- BlackRock saw an uptick in client interest after Bitcoin’s “decoupled” from tech stocks.

- Bitcoin's correlation to risky assets is key to its investment case, said the firm's crypto head.

BlackRock says Bitcoin will soon be risky not to own.

That’s if, and a big if, the price of the top cryptocurrency truly manages to break free of its tight correlation to riskier assets like US technology stocks.

“The correlation between bitcoin and tech stocks is going to be an absolutely critical driver,” Robbie Mitchnick, head of digital assets at BlackRock, told DL News. “If Bitcoin trades more like a tech stock, it is not very interesting to institutions.”

But if Bitcoin trades with low or even negative correlation to what he calls “left tail” events, or extreme bouts of downside risk, “then it becomes potentially a very important portfolio asset to all manner of institutional portfolios.”

Added Mitchnick, who wrote the comments following his appearance at the Token2049 crypto conference: “Then the conversation goes from, ‘Is this too risky for us?’ to, ‘Might it be risky not to own any?’”

Bitcoin backers are optimistic as the coin’s performance continues to “decouple” from equities and begins to stand on its own as a relatively low-volatility asset.

The disconnect is a signal to some that the cryptocurrency is starting to behave like a safe haven, like gold, and not riskier assets.

Mitchnick’s comments came during Token2049, the cryptocurrency conference in Dubai this week where he appeared on a panel hosted by Bloomberg ETF analyst Eric Balchunas.

Balchunas later spoke more about the discussion with Mitchnick.

“Larger institutions, they’re looking for digital gold,” Balchunas told an interviewer on the sidelines of the conference. “What they want is a safe haven, indestructible money, something that can hedge inflation and the market.”

Balchunas recounted the panel conversation with Mitchnick where the BlackRock executive said that when Bitcoin first started decoupling from stocks, institutions called the firm to find out more.

Decoupling will be “good long-term, not just for the ETF but Bitcoin in general,” Balchunas said.

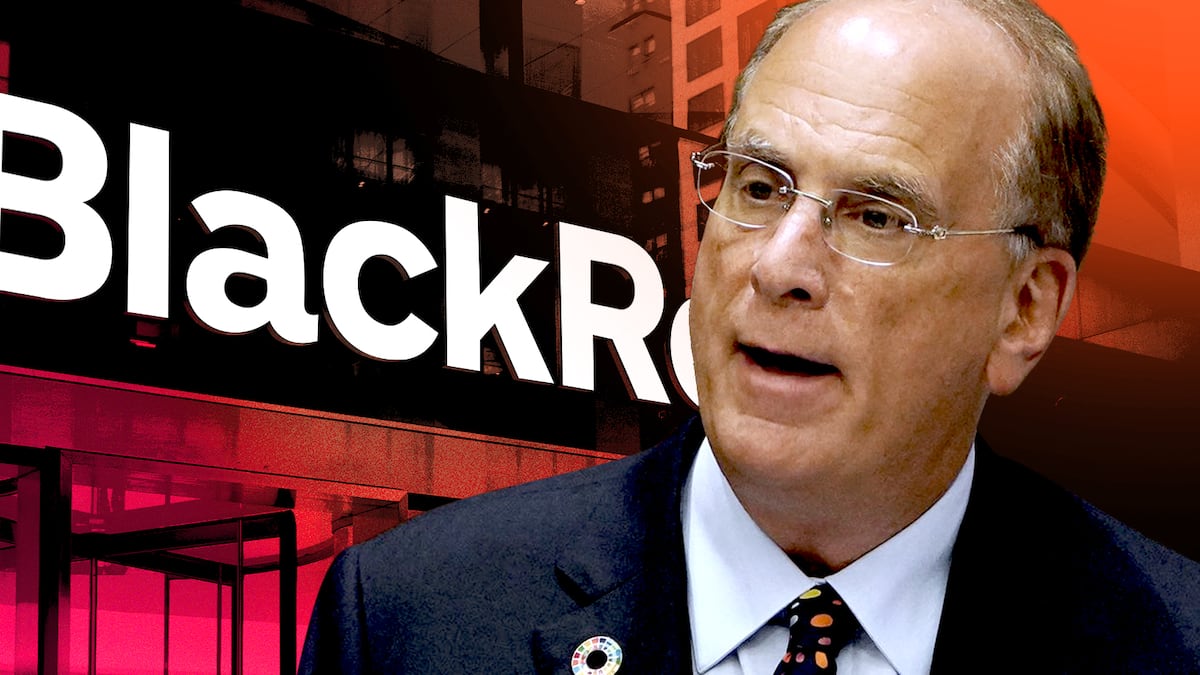

BlackRock is the world’s biggest investment firm, managing some $12 trillion in assets.

CEO Larry Fink has long touted Bitcoin as digital gold in a bid to lure more investors to the firm’s record-breaking Bitcoin exchange-traded fund. The ETF has lured about $57 billion since its debut in January 2024.

The firm runs the $2.7 billion onchain BUIDL fund, composed of tokenised Treasury bonds. It operates two crypto-focused ETFs, the iShares Bitcoin Trust and the iShares Ethereum Trust ETFs.

BlackRock’s Bitcoin ETF, IBIT, dominates the Bitcoin ETF space with about $37 billion more in assets than its closest competitor, Fidelity’s FBTC ETF, according to DefiLlama.

“IBIT is probably the one used by the large institutions themselves,” Balchunas said.

Andrew Flanagan is a markets correspondent for DL News. Have a tip? Reach out to aflanagan@dlnews.com.