- Investors are playing the so-called Trump trade ahead of the US election.

- Big name investors outline where they're placing their bets.

- BlackRock's Larry Fink explains why it doesn't matter.

Investing giants, including Daniel Loeb and Paul Tudor Jones, are piling into assets that they see paying off should Donald Trump win the US election.

Positioning has shifted this month as polls drift more in the former president’s favour and as betting markets like Polymarket imply a Trump win over Vice President Kamala Harris.

The so-called Trump trade has been a staple in crypto ever since the former president backed the digital assets industry in May.

“If the betting markets are right, then there’s a higher probability of red sweep,” Omar Sayed, an investor and former portfolio manager at Millennium, told DL News.

Such a sweep of Republican victories in the Senate, House, and Oval Office, he said, would “favour things that could benefit from deregulation — so the banks could benefit from better M&A markets. And at least in the short term, there would be a kind of ebullience.”

That’s what markets are pricing in now as equities soar, Sayed said.

They’re also bracing for more inflation, he said.

Morgan Stanley said one scenario under Trump — including tax cuts combined with tariffs — would lead to a 0.9 percentage point gain in inflation over four quarters.

Experts have said such a risk is reflected in gold’s near-record price and booming inflows to spot Bitcoin exchange-traded funds.

“If tariffs go up, and then Trump follows through on the tax cuts without a revenue offset, you could have a sovereign bond sell off, and that could dislocate lots of risk markets,” Sayed said.

“A lot of people are focused on 2025 potentially being a sovereign bond crisis, and we haven’t seen that in a long time. But right now, the markets are very sanguine on that risk.”

Here’s how the world’s biggest investors are playing the election.

Stan Druckenmiller

Sayed echoed titans like billionaire investor Stan Druckenmiller.

Financial markets are “convinced Trump is going to win.” “You can see it in the bank stocks, you can see it in crypto, you can even see it in DJT, his social media company,” the former chairman of Duquesne Capital told Bloomberg Television.

Daniel Loeb

Third Point’s Daniel Loeb said he’s also prepping for a Trump victory, Bloomberg reported, citing an investor note. Trump’s plan to slap tariffs on foreign imports will boost manufacturing, infrastructure spending and some materials prices.

At the same time, fewer regulations will lead to more “corporate activity,” Bloomberg cited the note as saying.

“We have increased certain positions that could benefit from such a scenario via both stock and option purchases and continue to shift our portfolio away from companies that will not,” he wrote, without elaborating on specific targets.

Paul Tudor Jones

”In the hedge fund world, this is the macro Super Bowl coming up on November 5,” Paul Tudor Jones, founder of Tudor Investments, told CNBC.

“I don’t know if I necessarily believe the betting markets” predicting a Trump win, he said, but he’s betting on the former president’s victory anyway.

“What it means is more inflation trades,” Tudor Jones said, adding that his fund is long gold and Bitcoin as inflation bites, while he’s also piling into commodities.

He, too, acknowledged concerns about a debt crisis and referred to the United States’ $35 trillion national debt — a figure that is seven times its annual tax revenue.

“I am clearly not going to own any fixed income.”

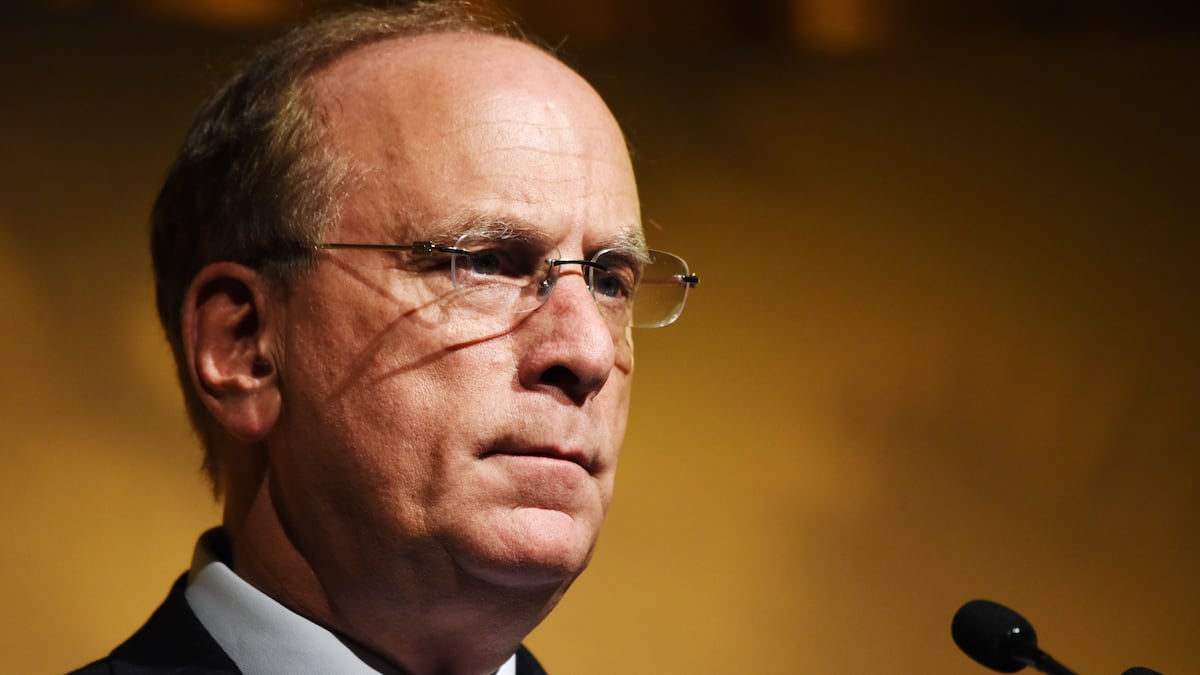

BlackRock’s Larry Fink

BlackRock CEO Larry Fink says he’s had enough of the election chatter.

“I’m tired of hearing this is the biggest election in your lifetime,” the Financial Times reported Fink as saying at a conference.

“The reality is, over time, it doesn’t matter. Unfortunately, there’s too much preoccupation with whether the market’s going up or down at any one time, any one quarter.”

Still, some investors think on shorter time frames — Fink said that more than half of BlackRock’s nearly $12 trillion in assets under management are retirement funds.

“It really doesn’t matter,” Fink added. “We work with both administrations and are having conversations with both candidates.”

The FT said the conference was hosted by the Securities Industry and Financial Markets Association on Monday.

Polymarket whales

The betting site Polymarket puts Trump’s odds of winning at 602% versus Harris’ 40%. While that is bullish for a Trump win, the illiquid prediction market has been skewed partly by four whales who have piled millions into pro-Trump bets.

Accounts named Fredi9999, Princess Caro, Michie, and Theo4 have collectively spent at least $27 million on the question: Who will win the 2024 presidential election?

Their “Yes” bets on Trump have helped drive the cost to 60 cents, implying 60% odds that he wins come November.

Trista Kelley is DL News’ Editor in Chief. Got a tip? Email at trista@dlnews.com.