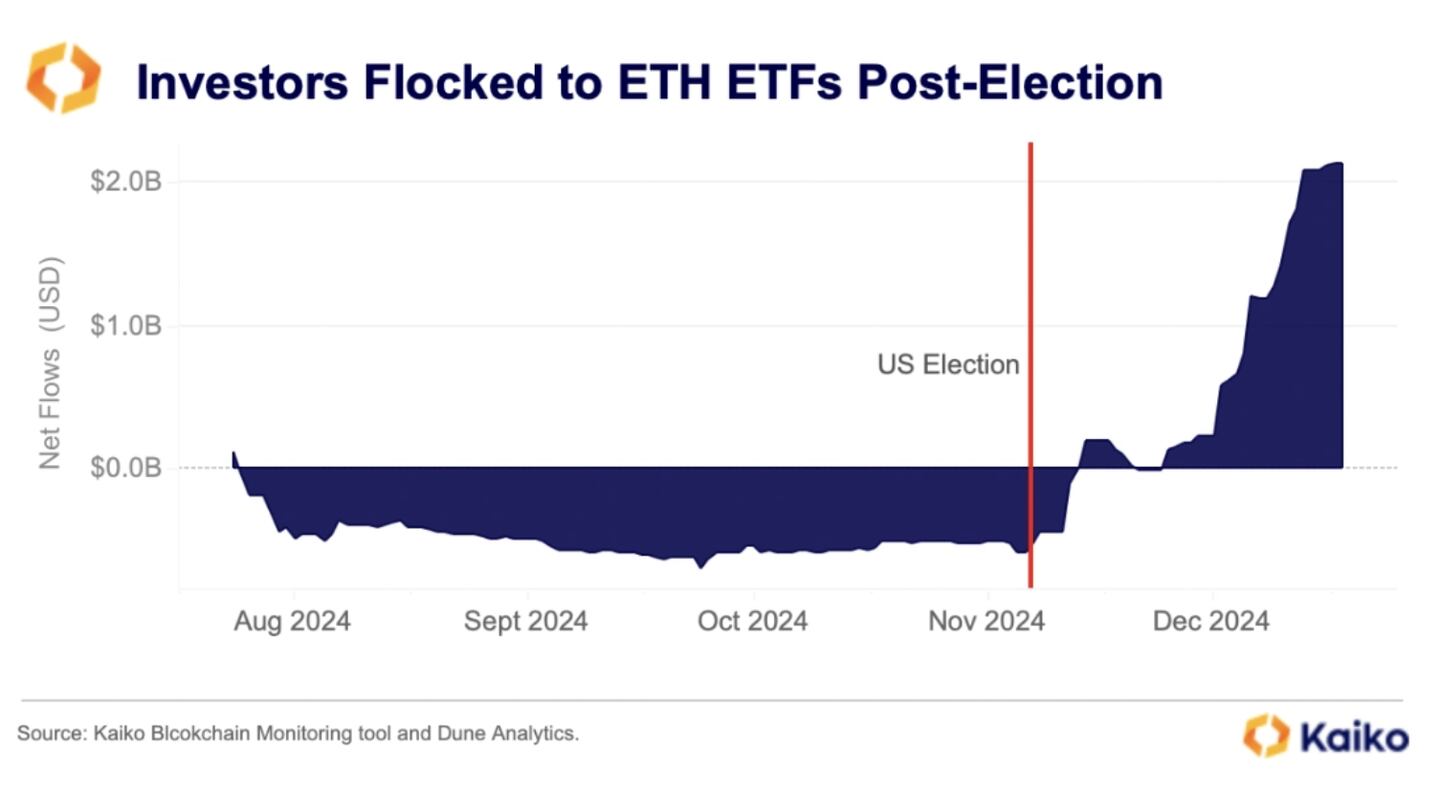

Ethereum on the move

Kaiko forecasts a positive 2025 for Ether, the second most valuable cryptocurrency.

“ETH is set to be one of the big winners from the regime change in Washington DC.,” said the analysts.

The firm thinks that clarity around its classification — whether it is a commodity or a security — will spur growth next year.

And while many investors were growing increasingly wary of Ethereum, especially after the Ether to Bitcoin ratio hit an annual low, the cryptocurrency stabilised and rose after the election.

In the past 30 days, Ethereum ETFs have registered only three days of outflows, according to Coinglass. Investors, meanwhile, have poured in more than $12 billion.

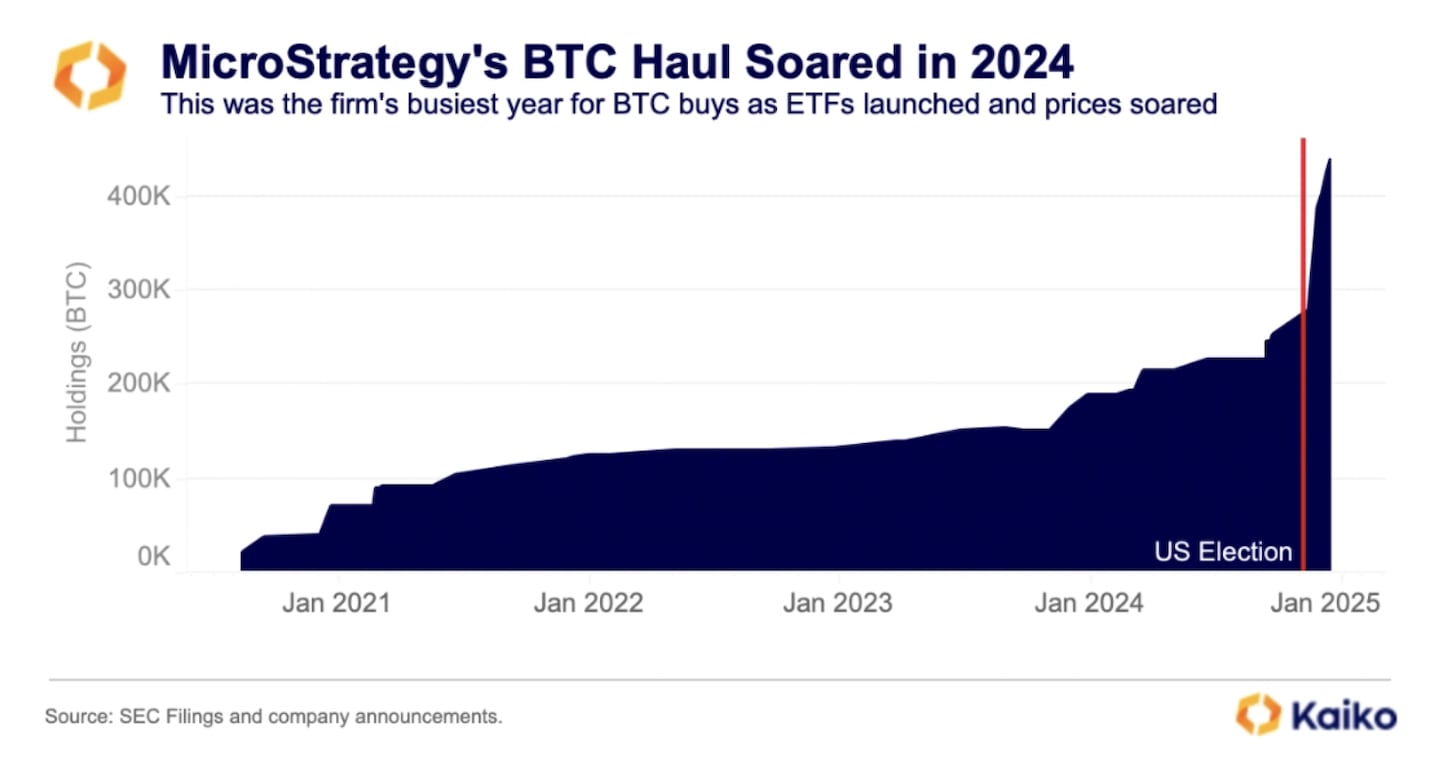

Saylor’s Bitcoin flex

For years, Michael Saylor’s decision to load MicroStrategy’s treasury with billions of dollars worth of Bitcoin was a high-risk bet.

With Bitcoin soaring to all-time highs this year, the CEO’s unorthodox approach paid off handsomely.

“For now the strategy is working,” Kaiko analysts said. The firm now holds more than 444,000 Bitcoin or $42 billion.

Still, MicroStrategy doubters continue to express concern about the software firm’s amassing of Bitcoin.

Next year, shareholder activists are expected to lobby other US listed companies to invest in Bitcoin even though Microsoft stockholders roundly rejected the idea this month.

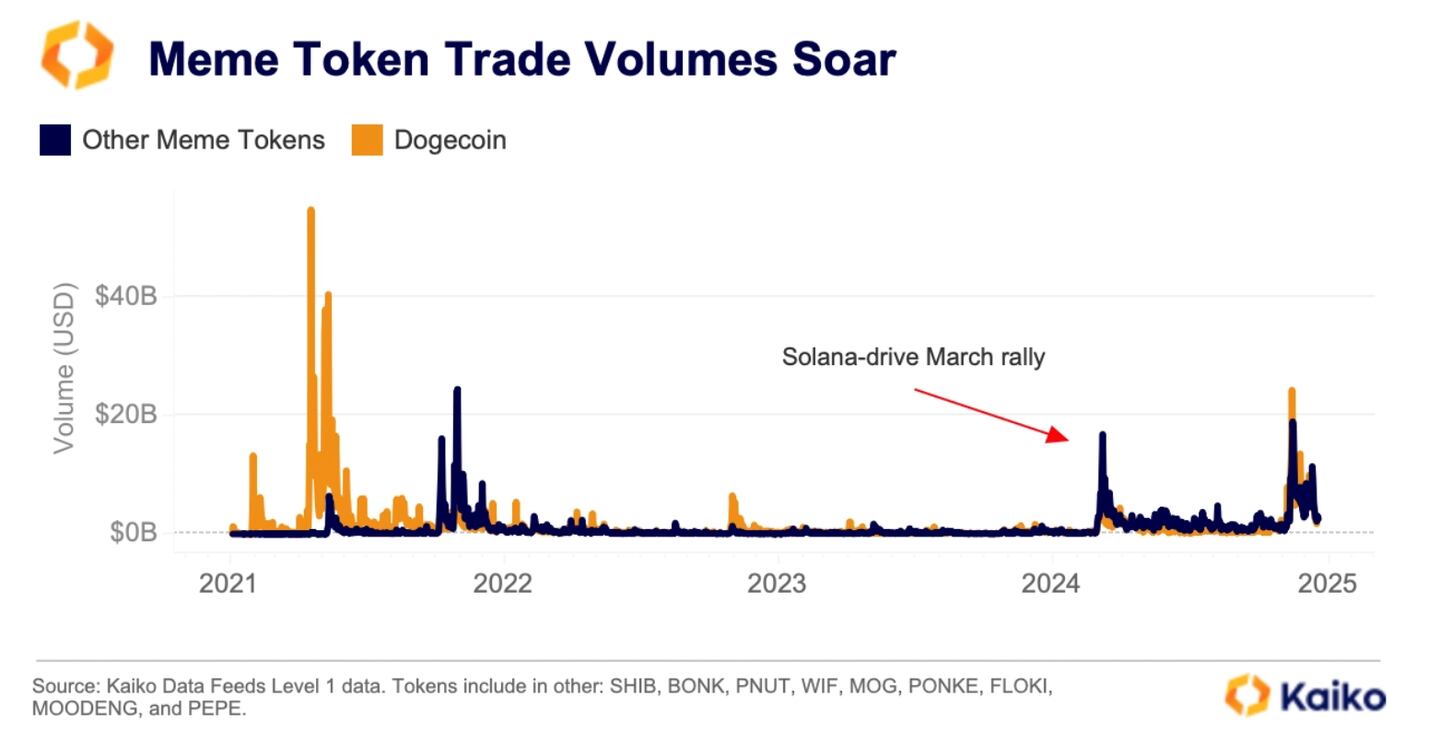

Memecoin mania

Memecoins began as a family-friendly fad, with PEANUT the squirrel and DogWifHat attracting investors in what seemed like marginal financial gains.

Pump.Fun, a platform that allows anyone to spin up a memecoin has been one of the most popular projects to rise in 2024.

But memecoin mania quickly took a sinister turn. Traders created racially-charged tokens and extreme content as some faked their own deaths.

More to come in 2025

Taken together, these five charts chronicle a rally that feels different than past bull runs, say Kaiko analysts.

Yet crypto remains a volatile asset that routinely foils predictions. As 2025 unfolds, investors will undoubtedly be in for more surprises.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.