- Kraken's 2019 acquisition of CF Benchmarks has paid off handsomely in the Bitcoin ETF boom.

- BlackRock, Ark Invest,and other Wall Street giants use the venture's Bitcoin Reference Rate.

- Kraken is raking in licencing revenue as investors plough cash into ETFs.

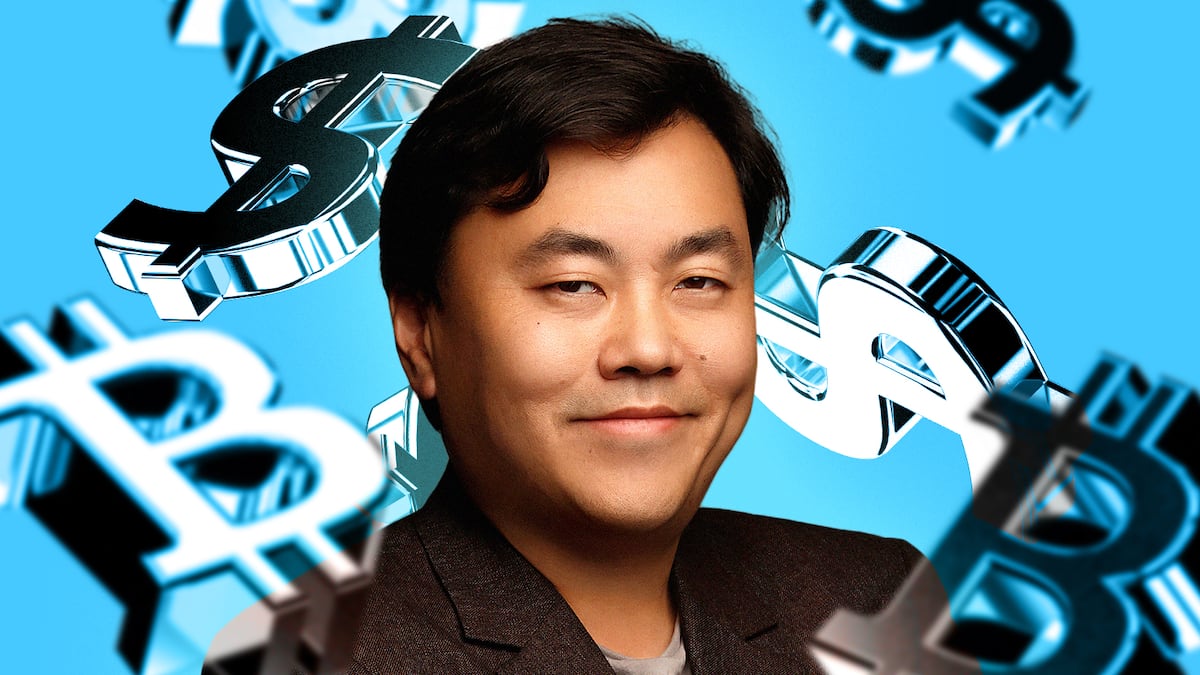

Sui Chung couldn’t believe what he was seeing.

It was late one night in February, and Chung, the CEO of a financial outfit called CF Benchmarks, was eyeballing numbers on his laptop.

“I pulled up my revenue forecast,” Chung said in an interview at a coffee shop in London’s Soho neighbourhood. “By the time I’d done all the maths it was 1 am, and I was like … bloody hell.”

More than $1.4 billion had poured into 11 new Bitcoin exchange-traded funds in the last few weeks, according to data in the Bitcoin Reference Rate, or BRR, an index produced by his firm.

Six of those funds issued by Wall Street giants BlackRock, Ark Invest, and Franklin Templeton, among others, track the BRR index.

This meant Chung’s company was about to rake in loads in licencing revenues.

In one month, the Bitcoin ETFs had hit Chung’s one-year target. And the Bitcoin ETF boom was just getting started.

Eye-watering revenue

The performance also demonstrated the prescience of Kraken, the San Francisco-based crypto exchange. In 2019, Kraken acquired CF Benchmarks for a nine-figure sum.

Now, investors have ploughed almost $58 billion into Bitcoin ETFs — CF Benchmarks is sitting on a cash cow as licence fees pile up.

Even better, neither Binance nor Coinbase, Kraken’s archrivals in the crypto exchange arena, have index businesses of their own.

And CF Benchmarks has excluded pricing data from Binance, world’s biggest and most liquid exchange because it doesn’t meet its criteria.

While CF Benchmarks doesn’t disclose how much it’s earning, it’s poised to generate fees for some time.

S&P Dow Jones, for instance, charges clients around 3 basis points, or 0.03%, on assets based on its S&P 500 indexes, according to a 2022 paper.

Consider just one of those ETFs — State Street’s — is managing $541 billion. That means S&P is bagging $162 million in fees from that one fund.

In April, Hong Kong approved Bitcoin and Ethereum ETFs and the three issuers — Harvest Global Investments, China AM, and Bosera AM — use the BRR as the benchmark for their offerings.

$40 trillion market

Without indexes, there wouldn’t be ETFs. Companies such as BlackRock’s iShares unit manufacture indexes to support ETFs. And they track everything from stocks to bonds to commodities such as gold and oil.

Benchmark indexes such as S&P 500 support a panoply of ETFs and have become fixtures in the $40 trillion retirement market.

Somewhere along the way, Chung realised that there was an opportunity create an index for Bitcoin.

With a background in benchmarking, Chung was steeped in the inner workings of the financial data that powers capital markets.

In 2016, Crypto Facilities, a London-based crypto derivatives exchange, realised it needed an index to help settle crypto futures contracts at the right price.

It was also in talks to provide this index to the CME, the derivatives trading giant in Chicago, for its forthcoming Bitcoin futures product.

‘No blueprint’

Chung was brought on to create the index with just four software developers, eventually creating a business under Crypto Facilities’ umbrella in 2018.

Few Bitcoin indexes existed at the time, so Chung’s team was working “with no blueprint,” he said.

He thought it could look very much like indexes from dominant providers S&P or MSCI. But there were key challenges.

Unlike equities, crypto is a 24/7 market that trades on a variety of global, unregulated exchanges.

S&P just has to take a snapshot of the price of, say, Apple stock at one time and in one place — say, the close of day on the New York Stock Exchange.

“But with crypto, you have to figure out what is the price of Bitcoin at any given moment in time, and what are the key moments of the day when financial transactions are settled, and build a methodology around that,” Chung said.

“And you must do that reliably in a manner consistent with financial regulations for traditional products — even though it’s this new asset class,” Chung said.

It was a big challenge. But Chung’s team had a powerful weapon — its relationship with the CME.

The CME’s Bitcoin futures contracts were among the first such regulated products in crypto, and it licensed BRR from launch in late 2017.

And then Kraken came calling.

Compliant indexes

In 2019, the exchange bought Crypto Facilities and CF Benchmarks for an undisclosed sum. But it was Kraken’s biggest deal since its exchange went live in 2013.

“In CF Benchmarks, we recognised the central role an authorised benchmarks administrator would have to play” in Bitcoin ETFs, Tim Ogilvie, Head of Kraken Institutional, told DL News.

“Fast forward to today, and CF Benchmarks is now the world’s largest crypto indices provider,” Ogilvie added. “They will play an important part in the proliferation of the crypto product space.”

Producing compliant indexes is not easy. Index providers have to input prices from heavily-regulated bourses like the NYSE and the Nasdaq to ensure the integrity and reliability of the data.

Regulators don’t want investors buying ETFs that are predicated on flawed indexes.

But it’s hard for a crypto index provider to input similar types of pricing in a marketplace where regulation and reliability remains patchy.

As a result, CF Benchmarks maintains strict selection criteria exchanges must fulfil to be considered for inclusion in the benchmark, Chung said.

For example, the exchange must prove that it prevents fraud and executes strict know-your-customer processes and anti-money laundering checks.

No Binance

The BRR aggregates pricing data from six constituent exchanges, including Kraken, Gemini, and Coinbase. Binance, though, is not tapped because of its regulatory issues.

After the exchange paid a $4.3 billion penalty and pleaded guilty to violating US banking law in November, CEO Richard Teng, Binance is working to comply with regulations. But it’s been a slow process.

Chung conceded that not having pricing data for an exchange that now boasts 200 million global users is a major data gap.

Yet, it’s more important that he’s able to stand by the benchmark’s integrity.

“If that means I have a smaller business, so be it,” Chung said.

New wave

Now, Kraken’s deal for CF Benchmarks has positioned it to profit from a new era in crypto — the advent of Bitcoin and Ethereum ETFs.

As affordable and easy to trade products, ETFs promise to open the crypto market to a new wave of investors.

While reception of the Hong Kong funds has been lukewarm compared with the US, analysts say the offerings could rack up $1 billion between them.

Chung is now setting his sights on South Korea, where authorities are discussing whether to allow spot Bitcoin ETFs.

Reach out to the author at joanna@dlnews.com