- Ethereum has endured a year of pain and there’s data to illustrate it.

- Major rivals have clawed market share from Ethereum.

- Top developers are hoping to reverse the slump.

It may be hard to admit for Ethereum investors, but the numbers tell a grim story about the second largest cryptocurrency: it’s losing mindshare, momentum, and its once commanding lead alongside Bitcoin over the crypto industry.

In the last year, the $339 billion network has been outshined by Bitcoin, outmanoeuvred by Solana, and economically strip-mined by its bevy of layer 2 networks.

Cracks have even begun to emerge among even the staunchest proponents of the network. Critics blamed the Ethereum Foundation, the nonprofit organisation that guides the blockchain’s growth and development, for not doing enough.

Co-creator Vitalik Buterin has stepped in to address the concerns as Ethereum’s woes mount.

Buterin said changes were being made to the Ethereum Foundation’s leadership team. He, however, asked critics to tone down their attacks on the foundation’s executive director Aya Miyaguchi who had courted a large part of the supposed blame.

Major Ethereum developers like Ben Jones, a co-founder of layer 2 network Optimism also sound the rallying cry for cooperation to lift the network out of its current malaise, saying the time had come to make improvements to the ecosystem.

These three charts tell the story of Ethereum’s decline.

Muted price performance

Ethereum is the least-performing among the major cryptocurrencies in the last year.

Bitcoin and Solana have more than doubled in price, Dogecoin has tripled, and XRP has risen five-fold within the time frame.

Meanwhile, Ethereum has posted a meagre 22% price uptick. That’s considered low in crypto terms.

On Monday, Ethereum’s price crashed 24% and fell to $2,300, its lowest level since last summer. It has since recovered to $2,700 after Eric Trump endorsed investment in the asset on Monday.

“In my opinion, it’s a great time to add Ether,” the US President’s son posted on X on Monday.

Despite the slight recovery, some market analysts say the price might still go lower in the short term.

“Ethereum still has an untouched liquidity shelf in the $2,110-$2,100 range, the equal low,” Arthur Azizov, crypto payment provider B2BINPay, told DL News.

A liquidity shelf is a price level where traders have stacked a large volume of buy and sell orders while an equal low is a price point that an asset has reached multiple times but hasn’t fallen below and has instead bounced upwards.

“Yesterday’s move cleared a significant local liquidity shelf, but it didn’t reach this key equal low, which ideally should have been taken out,” Azizov said. “This suggests that Ethereum could still dip below $2,100.”

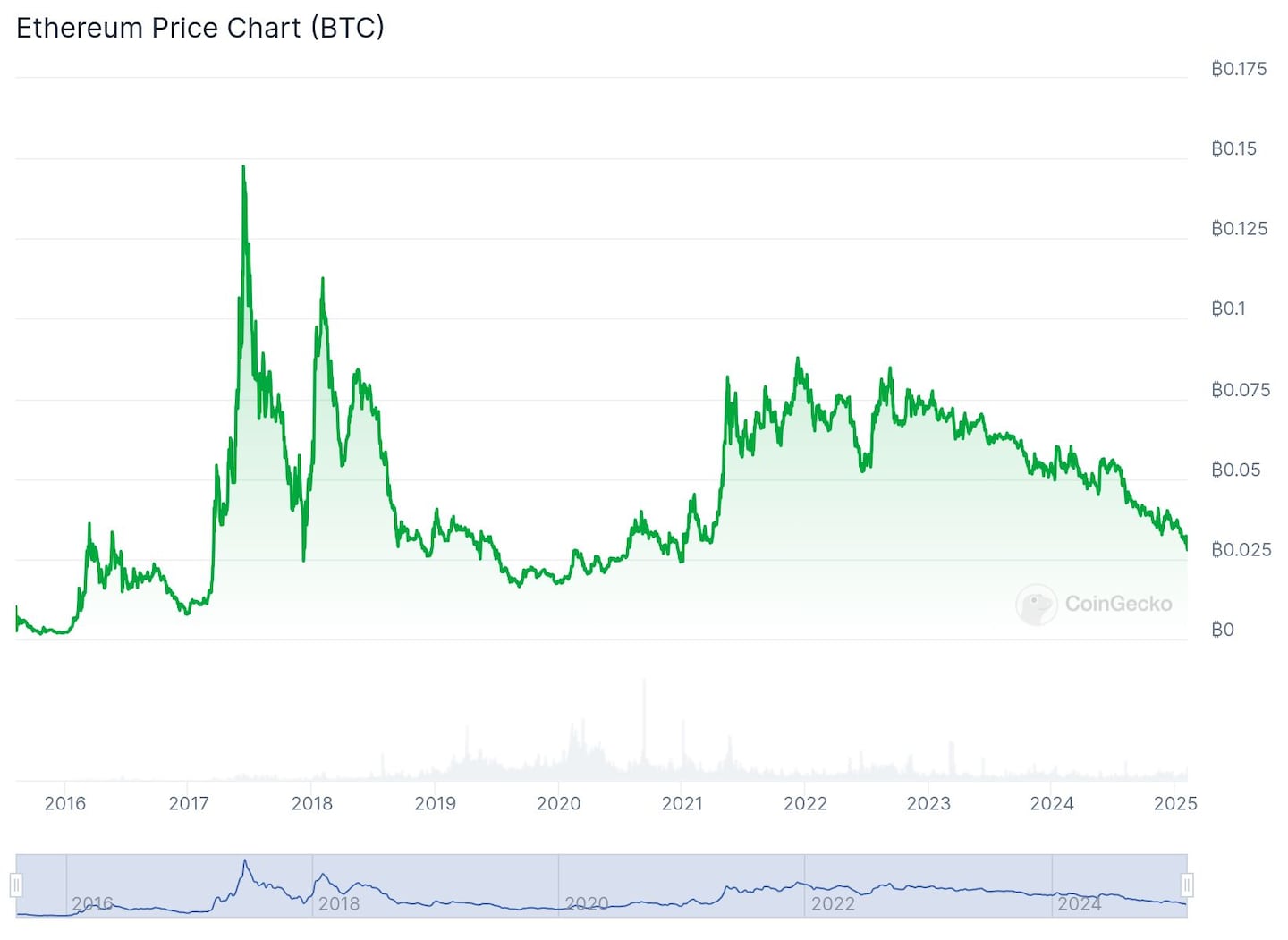

The flippening that never was

For years, Ethereans chanted the prophecy of a coming flippening, when Ethereum’s market value would eclipse Bitcoin’s.

They argued that Ethereum’s native support for smart contracts that underpins DeFi would push its network to become more valuable than Bitcoin which has limited scripting capabilities.

But market reality has delivered a harsh verdict ― Ethereum hasn’t only failed to overtake Bitcoin, it has stumbled and fallen far behind the market leader.

The Ether/Bitcoin ratio which tracks the price of Ethereum against Bitcoin is at its lowest level in four years, according to price tracker CoinGecko.

Four years ago, sectors such as NFTs and decentralised finance were just taking off.

NFTs have fizzled out and DeFi isn’t an Ethereum-only sector, even if the network still controls the majority of the market.

DeFi’s market value as measured by the volume of investor funds in the sector is at $132 billion, according to DefiLlama data ― that’s $73 billion shy of its November 2021 peak.

Meanwhile, Bitcoin has become the darling of institutional investors with publicly listed companies holding the asset on their balance sheets.

Michael Saylor’s MicroStrategy began acquiring Bitcoin in 2020. The company now owns $30 billion worth of the asset.

In the US, the Securities and Exchange Commission approved Bitcoin exchange-traded funds last year. They amassed $107 billion in assets under management amid frenzied adoption from big-money players. Ethereum ETFs also launched last year but did not achieve the same level of success.

Economic black holes

Ethereum spent years transitioning to a deflationary Ether supply issuance.

The Merge and EIP-1559 made Ether’s supply shrink, causing the cryptocurrency’s supply to become net negative and thus deflationary.

But the Dencun upgrade that rolled out blobspaces, a temporary way to store large data on the blockchain, seems to have reversed those gains.

While Dencun made layer 2 networks cheaper to use by reducing data storage costs, it has had an unintended consequence of accelerating the Ether token supply.

Ethereum’s once-scarce supply is inflating again, reversing the deflationary effects of its burn mechanism. The network is now on the verge of erasing all the Ether burned since The Merge over two years ago, according to data from Ethereum analytics dashboard Ultrasound.money.

Ethereum proponents now look to the upcoming Pectra upgrade to solve some of these problems.

The Pectra upgrade aims to reverse Dencun’s unintended side effect that dampened Ethereum’s burn rate and made the cryptocurrency to become inflationary.

Ethereum developers say Pectra will upgrade the way smart contracts work and increase on-chain activity and gas consumption. Gas is what Ethereum users pay to transact on the network.

The upgrade is also expected to introduce a new fee market for blobs that would be economically viable for both layer 2 networks and Ethereum itself.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.