- Earliest signs of an altcoin season are emerging, analysts say.

- Many big cap coins have enjoyed triple digit gains.

- Past cycles offer a guide of what's to come.

Forget Christmas. Altseason is upon us.

Altseason is a period when interest – and prices – surge for cryptocurrencies other than Bitcoin.

In the 2017 bull cycle, for instance, alternative cryptocurrencies multiplied in value thousands of times within a few short months, triggering a shower of riches for newly minted investors in the space.

Now, with the value of the OTHERS altcoin index soaring 76% since early November, to $334 billion, a new golden age appears to be dawning for Bitcoin’s offspring.

“It’s far from a nothingburger, we’re on the brink of a full-blown altseason,” Matthew Mena, head of US crypto research at 21.co, told DL News.

Dino coins

While sceptics may doubt altcoins are poised to soar for a sustained period of time, Mena said positive signs are already emerging.

This year, a number of “dino” coins from the 2017 era have already jumped triple digits.

XRP, the coin associated with Ripple, is up 177% in the past 30 days, and Dogecoin, the memecoin stalwart, climbed 140% in the same timeframe. Cardano, meanwhile, spiked 186% in the past month, according to CoinGecko.

Even Axie Infinity, the blockchain game play that’s long been out of favour, is delivering a 43% return to holders of AXS over the last 14 days.

“On top of that, laggards like Ethereum are breaking key resistance levels,” Mena said.

‘The usual crypto bro cycling out of Bitcoin and into alts will look differently.’

— Christopher Inks, TexasWest Capital

On Tuesday, the second most valuable cryptocurrency crossed the $3,600 mark for the first time since mid June. Many say a trip to $10,000 is just around the corner.

Alex Kruger, a macro analyst, agrees with Mena’s analysis, to a point.

Michael Saylor’s billion-dollar purchases of Bitcoin “gives oxygen to crypto natives to go gamble,” he told DL News.

That, in turn, is prompting seasoned retail investors to buy DINO coins even as newer entrants pile into memecoins.

Even so, Kruger doubts this altseason will feel like the 2017 bull run.

“Altseason a la 2017 is too much,” he said.

In any event, analysts are watching closely to see how the cycle pans out.

Juicy upside

After traders realise Bitcoin may not offer as much juicy upside, they “chase pumps” down the food chain, toggling from large caps to small caps, Mena said.

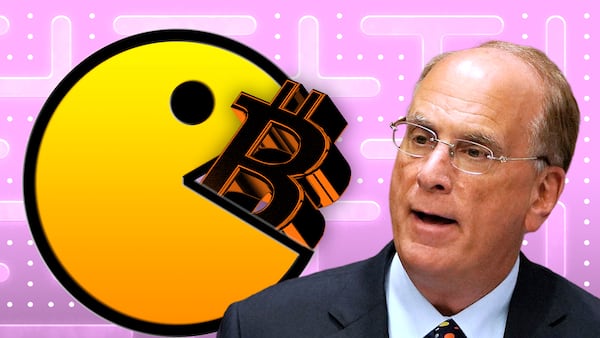

Unlike past cycles, this one features new forces that are reshaping the marketplace. Case in point: crypto ETFs, said Christopher Inks, CEO of trading firm TexasWest Capital.

“The usual crypto bro cycling out of Bitcoin and into alts will look differently,” he said.

That’s because ETF buyers, who have been in Pac-Man mode, aren’t rotating capital into alternative cryptocurrencies.

At the same time, Inks and Mena said investors may start focusing on specific sectors such as AI.

The intersection of digital assets and AI in offerings such as the bizarre memecoin GOAT is deeply crypto-native and making waves across Crypto Twitter, Mena said.

“AI and AI agents are two key sectors I’ve been keeping an eye on,” he said.

Pedro Solimano is a Markets Correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.