- The SEC’s approval of 11 US spot Bitcoin ETF applications kicks off a new market for the cryptocurrency.

- Analysts tell DL News that they expect gradual gains in ETF inflows over time.

- There's a wide variation of predictions for how much the ETFs will attract, and when.

Following the landmark approval from the Securities and Exchange Commission for almost a dozen US spot Bitcoin ETFs, attention now shifts to just how much investors will trade them.

Analysts told DL News that the focus is now on capital inflows within the first 48 hours of the ETF’s launch as it enters the $9.4 trillion global market for exchange traded funds.

Estimates for inflows range from significant to potentially record-setting.

The potential market for spot Bitcoin ETFs in the future could be around $150 billion, Eric Balchunas, an ETF analyst at Bloomberg Intelligence said late last year.

Financial advisors in the US manage around $30 trillion, and this figure is just 0.5% of that.

Balchunas said Tuesday that he expects around $15 billion in flows in the first year.

That would take total spot Bitcoin ETF assets under management to around $50 billion — considering Grayscale’s GBTC has a head start of some $30 billion.

Standard Chartered estimates that Bitcoin ETFs could see somewhere between $50 and 100 billion in inflows in 2024.

This would support the banks’ Bitcoin price projection of $100,000 by year end.

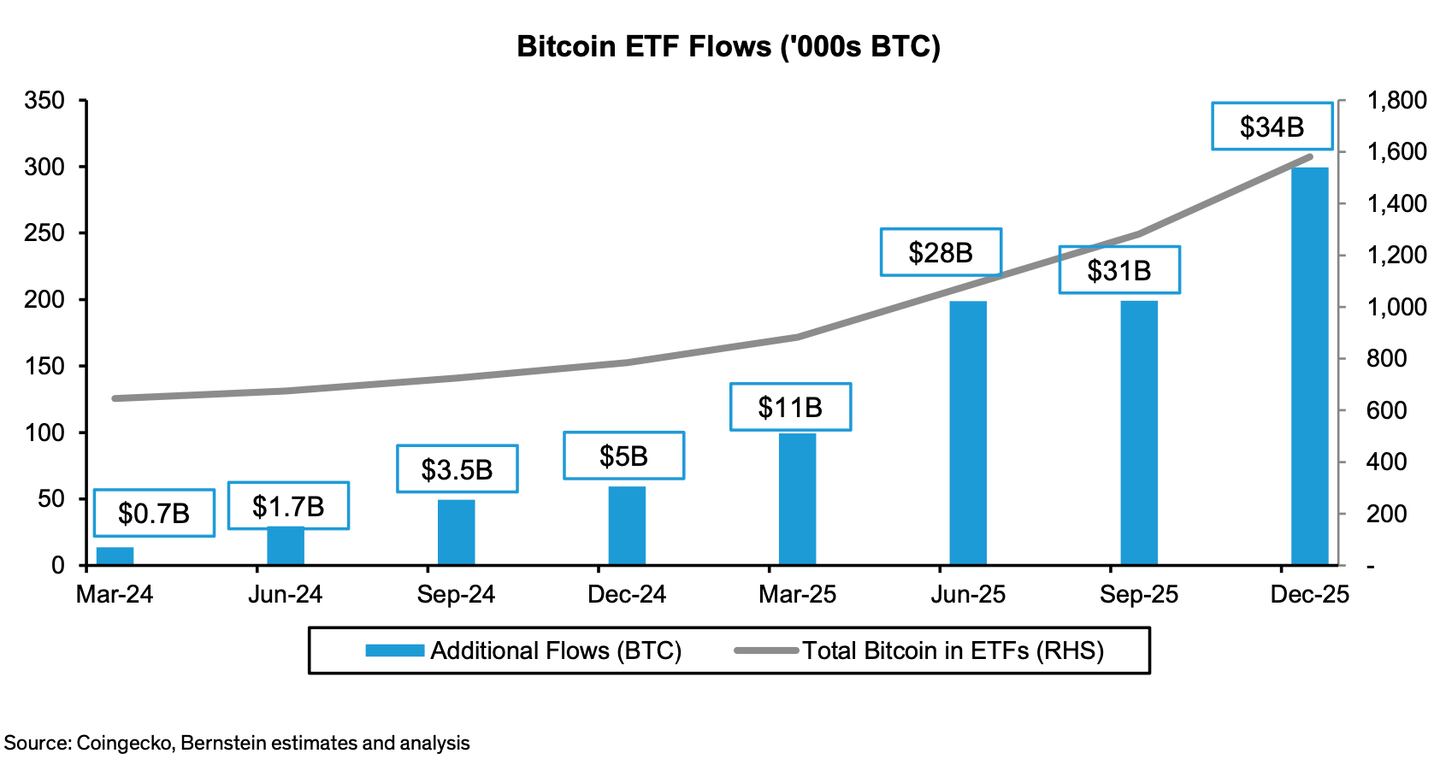

Meanwhile investment adviser Bernstein estimates flows of more than $10 billion in 2024, rising to $80 billion in 2025.

Over the next five years, Bernstein’s Gautam Chhugani said in a note that he expects about $300 billion, or 10% of Bitcoin supply, to be custodied by regulated Bitcoin ETFs.

Bitcoin has risen 1.2% over the past 24 hours to $46,570 while Ethereum, the world’s second-largest crypto, rallied 9% to $2,580.

To date, the existing record for an ETF’s debut stands at roughly $1.25 billion, set by BlackRock’s US Carbon Transition Readiness ETF almost three years ago.

A more relevant benchmark to compare would be ProShares Bitcoin Strategy ETF, which secured $1 billion within its first two days when it launched in 2021, said Anthony Rousseau, head of brokerage solutions at TradeStation.

Analysts say now is the time to exercise caution as institutions perform their due diligence before assimilating Bitcoin into their portfolios, which could take months.

In any case, a temporary phase of short selling is expected within the first few days following the launch, according to Nansen’s principal research analyst, Aurelie Barthere.

Volatility is also expected to diminish across spot markets as new liquidity enters the fray.

Bitcoin’s historical volatility index, measured over seven days, shows the digital asset trending at its highest point since March, per TradingView data.

Other indexes, which measure Bitcoin’s price fluctuations over a 30-day timeframe, show volatility has continued to rise since October at 2.3%, still below the 3.5% set 14 months ago.

“Long-term price trends will be characterised by higher liquidity and lower volatility since established players can absorb more directional flow,” Le Shi, head of trading at Auros told DL News.

“This transitional shift is expected to unfold gradually, likely developing over the next few years.”

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.