- Coinbase and MicroStrategy shares have rocketed up some 300% this year, clobbering bearish investors.

- Short sellers in crypto stocks have suffered a whopping $6 billion in year-to-date losses.

- S3 Partners Ihor Dusaniwsky sees another squeeze coming.

Monday was hard on short sellers of crypto stocks, with $387 million in losses in 24 hours.

Short sellers of crypto stocks are having a rough year— they’ve suffered over $6 billion in year-to-date losses.

That’s according to data firm S3 Partners, who expects their pain to get even worse.

Over half of those losses occurred shorting Coinbase’s stock. Coinbase and MicroStrategy’s stock prices are each up around 300% since January.

Coinbase’s short interest of 14% — up 1% from this time last month — indicates many bears are still betting the price will come down.

The shorts’ pain may not be finished.

“The sector is poised for a surge in short-squeeze-based short covering,” S3′s Ihor Dusaniwsky said in a report.

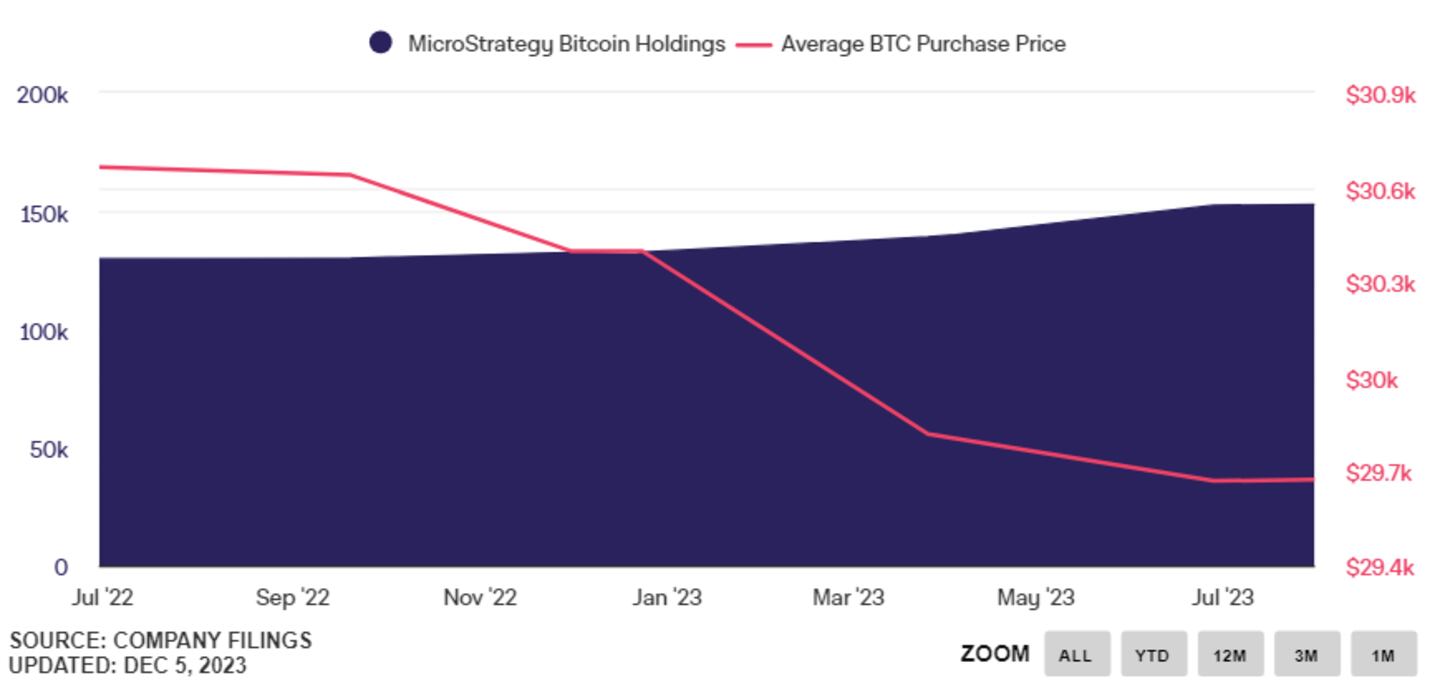

Investors are also shorting the largest corporate Bitcoin holder, MicroStrategy, which is finally in the black on its massive Bitcoin bet.

In November, MicroStrategy added 16,130 Bitcoin to its coffers, adding up to 174,530 BTC, or around $7.6 billion.

The huge rallies in crypto stocks have bears tangling with two possibilities: either the market is finally overbought and prices may come down, or it will continue to skyrocket and they will be forced to exit their positions.

Short sellers borrow shares, sell them in the market, then buy them back and return them when the price goes down. A short seller then pockets the difference.

It’s a risky strategy, because if the stock shoots higher, losses can quickly exceed a short seller’s initial investment.

If a stock rallies — as Coinbase and MicroStrategy have — short sellers must cover their positions by pumping in more money.

This can lead to a so-called squeeze, when short sellers accelerate the increase of an already increasing asset as they cover losses.

Short sellers have covered $2.2 billion in 2023, with $697 million of new short selling since Bitcoin’s low in September.

Experts have slated January for a batch of spot Bitcoin ETFs to potentially be approved in the US, which means bears have at least a month longer to contend with ongoing ETF-related hype.