- Binance now boasts 150 million customers, with 22 million joining in the last three months.

- Investors may be shrugging off regulatory issues because the exchange offers deep liquidity.

- Liquidity trumps regulation as pro crypto traders' top concern, Coalition Greenwich found.

- Volume on CME, CBOE Digital and Coinbase may grow on a relative basis for US institutions.

Binance CEO Changpeng Zhao boasted last week that his crypto exchange reached 150 million users, with 22 million added in the last three months alone.

While it’s unclear what Zhao’s number of registered users represents — individuals or accounts? — there’s no mistaking that people do a lot of crypto trading on Binance.

This, even as the company faces a mountain of legal woes.

The world’s biggest crypto exchange is staring down threats including a Securities and Exchange Commission lawsuit, a Department of Justice probe, and legal snags in Europe and beyond.

NOW READ: How secretive speed-trading firms like Jump and Jane Street make a killing in crypto

Why are Binance customers so willing to overlook such regulatory risks and pile in anyway?

What big institutional players at banks and hedge funds seek — more than the safety of regulatory guardrails — is a big pool of traders to take the other side of their bets, Paul Howard, head of sales at Zodia Markets, told DL News. Zodia Markets is a digital asset brokerage and exchange platform backed by Standard Chartered.

“The majority of exchange volume, more than 80%, is being traded on unregulated venues, so capturing that liquidity — even with all the counterparty risk it entails — is something those operating in the space are comfortable with,” said Howard, a former derivatives trader at Morgan Stanley and Goldman Sachs.

NOW READ: Investors pull $4bn from Binance as regulators and rivals close in

In other words, it’s all about liquidity.

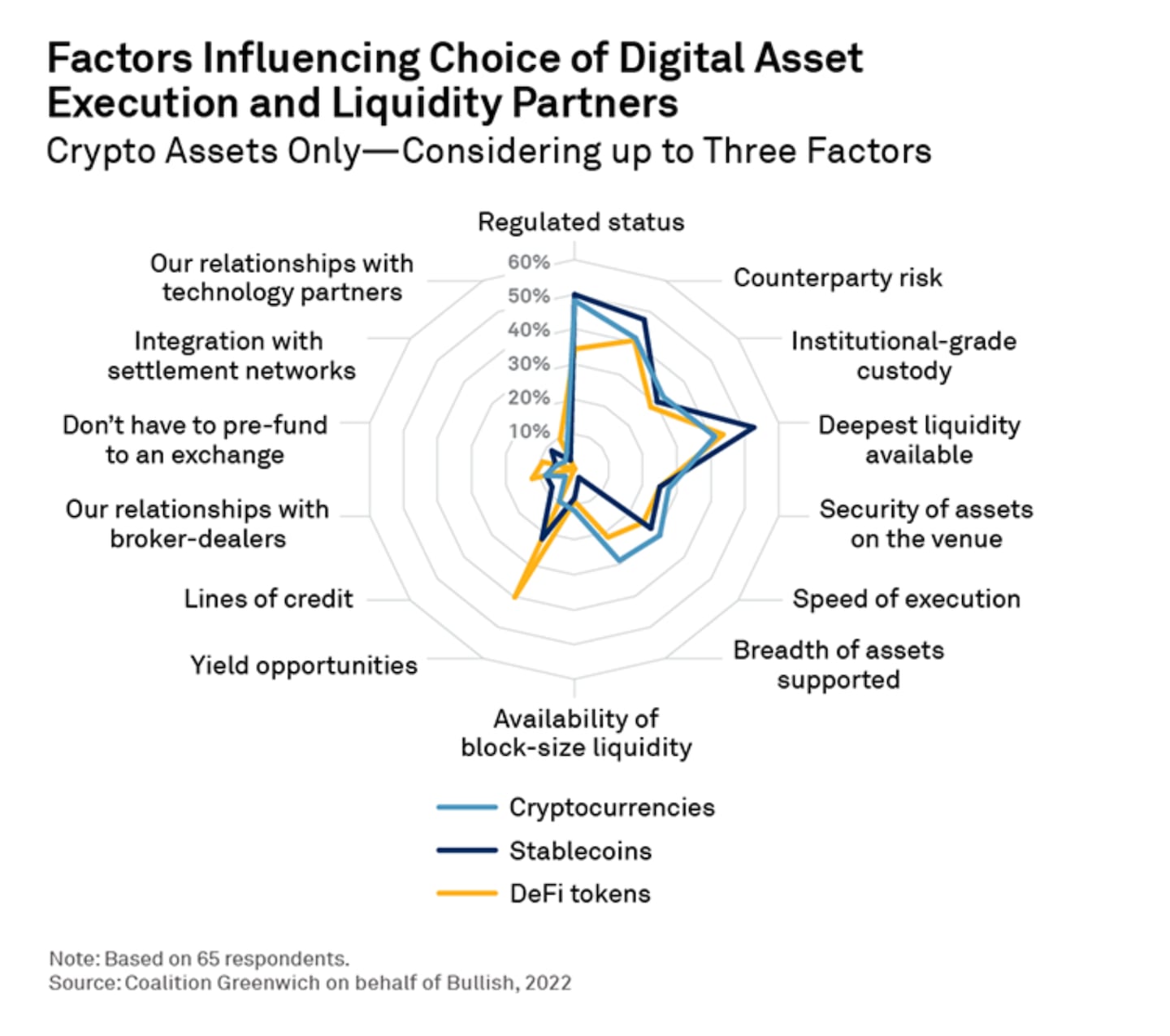

His comments echo Coalition Greenwich, a financial data and research firm that recently ranked what institutional crypto traders value most from their venue or partner.”

Institutional traders want liquidity above other factors, a point that has thus far been absent in the regulatory debate,” the company found in a survey of crypto-focused financial professionals.

Coalition Greenwich listed the top five issues for crypto trading pros:

- Deepest liquidity available

- Regulated status

- Counterparty risk

- Speed of execution

- Breadth of assets supported

NOW READ: Crypto exchange guardrails are coming whether Gary Gensler wins his crusade or not

Binance doesn’t have an official headquarters — playing a sort of jurisdictional hopscotch while customers from Japan to Nigeria have been able to use the platform even without an official nod from local regulators.

That means some users open multiple accounts with different IDs. Would one person’s multiple accounts count as one user, or several?

Binance did not return a request for comment.

In any case, Howard said: “This is a large retail user base and that is powerful. They have arguably one of the broadest product sets in the market, and streamlined onboarding processes, so it’s super easy, based on the levels of KYC you want to do.”

KYC refers to so-called know-your-customer checks that pro traders must implement to assess counterparty risk.

NOW READ: Binance’s German license pullback may be ‘strategic choice’ as MiCA looms

And as regulations solidify, professionals who do rank those guardrails as more important than liquidity will kick start a “gradual tipping point,” Howard said.

“We can see that starting to happen,” he said. “It will be accelerated with the advent of regulations and ultimately, prime brokerage in the space — once exchanges and platforms are connected directly with banking partners.”

Coalition Greenwich said it sees the bulk of spot crypto liquidity expanding outside the US, as American regulators and politicians hash out rules for the sector.

NOW READ: EU regulators flag new crypto risks and weigh rules that may impact Uniswap and Binance

That means “crypto liquidity will mostly evolve elsewhere, especially on non-US platforms and decentralised exchanges like Uniswap, continuing a trend we have recognized for well over a year,” the company said in its report. Binance may find rivals gaining ground.

Derivatives volumes on CME, CBOE Digital and Coinbase will grow on a relative basis for US institutions, Coalition Greenwich predicts.

But that’s on the institutional side.

Howard said that for everyday retail investors in crypto: “Regulatory worries do not really bother most of the crypto community, they are used to it.”

Do you have a tip on Binance or another story? Reach out to me on trista@dlnews.com.

This article has been updated to clarify the description of Standard Chartered’s Zodia Markets division.