OpenAI CEO Altman finds $100m for eyeball-scanning Worldcoin project

OpenAI CEO Sam Altman has made progress on a $100 million funding round for his iris-scanning Worldcoin cryptocurrency project, The Financial Times reported.

The report follows a piece from The Block in February. Worldcoin seeks to address the increased capabilities of artificial intelligence by distinguishing humans from bots and “establish an individual’s unique personhood” across various applications, according to the company.

Critics have raised eyebrows at the project, due to privacy risks associated with the collection of private biometric data.

🤔Sam Altman, the CEO of OpenAI is close to clinching $100 million in funding for cryptocurrency project Worldcoin pic.twitter.com/r98gvPbzxc

— Crypto Crib (@Crypto_Crib_) May 15, 2023

NOW READ: Aragon’s $200m activist battle ignites DAO debate: ‘Lining up soldiers doesn’t mean an attack’

Will Tornado Cash developer stay in the Netherlands for his trial?

Tornado Cash developer Alexey Pertsev’s residence status will be one of the topics on the docket at his next court appearance on May 24, DL News reported.

Russian-born Pertsev’s permit to remain in the Netherlands is due to expire in July. The Dutch Immigration and Naturalisation Service will need to provide clarity if his residence is not extended during the hearing.

Pertsev is currently under house arrest after spending eight months in Dutch jail, facing money laundering charges over his role at the crypto mixer.

The case is being watched closely by the crypto community and privacy advocates as it will determine if developers can be liable if they know that their code can be used for crime.

NOW READ: Tornado Cash dev Alexey Pertsev faces trial this month — here’s what to expect

Ethereum developers scramble to fix finality issue

Ethereum developers rushed to release software updates over the weekend, after finality issues threatened network stability.

The network’s beacon chain saw issues Thursday and Friday, wherein lagging clients appeared to fail to achieve consensus.

The wider network was able to compute the transactions with time, but the issues sent up red flags across the community nonetheless.

The Ethereum Foundation has not yet stated a clear cause for the issues, and issues have ceased since the updates were implemented.

Yesterday close to 8pm UTC the Ethereum network lost finality for 25 minutes. Around that time, several valid, but untimely attestations were broadcast in the network. This typically happens when a node that is struggling to be synced, attests with an old view of the chain. 1/8

— Potuz (@potuz_eth) May 12, 2023

Bitcoin’s correlation to ETH drops below 80% for first time in years

Bitcoin’s correlation to the Ethereum Ether token fell beneath 80% on the month, marking the largest decoupling between the assets since 2021.

Correlation measures how two assets move in relation to each other, with Bitcoin up 62% on the year and Ether up 50%.

Bitcoin’s strength comes as many other cryptocurrencies have come under fire in 2023, particularly by US regulatory agencies such as the US Securities and Exchange Commission.

NOW READ: Bitcoin fee surge spurs calls for changes to treat NFTs and meme coins as spam

Bankrupt Quadriga will pay creditors 13% of initial investment

Bankrupt Canadian exchange Quadriga CX will pay users 13% of their total invested funds lost, according to a notice from creditors published Friday.

Quadriga is estimated to owe CAD $303.1 million, and will pay out creditors according to 2019 market prices. Funds paid out are equivalent to 87% of what the firm’s Trustee currently holds.

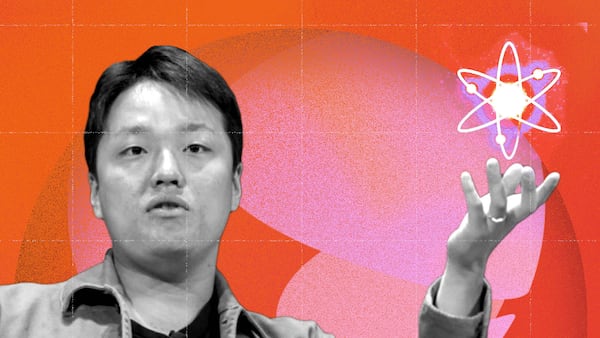

NOW READ: Do Kwon prosecutor warns of flight risk as crypto fugitive granted €400,000 bail and house arrest

Partisan gap widens on US stablecoin bill

US House Democrats are working on a stablecoin bill that differs widely from a Republican-drafted bill introduced in recent weeks.

The Democrat spin on the long-awaited stablecoin regulation places heavier emphasis on consumer protection, and aims to keep a proposed moratorium on algorithmic stablecoins such as the ill-fated TerraUSD.

Republicans scrapped such a rule in their new draft, and emphasised the right of states to regulate stablecoin issuers.

NOW READ: The rise and fall of Terra founder Do Kwon

More web3 news from across the web…

Binance to exit Canada after country imposes new crypto rules — Bloomberg

Microsoft, Goldman Sachs, and other big firms back launch of financial blockchain — Decrypt

Going full Bitcoiner: 1 million addresses now own 1 BTC or more — Blockworks