- Traders bet that Bitcoin will reach a new record before 2024.

- That’s according to data analysed by Kaiko.

- Here are five charts that signal a new rally.

Bitcoin’s price looks set for a new record after the election.

Kaiko’s analyst Adam Morgan McCarthy made that prediction this week by crunching data on options, futures, Treasuries and stock markets.

The data show that traders are betting on the price to surge “regardless of who wins the race,” McCarthy wrote.

This estimate comes as the crypto industry brace for the vote on November 5, which has been the first election where both candidates have made sector-friendly overtures.

Up to $80,000

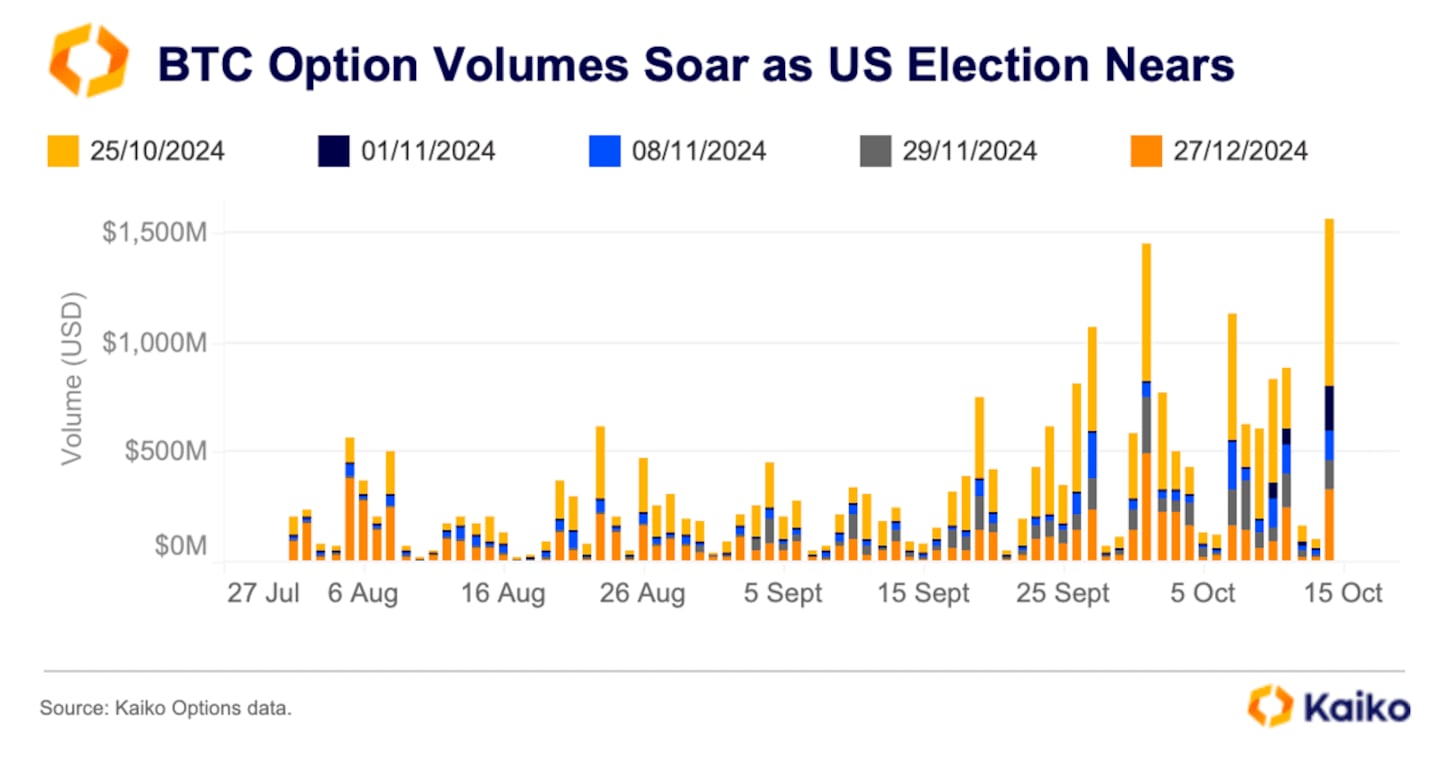

McCarthy noted that the volume of Bitcoin options trades has ticked up ahead of the election.

These trades give investors an opportunity to buy Bitcoin at specific prices at some point in the future and to profit from any difference between that price and the asset’s real price.

Notably, the expiration of the Bitcoin options trade on December 27 saw many traders pile in at bets that give the asset a price at $100,000.

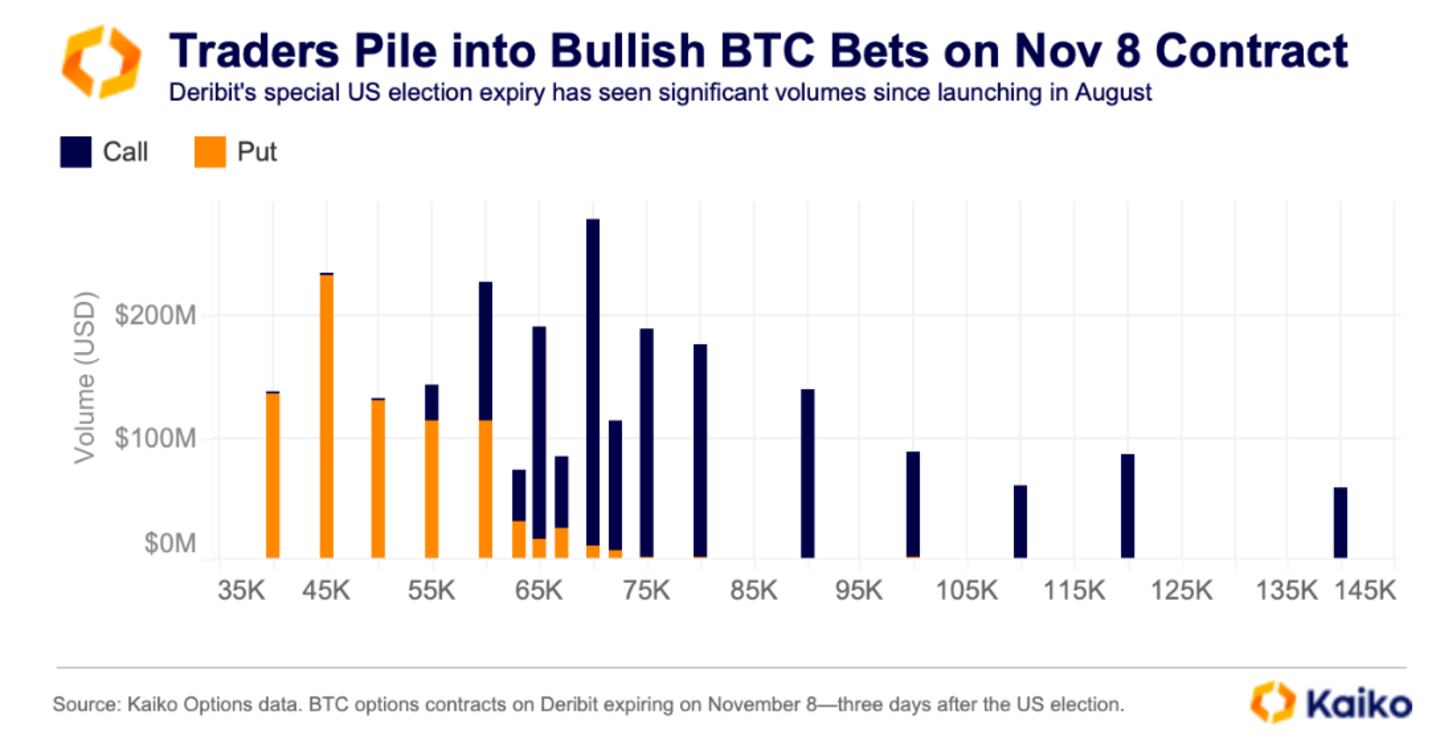

Traders have ploughed over $3 billion into mostly bullish bets at the November 8 expiration, with most of trades clustered in the $65,000 to $80,000 range, McCarthy said.

The contract expires just three days after the US election and one day after the Federal Reserve’s next meeting where the central bank is expected to announce another interest rate cut.

That’s usually bullish for Bitcoin. Low interest rates mean investors have more money to spend, which incentivises them to trade riskier assets like cryptocurrencies.

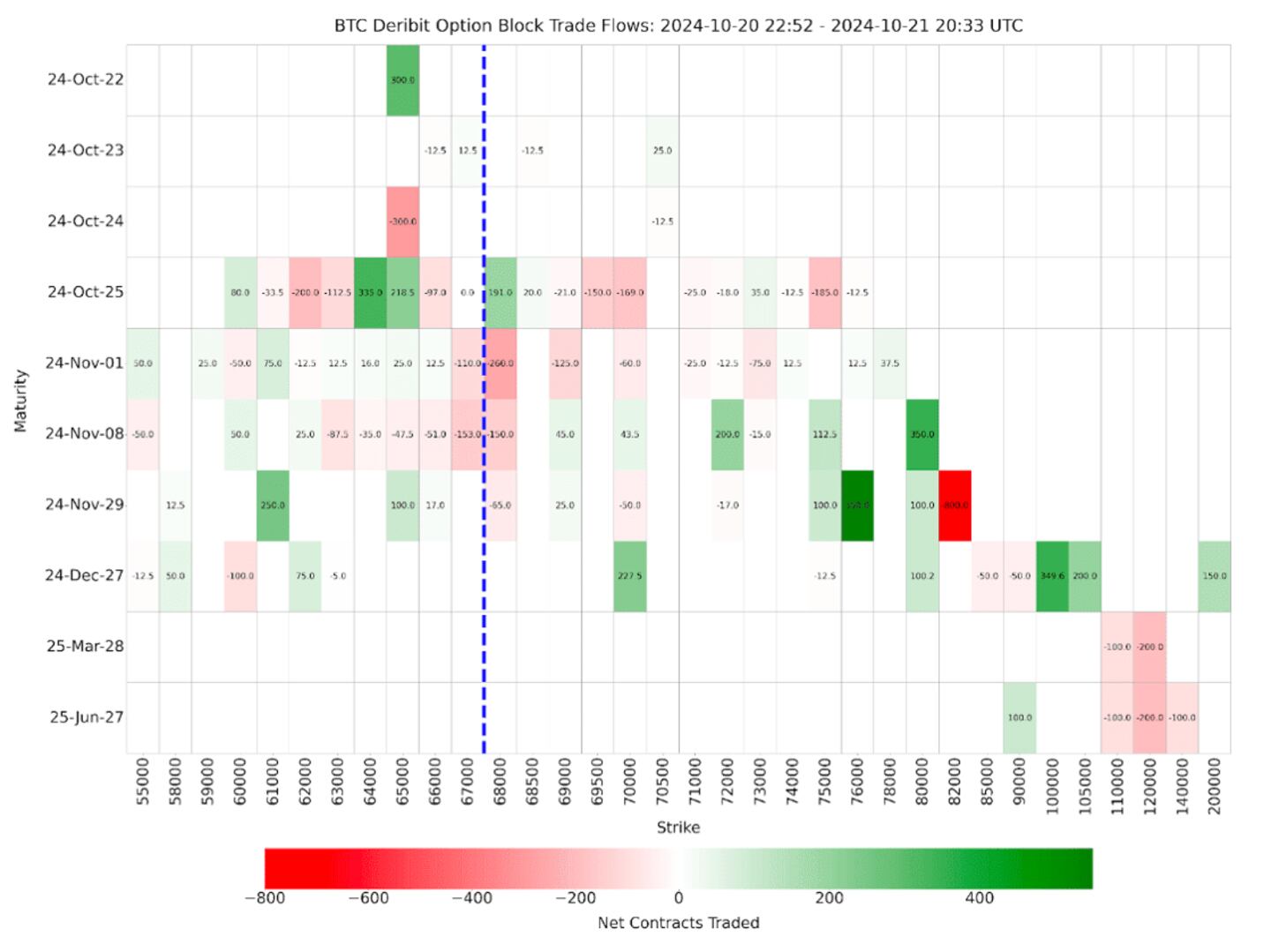

McCarthy also analysed so-called block trades. These trades are usually bulk orders from large traders.

Many of these trades are clustered around November expiration dates.

Between Wednesday and Thursday alone, McCarthy noted 550 contracts trading at contracts that valued Bitcoin around $76,000 on November 29.

Not just crypto

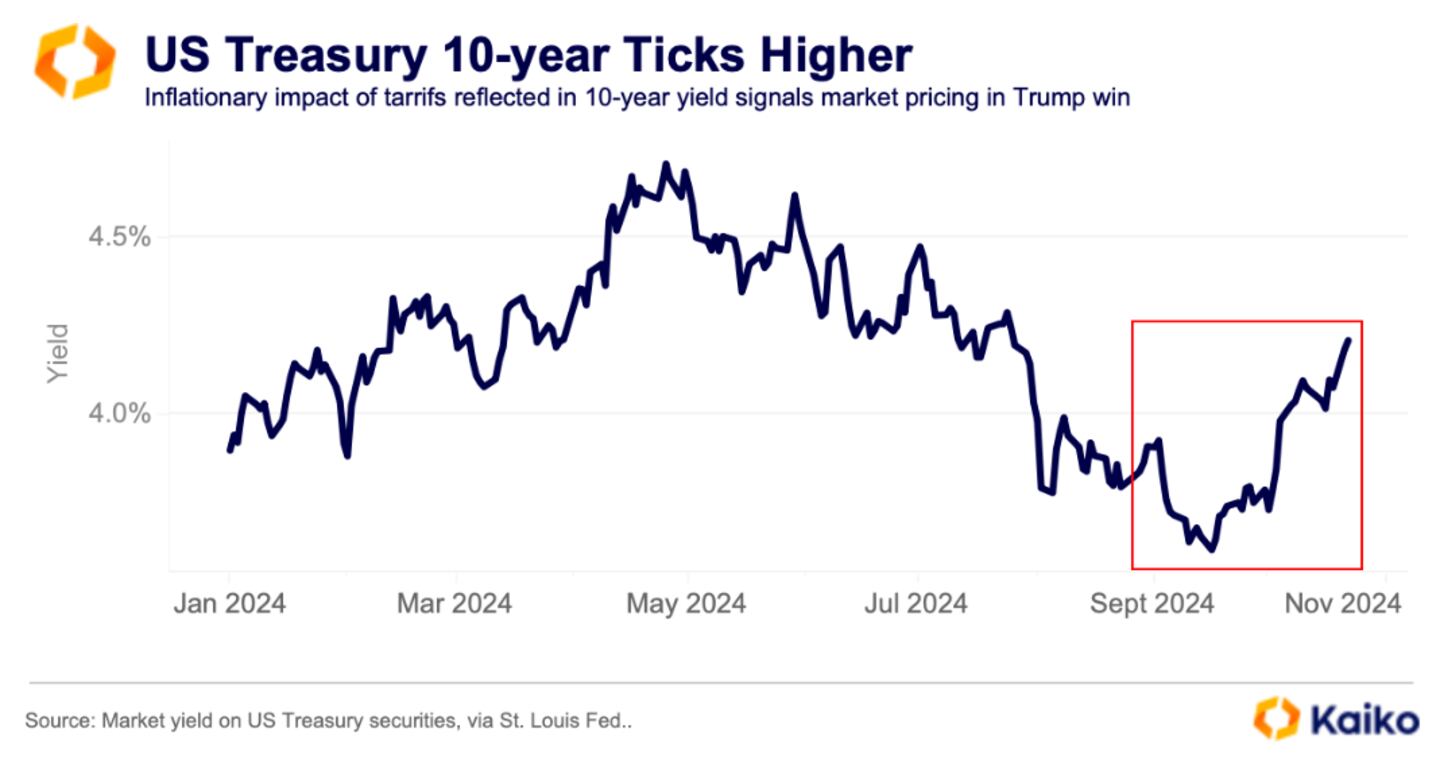

McCarthy also looked beyond crypto to gauge what markets expect to see after the election.

He notes that traders seem to anticipate that Donald Trump will win. The Republican candidate has pledged to raise tariffs, which is seen as inflationary.

Over the past month, the former president’s chances have improved — he has an almost 30 percentage point lead, according to a Polymarket prediction market. But Trump is about 2% behind Vice President Kamala Harris in national polls.

The 10-year Treasuries yield has ticked higher, which suggests that the market expects more inflation on the back of a Trump win, Kaiko said.

McCarthy cautions that it could simply mean that inflation could rise no matter who wins.

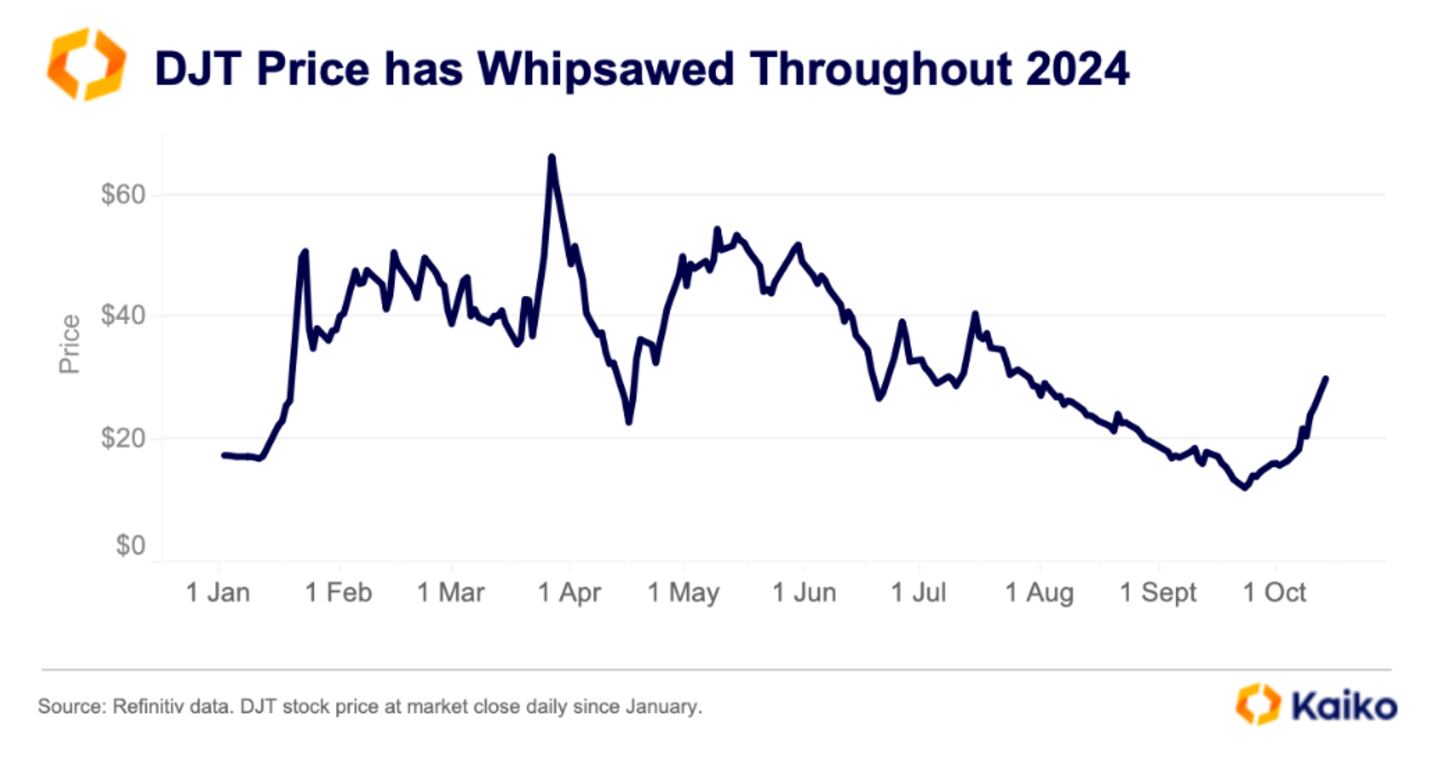

He also looked at the Trump Media and Technology Group’s stock market performance this year.

Even though it’s up nearly 80% since January, it has experienced several double-digit drawdowns in that time. That “reinforces the theory that markets are pricing in a Republican victory,” McCarthy said.

While the data suggest that traders expect to see more volatility, their overall bullishness “suggests that either candidate will be a net benefit for crypto in the long run,” McCarthy wrote.

Eric Johansson is DL News’ News Editor. Got a tip? Email at eric@dlnews.com.