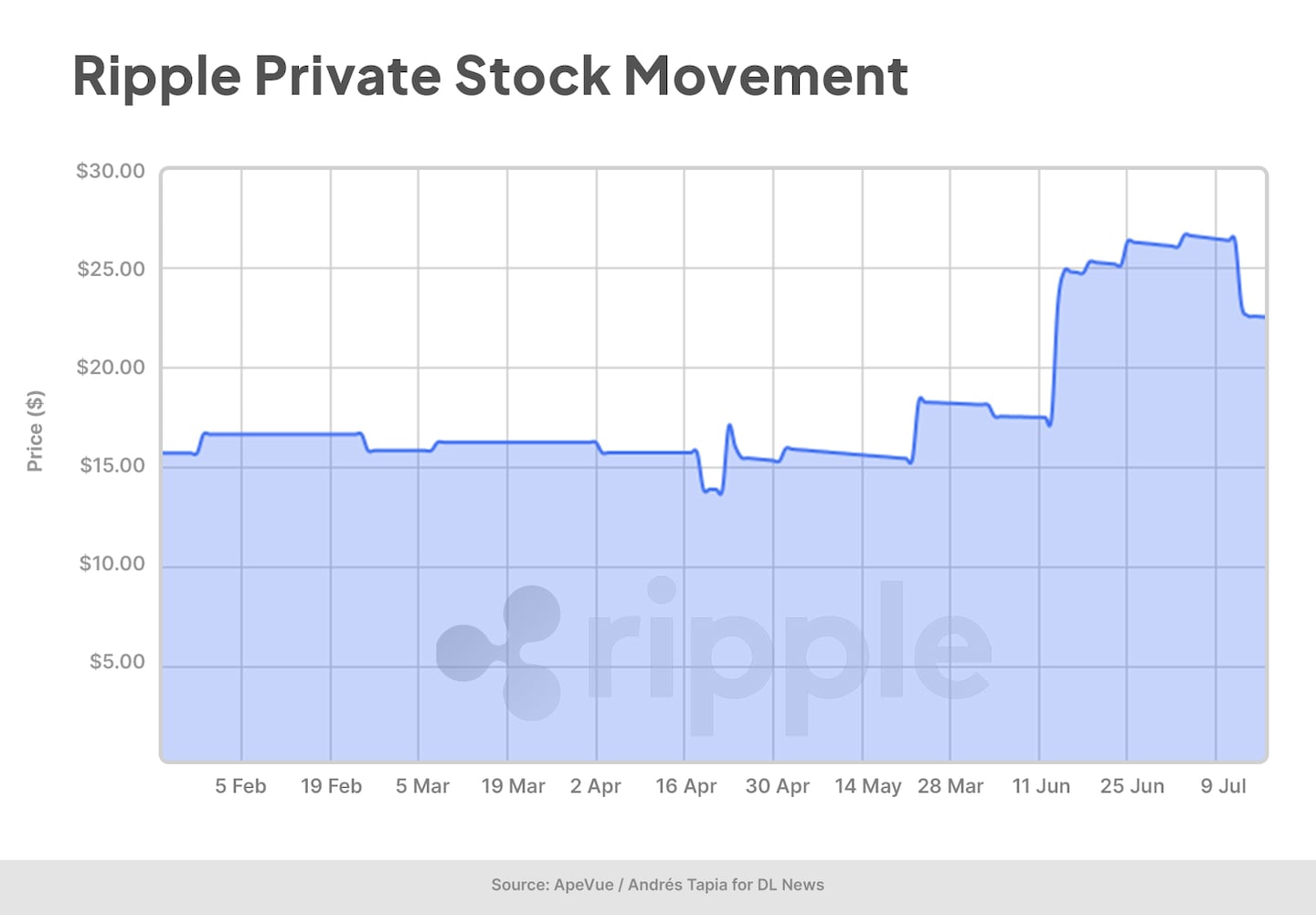

- Shares in Ripple jumped to $26 from $18 between June and July ahead of last week’s surprise in the Southern District of New York.

- “It’s hard to say regulatory progress isn’t playing a role here,” said Nicholas Fusco, CEO of ApeVue, a private stock pricing service.

Private market shares in Ripple soared over 40% in the past month, as bullish investors made bets that the company would win a positive ruling in its court case against the SEC.

The ruling was indeed positive for Ripple — the XRP token surged 70% after the judgement in the firm’s nearly three-year case with the Securities and Exchange Commission.

But savvy traders won big by piling into Ripple’s private stock much earlier. The share price traded as high as $26 in July, up from $18 at the start of June, according to ApeVue data.

Trading volume in Ripple’s private stock also saw a substantial uptick in the past month. Volume was up $40 million between bids and offers in the past 30 days, ApeVue data showed.

”It’s hard to say regulatory progress isn’t playing a role here,” Nicholas Fusco, CEO of ApeVue, a private stock pricing service, told DL News.

Secondary market brokers are seeing soaring demand for Ripple private shares, he said. Ripple’s private stock is up by about 44% this year.

Last week, Judge Torres in the Southern District of New York ruled that sales on exchanges, or programmatic sales, didn’t constitute a securities offering. This included distributions to employees. Institutional sales did constitute a securities offering.

The SEC alleged Ripple conducted an unregistered securities offering, through the sale of its XRP token. The offering was worth $1.3 billion, the agency said.

Ripple is unique among industry counterparts, with only ConsenSys seeing volumes rise recently.

The blockchain software company has seen volume rise since the first quarter, but the price is still on a downward trend, according to ApeVue.

Shares in Ripple have outpaced broader private markets this year.

The ApeVue50 broad market index, which tracks the most active 50 names in the late-stage secondary market, is down 0.95% since January versus Ripple’s more than 40% gain.

Ripple’s XRP token jumped to about $0.82 from $0.47 on Thursday, an increase of more than 70%, according to CoinGecko data. XRP’s rally has since lost some momentum, as the broader crypto market dipped.

Last week’s ruling was a blow for the regulator. New York Democrat Ritchie Torres called for SEC Chair Gary Gensler to rethink his approach to regulating the industry.

The summary judgement was “more of a win than I was expecting for the defendants,” according to Stephen Palley, a partner at Brown Rudnick’s Digital Commerce group.

He added that it “may be trending helpfully in the direction that secondary sales are not securities transactions.”

The court did not rule on whether secondary market sales of XRP constituted a securities offering. That question was not before the court, it noted. A trial will follow, and the SEC has the right to appeal the ruling.

US regulators have cracked down on crypto through lawsuits, arrests, and enforcement actions this year. The regulatory environment comes amid last year’s string of scandals, which culminated with the collapse of the crypto exchange FTX in November.

To share tips or information about Ripple or another story, please contact me at adam@dlnews.com.