- Two factors will make stablecoins a 'true digital currency.'

- Clear regulation has a serious silver lining for crypto.

- A look at how AI and blockchains can work together.

Forget crypto winter. It’s over. In 2024, it’s back to business.

That’s the central plot line of the predictions for the coming year, shared with us by some leading voices in the industry.

Stablecoins will be more widely used than ever, AI and traditional finance will intensify its entry into digital assets, and, just to keep everyone a bit sober, rules and regulations will become de rigueur whether you like it or not.

So get ready.

Stablecoins make a great leap forward

Julian Sawyer, CEO, Zodia Custody

The coming year could see stablecoins become a true digital currency — not just a settlement tool, or an on- and off-ramp.

There are two major factors at play. The first is regulatory, such as the UK government’s commitment to recognise stablecoins as a viable means of payment next year. The European Union’s Markets in Crypto-Assets, or MiCA, law also provides a detailed treatment on stablecoins and offere up hard rules for compliance.

Both regimes will help drive investor confidence and uptake.

The second major aspect is adoption. Visa, Mastercard and PayPal all process stablecoins. Major companies from Microsoft and Starbucks to CheapAir and ExpressVPN accept them or have stablecoin initiatives. This is only due to rise. Combined, these can lead to an increased role stablecoins play in the global payments network.

Clear regulation ushers in a ‘crypto spring’

Andrew Whitworth, policy director EMEA, Ripple

This year has seen significant milestones in the development of crypto asset regulation across Europe and the Middle East. The work of 2024 will be finalising these regimes and bringing all these efforts to fruition.

In the UK, the regulatory wheels are already in motion, and next year we’ll see consultations and proposals materialise into credible operational frameworks.

Secondary legislation will create proportionate guidance that will drive crypto asset and stablecoin adoption and utility. It will give new powers to the FCA to develop and oversee this regime, and will create new digital asset sandboxes that encourage new market entrants.

The crypto industry, once on the outside, is building its connections with traditional finance, and responsible regulation will aid markets to function well.

‘We are hopeful that 2024 will bring a new ‘crypto spring’ with regulatory progress, informed by private sector collaboration and new connections between academia, the public and private sectors.’

— Andrew Whitworth, Ripple

On the continent, the EU will continue to lead by regulatory example as MiCA enters the next stages of implementation.

The European Supervisory Authorities will complete MiCA level 2 and 3 rules which will provide final certainty on its regulatory provisions, from asset classifications to licence applications, giving the industry confidence to invest and grow sustainably across the whole Single Market.

We are hopeful that 2024 will bring a new ‘crypto spring’ with regulatory progress, informed by private sector collaboration and new connections between academia, the public and private sectors: Taken together this will spur industry investment and engagement and help drive growth, competitiveness, and inclusion in regional markets.

Crypto and traditional finance will fuse (but slowly)

Philippe Bekhazi, founder and CEO at XBTO Global

In 2024 we’re going to see an accelerated convergence between digital assets and traditional finance. The likely approval of multiple spot Bitcoin ETFs will galvanise the market but may not have the immediate big bang impact that some in the industry are expecting.

If approved, we will see a gradual mindset change as more traditional asset allocators start to include digital assets in their portfolios, and integrate them into their investment philosophy.

Crucial steps, such as the ETF, are being made towards greater institutional adoption of digital assets and ultimately the maturation of the crypto industry.

As we head into 2024, there are other exciting tailwinds at work, such as the halving of Bitcoin in April. Meanwhile, as the industry continues to be de-risked and regulatory frameworks are established, more institutional investors will recognise crypto’s potential.

Crypto criminals scale up

Phil Larratt, Director of Investigations, International at Chainalysis

In 2024, we can anticipate that illicit actors are going to become more sophisticated in the tactics and techniques they use, especially as more long-standing traditional organised criminals and financial crime actors continue to adopt crypto as well.

This is largely in response to the growing knowledge there is around how blockchain transactions are traced, and the increased frequency and effectiveness of law enforcement interventions.

This developing sophistication from illicit actors could involve the use of privacy coins, bridges, mixers and other obfuscation tools, but it’s worth noting that the technology to trace through obfuscation techniques will continue to advance too.

In response to this likely trend, we will need more intensive law enforcement investigations, increased training and knowledge sharing by law enforcement organisations, and even more advanced fraud protection programs and continued partnerships between the public and private sectors.

The buildout of blockchain infrastructure accelerates

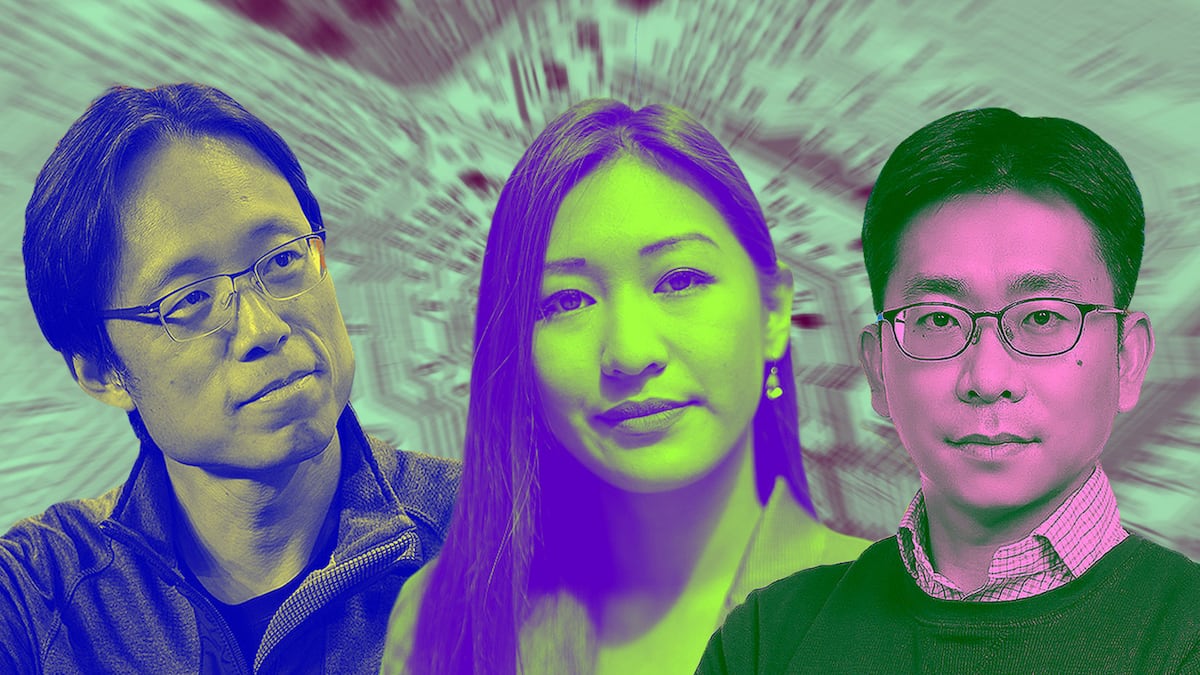

Samantha Yap, Founder and CEO of YAP Global

After enduring a lengthy bear market, 2023 witnessed what seems to be crypto’s recovery and laid the foundation for the next bull run.

While the industry was still dealing with the FTX collapse, the end of Sam Bankman-Fried’s trial wiped the slate clean and shifted the spotlight to the builders.

More people are now focusing on the future of blockchain instead of its past. There is a newfound passion for decentralisation and the emergence of technology innovations such as zero-knowledge rollups, modular blockchains and the growth of more scalable layer 2 networks and ecosystems.

‘The likely approval of bitcoin ETFs in the USA will be the latest and perhaps strongest harbinger of unmistakable institutional commitment to the crypto industry.’

— HB Lim, BitGo

Institutional investors re-commit to crypto

HB Lim, Managing Director of APAC at BitGo

The likely approval of bitcoin ETFs in the USA will be the latest and perhaps strongest harbinger of unmistakable institutional commitment to the crypto industry.

As traditional financial institutions enter the crypto space, their reach to large swathes of end customers—particularly retail customers—will be accompanied by increasingly stringent regulatory frameworks for the crypto industry.

‘We expect this fresh injection of liquidity to accelerate the tokenization of real-world assets, or RWAs.’

— Sangmin Seo, Klaytn

Crypto players across both centralised and decentralised crypto service providers will come to accept the reality that they are now operating in a highly regulated space, and will be viewed by government agencies and regulators under the same legal and regulatory lens that traditional financial institutions are subject to.

As such, for better or for worse, crypto players will come to resemble traditional financial institutions in how they think about and deal with risk and compliance.

Real-world asset tokenisation throttles up

Sam Seo, CEO, Klaytn

We expect this fresh injection of liquidity to accelerate the tokenization of real-world assets, or RWAs, leading to the formation of a stable asset class on-chain alongside stablecoins, as well as the introduction of leveraged products linked to DeFi.

Additionally, growing interest among institutions in RWA tokenization will play a major role in the expansion of tokenized assets.

And with increasing regulatory clarity in regions such as Asia, Europe and North America, the importance of intrinsic value assets will increase. These two factors will lead to the expansion of regulated on-chain assets and DeFi services that provide investor protection and are compliant with anti-money laundering requirements.

Based on the above, we foresee that DeFi will evolve to encompass both the growing liquidity of RWA tokens and crypto assets.

The DeFi services that can capitalise on the composability and synergy of the “Money Lego” model to capture both, while providing participants with healthy and sustainable tokenomics, will become leaders in the space.

Falling interest rates and regulatory clarity will spur confidence in web3

Yat Siu, Chairman, Animoca Brands

We are transitioning to a more stable interest rate environment and witnessing emerging regulatory clarity, with regional web3 infrastructure strengthening - particularly in Asia, thanks to favourable policies in places like Hong Kong and Japan.

As the industry matures, investment trends for 2024 will probably focus on proof of engagement and fundamental value. We expect blockchain gaming and the open metaverse to continue to attract significant investment due to growing user awareness of digital ownership and the other advantages of decentralisation.

‘As AI continues to evolve, blockchain will increasingly be used to address some of the concerns of AI specifically on compute, data, and learning models.’

— Renz Chong, BreederDAO

Various AAA web3 games that have been in development the last few years will launch in 2024, significantly increasing the quality of available web3 gaming experiences.

With billions of gamers already familiar with virtual currencies and assets, I think that web3 gaming will thrive in 2024, especially in Asia and the Middle East, with Europe also demonstrating heightened interest.

AI will increase the use of blockchain networks

Renz Chong, Founder, BreederDAO

As AI continues to evolve, blockchain will increasingly be used to address some of the concerns of AI specifically on computing, data, and learning models.

Decentralised computer models will allow people to access larger and faster amounts of overall compute power; AI-powered data models will allow builders to access more sources of data, which will equate to more robust results.

And at the same time, blockchain can be used as a means to track which data sources came from where. This means that people will also be able to more easily create specialised language learning models by training them on specific proprietary data.

And as these become more prolific, zero knowledge proofs and similar technologies will be crucial in verifying legitimacy of how LLMs are trained without necessarily disclosing the dataset.

Got a story about crypto in Asia? Get in touch with DL News’ Asia Correspondent at callan@dlnews.com