In the fast-paced world of crypto, there are hundreds, if not thousands, of fledgling projects vying to disrupt existing industries, or provide vital infrastructure for those who are.

But while the ideas these projects pioneer can vary greatly, they all need one thing to succeed: money.

Building in crypto is expensive — just like any other industry. Ambitious projects can quickly run into the red due to labour costs, price oracle fees and server support bills.

Unless developers fund a project themselves, the money has to come from investors.

This article explains how crypto projects raise money, and how to track funding rounds with DefiLlama. That’s also the method DL News uses to publish its regular updates on raises.

How crypto projects raise money

One of the most popular avenues for crypto funding is through venture capitalist firms running investment funds that bet on new and unproven projects.

Some of the biggest VC firms actively investing in crypto include a16z, Polychain Capital, Pantera Capital, Variant and Paradigm.

It’s not just VC firms that can bankroll projects — sometimes wealthy individuals make sizable investments on their own. These people are referred to as angel investors.

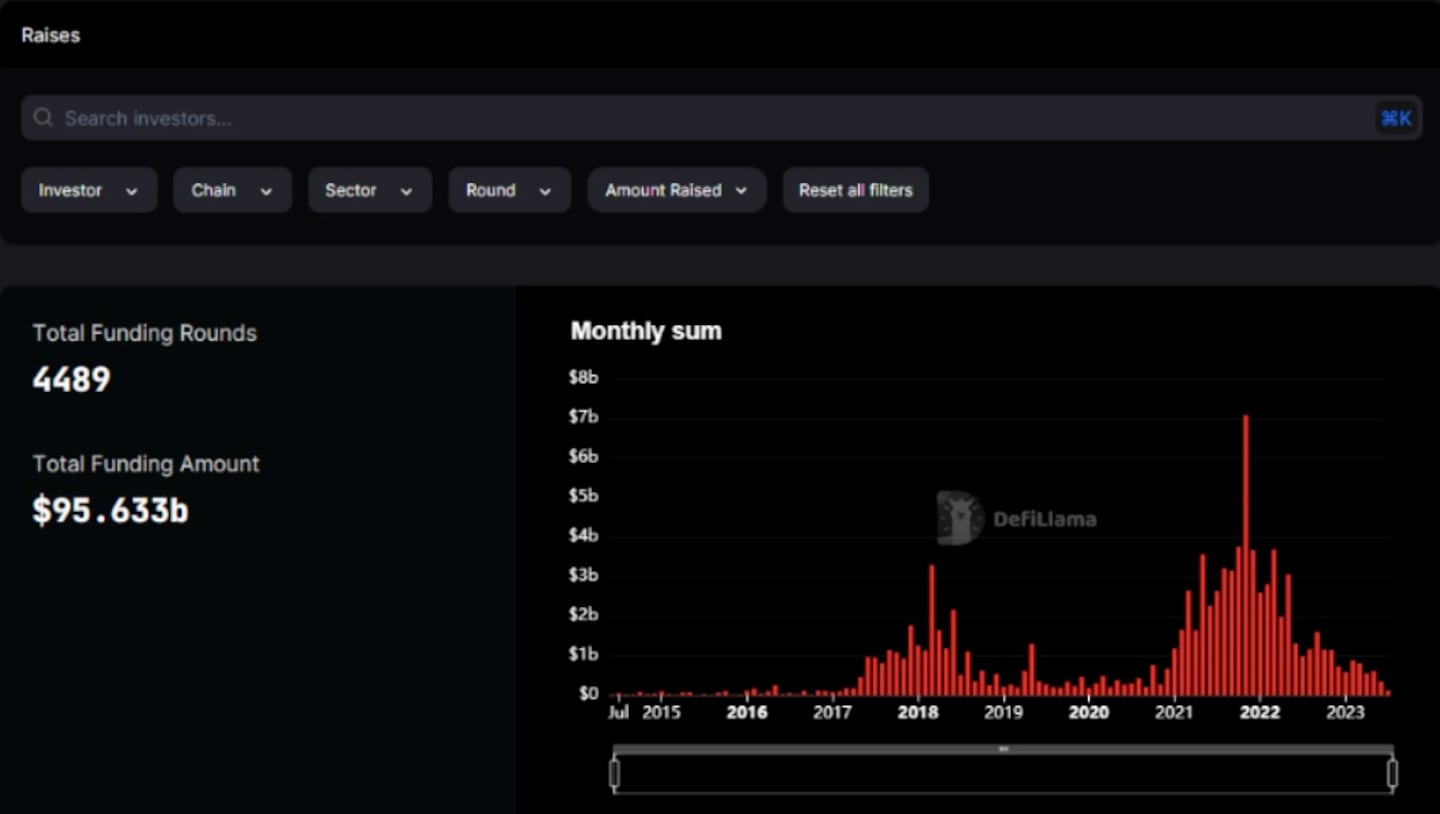

So far in 2023, VCs and angel investors have poured over $4.9 billion into the crypto industry. But that figure pales in comparison to 2021, which saw a record $31 billion in venture capital inflows.

Crypto projects aren’t limited to making bold promises to wealthy VCs. They can also attempt to crowdsource funding through public web campaigns. Such offerings have become known as Initial Coin Offerings, or ICOs, which are like an unregulated, crypto version of the Initial Public Offering (IPO) model found in traditional finance.

ICOs enjoyed a boom during the 2017 bull market but have fallen sharply in popularity after regulatory crackdown from the US Securities and Exchange Commission.

Some projects still raise funds via token sales, but under different models. One model, called an Initial DEX Offering — or IDO — involves selling tokens using liquidity pools and smart contracts on a decentralised exchange, and usually tries to exclude US-based investors.

Why track fundraises?

For investors, tracking raises offers insight into not only the financial health and potential growth of a certain project, but the entire crypto industry if taken in aggregate.

If a project is able to keep raising money at higher and higher valuations, it’s a great indication of high investor confidence. It could also signal a project’s intention to expand into new markets or to hire more staff to improve their product.

On the flipside, if a project has to raise funds at a lower valuation than a previous funding round, or struggles to attract enough investors to fill a round, it might be a sign that interest is waning and that the project is in trouble.

But be careful — the venture capital firms that invest in crypto projects don’t always have the best judgment, as those who plowed $1.8 billion into crypto exchange FTX before its untimely demise found out last year.

Analysts, too, can examine fundraising across the entire industry to develop a broader understanding of market dynamics by tracking funding patterns and trends across DeFi. Greater fundraising in specific sectors, such as bridges, might make bridge-related tokens a hot commodity.

How to track raises with DefiLlama

DefiLlama tracks raises manually, so you can be sure someone has looked at each raise added to the dashboard to make sure it’s accurate.

You can also submit your raise using this form. And for any raises-related questions, just get in touch with llamaintern.

Our llamas also scour social media and news sites to find new raises, and work with investors to make sure the dashboard is up to date.

However, as DefiLlama only started compiling data on raises in September 2022, there are limitations to the data set.

For example, information on many raises from around 2017 has been lost, making it difficult to backfill. This is either because a lot of the companies raising back then failed and took down their websites, or because their teams have deliberately tried to hide information.

To get to the raises dashboard, head over to the “Raises” tab on the left of the screen. This section is divided into two sub-sections: “Overview” and “Investors”.

The ‘Overview’ section

Starting at the top, look for a particular investor in the search bar. You can also scroll through an alphabetical list of all tracked investors using the search bar — there are hundreds to explore.

The main fundraising tracker sits below the search bar. (A perceptive user will notice that DeFi raises begin in June 2014, the month in which Ethereum launched its ICO.)

The chart can be filtered by investors, chains, sectors and amount raised. It’s also possible to download this data as .csv and .json files — just hit the download button on the bottom right of the chart.

The project search bar is useful for finding out how much a particular project has raised. Type a project or company’s name into the search bar to reconfigure the field. If left blank, the field will list all projects by the most recent raise. This is handy for keeping up with the latest projects.

The project field includes valuable information such as:

- Round: lists the type of raise (pre-seed, seed, strategic, venture round, public/private token sale, ICO, angel round, and more).

- Description: provides a short description of the type of project conducting a raise.

- Lead investor and other investors.

- Valuation: listed in USD.

- Chains: the blockchain(s) on which the project operates.

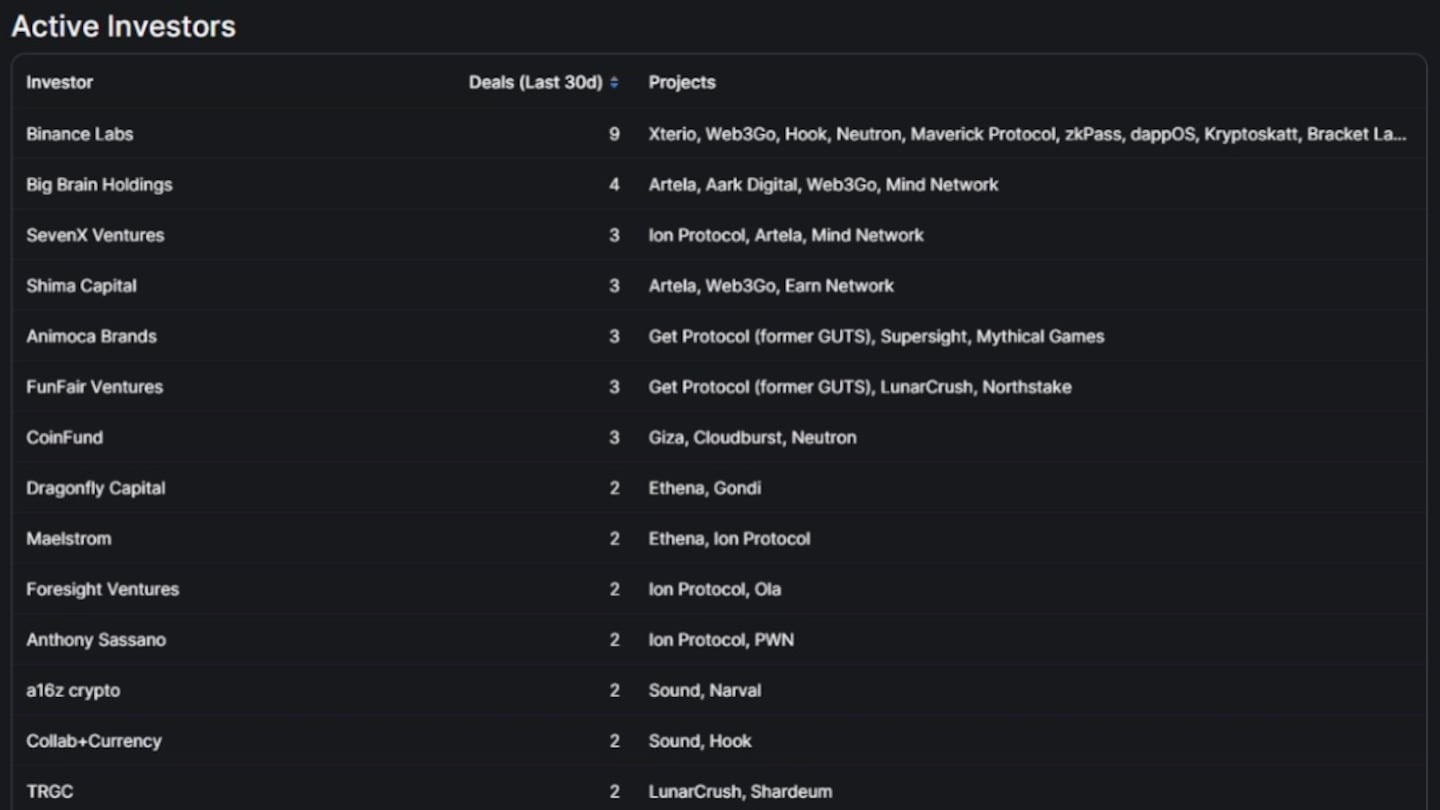

The ‘Active Investors’ section

A separate active investors page is useful for finding out who’s spending on crypto right now. It comprises a field with three columns that display the investor, the number of deals they have made in the past 30 days, and a list of the projects they invested in.

While DefiLlama tracks the majority of DeFi raises, keep an eye out on Twitter and from crypto news sources to stay abreast of the latest funding rounds. As long as money keeps flowing into DeFi, there will always be new projects to explore.

Next steps

- Head to DL News and find an article about a recent raise.

- Look at the raises chart and compare crypto funding to market events — there might be some correlation there.