- Ethereum celebrates the one year anniversary of its transition to Proof-of-Stake on Friday.

- Under Proof-of-Stake, the network has reduced global electricity demand by an amount equal to that of entire countries such as Myanmar and Slovakia.

- But the Merge has done little to help some existing problems, such as a lack of client diversity.

A year on from the Merge, Ethereum’s landmark upgrade has bolstered the blockchain’s public image and enhanced its green credentials. But issues of centralisation and technical diversity remain, according to developers and DeFi builders.

September 15 marks the one-year anniversary of the Merge, which, among other things, transitioned the leading smart contract network from the energy-intensive Proof-of-Work consensus mechanism to the greener Proof-of-Stake.

Under Proof-of-Stake, Ethereum has reduced global electricity demand by an amount equal to that of entire countries such as Myanmar and Slovakia in the year since the Merge.

That’s according to data from The Cambridge Centre for Alternative Finance, which says Ethereum’s energy use dropped 99.99%, down from the estimated 21.41 terawatt hours of electricity it used the year before the Merge under Proof-of-Work.

Ethereum’s new green credentials have had the biggest impact in the year since the transition.

“The discussion changed a lot,” Ethereum core developer Marius van der Wijden told DL News. “If you discussed crypto or Ethereum before the Merge, it immediately went to energy consumption and emissions.”

“Now we can have good discussions about the merits of blockchain without having to discuss the environmental impacts,” he added.

NOW READ: Vesta Finance token soars 150% as DeFi protocol is rocked by rage quit proposal

And Van der Wijden isn’t the only one to say so.

“No longer being a wanton environmental polluter is a significant improvement to the blockchain’s public image,” Nick Ashley, marketing manager at Ether liquid staking provider Rocket Pool, told DL News. “Institutions can take Ethereum more seriously, with the option to earn a return on their holdings while complying with ESG policies.”

Ashley also noted the increasing interest from universities, which are now more eager to participate in Ethereum’s security and contribute to ongoing research and education.

However, while many predicted that Ethereum might see increased investment interest after the Merge thanks in part to its energy use reduction, this has yet to materialise.

Data from Coinshares shows that institutional investment into Ethereum actually decreased by $108 million since the start of the year. In a September 11 report, Coinshares noted that Ethereum was the “least loved digital asset amongst exchange traded products investors this year.”

Economic improvements

Aside from cutting carbon emissions, The Merge also cut issuance of Ethereum’s native cryptocurrency Ether by about 95%. Under Proof-of-Work, the network paid out around 13,000 Ether a year to miners for securing the network. Under Proof-of-Stake, this figure dropped to 1,600 Ether annually.

According to Ashley, this “solved one of the most important problems of all by ensuring that Ethereum can remain sustainable in the long term.” If the pre-Merge issuance continued, the supply of Ether would have grown indefinitely, diluting the market and providing stakers little incentive to lock up their Ether to secure the network.

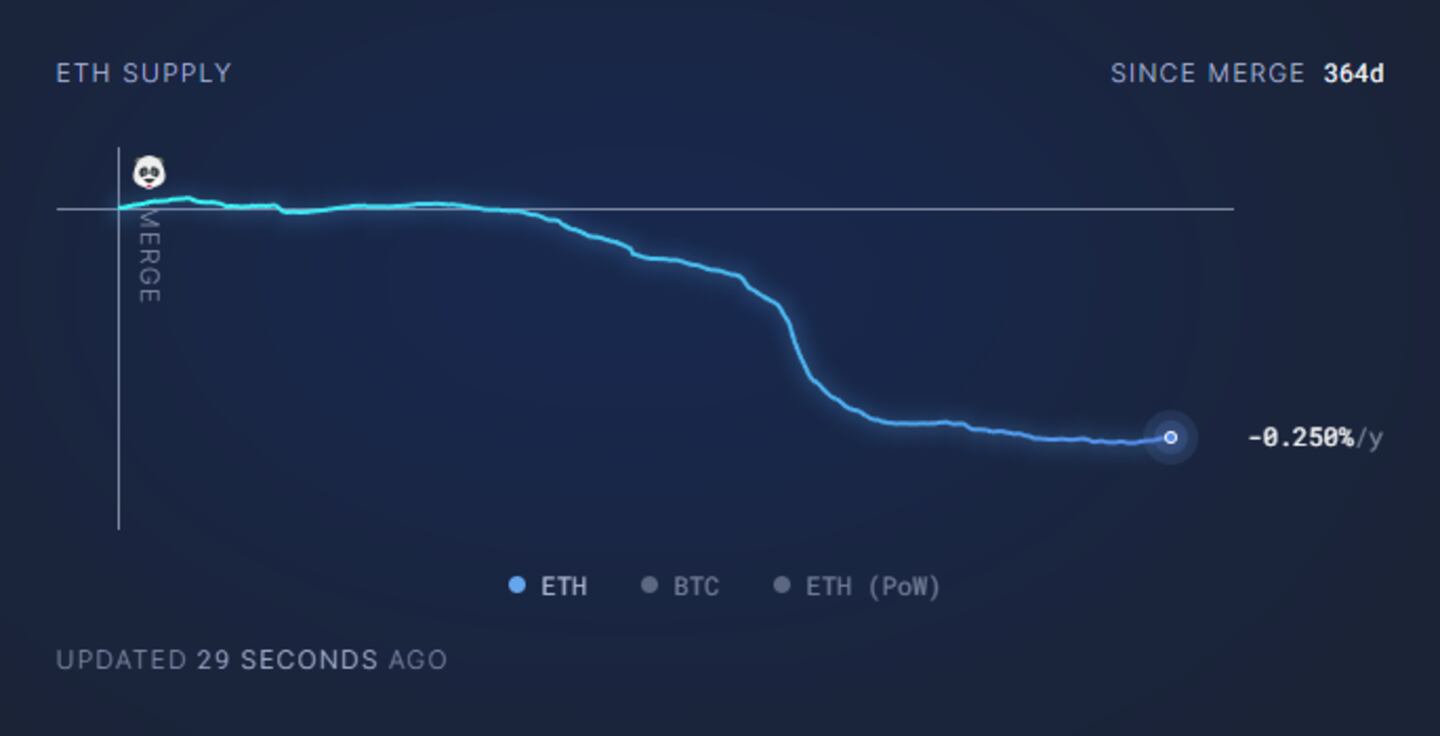

The reduced emissions, combined with a previous upgrade which enabled the Ethereum network to burn a portion of transaction fees, has made Ether disinflationary over the past year — even more so during times of high network activity when more transaction fees are burned.

With Ether burned from transactions outpacing new emissions since the Merge, projections from Ethereum data platform ultrasound.money show the Ether supply is likely to find equilibrium at around 73 million, if the current yearly usage continues.

Since the Merge, the Ethereum network has burned 300,000 Ether, worth approximately $480 million.

Diversity issues

Despite the improvements to Ethereum’s energy consumption and economic structure brought by the Merge, it also exacerbated an existing problem.

According to Ethereum core developer Preston Van Loon, the lack of Ethereum client diversity following the Merge has been “prominently discussed” in developer circles.

Ethereum clients are pieces of software that run Ethereum and communicate over the network with other clients.

Van Loon explained how shortly after the Merge, the Prysm client became dominant and exceeded a super majority above two-thirds of the entire Ethereum network.

NOW READ: Compound founder Robert Leshner says ‘institutions aren’t coming’ to DeFi

“Having a single client representing more than two-thirds of the network was a considerable risk,” Van Loon said. “The client could have a bug that may become finalised with the remaining third in disagreement.”

“Diversity has improved significantly, but there is still room to improve, especially on the execution layer where Go Ethereum is an overwhelmingly dominant client,” Van Loon added.

An Ether staking surge

The Merge, and the subsequent April 2023 Shanghai upgrade, also drove billions worth of Ether into staking — particularly liquid staking services such as those offered by Lido and Rocket Pool.

“Ethereum’s transition to Proof-of-Stake can be broken down into two phases, the Merge in September of last year and the Shanghai upgrade back in April,” Marin Tvrdić, a business development contributor at Lido DAO, told DL News.

“The biggest impact of this transition is the rapid growth of the liquid staking economy,” he said.

Since the Merge, deposits to liquid staking protocols have more than doubled. According to DefiLlama data, over $19 billion worth of Ether is currently staked through liquid staking protocols, with the biggest protocol, Lido, accounting for 73% of the market.

Tvrdić also noted that the Merge has allowed staking protocols to focus on expanding access to staking, helping to consolidate Ethereum’s overall decentralisation.

Van Loon also highlighted how the switch to Proof-of-Stake has helped open up Ether staking not just for liquid staking protocols, but also for individuals by lowering barriers to entry. Under Proof-of-Work, only entities with sufficient hash power or operating mining pools had the privilege of building new blocks and verifying transactions.

NOW READ: Speed-trading giant borrows Coinbase playbook in slamming Gary Gensler after SEC lawsuit

Now, he explained, anyone with ordinary hardware and 32 Ether can become a block producer.

“Ultimately, the switch has made Ethereum a more decentralised network,” he said.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.