DefiLlama is a transparent and open-source analytics website for decentralised finance. What started as a simple TVL, or total value locked, tracker in 2020 has since evolved to track dozens of metrics for over 2,600 protocols across more than 180 blockchains.

At no cost to its users, the site publishes metrics like trading volume, protocol revenues and fees and available yield rates, as well as detailed insights into protocol expenses, treasuries and hacks. This article will explain how to navigate all this information.

What data does DefiLlama provide?

DeFi Dashboard

The DeFi Dashboard is DefiLlama’s flagship dashboard. Located on the front page, it lists thousands of protocols and contains metrics such as TVL, volume, fees and revenue. In addition to the overview, there are 10 additional subsections to the Defi Dashboard:

- Chains: This subsection shows data for individual blockchains. It displays active user count, the number of protocols built on the chain, TVL, and the combined value of all stablecoins on the network.

- Compare Chains: This subsection lets users pit blockchains against each other by comparing TVL, fees and revenue, transaction count, and active user count.

- Airdrops: This dashboard lists DeFi protocols without tokens which may potentially launch one and distribute it through an airdrop to early adopters. The dashboard includes market category data, TVL, money raised, and notes how long ago it was listed on DefiLlama.

- Treasuries: Treasuries are protocol’s warchests. This dashboard breaks down treasury assets by stablecoins, major assets like BTC and ETH, the protocol’s native tokens, and other sundry coins.

- Oracles: Oracles deliver price feeds to DeFi protocols. This subsection lists dozens of oracles and the combined total value locked of the projects they provide information for.

- Forks: Successful projects tend to get copied in DeFi, and these copies are called forks. This dashboard lists the number of times the original project or chain has been copied and how much TVL the copies have compared to the original.

- Top Protocols: This table displays the top dogs of over 30 categories in DeFi, including liquid staking projects, lending markets, decentralised exchanges and NFT marketplaces.

- Comparison: A place to compare multiple protocol’s historical TVL.

- Protocol Expenses: This subsection includes a short list of protocols that have published information about their expenses. It also lists headcounts, which denote the number of active employees.

- Token Usage: This subsection explores the extent to which a DeFi project is exposed to ETH. A project greatly exposed to ETH in a bear market stands to gain the most if ETH rises in price.

- Categories: This section tracks the value of over 30 categories on a historical timeline graph. The dashboard describes the services offered in each category and how many protocols are included in them.

- Recent: Arriving early to a project can sometimes be a financial boon. The Recent subsection includes a list of protocols recently-added to DefiLlama, their market category and their TVL.

- Languages: One for the coders and developers, this subsection shows which coding languages protocols are written in. So far, there are 17 languages including Solidity, Vyper, and Rust.

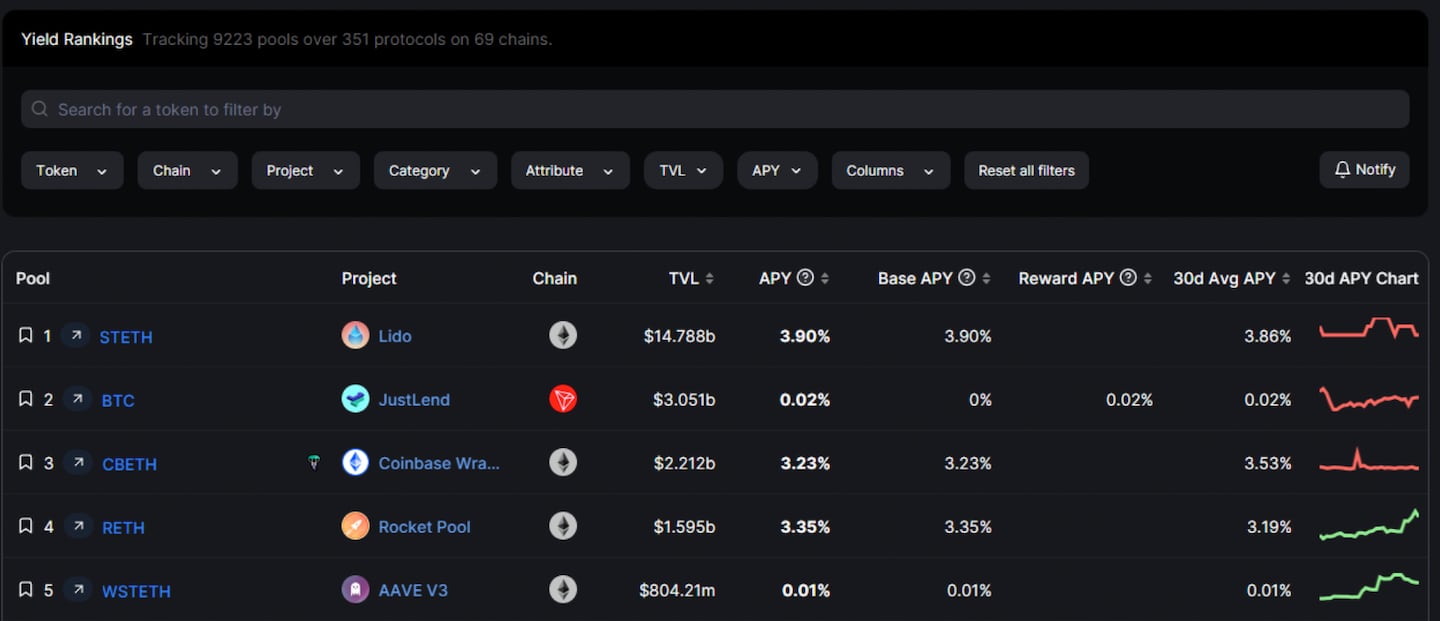

Yields

The Yields dashboard is a DeFi farmer’s godsend. It tracks around 9,000 pools across hundreds of protocols and dozens of chains. Researchers can use it to find the best money-making opportunities, then filter them by asset type, protocol, TVL, and historical annual percentage yield (APY).

Some projects include a Reward APY — incentives paid out in a project’s native token, rather than generated from trading fees, lending, or staking.

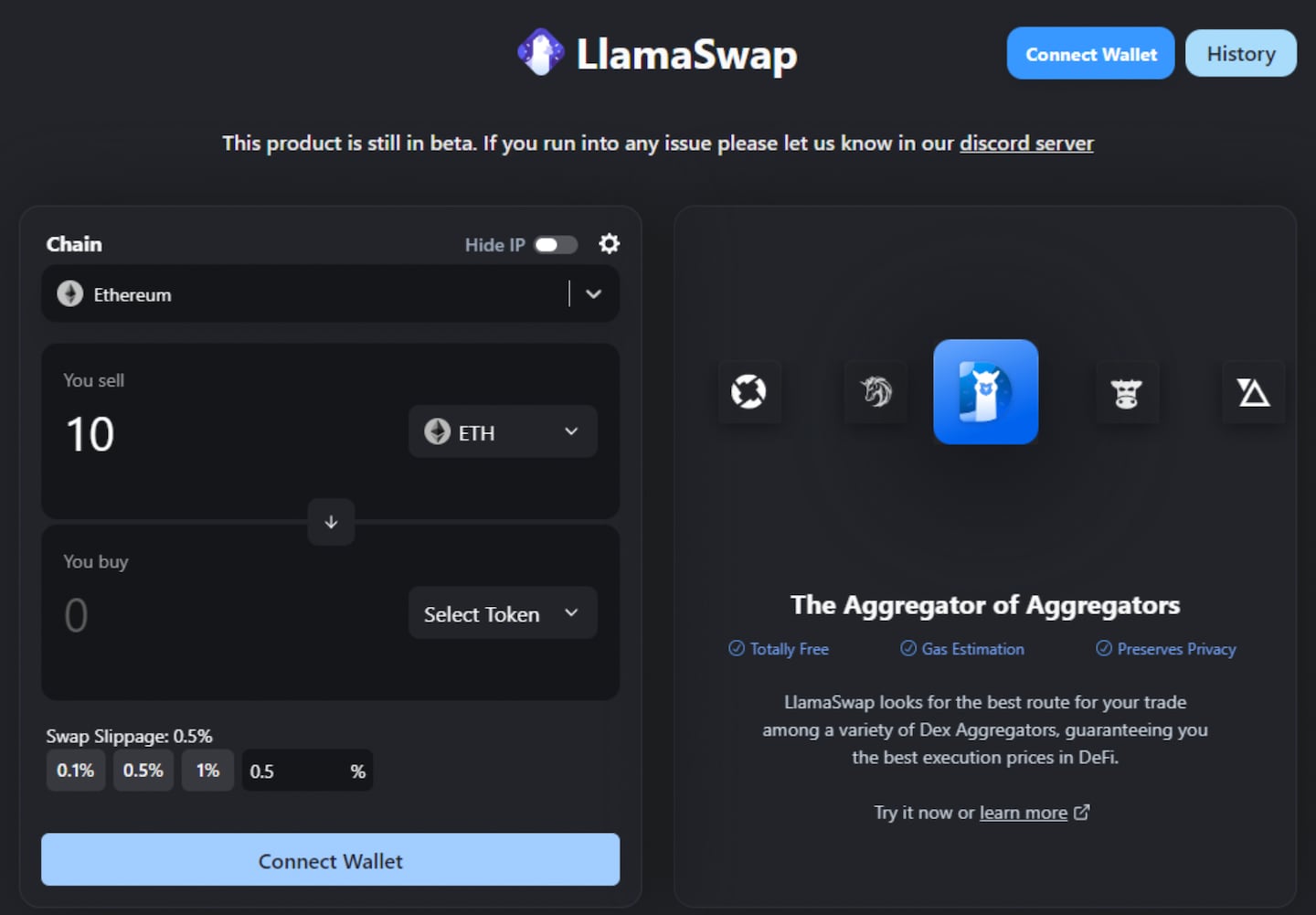

LlamaSwap

DefiLlama created LlamaSwap, a free protocol which finds the best prices on crypto trades across the top 10 decentralised exchange aggregators.

NFTs

Once a frenzied market, non-fungible tokens (NFTs) have cooled off over the crypto winter. However, there’s still data to mine, and DefiLlama tracks the most popular collections and markets.

- Collections: This subsection lists hundreds of NFT collections. It provides data on NFT floor prices — the lowest price an owner of a particular collection is willing to sell an NFT for, historical changes in price and volume, the number of sales, and the total supply.

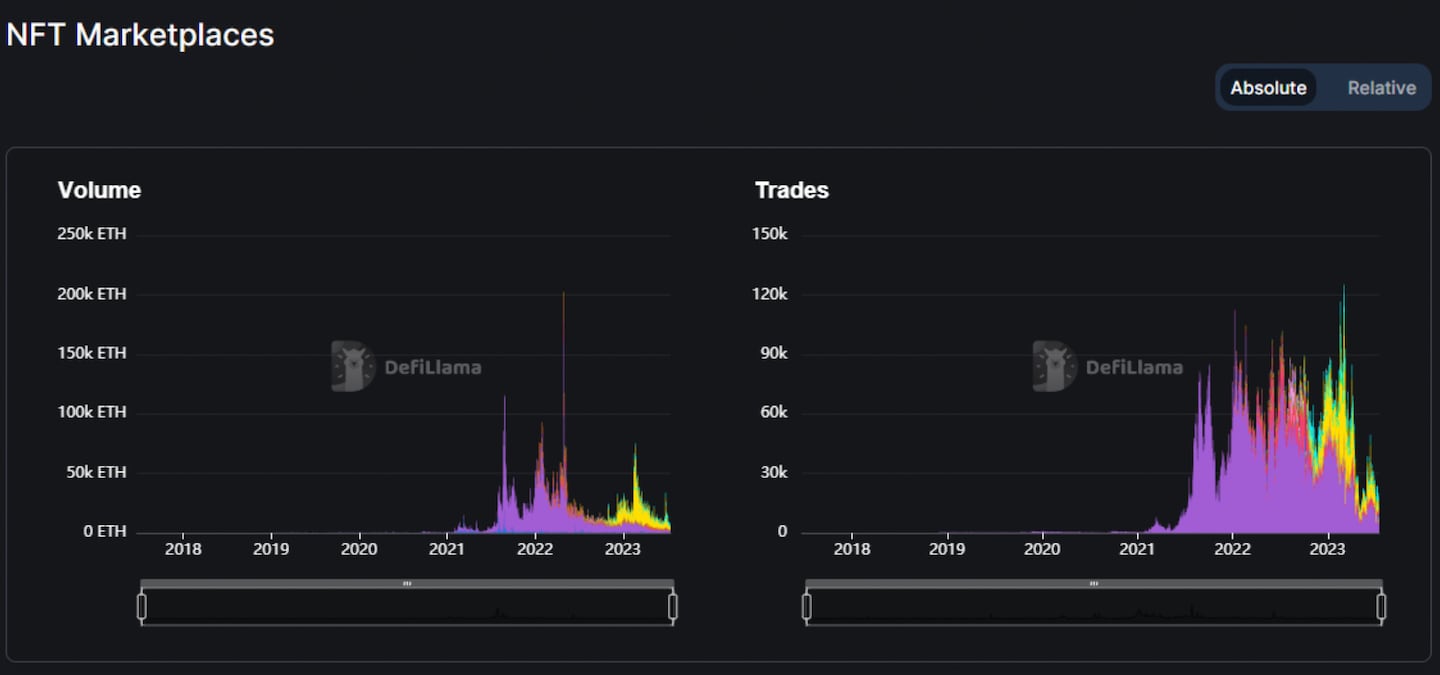

- Marketplaces: The places where NFTs are traded. This subsection includes timeline graphs that allow analysts to compare trading volume by project.

- Earnings: A dashboard of NFT creators and the amounts their projects earned from minting and royalties.

Unlocks

This section tracks when a venture capital firm or protocol team member’s vested tokens are scheduled to be available for selling. These events tend to precede price movements.

Sometimes, unlocked tokens are dumped onto the market pushing prices down.

However, if holders decide not to sell their unlocked tokens, it can be interpreted as a sign of confidence and push the token’s price higher.

Borrow Aggregator

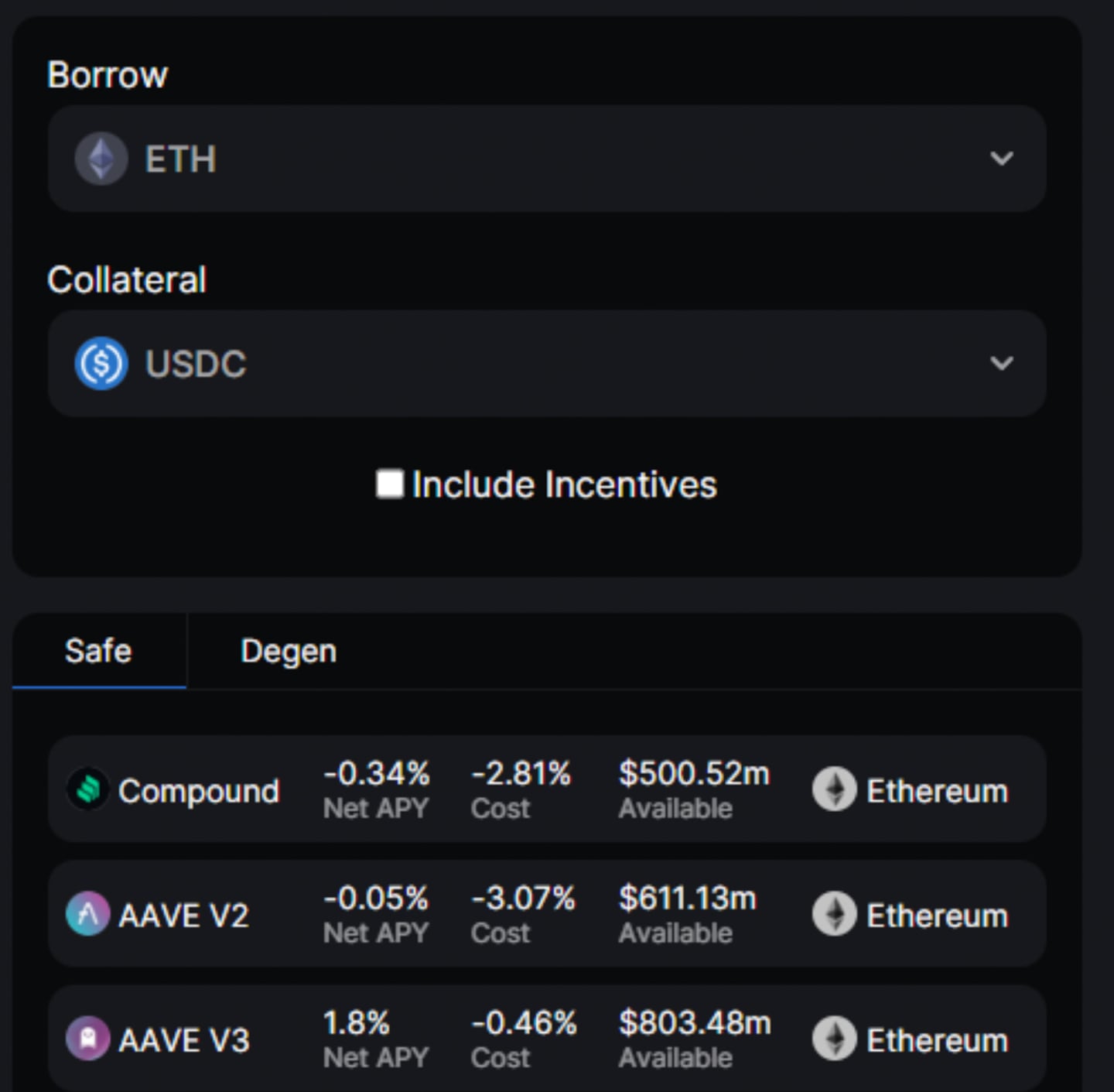

The Borrow Aggregator finds the best route for borrowing an asset with a specified collateral. The dashboard shows which protocols offer borrowing for a specified asset, the cost to borrow it, and the amount available to borrow.

CEX Transparency

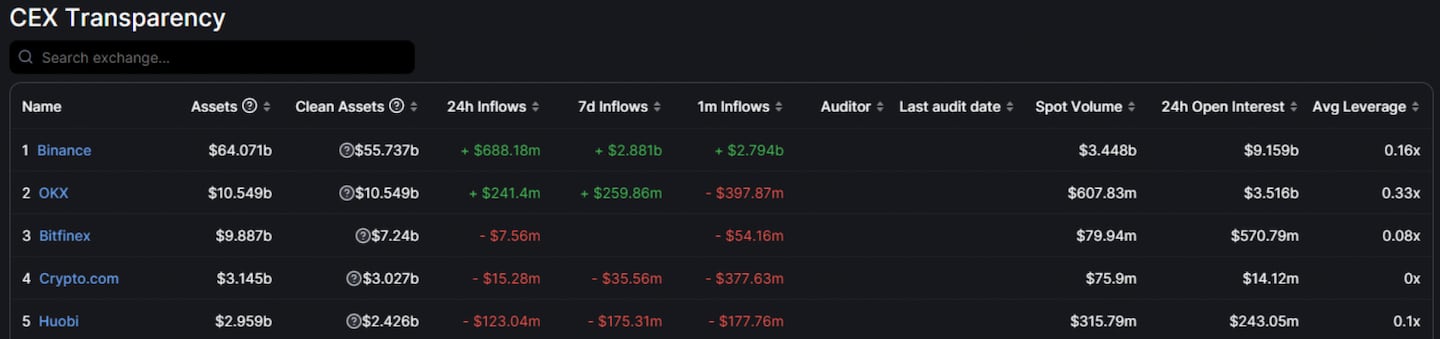

After several crypto companies failed in 2022, investors began demanding proof from these centralised giants that they did in fact hold enough assets in reserve to back customer deposits.

Companies that have provided DefiLlama with on-chain data showing how much crypto they hold have it posted on the CEX Transparency dashboard.

Using this data, DefiLlama also calculates the total value of an exchange’s assets, the amount of money coming in and out of the exchange, and audit information, if any is available.

Bridges

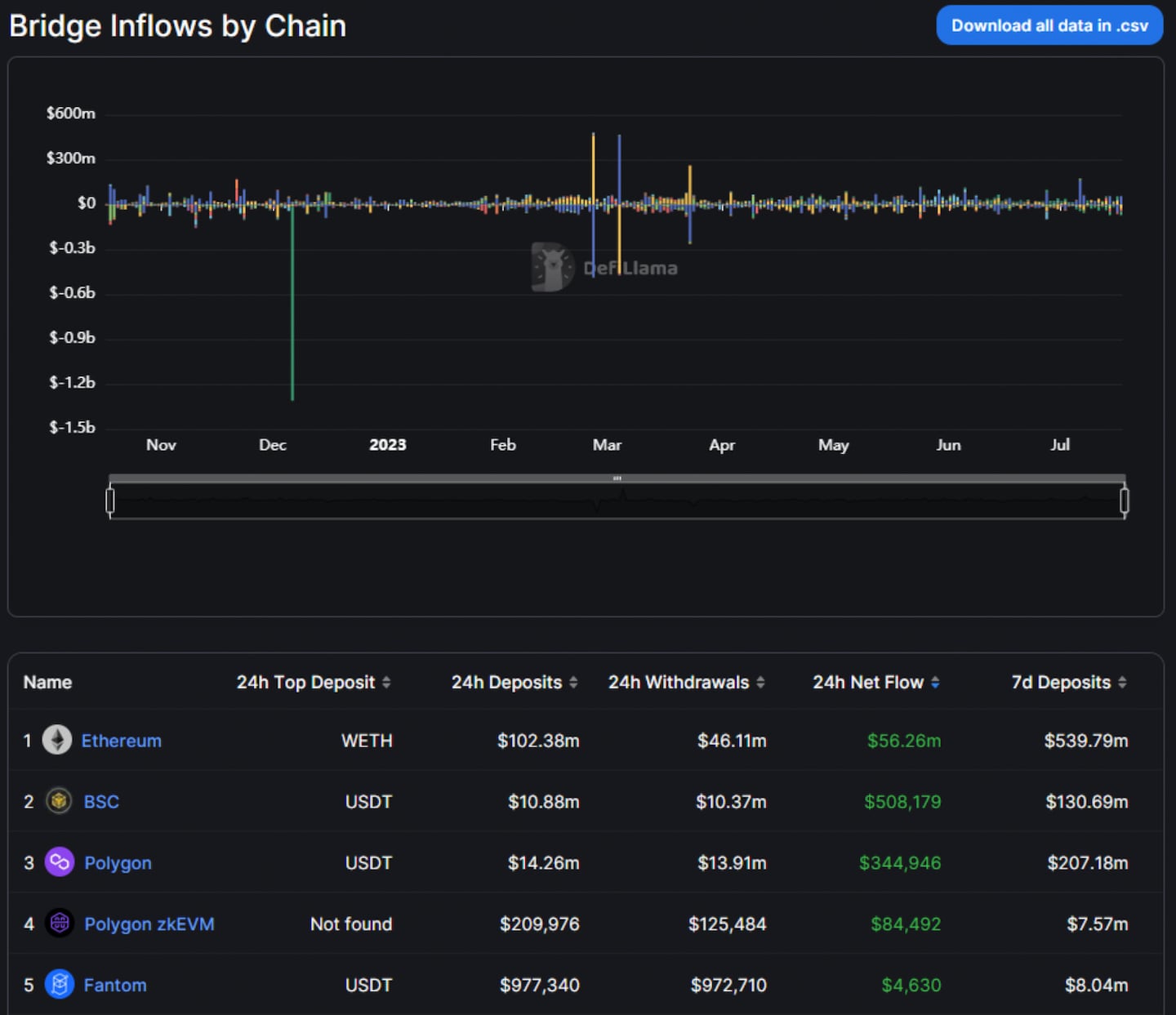

Bridges let DeFi users move assets between blockchains. The Bridges dashboard shows a historical timeline of the total volume of crypto moving across hundreds of bridges. Historical bridge transaction data is downloadable in .csv format.

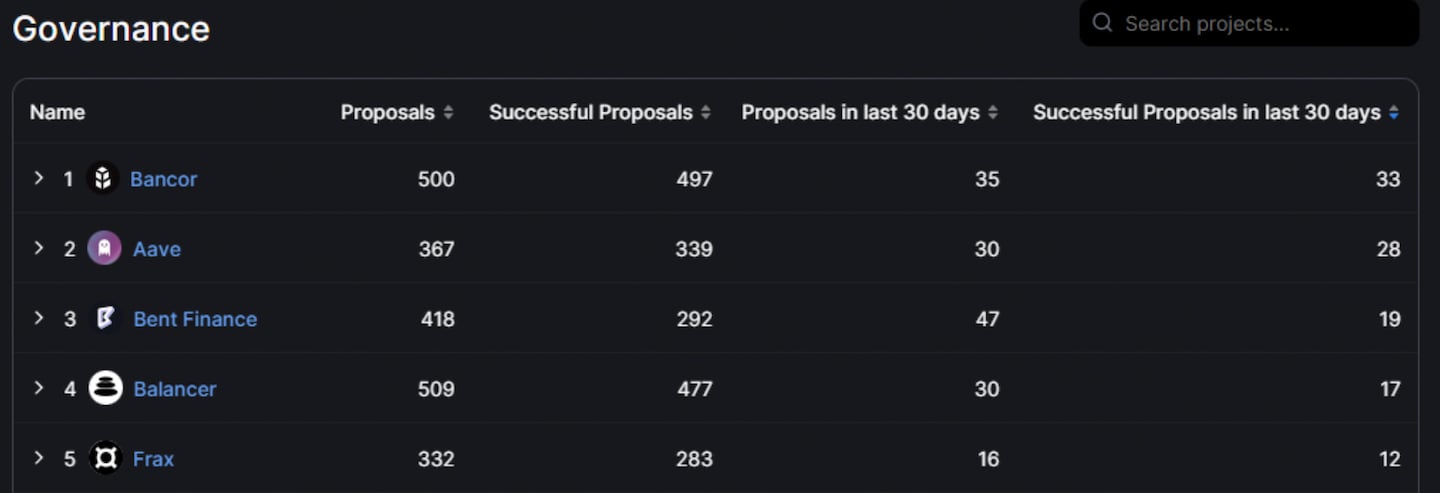

Governance

DeFi protocol stakeholders regularly put forward governance proposals, which, with enough support, are voted on by that protocol’s token holders.

These determine the future direction of a project. Tracking these proposals gives insight into what changes protocols are planning. The Governance dashboard tracks the history of proposals for hundreds of DeFi protocols.

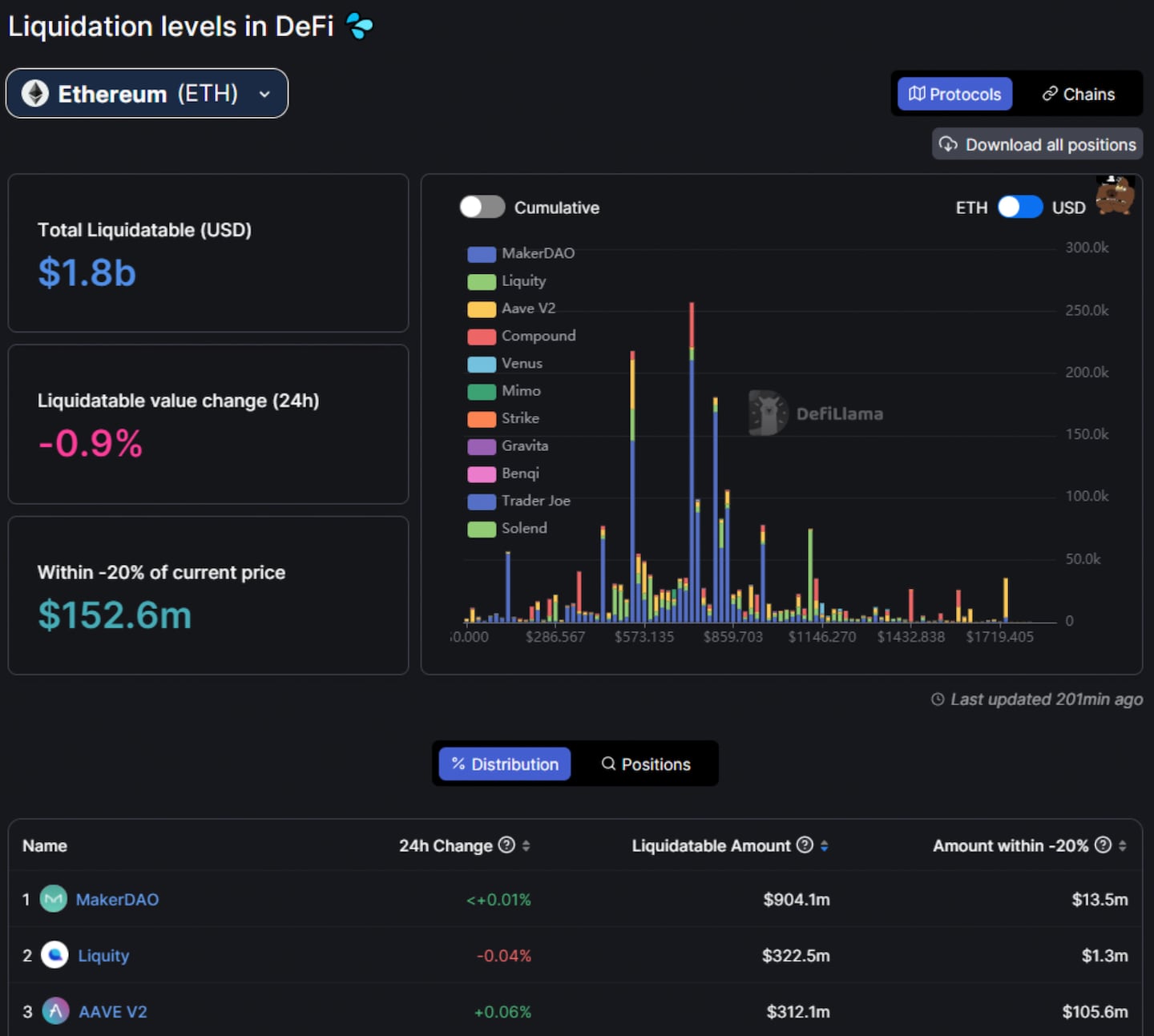

Liquidations

Liquidation is when a financial institution closes a business or trader’s financial position to ensure it does accrue debt. In DeFi, the liquidation process is partially automated by smart contracts.

DeFiLlama tracks liquidation data for 11 different lending protocols and dozens of assets across multiple chains. The Liquidations dashboard shows the total liquidatable amount of each asset and at what price specific token positions will enter liquidation.

Volumes

Trading volume refers to the value of all the trades of an asset within a specific time frame. The Volumes dashboard gives an overview of the trading volumes of tokens across numerous decentralised exchanges.

The Chains subsection provides data on the trading volumes of assets across different blockchains, and the Options and Derivatives subsections show the trading volumes of various derivatives products, such as options and perpetual futures contracts, across different platforms.

Fees /Revenue

In decentralised finance, protocols charge fees, payable with crypto, for providing financial services. After paying operational costs including marketing, infrastructure, and salary, protocols use the crypto left over — the revenue — to improve the project, bolster treasuries, and provide rewards to incentivise people to use the platform.

DeFiLlama’s Fees/Revenue dashboard tracks the fees and revenue for hundreds of protocols across dozens of blockchains. This data, which spans 17 columns, also shows how much revenue goes to investors.

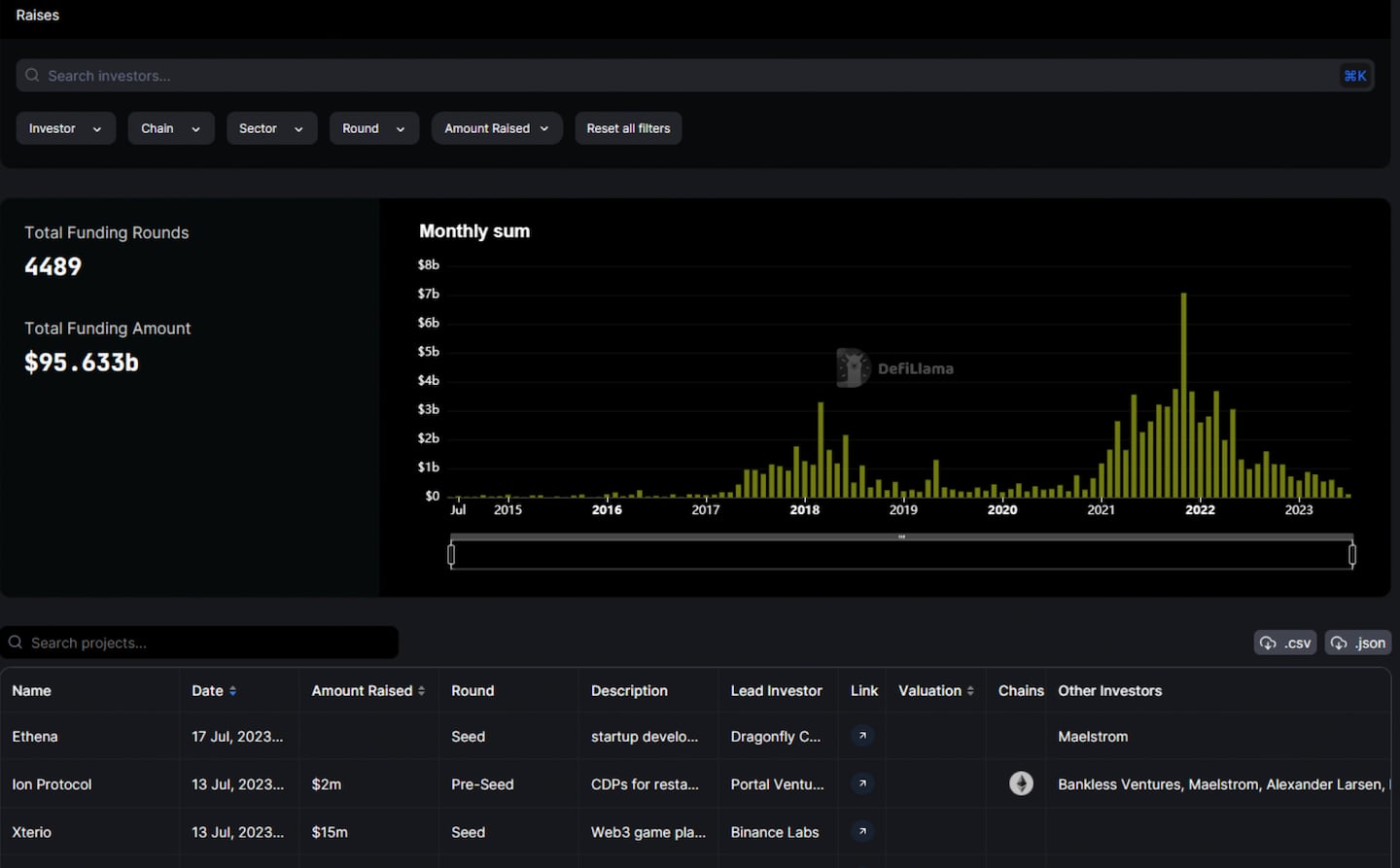

Raises

The Raises dashboard displays a history of funding rounds for DeFi protocols and crypto startups, denoting the amount raised, which investors participated, and a description of what they invested in. All results can be filtered by sector, blockchain, investor, type of round and amount raised.

An Active Investor subsection shows which funds are participating in what projects, and the number of deals they have been involved in over the past month.

Stables

Stablecoins are arguably the lifeblood of DeFi. They are cryptocurrencies that are pegged to the value of real-world assets, such as fiat currencies or gold.

The landscape of the stablecoin market is just as important as that of the DeFi protocols using them.

That’s why DefiLlama dedicated a whole dashboard to stablecoin data. In it, you can find a total stablecoin market cap and historical timeline of stablecoin dominance.

Over 100 stablecoins are listed and the dashboard shows what blockchains they are available on, their market cap, and what percentage off-peg they are — an off-peg stablecoin usually spells trouble; just ask Terra’s UST.

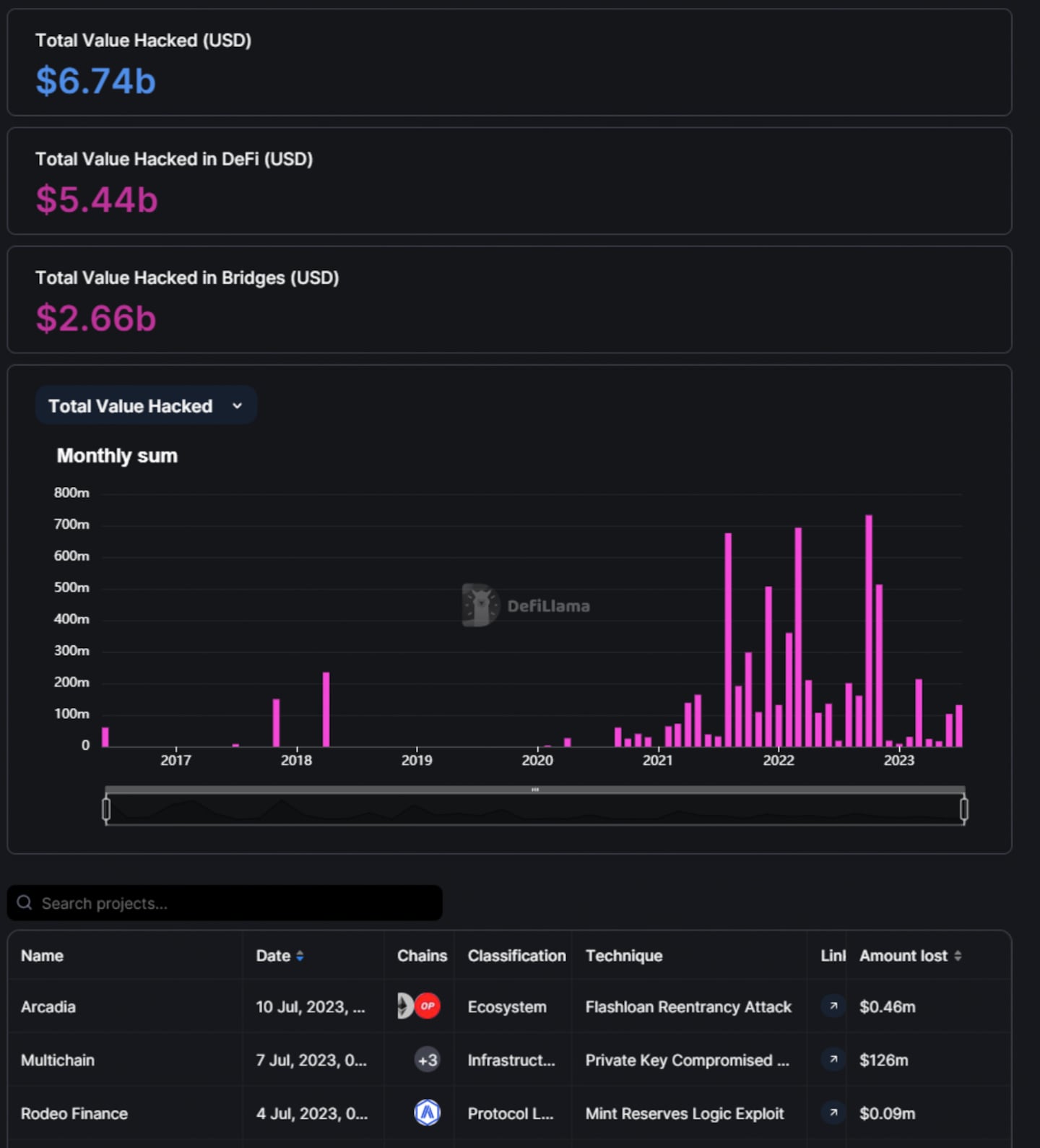

Hacks

The bane of the crypto industry, hacks and exploits have cost unwary investors billions over the years. Fortunately, there is a large community tracking every such event, and DefiLlama’s Hacks dashboard records them all.

This section includes a historical list of hacks and exploits dating back to the 2016 Ethereum DAO hack. Each event is classified by what was affected, what technique the hacker used, and the total amount lost.

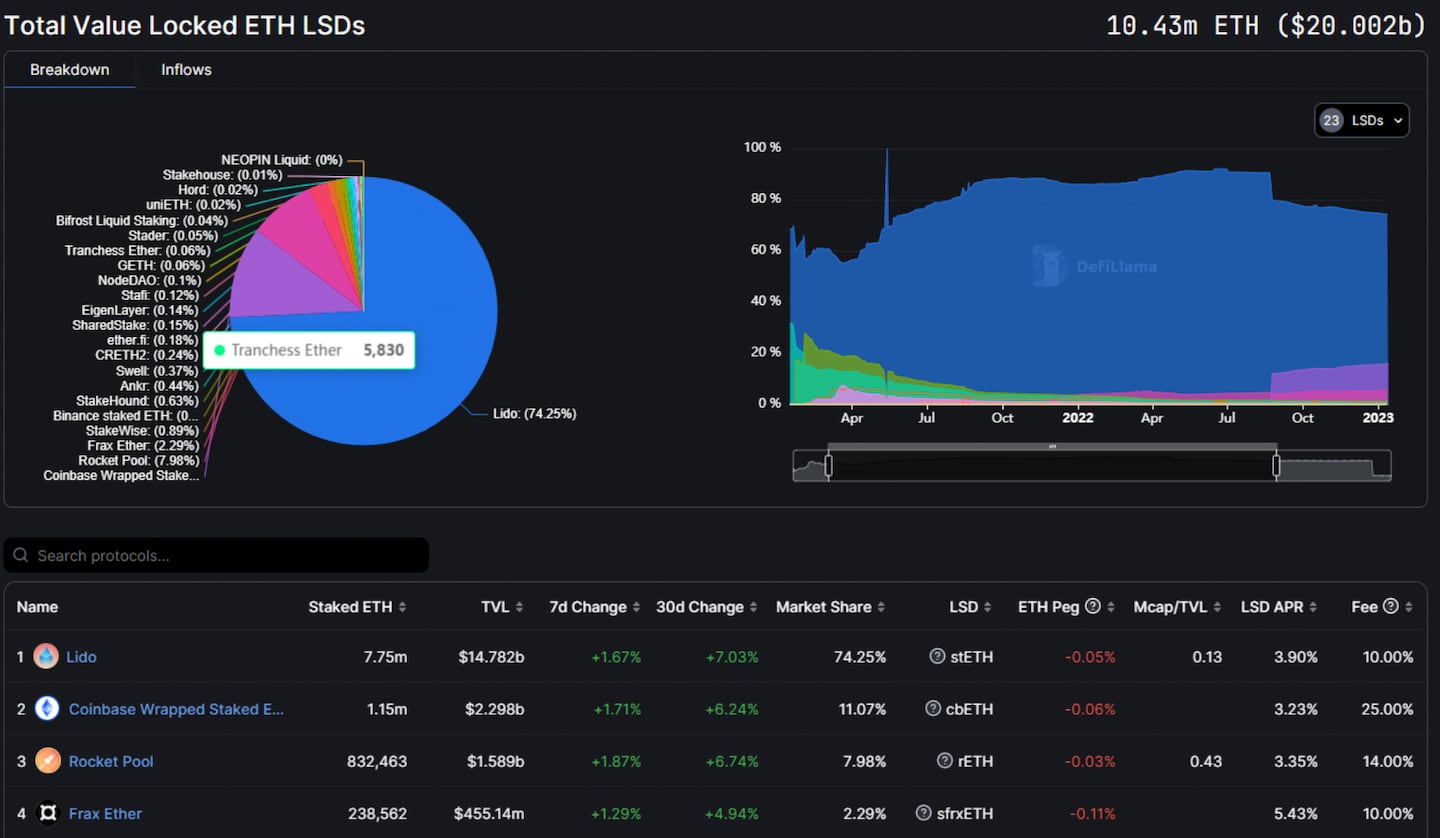

ETH Liquid Staking

The ETH liquid staking market has taken DeFi by storm ever since the Ethereum Network’s Shapella upgrade in the second quarter of 2023.

Liquid staking is where users stake their Ether through a DeFi protocol and receive a receipt-like token in return which represents their staked Ether. Holders can use this liquid staking token across other DeFi protocols to provide liquidity or as collateral for a loan.

The ETH Liquid Staking dashboard shows the market share for different liquid staking protocols, what derivative is given by each protocol, and the annual percentage yield it pays.

There you have it — DefiLlama’s complete arsenal of investigative tools, all for free. With such an abundant collection of data, there’s bound to be some helpful information for any who visit. Master these investigative tools and you are certain to become a well-informed DeFi(Llama) wizard.