- Crypto M&A activity has picked up in the first half of 2025.

- Regulatory changes and FinTech’s embrace have made investors more comfortable with crypto.

Crypto heavyweights are on a buying spree.

Consolidation in the crypto industry is on pace to hit its highest level since the 2021 bull market, according to Pitchbook, which provided DL News with data going back to 2020.

That year, there were 243 mergers or acquisitions in crypto valued at a combined $13 billion.

There have been 97 deals valued at $5 billion through the first five-and-half months of 2025, putting the industry on a pace to possibly equal or best 2021.

Crypto analytics firm Messari put the figure even higher, with an estimated 116 deals worth more than $7.8 billion through the first week of May.

So why now? What’s driving the action?

Classic consolidation, for starters.

Gobbling up small players

Some of the industry’s largest players are gobbling up smaller competitors as US lawmakers move swiftly to establish a regulatory regime for crypto, and the market surges on optimism that digital assets have finally gone mainstream.

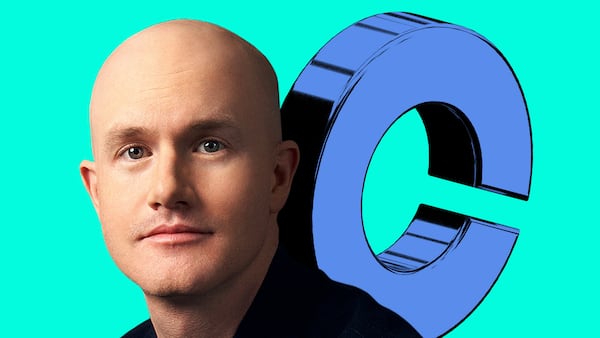

On May 8, Coinbase acquired crypto options exchange Deribit in a $2.9 billion cash and stock deal.

On Tuesday, the market was buzzing with speculation that Coinbase or Ripple may take a run at buying Circle, the issuer of the USDC stablecoin.

Even DAOs — the ostensibly leaderless cooperatives that govern many DeFi protocols — are getting in on the action.

Just this month, Synthetix proposed acquiring Derive, and Gnosis, the company behind Gnosis Chain, Safe, and CoW Swap, acquired HQ, a Singapore-based fintech firm.

“The industry is maturing,” Moon Pursuit Capital’s Utkarsh Ahuja told DL News.

“We’re starting to see more of a convergence of TradFi with crypto — traditional finance with crypto,” he added.

TradFi is crypto patois for traditional finance.

Fintechs on the march

Last year, payment processor Stripe began offering crypto payments for the first time since 2018, and retail trading platform Robinhood acquired crypto exchange Bitstamp. Revolut has been expanding its push into crypto.

“Revolut, Stripe, these two are going so hard into crypto in the [last] six months, I actually think that’s more of the trigger,” Sharon Paul, co-Founder and CEO of HQ, told DL News.

“When large fintechs are willing to get involved with crypto… the perception of the risk goes down.”

Several major crypto firms have made acquisitions this year.

In January, Circle, the company that issues the USDC stablecoin, bought Hashnote, the world’s largest tokenised treasury fund.

‘The US is really trying, and that’s what’s allowed these companies to make these acquisitions.’

— Utkarsh Ahuja

Robert Leshner, CEO and co-founder of crypto-focused asset management firm Superstate called it the “firing gun” in the race to put traditional assets on the blockchain.

In March, US-based crypto exchange Kraken acquired NinjaTrader, a retail futures trading platform, for $1.5 billion.

Last month, Ripple said it had acquired London-based prime broker Hidden Road for $1.25 billion.

And last week, Robinhood made another crypto acquisition, purchasing Canadian exchange WonderFi for $250 million Canadian dollars in an all-cash deal.

Stablecoin bill breakthrough

There’s also been a slate of smaller deals: Anchorage Digital purchased stablecoin issuer Mountain Protocol; IntoTheBlock and Trident Digital merged to form Sentora; and Bitcoin holding company Nakamoto merged with KindlyMD.

US President Donald Trump’s support for crypto, coupled with a Republican-led Congress, has fanned hopes that the US is poised to create a regulatory framework for issuing and trading digital assets.

On Monday, the Senate voted to fast-track potential approval of the Genius Act, a landmark stablecoin bill, after Republicans made concessions to Democrats concerned with protecting consumers, and the financial system, from bad actors.

“[The] US is really trying, is really making a push from a regulatory standpoint, and that’s now what’s allowed these companies to make these acquisitions,” Ahuja said.

Even decentralised finance is getting in on the action.

Natural partnership

Synthetix, a protocol that provides liquidity for decentralised derivatives exchanges, has proposed acquiring Derive, a blockchain-based options exchange.

Both organisations are run by DAOs, and the proposal set off a contentious debate on social media.

Gnosis’ acquisition of HQ also required — and earned — DAO approval.

Gnosis co-founder Friederike Ernst said consolidation often spikes when markets go sideways, as they did in April after Trump announced sweeping tariffs on imports from most other countries.

But in the case of Gnosis and HQ, she described the acquisition as a natural partnership given HQ’s use of Gnosis technology and its presence in Asia.

“Had Sharon and [HQ co-founder] Sunny [Singh] been in France, this probably would not have happened,” Ernst told DL News.

Gnosis’ DAO is relatively drama free, Ernst said — a major benefit when trying to finalise a deal that would otherwise be negotiated entirely behind closed doors.

HQ’s investors, however, had to be reassured this nontraditional process was worth the trouble.

“Our cap table is fairly big — it’s a mix of crypto, fintech, centralised exchanges,” Paul said.

“Our investors, we also had to really make them comfortable with us going public with certain parts of the terms and with the deal’s terms being on the DAO proposal, because ultimately, the DAO treasury was what was also funding part of the acquisition.”

When Paul first started HQ in 2022, investors asked how she foresaw them eventually exiting their investment.

“We actually did tell them that three years from now, we do see the more mainstream, bigger players, i.e. largely centralised exchanges, entering our space,” she recalled.

She was right on target.

“It’s actually very surreal.”

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.