A version of this article appeared in our The Decentralised newsletter on September 03. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Polygon’s MATIC token is getting a new name.

- Cardano’s Chang hard fork goes live.

- MakerDAO’s Sky rebrand sparks controversy.

MATIC migrates

Polygon’s $3.7 billion token is getting a new name.

On Wednesday, MATIC, the native token on Polygon’s flagship blockchain of the same name, will transition to POL.

🧵 POL Upgrade | Everything to Know 🧵

— Polygon (※,※) (@0xPolygon) August 27, 2024

Users w/ MATIC on Ethereum can upgrade today via Polygon Portal Interface: https://t.co/Ibs1ONels1

There is no deadline for users to upgrade. All MATIC on Polygon PoS & staked MATIC on Ethereum will upgrade automatically on Sept 4. pic.twitter.com/qKnyYFrlqH

Polygon launched MATIC in 2019 when the Polygon ecosystem consisted of just the Matic blockchain.

Polygon has since launched another blockchain called Polygon zkEVM, and is also building what it calls the AggLayer — a new approach to scaling blockchains.

The new POL token represents the entire Polygon ecosystem, and will “provide valuable services” to the network, Polygon said in a blog post explaining the transition.

However, Polygon has not revealed what those services are yet.

Polygon recently shifted its marketing strategy away from big brand partnerships to appeal more to crypto-native users.

The MATIC rename — and its emphasis on Polygon’s broader DeFi ecosystem — appears to play into this shift.

Cardano’s new governance

Cardano just became the first major blockchain to let its token holders weigh in on governance.

At 10:44 pm London time on Sunday, the blockchain completed its long-awaited Chang hard fork, introducing the new governance system.

Now ADA holders can delegate their tokens to so-called DReps, who will participate in Cardano governance on their behalf.

Cardano’s development was previously managed by Charles Hoskinson’s blockchain engineering firm, Input Output Global, the Cardano Foundation and Emurgo, Cardano’s official commercial arm.

Proponents say the move makes Cardano more decentralised, and could also make it more attractive for institutions looking to dip their toes into DeFi.

But token-based governance can be difficult to get right.

A similar form of governance called decentralised autonomous organisations — or DAOs — have received criticism.

Detractors say many DAOs have excessive budgets, suffer from inadequate checks and balances, and end up controlled by a few powerful stakeholders.

MakerDAO becomes Sky

DeFi lender MakerDAO has transitioned to Sky, the latest step in co-founder Rune Christensen’s so-called Endgame plan.

But the reception has been mixed.

The most controversial change is that USDS, the new version of the DAI stablecoin, contains a freeze function in its code, giving Sky discretion to halt USDS transfers from holders’ wallets.

Christensen has since addressed the issue, assuring users that an unfreezable version of DAI will live on even after the USDS transition.

Others have criticised Sky’s lack of innovation in recent years.

“This announcement must be some kind of a joke,” Nour Haridy, founder of DeFi protocol Inverse Finance said on X.

“The literal single new feature brought by this ‘upgrade’ is their ability to freeze your tokens.”

Phoenix Labs CEO Sam MacPherson hit back, arguing that thanks to the protocol’s decisions, Sky’s revenues are at all-time highs.

Phoenix Labs is a research and development firm spun out of Sky.

Data of the week

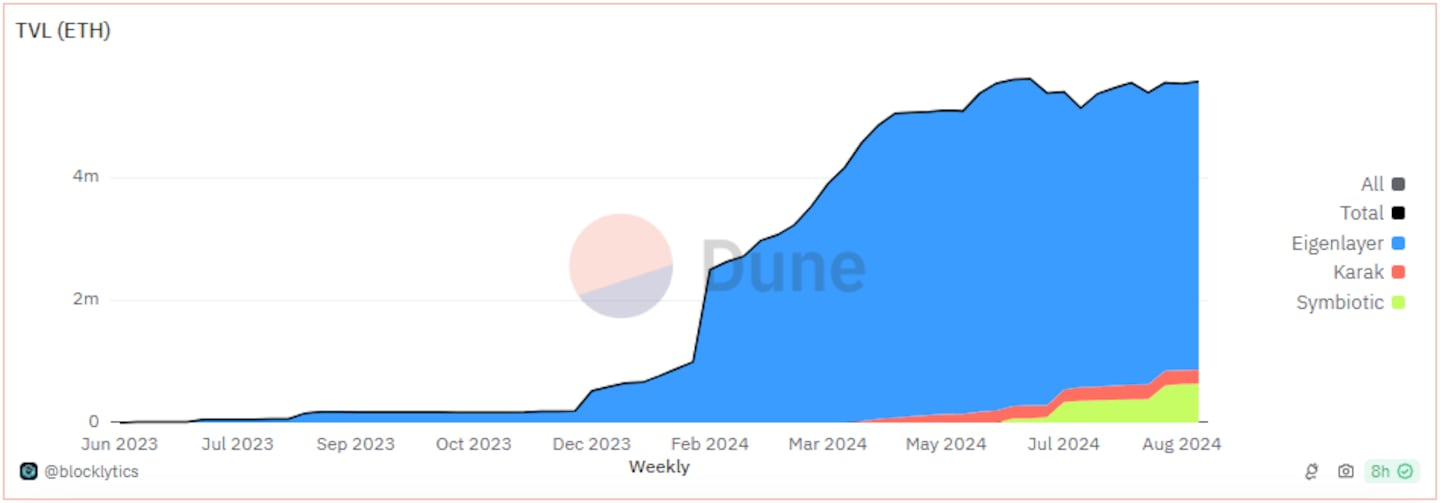

Symbiotic is carving out a chunk of the Ethereum restaking market.

Deposits are up 41% over the past month while its competitors saw major outflows. Since the protocol’s June launch, it has attracted $1.6 billion.

Symbiotic has performed much better than Karak, another restaking protocol hopeful looking to break into the market.

But Symbiotic still pales in comparison to $11 billion restaking behemoth EigenLayer.

This week in DeFi governance

VOTE: Aave to onboard USDS, the rebranded DAI token

PROPOSAL: Threshold proposes $36 million WBTC buyout from BitGo

VOTE: Lido DAO set to approve ‘BORG’ wrapper for its Alliance Programme

Post of the week

Pseudonymous security researcher Czar102 announces Blueprints, a new concept designed to make DeFi more interconnected.

🎉 I am pleased to announce Blueprints, the concept I have been thinking about and working on for a long time.

— Czar102 (@_Czar102) September 2, 2024

It's a piece of free infrastructure for anyone to build on. No ownership, no governance, no token.

See my post "Blueprints – DeFi Composability Endgame":…

What we’re watching

The Ethereum Foundation releases an update on its 2024 allocation of grant funds.

Grants that secured funding last quarter are in the spotlight 🎯 Check out our Allocation Update: Q2 2024 blog post for the full rundown! https://t.co/ipKbstK4mE

— EF Ecosystem Support Program (@EF_ESP) August 30, 2024

Got a tip about DeFi? Reach out at tim@dlnews.com.