- Congress is working on a range of bills that could have far-reaching impact on crypto.

- Industry advocates welcome clarity, but push back on some provisions that “make little sense.”

Crypto chieftains often clamour for regulatory clarity to reduce industry uncertainty.

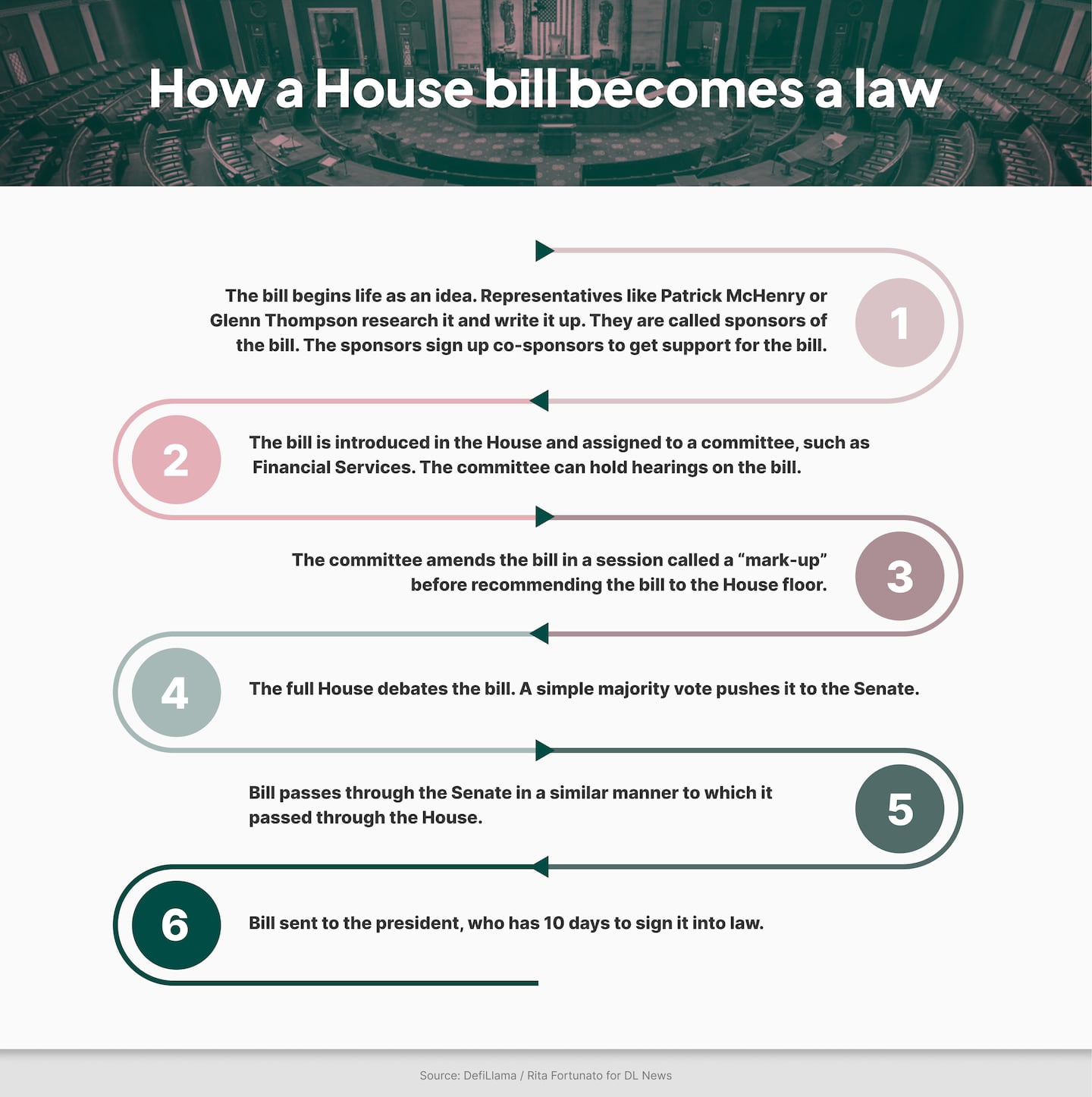

However, some crypto bills making it through the US legislative machinery (see graph below) may provide more than they bargained for by enforcing tougher rules that could shake decentralised finance to the core.

Some of these efforts reflect the desires of the crypto community for tailored regulation to allow them to operate with clarity.

Others reveal lawmakers’ concerns about money laundering, consumer protection, and decentralisation.

So let’s break down seven of the bills inching through Capitol Hill.

The Financial Innovation and Technology for the 21st Century Act

Concerns seemed far away in late July, when the industry celebrated two crypto bills passing through two Congressional committees, taking them one step closer to becoming law.

One of these was the Financial Innovation and Technology for the 21st Century Act, whose passing Coinbase CEO Brian Armstrong labelled as “a vote to protect your crypto, American innovation, and national security.”

The bill would provide trading new rules for crypto exchanges, and make the Commodity Futures Trading Commission the main crypto regulator in the US.

However, the bill has been criticised by Democrats and consumer rights groups, partly for giving the CFTC more responsibilities without ensuring it additional funding to live up to them.

NOW READ: Progressive watchdogs slam McHenry’s crypto bill as a cure worse than the ‘disease’

In a debate before the bill was passed out of the House Financial Services Committee, Stephen Lynch, the Democratic representative from Massachusetts, called it the “worst piece of legislation that has been presented for mark-up in that 20 years.”

The Clarity for Payment Stablecoins Act

The Clarity for Payment Stablecoins Act would put in place a legislative framework for the issuance of payment stablecoins.

Under this bill, stablecoin issuers must be regulated firms like banks and must maintain reserves of safe assets backing the stablecoin on a one-to-one basis.

The bill passed a House Financial Services vote to go to discussion by the broader House, but only after a very contentious discussion in late July.

NOW READ: Stablecoin laws could give US an edge — if they ever get off the ground

Republican House Financial Services Committee chair Patrick McHenry, and the committee’s top Democrat Maxine Waters have negotiated this bill for the better part of a year and a half. But Waters and other Democrats have major objections to the bill.

Waters said during the debate that the version voted on was rushed through by McHenry despite the fact that neither her team nor the administration approves of it in its current form.

NOW READ: Coinbase walks back Brian Armstrong’s assertion SEC asked exchange to delist every token but Bitcoin

Democrats object to the bill’s provision that stablecoin issuers can be licensed by state, as well as federal regulators.

States could attract issuers by lightening the reserve requirements, undermining the whole point of the bill, Waters said.

The Lummis-Gillibrand Responsible Financial Innovation Act

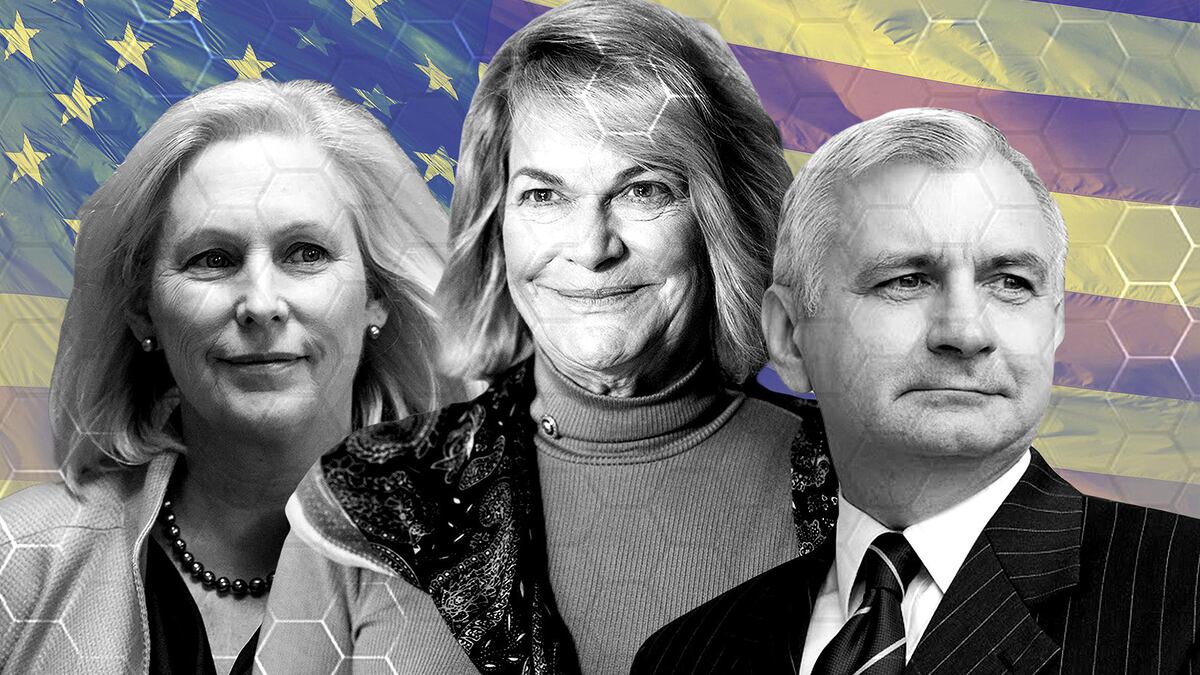

The Lummis-Gillibrand Responsible Financial Innovation Act is the result of collaboration not only across the aisle, but also across two committees in the Senate.

It’s the work of Republican Cynthia Lummis, a member of the Banking committee, and Democrat Kirsten Gillibrand, a member of the Agriculture committee.

The two Senators introduced this bill during last Congress, but went back to the drawing board after the collapse of the FTX exchange.

They presented a new version in mid-July of this year with bulked-up safeguards for crypto consumers.

The bill is almost 300 pages long and addresses a swathe of the crypto industry, from stablecoins to ATM operators, from exchanges to mixers. It provides legal definitions of crucial terms, including “crypto-asset” and “decentralised exchange.”

But the bill’s most important provisions would make it mandatory for crypto exchanges to register with a regulator, most likely the CFTC.

The Securities and Exchange Commission, however, is given more teeth to enforce consumer protection.

Miller Whitehouse-Levine, CEO of the DeFi Education Fund, told DL News that the Lummis-Gillibrand bill was generally encouraging, but contained some concerning elements.

Among those, he said, the bill shows some suspicion of self-hosted wallets.

Centralised crypto exchanges and wallet providers have to identify customers under anti-money laundering and know-your-customer rules.

But self-hosted wallets remain in the control of the user, providing pseudonymity.

NOW READ: Powerful central bank group says crypto ‘amplifies’ risks and contributes nothing to society

The Lummis-Gillibrand bill doesn’t ban these wallets outright, but it would require exchanges to follow new standards “relating to money laundering, customer identification and sanctions” when interacting with customers who hold these wallets.

For many DeFi users, this scrutiny obviates the entire point of self-hosting.

“In our view, self-custody is the fundamental innovation of digital assets — without it, there is no such thing as crypto or DeFi,” Whitehouse-Levine said.

“We want to make sure that the ability to self-custody assets is always protected and ideally welcomed in any legislation.”

The bill may have little chance of becoming law in its current form, given that 2024 is an election year and the Senate Banking committee boasts some redoubtable crypto opponents, including Elizabeth Warren.

NOW READ: Elizabeth Warren’s anti-crypto crusade may bolster Wall Street’s land grab in Bitcoin market

But that doesn’t necessarily mean the work is wasted — bills that don’t become law often influence discussion, and are chopped up and partly included in other legislative efforts.

“Because the bill is so comprehensive, it would be difficult to move altogether. But that doesn’t mean that individual portions couldn’t move on their own,” Whitehouse-Levine said.

The CANSEE Act

Another bipartisan bill from the Senate, the CANSEE (Crypto Asset National Security Enhancement and Enforcement) Act was introduced in mid-July.

Led by co-sponsor senator Jack Reed, the act targets DeFi and crypto ATMs. Its authors say these technologies enable illicit finance and money laundering by bad actors like the North Korean government.

The bill essentially requires DeFi services to meet the same AML and sanctions compliance obligations as banks and centralised exchanges.

NOW READ: Senate slips crypto provisions into must-pass defence bill

DeFi services would have to put in place AML programmes, identify their users and report suspicious transactions.

It grants the Treasury Department new powers to decide who is on the hook for violations, including developers and funders of projects.

Crypto advocates have slammed the bill, saying it would make DeFi development impossible.

Lars Seier Christensen, founder and CEO of blockchain company Concordium, told DL News it would create significant issues if passed.

“The way in which it has been proposed makes little sense to me,” he said.

The wide powers granted to the Treasury to determine control undermine the founding principle of DeFi technology — decentralisation, Christensen added.

“The bill passing could eventually lead to the Secretary of Treasury adopting stringent control over many projects, leading to the DeFi industry being controlled entirely by a governmental body, and becoming more centralised than traditional finance itself.”

Crypto ATMs and the defence budget

The US Senate recently passed a record-setting defence budget bill with strong bipartisan support.

Tucked into that bill was crypto-focused AML legislation.

The bill sets new rules that would require crypto ATMs to gather identifying information on their users.

The bill combines provisions from the Lummis-Gillibrand act with provisions from the Digital Asset Anti-Money Laundering Act by Democratic Senator Elizabeth Warren and Republican Senator Roger Marshall.

The defence bill is likely to encounter heavy resistance in the House.

The Blockchain Regulatory Certainty Act and the Keep Your Coins Act

Two short bills originating in the House of Representatives were bundled up with other bills and voted out of committee in late July, which means they now go to the full House to consider.

One is the Blockchain Regulatory Certainty Act, sponsored by House Majority Chief Whip Tom Emmer.

This bill affirms that blockchain developers that do not hold customer assets would not be classified as money transmitters under state-level law or financial institutions under federal law, and would therefore not have to register for a licence.

The other, The Keep Your Coins Act, is sponsored by Representative Warren Davidson.

Davidson said the bill is designed to preserve Americans’ privacy while transacting with crypto assets.

Specifically, it protects the right of crypto users to keep their digital assets in self-hosted wallets.

Do you have a tip on a crypto regulation story or something else? Reach out to me at joanna@dlnews.com.