- Today’s DAT playbook turns reflexivity into strategy by minting tokens, buying crypto, and amplifying belief in a loop that fuels both treasury and narrative.

- Japan’s Metaplanet and U.S.-based BNB Network Co. convert tax and regulatory friction into structural advantage, while BNC’s DAT exemplifies what a DAT can achieve.

- DAT performance depends on alignment, where fundamentals, leadership, and narrative must move together for premiums to persist.

Just a couple months ago, digital asset treasuries were crypto’s hottest trade. Spurred by soaring valuations, hundreds of companies raced to accumulate Bitcoin, Ether, and other digital assets.

The mania has cooled in recent weeks. Companies that saw their stock soar after announcing multimillion-dollar crypto purchases are now trading at a discount relative to that crypto.

Still, some are holding strong, with their mNAV — short for market-cap-to-net-asset-value multiple — comfortably in the black.

How do the do it? In the LlamaU article below, pseudonymous DefiLlama analyst Meta explains the drivers of mNAV premiums, as well as examples where the logic behind those premiums “breaks.” (Read Meta’s previous article: What is mNAV? How to calculate and trade it? Your DefiLlama guide to the metric for digital asset treasuries)

Handbook for DAT Strategy

DATs are no longer just holding crypto — they’re leveraged to actively expand their own holdings and valuations.

They aren’t just ‘hodl’ing tokens; it has become a competitive game of accumulation. DATs are trading their own market caps against themselves, turning investor sentiment into capital and capital into narrative fuel.

This new species of equity, known as Digital Asset Treasuries (DATs), sits at the intersection of corporate finance and crypto reflexivity.

Their fundamentals are blockchain-based, their premiums narrative-driven, and their strategies systematic: print, buy, compound, repeat.

What began as an experiment with MicroStrategy’s Bitcoin accumulation model has evolved into a broader movement spanning Bitcoin, Ethereum, Solana, and beyond.

Today, SBET, BMNR, and others have creatively applied the same reflexive mechanics to staking yield, token diversification, and capital recycling; transforming what used to be static balance sheets into market engines.

What Is an mNAV Premium?

mNAV = Fully Diluted Market Cap ÷ Treasury Value (USD)

1.0x → equity equals treasury value (fair)

> 1.0x → investors pay a premium for leverage, yield, or access

< 1.0x → the stock trades at a discount to its underlying crypto

If you’re new to mNAV or want a step-by-step breakdown of how it’s calculated, “HYPE DAT Ecosystem: A Clean Case Study for mNAV” is where you want to start.

A premium can be narrative-driven, structural, engineered, or yield-supported. When these align, mNAV becomes less a ratio and more a reaction: a positive feedback loop between equity and treasury that refines sentiment into capital.

MicroStrategy: The Blueprint for Capital Reflexivity

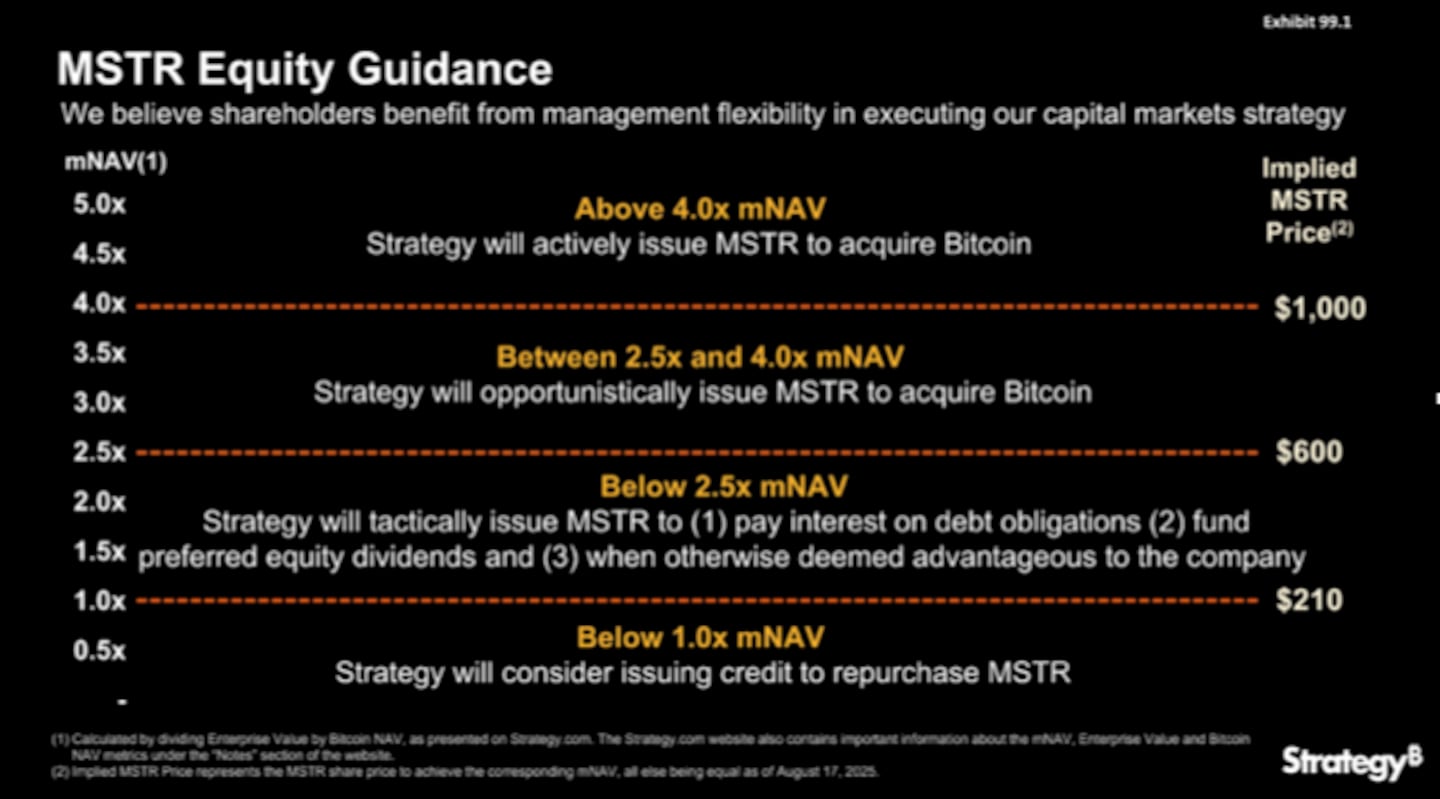

MicroStrategy pioneered the quintessential DAT model; they codified, refined, and evolved their procedure making them the gold standard. Below is the company’s official equity guidance slide from Exhibit 99.1 (August 2025):

Its strategy slide divides valuation into mNAV zones, each dictating a different capital playbook:

- Active: issue equity aggressively to buy more Bitcoin

- Opportunistic: issue selectively during favorable sentiment

- Tactical: issue sparingly for debt or liquidity needs

- Defensive: may use credit to repurchase stock

Active issuance expands Bitcoin holdings through ATMs (At-the-Market equity offering, where companies sell newly issued shares directly on to the open market), convertibles, and secondary offerings. Opportunistic issuance occurs briefly, often above 3x mNAV, allowing controlled compounding with minimal dilution. Tactical issuance covers debt or dividends without selling BTC. Defensive stance slows issuance or uses credit to repurchase shares, supporting the stock’s floor and resetting the flywheel.

This structure turns capital markets into a feedback engine. When mNAV rises, MicroStrategy issues to buy BTC. When it falls, issuance tightens or reverses through buybacks. Dilution becomes reflexive compounding.

Profit vs. Cost Basis: The First Premium Driver

The simplest catalyst for premiums or discounts is positioning versus entry cost.

When a DAT’s treasury sits above its average purchase price, the market usually assigns a premium (>1x mNAV). Below cost, the market discounts it.

Across the DeFiLlama Digital Asset Treasuries dashboard, profitable treasuries consistently trade higher while underwater ones remain cheap.

Examples include:

- MSTR (MicroStrategy) — BTC Treasury, Above Basis → Premium (mNAV ~1.5x)

- KIDZ (Classover) — SOL Treasury, Above Basis → Premium (mNAV 2.1x–3.5x)

- UPXI (Upexi) — SOL Treasury, Max FD lens → mNAV ~1.5x

- MARA (Marathon Digital) — BTC + Infrastructure Premium (1.2x–1.7x)

- NAKA (Nakamoto Holdings) — High BTC Entry → Discount (0.5x–0.8x)

- BTBT (Bit Digital) — ETH Treasury w/ Yield → Premium (>1x)

Geopolitical and Structural Premiums

Premiums also form along jurisdictional and regulatory lines — where access or taxation changes valuation dynamics.

Metaplanet Inc. (OTC: MTPLF, TSE: 3350.T) is Japan’s flagship Bitcoin treasury and one of the clearest cases of jurisdictional alchemy.

Under Japan’s tax code, corporations must mark crypto holdings to market annually and pay tax on unrealized gains.

In contrast, capital gains on listed shares are taxed separately at an effective 20.315% (Japan National Tax Agency).

This makes Metaplanet (MTPLF) a tax-deferred Bitcoin proxy, letting investors gain BTC exposure through equity. By holding Bitcoin through equity rather than directly, Metaplanet turns that asymmetry into a structural advantage, maintaining a 1.8x–2.0x mNAV with it at its peak having maintained >8x mNAV for weeks on end. A textbook case of tax alchemy: turning friction into premium.

DATs in regulated markets can tap capital barred from direct token exposure. MicroStrategy succeeded because it epitomized this: a compliant, levered Bitcoin wrapper for institutions.

Formerly CEA Industries, BNB Network Co. (BNC) is one of the few public DATs with direct BNB exposure.

With no BNB ETF or trust in the U.S., it serves as a listed proxy for Binance’s ecosystem; similar to how MSTR fulfilled the role early on as the only institutional onramp for BTC exposure.

It trades near 1.87x mNAV. Given that it is publicly endorsed and heavily invested into BNB DAT by the venture capital entity YZI Labs, formerly Binance Labs, which is officially funded and partnered with Binance itself. Until a formal BNB ETF exists, that scarcity alone supports the premium.

Together, Metaplanet and BNB Network Co. show the geography of premium. Where Metaplanet turns Japan’s crypto tax disadvantage into equity advantage, BNC leverages America’s regulatory bottleneck on BNB exposure.

Both convert policy friction into scarcity. Metaplanet provides the purest example of geopolitical arbitrage in the DAT playbook.

The Yield Flywheel: Turning Assets Into Income

SBET and BMNR pioneered ETH-based treasuries that generate yield natively.

By staking directly on Ethereum, both earn validator-level returns (~3–5% APY) that continuously expand NAV.

That yield compounds through feedback: staking generates rewards, NAV expands, the market reprices equity upward, and higher valuations reinforce the premium.

The difference lies in the ingredients: mindshare, leadership, and visibility. SBET, with Joseph Lubin, cofounder of Ethereum, and Joseph Chalom, former Head of Digital Assets at BlackRock, has top tier pedigree however BMNR’s Tom Lee has a very public presence with his appearances on CNBC. This ends up likening Tom Lee to MSTR’s legendary Saylor whose loud, consistent, charismatic bullishness were undeniable variables in the success of establishing MicroStrategy as a household name.

BMNR paralleled this best for the Ethereum DATS by staying on top via a combination of buybacks, retail engagement, and visible leadership.

BTCS also earns ETH staking yield but trades below parity lending proof that yield alone can’t ignite the flywheel without narrative and conviction.

Ultimately, yield is the base metal, and narrative, leadership, and timing are the reagents that determine whether it compounds or burns off.

Diversification and Moonshots

Some DATs diversify through moonshot allocations: small, high-beta bets meant to amplify upside or hedge decay.

GameSquare (mNAV = ~1.11x) holds ETH, a CryptoPunk, and ANIME token positions. It trades slightly above parity, a modest premium for narrative diversification.

BMNR allocated $20M into ORBS (formerly OCTO), a Worldcoin (WLD) DAT, at $1.46/share. By October 2025, ORBS traded above $10, a 6x gain. Clearly, these moonshots can convert asymmetric exposure into subtle mNAV leverage through optionality.

When the Premium Logic Breaks

Not all DATs follow the “profit = premium” or “association = value” logic.

TRON (Ticker: TRON) – Despite profitable reserves and close ties to the TRON blockchain, the stock trades at a steep discount. TRON, which is the only TRX DAT treasury, trades at a 0.53x max fully diluted mNAV,

Despite TRX hosting ~$77.5B in stablecoins, composed of ~98% USDT (DeFiLlama), and dominating transfers across Asia, Africa, and Latin America, in the West, it’s viewed as a transactional rail, not an investable asset, keeping its mNAV deeply discounted.

Contrast this with BNB Network Co. (BNC). BNB’s exchange linkage and predictable revenue burns make it behave like equity.

Binance uses a share of revenue to buy and burn BNB: a deliberate, showy, aggressive mechanism versus TRX’s passive gas burns.

Traditional finance investors quickly recognize the pattern as an equity-like feedback loop, sustaining BNC’s 1.87x mNAV whereas TRX’s gas burning blockchain hasn’t attracted attention to TRON treasury keeping it below parity. Simply put: BNB’s burn program mirrors corporate buybacks, while TRX’s gas burns are passive and minor in comparison.

BNC maintains premium; TRON does not. In numerical terms, the contrast between the two when examining max mNAV is astronomical: a difference of over 300%!

BTCS, one of the first ETH staking firms, trades around 0.88x mNAV. SBET and BMNR captured attention with clear messaging and buybacks; BTCS remained quieter, focused on infrastructure over narrative. It delivers on-chain results but lacks social reflexivity; proof that legitimacy without visibility still prices like a discount.

These cases show DAT premiums are behavioral, not mechanical. Narrative clarity, investor access, and perceived intentionality decide whether association becomes valuation.

TRX dominates usage but not mindshare translating to a discount for TRON; BNB’s engineered burn loop mirrors equity translating to a premium for BNC as if accounting for revenue generation; and BTCS shows substance alone isn’t enough.

In this market, numbers matter but narratives are the driver for positive multiples.

Fundamentals Meet Reflexivity

In the DAT ecosystem, premiums aren’t random; they’re engineered. Every successful treasury blends fundamentals, narrative, and structure into a reflexive loop: fundamentals anchor value, narrative amplifies it, and capital strategy turns that feedback into growth.

MicroStrategy utilizes financial wizardry to convert sentiment into Bitcoin. Metaplanet and BNC alchemize geography into premium through geopolitical arbitrage. BMNR, SBET, and GAME merge yield and narrative momentum. TRON and BTCS remind us that usage without story rarely sustains a premium.

In this financial alchemy, fundamentals are the lead, narrative is the spark, and regulation is the catalyst that determines how brightly it burns.