- Institutional encroachment into crypto doesn’t mean retail will be left out.

- Wall Street will still have a difficult time interacting with much of crypto.

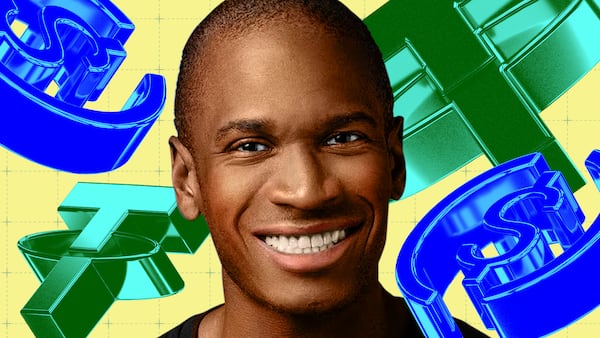

- Arthur Hayes shares where small-time investors can still make money.

Wall Street is pouring money into the crypto industry, but that doesn’t mean small-time investors can’t make a profit.

That’s according to Arthur Hayes, the chief investment officer of crypto fund Maelstrom.

During a fireside chat as part of Singapore’s week of crypto events, Hayes explained that the barrier to the “hottest crypto” projects is still too high for institutions to get involved.

“From the perspective of a lot of these managers, it’s very difficult to invest in the hottest crypto,” he said during an event at the five-story Pan Pacific hotel. “You have to be comfortable using the actual technology, which is not what they want to do.”

Other factors, such as using two-factor authentication or employing a strong password, also aren’t second nature to this demographic of investor.

“They’re going to lose a whole year of returns because someone getting paid $50,000 a year clicks the wrong link,” Hayes said, referring to phishing attacks that run rampant in the industry. “That’s crypto.”

Still, institutional investors are making serious inroads familiarising themselves with crypto rails.

Heavyweight fund managers, such as BlackRock and Franklin Templeton, have deployed nearly $5 billion in so-called tokenised funds, or funds that can be bought and sold on a blockchain, according to data from RWA.xyz.

Likewise, Mike Novogratz’s firm, Galaxy Digital, began issuing company stock on Solana and Ethereum shortly after listing on the Nasdaq.

At the same time, the US Securities and Exchange Commission are making it much easier for buttoned-up firms to enter the market. In August, SEC chair Paul Atkins announced “project crypto” as part of a deregulation blitz to move markets “from an off-chain environment to an on-chain one.”

This influx of investors is expected to continue increasing, too, as central banks turn to a host of financial tools add liquidity to the system — a prediction Hayes continues to stand by.

“No one is ready to accept austerity. No one’s ready to tighten their belts, reduce the amount of credit, suffer a contraction in economic activity and a loss at the ballot box,” he said. “It’s always printing money in some way, shape or form.”

These sorts of events typically correspond to rising prices across financial assets, including cryptocurrencies.

So where exactly should users be looking for alpha?

“There’s awesome opportunities in DeFi and yield farming,” said Hayes. “Institutions, fundamentally, probably won’t be able to get into these ecosystems as heavil as a retail trader because that’s not what they’re set out to do.”

“They just want to put some fiat in an asset, make more Fiat, and then call it a day,” he added.

Liam Kelly is a Berlin-based reporter for DL News. Got a tip? Email him at liam@dlnews.com.