By some measures, the non-fungible token — or NFT — market remains frustratingly unquantifiable. What metric could truly capture the weirdness of a crude rock JPEG selling for $1.3 million in August 2021, or Taco Bell’s taco-themed GIFs that sold out five months earlier?

DefiLlama’s NFT dashboard tries to quantify the ups and downs of one of crypto’s most volatile markets. Over $17 billion worth of NFTs swapped hands in a month at the market’s January 2022 peak, only for the asset class to crash by about 90% by September of that year.

This article unpacks the core concepts that define this strange market, and teaches about how DefiLlama’s tools can help analyse it.

What is an NFT?

Non-fungible tokens, or NFTs, differ from regular cryptocurrencies in that each token is individual and distinct. Because of this unique feature, NFTs are often used to affirm ownership of some digital artefact. Common uses for NFTs include digital art and music, event tickets, trading cards and video game cosmetics, with new use cases envisioned regularly.

Many NFTs confer ownership to intangible items, like decentralised domain names, or Jack Dorsey’s first tweet. However, NFTs can also be used to tokenise real-life things like physical art or luxury watches, providing an easily-accessible record of provenance and ownership.

The Ethereum blockchain was among the first to popularise NFTs, and has become the chain of choice for most NFT connoisseurs.

Most NFTs on Ethereum are built using the token standards ERC-721 and ERC-1155. These standards have since been ported to other blockchains like BNB Chain, Solana and Polygon.

It’s often easy to duplicate the piece of media an NFT represents, whether that’s digital art, music, or something else. However, the real value of an NFT lies in the unique ownership rights it confers to that piece of media.

These are not necessarily legal property rights or copyrights – the Grumpy Cat owner’s cease-and-desist letter to the creator of the NFT version attests to that – but ownership over exclusive metadata.

Each NFT contains metadata that describes the characteristics and properties of the token, such as its creator, traits and transaction history. This metadata is stored on the blockchain, creating an immutable record of ownership that anyone with access to the blockchain can verify.

An NFT’s metadata can often be a strong determinant of its value. Art or video game NFTs are often sold in collections, and the rarer an NFT’s metadata, the more valuable it usually is.

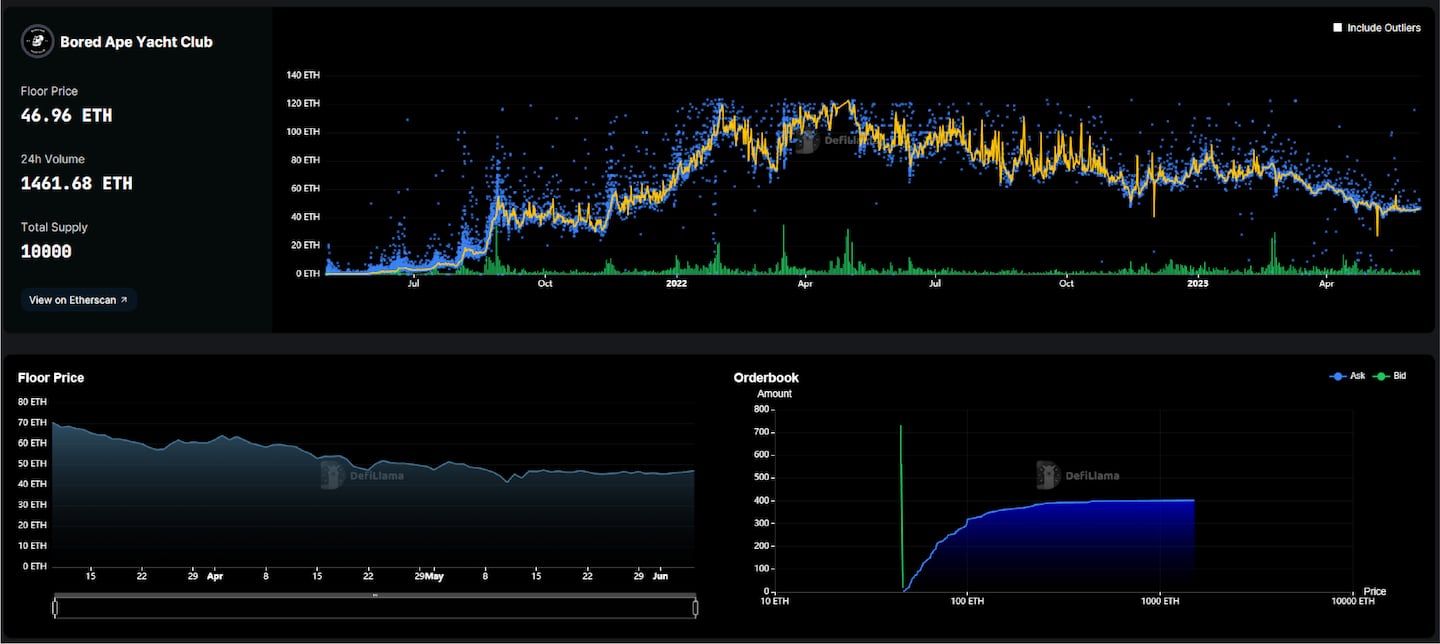

For example, each NFT in the 10,000-strong Bored Ape Yacht Club collection is fashioned from over 170 traits, and the rarer traits sell for more. A single golden-haired, beanie-sporting Bored Ape sold for $3.4 million in October 2021.

Alternatively, some NFTs are more valuable than others because they provide certain boons to holders guaranteed by their creator. Select NFTs from Internet personality Gary Vee granted holders the opportunity to go garage-saling or play tennis with him.

DefiLlama’s NFT aggregator dashboard displays the top collections and marketplaces. It also contains information about NFT floor prices, 24-hour trading volume, individual purchases and a link to NFT smart contract addresses on Etherscan, a popular blockchain explorer.

The dashboard lists hundreds of NFT collections, each of which lists the collection’s total supply and the number available for sale on NFT marketplaces.

The one-day sales volume can help traders find the most hyped collections.

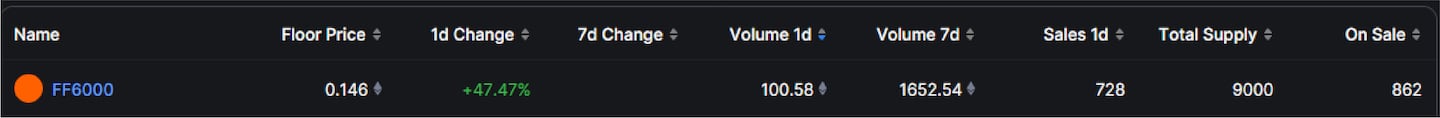

The barrier to entry for launching an NFT collection is low. Because of this, new collections pop up almost constantly, often springboarding off of current events, meta-irony and inside jokes, and other more successful collections. For example, among the hottest NFTs as of this writing is FF6000, a collection of NFTs named after the orange colour hex code. The floor price of these tokenised orange blocks increased by 47% in a day to $250 following 100 ETH worth of trades.

Free market competition

Most NFTs trade on marketplaces. Over 80 million NFTs are currently up for sale on OpenSea, the largest such bazaar. OpenSea helped launch NFTs into the mainstream in 2021, but other NFT marketplaces have since sprung up to beat it at its own game.

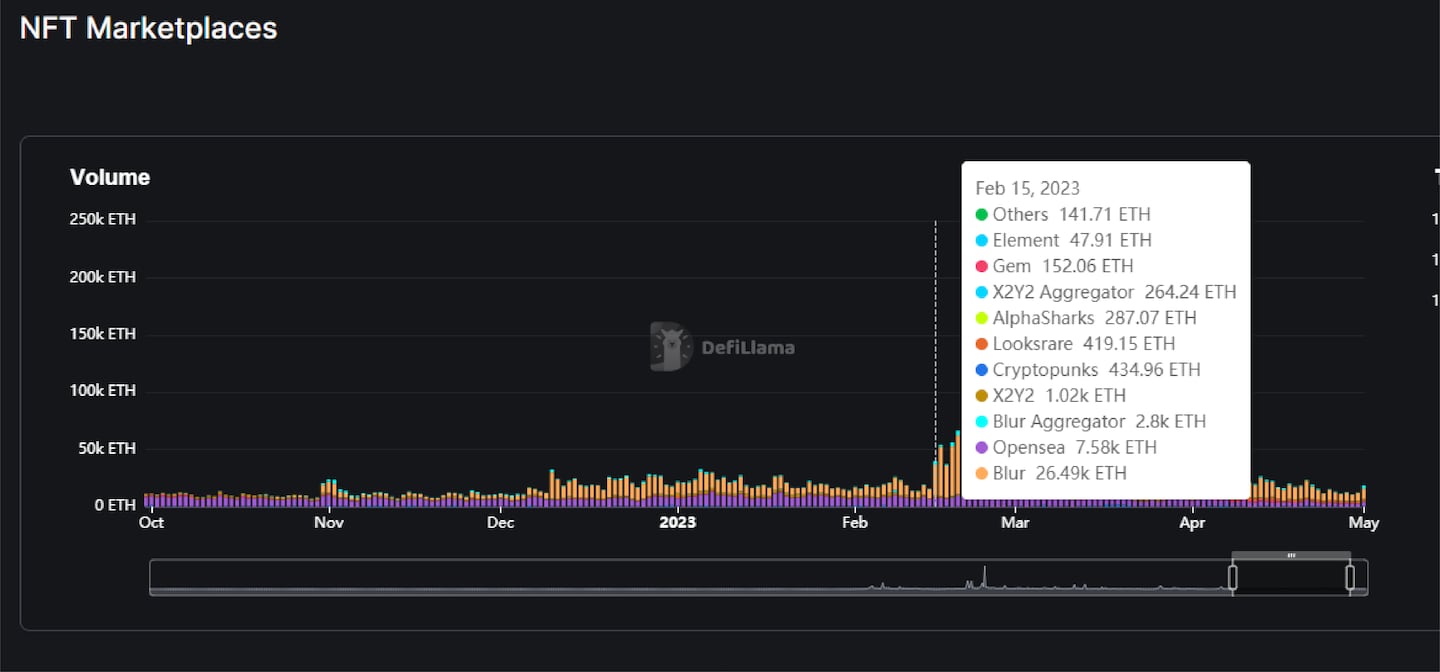

A battle for NFT market dominance broke out in early 2023 between OpenSea and a newcomer called Blur. Blur attracted customers by lowering sales fees and making royalties paid to NFT creators optional. Blur wreaked havoc on OpenSea’s market share, forcing the incumbent marketplace to cut fees under the company’s rebranded NFT aggregator “OpenSea Pro.”

So who won the battle? DefiLlama’s NFT dashboard tells the story with data.

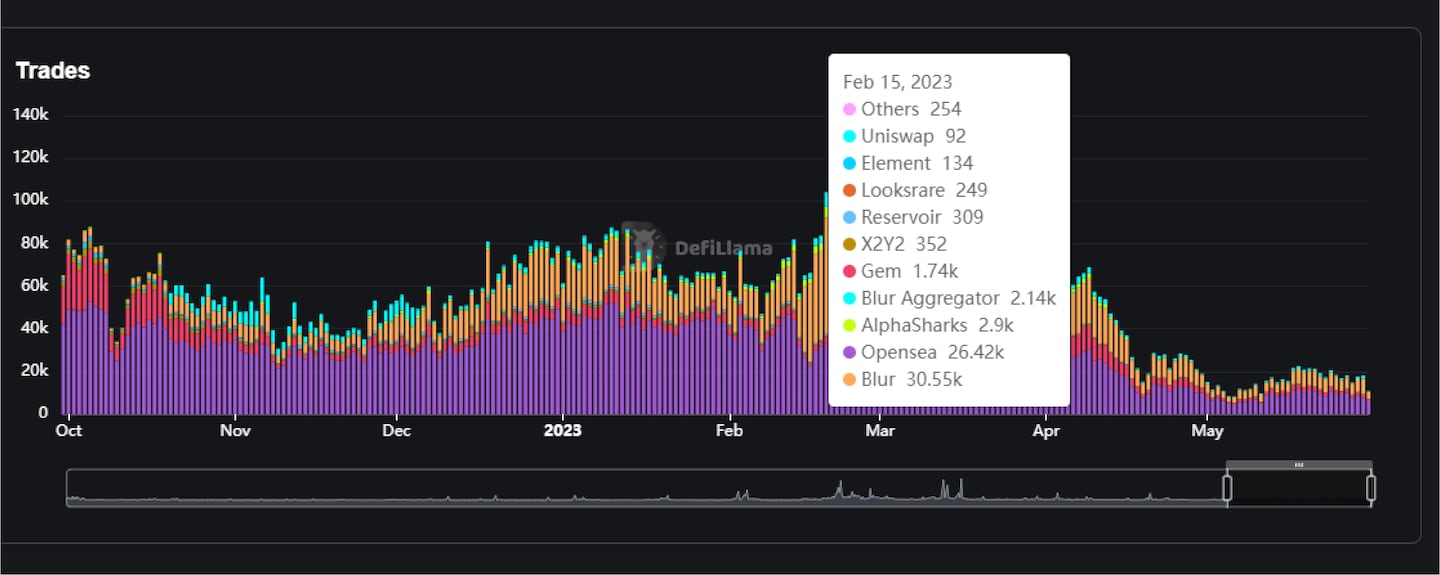

Blur launched its marketplace in October 2022 and released its own token the following February. The Volume chart on DefiLlama’s NFT Marketplaces dashboard focuses on these dates with the timeline sliders.

The sliders make it easier to see how Blur experienced a surge in trading volume after its token launched – growing 300% overnight on February 14. Blur’s spike bumped up trading volume on OpenSea, too, but Blur outpaced it. By February 22, users traded almost 600% more NFTs on Blur compared to OpenSea.

The “Trades” graph shows how the number of trades on Blur’s marketplace increased 75% from February 14 to 15, while OpenSea’s numbers dropped by almost 25% in the same period.

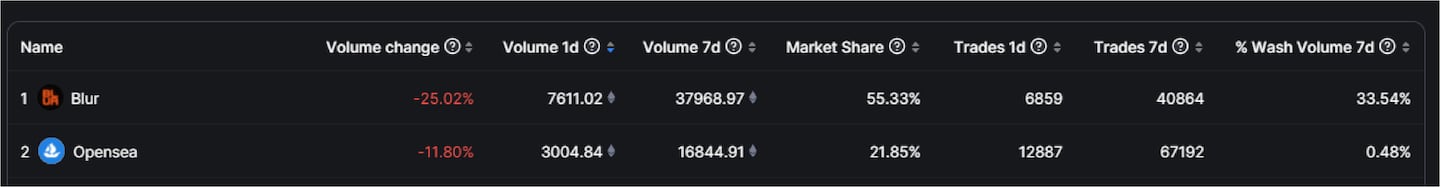

But one metric undermines Blur’s success. As the chart above shows, Blur has a far higher percentage of wash trading volume compared to OpenSea.

Wash trades are when the same person or people buy and sell an asset again and again to create a false impression of market activity — or in the case of Blur, to farm the marketplace’s lucrative token airdrop.

Wash trading is rampant on Blur: NFT tracking platform CryptoSlam found 80% of trades on Blur to be inorganic throughout its token release week.

The steep rise of inorganic trading prompted updates to NFT analytic platforms’ wash trading filters. DefiLlama now omits trades that contain the following characteristics:

- Self-trades, where the buyer and seller have the same address.

- Circular trades, where an NFT finds its way back to the seller on the same platform.

- Buys and sells funded by the same address.

- Using flash loans to buy an NFT.

- Multiple transactions between the same buyer and seller paid above floor price.

These filters are not fool proof, and wash traders continue to find ways to bypass them. As long as platforms like Blur continue to incentivise the practice, wash trades will continue to skew NFT analytics data.

From an outsider’s perspective, sky-high valuations for digital pictures of monkeys or orange blocks might seem detached from reality. But if crypto experiences another bull market, the newly-minted millionaires will look for ways to show off their wealth. And, as history has taught us, NFTs and the luxury digital goods they represent will likely be a popular choice.

But fear not — DefiLlama will be here to equip you with the insights and data needed to navigate this eccentric market.

Next steps

- Explore NFT wash trading data compiled by hildobby, a pseudonymous data analyst at crypto venture fund Dragonfly.

- Read up on court battles revolving around NFTs and copyright laws, such as the “Grumpy Cat” cease-and-desist order.