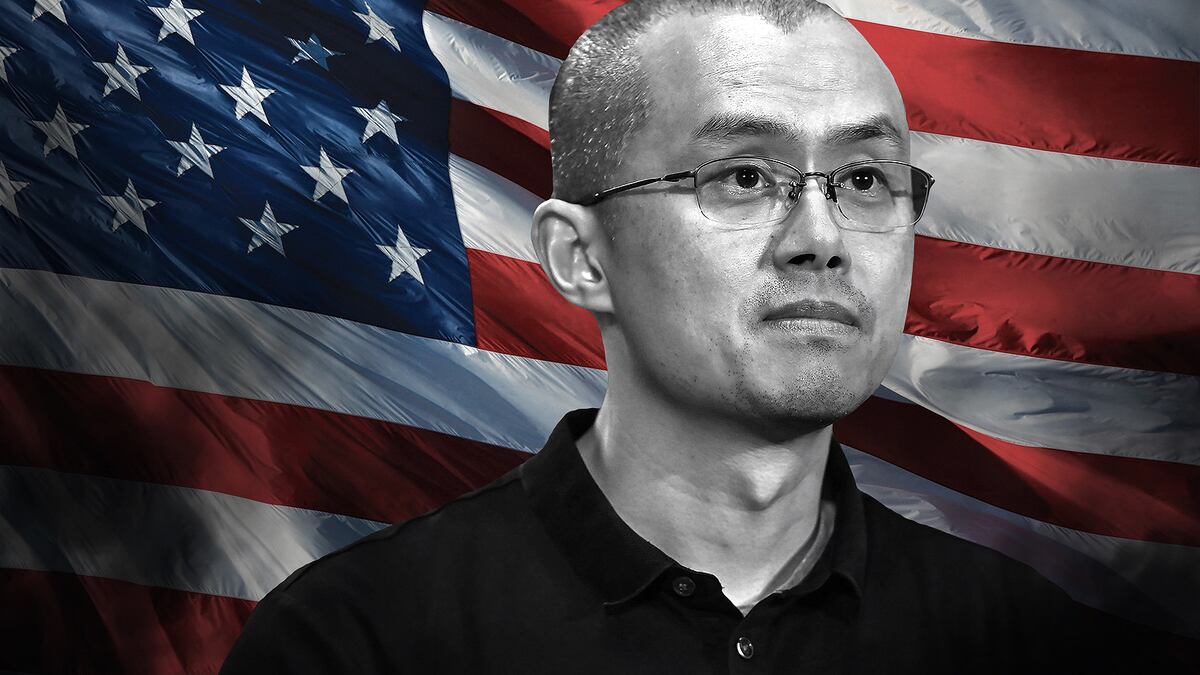

- Crypto prices plunged as US regulatory action against Binance weighs on investors.

- SEC deemed the token BNB a security as the regulator sues crypto’s biggest venue.

- Solana, Cardano, Cosmos, The Sandbox, and Axie Infinity were all deemed securities in a filing Monday.

Bitcoin tracked a drop in crypto markets as sentiment worsened following the Securities and Exchange Commission’s latest enforcement action against centralised exchange Binance.

Binance has shown a “blatant disregard for federal securities laws,” according to the SEC’s filing. The exchange has “unlawfully solicited US investors to buy, sell, and trade crypto asset securities,” the regulator added.

The SEC’s suit alleges Binance’s CCO at the time said the company was operating an unlicensed securities exchange in the US in December 2018.

“We are operating a fking unlicensed securities exchange in the USA bro,” the unnamed executive told a Binance compliance officer, according to the filing.

NOW READ: Silvergate short seller says he’s betting against Signature: ‘Binance is next’

The regulator named several prominent cryptocurrencies as securities in a filing made Monday as the regulator sues Binance. BNB — formerly known as Binance Coin — Solana and Cardano were deemed securities in the filing.

In total, the regulator said 12 different tokens on the exchange were securities. The majority of the tokens have very low volumes and rely on Binance for most of their liquidity.

Binance is crypto’s biggest venue by trading volume, with over $11 billion in the past 24 hours, according to CoinGecko data — 10 times the amount Coinbase, the second largest, has done in the same period.

Crypto prices plunge

Investors dumped tokens as the SEC threat to exchange giant Binance sent sentiment lower.

Bitcoin fell 2% in the hour after the filing, trading below $26,000, according to CoinGecko data. Related markets fell in tandem with the leading cryptocurrency.

Coinbase shares were trading below $57 shortly after midday New York time, down over 12% since the opening bell, according to data via TradingView. MicroStrategy, seen as a proxy for investing in Bitcoin due to it holding 140,000 Bitcoin, dipped 9%.

The tokens named in the SEC’s suit experienced sharper sell-offs, all of which are a fraction of the size of Bitcoin. BNB plunged 8% to $278.50, following the news, according to Binance data via TradingView.

The most popular trading pair for BNB is, BNB/USDT. The pair accounted for nearly 20% of the token’s total volume over the past day.

Trading volumes have almost tripled to $290 million since the announcement, according to TradingView data, as investors rushed to offload tokens.

Solana fell over 9% since the announcement, while Cardano was down around 7%.

Binance said it was disappointed by today’s action from the SEC as it was engaging in “good-faith discussions to reach a negotiated settlement to resolve their investigations.”

The exchange criticised the regulators recent approach to regulating crypto, saying the agency is using “blunt weapons of enforcement and litigation rather than the thoughtful, nuanced approach demanded by this dynamic and complex technology.”

”Unilaterally labelling certain tokens and services as securities,” makes regulating crypto more difficult, Binance said in its response.