- Bitcoin ETFs saw $2.45 billion of inflows last week — the largest on record.

- The flows came after several spot Bitcoin ETFs were launched in January in the US.

- Trading volume, open interest and institutional adoption have all increased with rising crypto prices.

Bitcoin is breaking records as investors flock into new spot Bitcoin exchange-traded funds in the US with $2.45 billion flowing into the funds last week — the highest weekly total ever.

In a new report, Kaiko attributed 99% of the inflows to the US market, with the majority of flows heading into spot Bitcoin ETFs such as Wall Street giant BlackRock’s iShares Bitcoin Trust.

The iShares fund is one of 10 new ETFs to hit the market since the US Securities and Exchange Commission approved them on Jan. 10. It is the most successful ETF launch of all time.

Since its launch, the iShares Bitcoin Trust has had over $6 billion in inflows, followed by Fidelity Investments’ Wise Origin Bitcoin Fund, at $4.3 billion.

US ETF dominance

US platforms have dominated Bitcoin trading since late last year, consistently wielding over 50% of global market depth.

“The increase in liquidity has been driven by US platforms and is likely linked to the spot ETF approvals,” Kaiko wrote in its report.

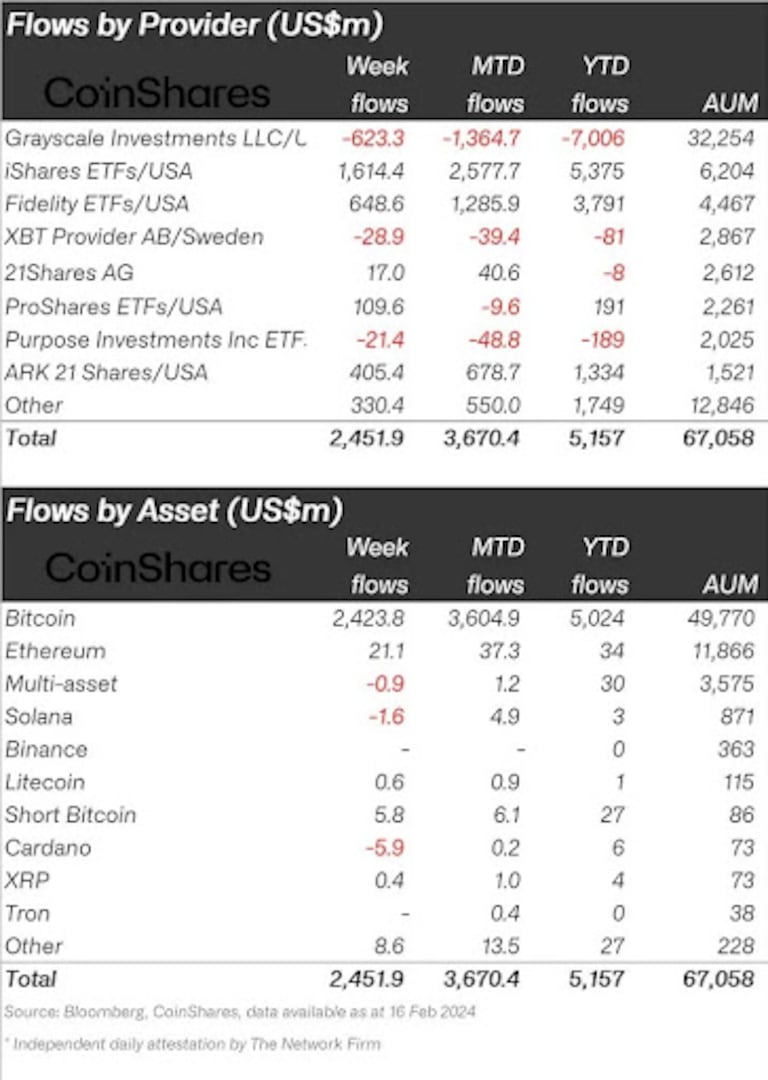

US spot Bitcoin ETFs have pulled in the bulk of this year’s $5.2 billion in Bitcoin inflows, a number hurt by outflows from the Grayscale Bitcoin Trust, the incumbent ETF on the market.

Grayscale has seen $7 billion in outflows this year, as investors migrated to ETFs with lower fees such as the iShares Bitcoin Trust and Wise Origin.

Grayscale outflows have slowed in recent weeks, but more trouble looms. Last week, a judge granted bankrupt crypto lender Genesis’s request to offload $1.6 billion in Grayscale stock — a move that banking giant JPMorgan said that will create selling pressure for Bitcoin and that could contribute to another $10 billion in outflows for Grayscale.

Still, Grayscale’s bleeding has been outpaced by inflows overall, indicating continued growth in the sector.

Numbers go up

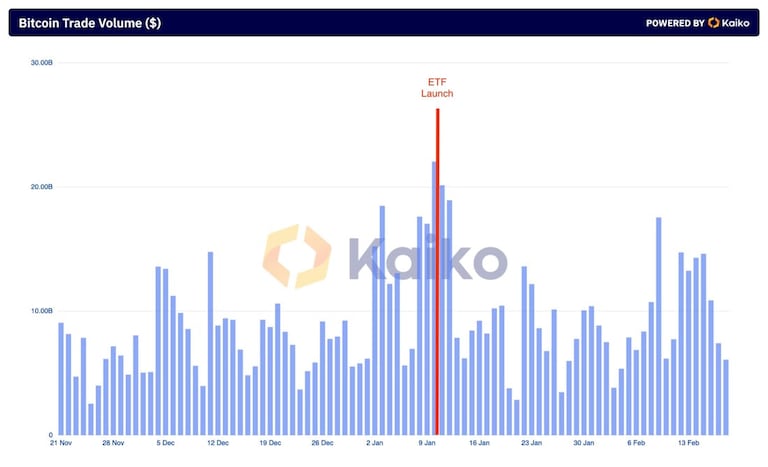

Bitcoin’s daily trading volume averaged more than $10 billion last week, Kaiko research shows. The firm noted that daily trading volume hasn’t surpassed the 10-month high hit on January 10, the day before spot Bitcoin ETFs made their market debut in the US.

The report showed that Bitcoin volumes are up and that average trade sizes are consistently above $1,000 per trade, a possible sign of institutional participation.

Tyler Pearson is a junior markets correspondent at DL News based out of Alberta, Canada. Got a hot tip? Reach out to him at ty@dlnews.com.