- BNB Chain has just joined Ethereum and Solana in the $2 trillion club.

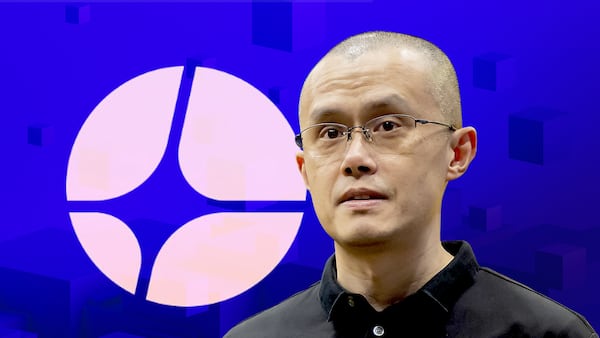

- Binance founder says it is memecoin season on BNB Chain.

- The memecoin market is down 69% from its December 2024 peak.

BNB Chain has crossed $2 trillion in cumulative trading volume on decentralised exchanges.

The catalyst: a massive surge in memecoin activity on the blockchain that even Binance founder Changpeng Zhao described as the chain’s memecoin season.

The milestone vaults the Binance-backed BNB Chain into the same rarefied air as Ethereum and Solana, both of which previously cleared the $2 trillion bar — they now have cumulative trading volume of $3.6 trillion and $2.1 trillion, respectively.

Paradoxical obsessions

Still, BNB Chain’s runaway meme-mania captures crypto’s chaotic heartbeat, which casts memecoins as one of the market’s most paradoxical obsessions.

The memecoin sector is down 60% from its December 2024 highs to be worth $57 billion. The slump was driven by macroeconomic uncertainty and highly publicised scandals such as the one involving Argentinian President Javier Milei.

Still, that hasn’t stopped traders from sprinting back to the noise.

Earlier this month, several traders made profits of more than $1 million from trading a viral memecoin called Binance Life on the blockchain.

The memecoin was launched on Four-Meme, a BNB Chain token launchpad similar to Pump.fun. Both Zhao and fellow Binance co-founder Yi He made social media posts about the token, boosting its value to over $500 million just three days after its launch.

Last week, BNB Chain developers announced a plan to reward memecoin traders on its blockchain with a $45 million airdrop as compensation for the October 10 market crash.

Surging activity

Trading activity is rising once again for memecoins, up 60% in the last 24 hours, and that’s not due to trading on BNB Chain alone.

Pump.fun, the largest Solana memecoin generator, has recorded close to $90 million in trading volume in the last 24 hours.

BNB Chain’s meme-fuelled DEX growth has driven the blockchain’s cumulative trading volume up 38% this year. That comes after two years of cooling activity on the blockchain as interest rotated to rival blockchains like Solana and Ethereum.

But BNB Chain is the leading blockchain for weekly transaction fees, pulling in nearly $16 million in the last seven days, Nansen data shows. That’s more than Ethereum and Solana’s weekly transaction fee haul combined.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.