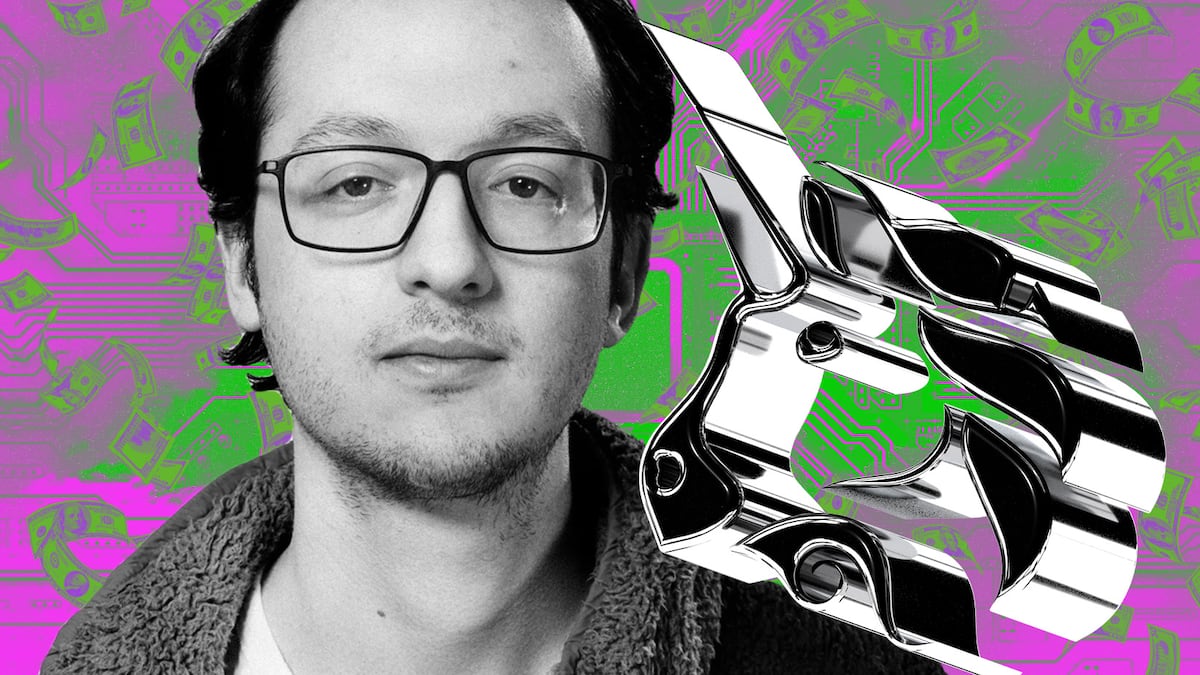

- New fee could raise millions for Uniswap creator company.

- Some criticised the move because it doesn't directly benefit UNI token holders.

- “The front-end fee introduces some interesting effects,” said Wintermute's Callen Van Den Elst.

Top decentralised exchange Uniswap introduced a 0.15% trading fee on its website and wallet that split the opinions of holders of the protocol’s governance token, UNI. The token has dropped about 6% since the announcement.

The new fee is controversial mostly because revenue from it will be directed to Uniswap Labs, the company that builds and maintains the Uniswap protocol. UNI holders, who govern the protocol, won’t benefit from it — at least not directly.

“It will allow us to continue to research, develop, build, ship, improve, and expand crypto and DeFi,” Uniswap creator Hayden Adams said in an X post announcing the new fee on October 16.

Based on Uniswap’s average daily trading volume of about $500 million, analysts estimate the fee may bring in as much as $12 million annually, provided the volume remains constant despite the higher costs of trading.

Building profitable protocols

Leighton Cusack, co-founder of DeFi savings protocol PoolTogether and a Uniswap delegate with 3.1 million UNI tokens, told DL News he favours the new fee policy for both Uniswap and token holders because it strengthens the ecosystem.

Delegates are members of a decentralised autonomous organisation — or DAO — who have been elected to represent other token holders and vote on their behalf.

“Building profitable businesses around protocols is important,” Cusack said.

Until now, Uniswap Labs had not made any money from its creation. It received all its funding through venture capital investment. The company’s latest funding round last October raised $165 million at a $1.7 billion valuation.

The new fee affects trades between Ether, wrapped Bitcoin, and several stablecoins pegged to the US dollar, Singapore dollar and Euro.

The choice of specific tokens may be related to regulatory considerations. A December post by the Uniswap Foundation said “stablecoins or Ether” are better candidates for levying fees because they “have not been the subject of public regulatory scrutiny” over the question of securities.

“The fee conceptually makes sense for Uniswap Labs, though timing does seem poor given retail flows are quite small right now,” Mika Honkasalo, founder of Access protocol and a Uniswap delegate with more than 5 million tokens, told DL News.

Only users making swaps through the official Uniswap website and wallet are subject to the fee. Those who use services that aggregate decentralised exchanges, such as 1inch or Matcha, or who interact with the protocol’s code directly do not incur the fee.

“The front-end fee introduces some interesting effects,” Callen Van Den Elst, DeFi envoy at trading firm Wintermute, told DL News. Wintermute is a Uniswap delegate with more than 600,000 tokens.

“We’ll likely get more decentralised front ends and elastic users will be pushed to aggregators, improving their trading experience,” he said.

The new fee comes in addition to a 0.3% fee the Uniswap protocol already charges on all swaps. This fee is then distributed to liquidity providers as a reward for supplying their tokens to the liquidity pool. The amount each liquidity provider receives is proportional to their share of the total liquidity in the pool.

Uniswap’s fee switch

While there is strong support among token holders for the new fee, there are some who oppose it.

“It’s pretty bad for UNI token holders,” a Uniswap delegate with more than one million tokens, who chose anonymity to speak candidly, told DL News.

They explained that one of the primary ways the UNI token derives value is the possibility that holders may one day activate Uniswap’s so-called fee switch — an option that would be hard-coded into the protocol to split a portion of liquidity provider fees with UNI token holders.

Many UNI token holders have long hoped that Uniswap would follow other DeFi protocols like Synthetix and GMX, which charge a fee and share a portion of it with their token holders.

The delegate said that the fee switch is “more difficult to implement now that the Uniswap Labs team already captures 0.15%.”

Others, including Wintermute’s Van Den Elst, said the opposite may be true.

“There is a good chance more pressure is put on the DAO to enable the fee switch, as they get a glimpse of what is achievable given the current numbers,” he said, adding that there is an important distinction in that the new front-end fee is directly borne by traders, while the hard-coded fee switch would take a portion of liquidity provider’s earnings.

“The potential effects are different from the DAO’s point of view,” he said.

Still, even if the DAO unified in favour of activating the fee switch, doing so could end up a regulatory nightmare.

“People underestimate the work that’s constantly going into activating the fee switch,” Honkasalo said.

For Uniswap Labs, a New York-based company that has already drawn attention from regulators, token holders activating the fee switch without proper legal consideration could present complexities. One major concern is that directing Uniswap fees to token holders might raise questions regarding securities law.

“I can understand frustration from UNI token holders that the fee switch hasn’t been turned on,” Cusack said.

“But I don’t see why that is Uniswap Labs’ fault or why the company charging a fee has any bearing on it.”

Tim Craig is DL News’ Edinburgh-based DeFi correspondent. Reach out to him with tips at tim@dlnews.com.