- Hayes's fund, Maelstrom, is “apeing into” Decentralised Science (DeSci).

- DeSci aims to fix systemic inefficiencies in traditional scientific research.

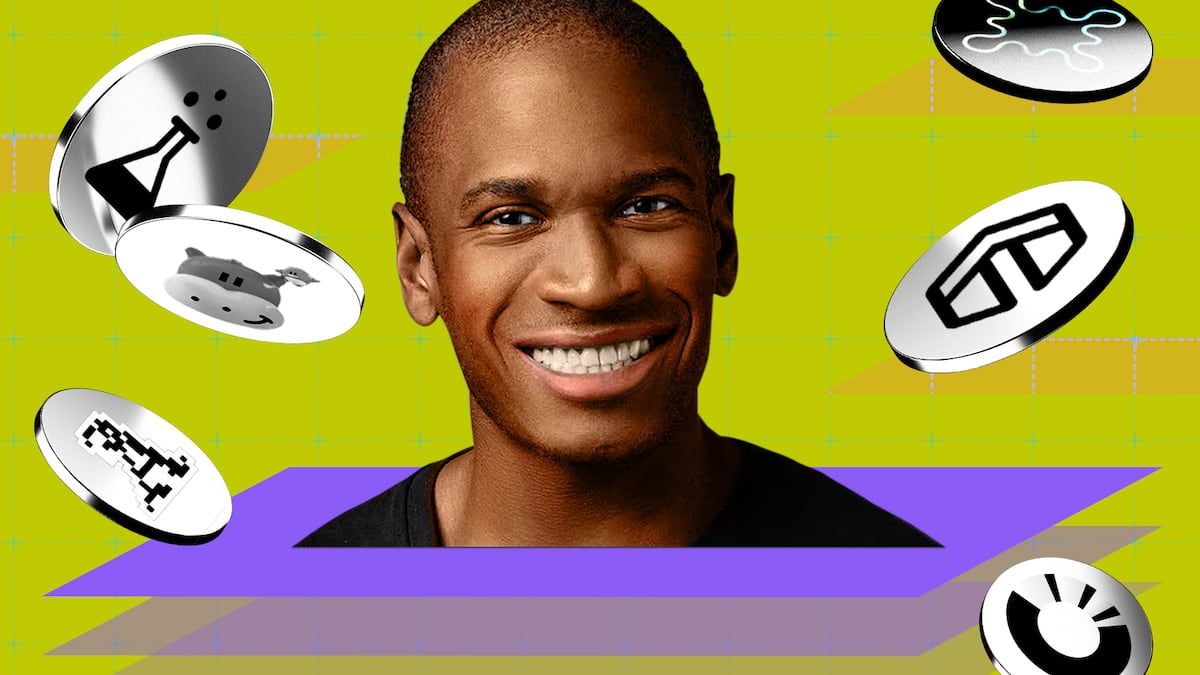

- ‘Degen DeSci’ is Maelstrom's investment thesis.

Arthur Hayes wants investors to get as risky as they possibly can.

“I will encourage the risk-takers at the fund to turn the risk dial” to degen, or high-risk trading, the chief investment officer at Maelstrom fund wrote in his latest blog post.

For Hayes, that means pouring money into a smallish sector of crypto: decentralised science, or DeSci for short. The term refers to tokens that target systemic inefficiencies in traditional scientific processes, including funding, limited access to longevity investments, and IP concerns.

The sector is worth some $2.2 billion.

Hayes said that crypto investors are overlooking DeSci — and his firm has piled into the burgeoning decentralised science industry, Hayes wrote on January 6. He added that his fund loves undervalued tokens.

“DeSci is one of the few truly new narratives in the space that many market participants have yet to hear of,” said Lukas Ruppert, an analyst at Maelstrom.

But that looks primed to change.

Research firm Kaito revealed that DeSci’s mindshare soared a whopping 2,600% in 2024, outpacing even the highly hyped up AI, and crypto’s most daring sector, memecoins.

Maelstrom allocated assets to seven DeSci tokens, including BIO — which accounts for half of the entire sector’s valuation — PSY, a project that tokenises intellectual property on psychedelics, and CRYO, a cryopreservation research project. The others are BIO, VITA, ATH, GROW, and NEURON.

Users who buy these tokens can tap into the underlying companies’ platforms for funding, voting on governance proposals, and early access into commercialisation of products.

Hayes maintained his firm’s $200,000 price target for Bitcoin, and laid out when he thinks the asset will peak.

Degen Desci

DeSci tokens are an asymmetrical bet.

Ruppert’s thesis lies in the small number of DeSci tokens that exist right now.

“There will only ever be so many OG DeSci blue chips,” he wrote. “Based on this unique dynamic, small cap inaugural BioDAOs offer the greatest upside potential.”

Pedro Solimano is a Markets Correspondent at DL News. Got a tip? Email him at psolimano@dlnews.com.