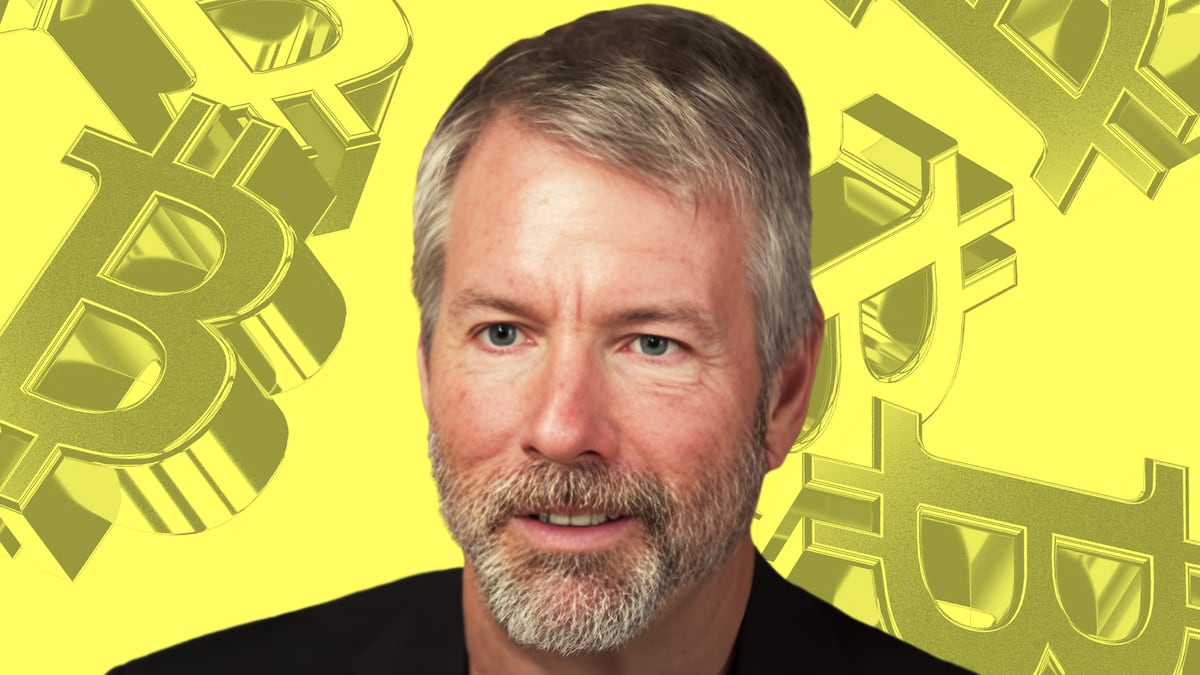

- In October, Michael Saylor announced plans to buy $42 billion worth of Bitcoin.

- His firm, once an enterprise software company, is solely and now officially focused on acquiring Bitcoin.

Michael Saylor won’t be stopped. “Borrow billions, buy Bitcoin,” as he’s put it before.

Less than a week after announcing a rebrand of his Bitcoin-hoovering firm MicroStrategy to simply Strategy, it’s back buying up more of the asset.

In an announcement on X, Saylor said Strategy recently acquired 7,633 Bitcoin, at a cost of about $97,255 per token, totaling $742 million.

The firm’s holdings have reached 478,740 Bitcoin at a cost of roughly $65,000 per token, which it first began acquiring in 2020.

To pay for part of that purchase, the company recently raised about $563 million by issuing a novel form of stock. “We’ll look at issuing preferred shares — things that are, in essence, a swap,” Saylor explained in October, per Bloomberg.

The company last touted a Bitcoin purchase on January 27, purchasing 10,107 tokens at a cost of $105,596 per.

The company previously announced plans to raise $2 billion from sales of preferred stock as part of its ambitious “21/21” proposal. The plan, a reference to Bitcoin’s capped issuance of 21 million tokens, revolves around Strategy’s plan to raise $21 billion from equity and $21 billion from fixed income instruments over the next three years, totaling $42 billion. With the funds they plan to – what else – “acquire more Bitcoin.”

Last week’s rebrand put paid to the notion of MicroStrategy still being an enterprise software company – Saylor had his first successes in the ‘90s, developing business intelligence software for places like McDonald’s – with a bright orange logo that matches the Bitcoin motif.

It now refers to itself as “the world’s first and largest Bitcoin Treasury Company,” explaining that by “using proceeds from equity and debt financings, as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital.”

The company’s financials tell the same story. It raises cash through debt and stock issuances, and last year generated its lowest revenue from the enterprise software segment.

President and CEO Phong Le said earlier this month that Strategy is ahead of schedule in completing $20 billion of its $42 billion capital plan.