- Whales Market is a Solana based protocol that offers a decentralised solution for users to trade pre-market tokens and points over-the-counter.

- There are currently 6 markets live with 4 more to be integrated soon.

- Traders are paying as much as 2.5% per transaction, resulting in an over 39% annual percentage yield for WHALES stakers.

There’s been a surge in DeFi protocols announcing or at least hinting at airdrops in 2024, with a majority implementing some form of a point system.

Points are rewards given by protocols to users for participating in specific activities, which are often later rewarded with a protocol’s native token. Normally these points are meant for individual users and there’s no money in them — until an airdrop takes place.

But over the past few weeks, a Solana protocol called Whales Market has emerged, offering a secondary-market for airdrop hunters to trade points and pre-market tokens.

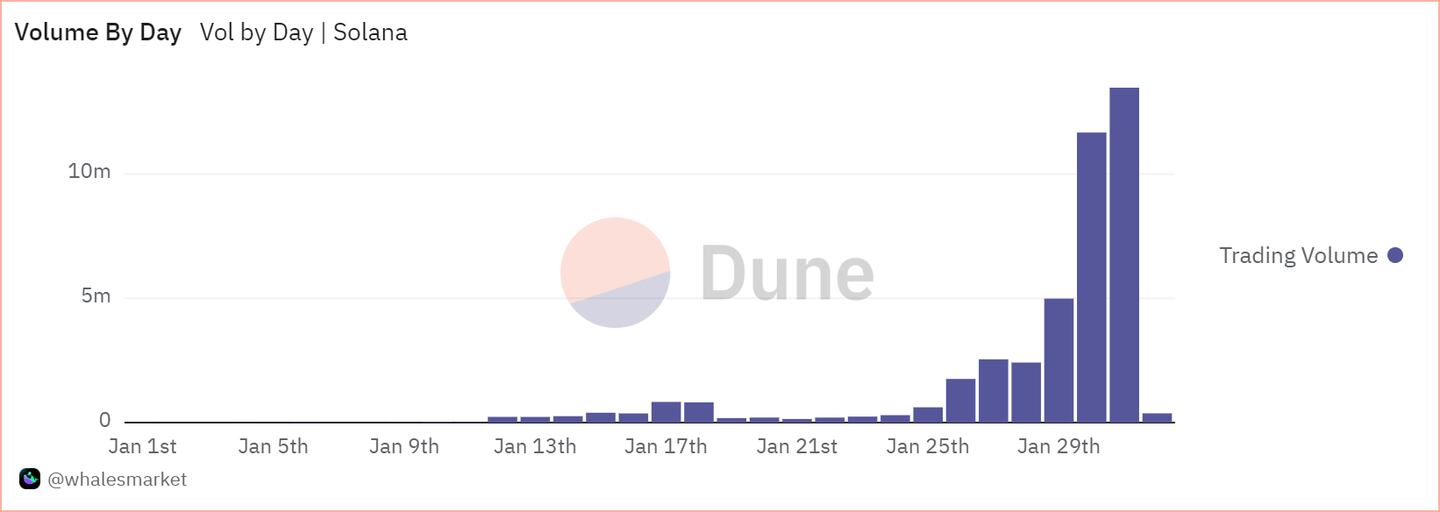

It had a head start trading Jupiter protocol’s airdropped token JUP, generating over $40 million in total volume before the token was officially live.

Over-the-counter trading is a way to buy and sell assets directly between two parties without using an official exchange. In the case of Whales Market, smart contracts facilitate these trades.

Traders are paying as much as 2.5% to buy these previously illiquid tokens, like DYM and AEVO, and points from EigenLayer, Hyperliquid, Friend.Tech and Magic Eden.

In just a few weeks these traders generated Whales Market over $860,000 in total fees from $44 million in total volume.

EigenLayer and Hyperliquid, have seen over $525,000 and $280,000 in total volume for their points markets respectively.

Other protocols like MarginFi, Drift, Kamino and Blast are also scheduled to be integrated soon.

The number of points in circulation is vast. EigenLayer has already distributed over 1 billion points to users, while other protocols like Kamino have over 43 billion points in circulation.

Many, if not all, of these airdrops do not have an official date announced for their token generation events. As such, Whales Market provides points owners an option to realise gains on their points today.

In addition to providing liquidity for otherwise illiquid assets, the markets on Whales also provide insight into the price discovery for new tokens.

The accuracy of these pre-token markets is underscored by the performance of previous markets like those for AltLayer’s ALT and Jupiter’s JUP. The ALT pre-token market on Whales Market showcased remarkable pricing accuracy, with an average selling price for ALT of $0.34 which is within 10% the trading price of $0.31 on decentralised exchanges.

Similarly, the JUP pre-token market had an average selling price for JUP at $0.69, closely mirroring its trading price of $0.54 on decentralised exchanges.

How Whales Markets works

For buyers, the platform presents two options, accepting an existing offer to sell or initiating a new buy offer.

Sellers mirror this flexibility, having the choice to either fill existing buy orders or create their own sell offers. Accepting an existing offer to sell is straightforward.

There is an existing offer to sell 10,690 EigenLayer points at a price per point of $0.22. If a user wants to purchase these points, they would pay $2,351, roughly the price of one Ether. This Ether would sit in a Whales Market smart contract — which comes with usual smart contract risks — until the EigenLayer token is officially live for trading.

Once the token is live, a 24-hour countdown commences, whereby sellers are obliged to fulfil their settlement obligations - in this case providing the tokens received from the 10,690 points.

The seller also makes a deposit upon creating an offer to sell.

Sellers who withdraw or fail to settle within the allotted time face penalties, with compensation deducted from their deposit to reimburse the buyer.

This compensation equates to the buyer’s deposit to provide some accountability. Moreover, buy orders remain binding unless the seller defaults by missing the deadline, protecting the interests of committed buyers.

Whales token up 2,400% in a month

The native token for Whales Market, WHALES, launched trading on January 8 at $0.08. The token is now $2.07, an over 2,400% gain in less than a month since its launch.

Over 10 million of the nearly 18 million total circulating supply is staked within the Whales Market dApp.

Revenue generated by the protocol is collected in various assets and converted into WHALES tokens and dispersed to stakers. 60% of the total revenue generated is distributed to stakers resulting in an over 39% annual percentage yield.

The token isn’t required to participate in points trading on the protocol.

Ryan Celaj is DL News’ New York-based Data Correspondent. Reach out with tips at ryan@dlnews.com.