- The revised odds of an Ethereum ETF approval have buoyed Ethereum-correlated assets.

- Investors in Grayscale's Ethereum Trust have bought up its discount in anticipation of an ETF approval.

Ether-correlated assets are surging after a surprise turnaround on the likelihood of an Ethereum spot ETF approval from Bloomberg Intelligence analyst Eric Balchunas.

While Ether itself rallied 22% to $3,800, several other assets have outpaced it.

Grayscale’s Ethereum Trust has in recent months become a gauge among traders for the likelihood of an Ethereum spot ETF approval.

That’s because the investment product, which launched in 2017, cannot be redeemed for the Ether tokens that back it. The lack of redemptions has meant that the trust has traded below its net asset value — or NAV — for most of the past two years. It traded at a steep 20% discount on Friday.

If the SEC approves spot Ethereum ETFs, however, Grayscale can convert its trust into an ETF. That’s what happened with GBTC, Grayscale’s Bitcoin Trust Fund.

Because ETFs can be redeemed for their underlying assets, that would allow traders to quickly arbitrage the discount to NAV, as they did when Grayscale converted its Bitcoin trust to an ETF in January.

After the recent rally, the Grayscale Ethereum Trust now trades over the counter at %2.7 premium to its backing, indicating that traders believe a conversion into an ETF is likely a done deal.

‘Ethereum betas’ rally

Liquid staking protocol Lido’s LDO governance token is among the biggest gainers, rising 31%.

Other popular Ethereum DeFi tokens, such as Uniswap’s UNI and Aave’s AAVE, have also jumped, but not as much as Ether or Lido.

As the biggest DeFi protocol on Ethereum with $35 billion of deposits, traders often look to Lido as Ethereum beta — a trading term for assets that react more sharply to price moves in a correlated asset, in this case, Ether.

Another popular Ethereum beta is memecoin PEPE, named after comic artist Matt Furie’s popular Pepe the Frog character. It’s the second-biggest memecoin on Ethereum after Shiba Inu.

PEPE gained more than 34% on the revised ETF odds, hitting a new all-time high. It now has a market value of over $5.3 billion.

Other Ethereum-related assets, such as crypto asset manager Grayscale’s Ethereum Trust, have also benefited. After a 31% gain, it’s now trading above its net asset value per share of $32.56 for the first time since March.

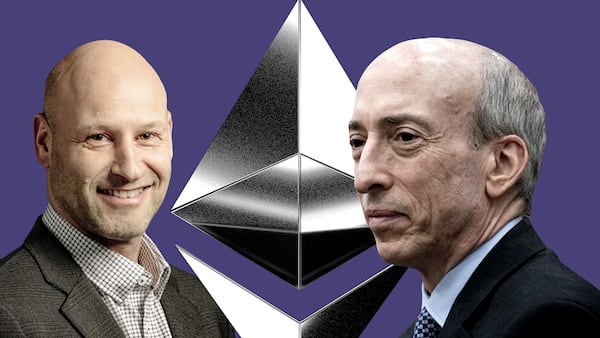

The moves upward comes after Balchunas revised his odds that the Securities and Exchange Commission will greenlight an Ethereum spot exchange-traded fund this week to 75% from 25%.

In an X post, the analyst said he was “hearing chatter this afternoon that the SEC could be doing a 180 on this (increasingly political issue), so now everyone is scrambling (like us everyone else assumed they’d be denied).”

Tim Craig is a DeFi Correspondent at DL News. Got a tip? Email him at tim@dlnews.com.