- Polymarket's volume has mutiplied eight times amid the 2024 presidential election.

- 'Domer' pulls back the curtain on how he plays the platform.

- Punters bet on everything from Taylor Swift's hits to Elon Musk's tweet count.

As Polymarket’s most prolific bettor, Domer has won almost $700,000 in the last three years by predicting the outcome of numerous events.

He bagged $50,000 by correctly guessing Sam Bankman-Fried would receive a 25-year prison sentence.

Domer notched another $50,000 betting Sam Altman would be fired as CEO of OpenAI.

Still, like any punter, he has taken his share of losses, too.

Earlier this year, he lost $120,000 after betting US regulators would not approve Ethereum ETFs; they were given the green light in May. And he’s bracing for a virtually certain $260,000 loss in July.

Even so, he just can’t quit.

“I just love trading,” said Domer, who prefers to use a pseudonym. “I’m probably getting four or five hours of sleep.”

Polymarket booms

He’s not the only one. With the US presidential election heating up and crypto running hot as a surprise issue, Polymarket is booming.

More than 20,000 traders are placing $56 million a month on the crypto-powered prediction market, which is eight times the volume on the platform 12 months ago, according to Dune Analytics.

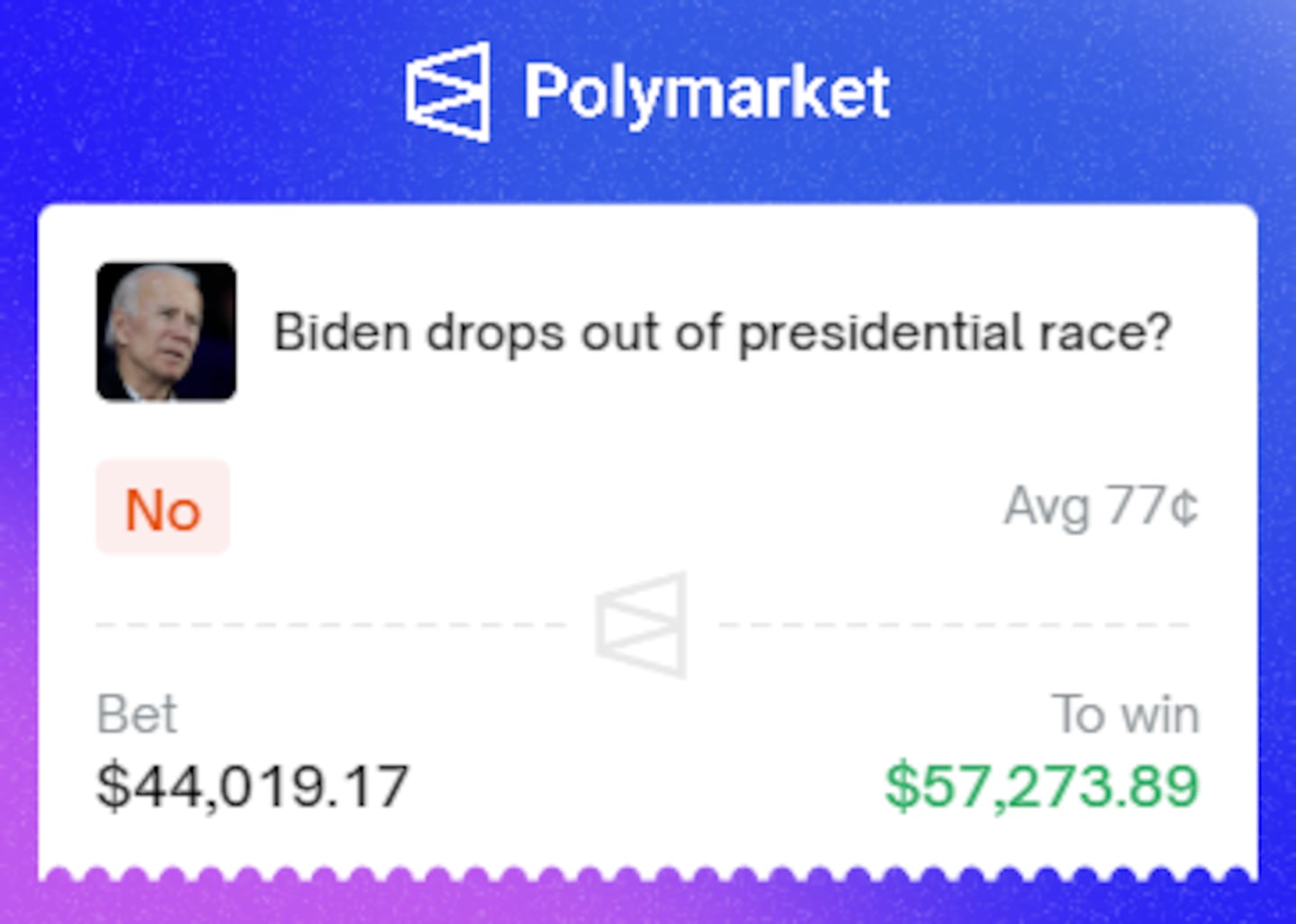

And Domer, whose Polymarket avatar is a picture of Ryan Gosling as Ken from Barbie, has placed his bets — he’s gambling $44,000 that President Joe Biden will not drop out of the presidential campaign, which is a pretty safe bet.

He’s also betting $8,700 that Donald Trump, the presumptive Republican Party nominee, will win the popular vote. In 2020, Biden won more than 7 million votes than Trump. (Domer says he’ll vote for Biden.)

This is just a sampling of the election action on offer.

Polymarket features 129 markets related to the contest. Some wagers are pretty obscure: How many times will tweets will Elon Musk post this week? Who will be the next actor to play James Bond?

There’s even a tiny $2,000 betting pool on whether Biden will say the word “malarkey” during the debate on June 27. Domer’s got $16 that says he will.

Betting on efficient markets

In many ways, this is Polymarket’s moment. Launched in 2020, the site is a mashup of sports betting chutzpah and prediction analytics.

Shayne Coplan, Polymarket’s CEO and founder, designed the platform to be the world’s biggest crypto prediction market. All bets are made in USDC, Circle’s dollar-pegged stablecoin, and crypto folk have flocked to the site.

Instead of relying on software programmes to produce forecasts, Polymarket is leveraging gamblers’ insatiable taste for action.

Do you know how many weeks Taylor Swift’s latest album will top the charts? Will China invade Taiwan this year? Who will win the Copa America soccer tournament this summer?

You can bet on these queries by buying shares in a specific outcome. When you and other bettors do so, the value of your bet rises even if you don’t stake any more, or falls, as the case may be.

Shares cost pennies. If you’re wrong, those pennies collapse to zero cents. If you’re right, the shares rise to a dollar.

‘I’ve let go of being too attached to wins or losses.’

— Domer

The model essentially relies on the efficiency of the marketplace to make guesses about an outcome possible. In that sense, Polymarket reflects many of the same dynamics at play in the capital markets — stocks go up and down, after all, based on investors’ assumptions.

So, too, do the shares in the many betting pools on Polymarket. “It’s probably the best approximation versus listening to so-called experts or pundits, or getting your news in a very biased fashion,” Domer said.

Thanks to its Discord channel, which lets users make suggestions for new markets in real time, Polymarket rapidly captures the zeitgeist and turns it into a bet.

Trump coin, or not?

On Monday, for example, debate erupted over whether Donald Trump actually created another Trump-inspired meme coin called DJT.

Today, there are a dozen different bets on Polymarket centred on the token.

The largest market, at $3.4 million, asks simply whether the token is real. Another $1.2 million bets on whether Trump’s son, Barron Trump, launched DJT.

Punters are even speculating on whether Martin Shkreli, the convicted fraudster and onetime hedge fund manager, will go back to prison this year. Shkreli, who has more than 190,000 followers on X, has been arguing that DJT has ties to the Trump team.

An insider with direct knowledge of decisions surrounding the Trump campaign told DL News on Wednesday that the campaign wasn’t involved in the project.

Onchain sleuth ZachXBT was also awarded $150,000 by analytics firm Arkham for correctly identifying the token’s creator as Shkreli himself.

DJT action

Of course, Domer has a hand in the DJT action.

Besides betting Shkreli $70,000 on X that Trump has nothing to do with the token, he’s also bet $3,200 that Shkreli won’t see any jail time despite the antics.

The DJT market is just one of 128,000 that Domer follows.

That’s another quirk of Polymarket. You can see everything anyone’s gambling on, including how much they’ve won or lost. There are even profit rankings across a day, a week, a month, and since the first bet a trader made.

On Friday, for instance, Domer has already made nearly $12,000.

Domer epitomises Polymarket’s rise as the go-to betting platform for crypto enthusiasts.

Domer, who’s based in Las Vegas, used to be a professional poker player. In 2007, he started dabbling in Intrade, one of the first prediction markets that eventually shut down in 2013, as well as PredictIt.

Now, he spends 100 hours a week on Polymarket. His bets are mostly political, but he’s also betting $23,700 that weed won’t be rescheduled in the US, another $15,800 that a cat meme coin will reach unicorn status, and $6,300 that Google’s CEO Sundar Pichai won’t be fired or step down this year.

Next month’s different, though. It’s his biggest bet yet.

He made a $260,000 bet with pseudonymous trader Gigantic Rebirth that Trump won’t win the GOP presidential nomination. Trump, already the presumptive nominee, will officially become the party’s presidential candidate at the GOP national convention in Milwaukee in July.

It begins. Got a sizable 2024 bet in the books: my $260k to GCR's $200k on whether Trump is the GOP presidential nominee.

— Domer (@Domahhhh) June 15, 2022

I've got the FIELD; GCR is betting on TRUMP.

Domer said he will recoup a chunk of the loss by wagering on the various contenders to be Trump’s running mate. For example, he bought $12,600 worth of shares in Florida Senator Marco Rubio winning the nomination. That bet has soared in value by 164% as Rubio’s prospects have improved.

Likewise, he also wagered that Senator JD Vance of Ohio will get Trump’s nod, and this bet has jumped 83% in value. If Rubio wins the vice presidential nomination over Vance, this would go a long way toward proving the efficacy of Polymarket’s predictability system.

Hungry for action

At a minimum, Polymarket’s design turns simple questions into sprawling, dynamic markets.

This permits punters hungry for action, like Domer, to trade the news until the market closes.

Still, he is keeping things in perspective. And he’s clearly delighted to just be playing the game.

“I may lose $15,000 on this stupid thing, but maybe two days later, I’ll make $16,000 on this other stupid thing,” he said.

“I’ve let go of being too attached to wins or losses.”

Liam Kelly is a DeFi correspondent at DL News. Got a tip about the election? Reach out at liam@dlnews.com.