A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- PayPal’s PYUSD integrates with DeFi stalwart

- Harmony devs fling threats after bug mints $2.2 million in extra tokens

- Is DeFi interoperability about to go mainstream?

PayPal’s push for liquidity

PayPal recently enlisted the help of crypto solutions provider Trident Digital to increase liquidity and use of its PYUSD stablecoin across DeFi.

Trident’s first move was to set up a liquidity pool on Curve Finance, one of the most popular places to trade stablecoins in DeFi. It also provided over $132,000 worth of bribes: incentives paid out to those who provide liquidity for PYUSD on Curve.

PayPool. Probably nothing https://t.co/omiM2PThDa pic.twitter.com/oJlzrzkQVg

— Curve Finance (@CurveFinance) January 10, 2024

Additionally, Trident proposed that lending protocol Aave let its users lend and borrow against PYUSD. A preliminary vote that ended last week showed Aave token holders overwhelming support the idea.

Trident’s push to boost PYUSD liquidity appears to be working. Over the past month, PYUSD has increased its circulating supply by over 33% to over 294 million

Trading volumes are increasing too. PYUSD looks set to experience its highest volume week of trading since it launched last August.

Still, PYUSD has a long way to go if it wants to challenge top stablecoins like those from Circle and Tether, which have a combined circulating supply of over 120 billion.

The recent efforts to increase liquidity signal that PayPal is no crypto tourist — it’s here for the long run.

If PYUSD’s success continues, other traditional payment providers will likely take note.

More ‘dis-Harmony’ on the blockchain

DL News’ DeFi Correspondent Aleks Gilbert investigated an ongoing spat between part time Harmony contractor Aaron Li and Harmony software engineer Casey Gardiner.

The pair give conflicting accounts about a bug that mistakenly created $2.2 million worth of ONE — Harmony’s native token.

Gardiner accused Li of withholding information about the severity of the bug and delaying its fix, while receiving and selling some of the erroneously minted tokens.

Li, in turn, defended the sale, and accused Gardiner of slow-walking the fix and compounding the problem.

The recent drama adds to previous controversies at Harmony, which include accusations of mismanagement and a $100 million theft by North Korean crime syndicate the Lazarus Group.

Despite a wave of new hires and a push to reposition itself after its meteoric boom and bust in 2022, Harmony deposits failed to recover with the broader crypto market last year.

DeFi interoperability is heating up

Proposals and upgrades to link together previously unconnected blockchains are becoming more prevalent.

Oasis Network, a privacy-focused layer 1 blockchain, just announced a cross-chain expansion of its wROSE token to Pancakeswap on BNB Chain, using Celer Network’s cBridge.

Restaking protocol EigenLayer also hinted at connecting the Ethereum and Cosmos ecosystems in a recent blog post.

Cosmos. Ethereum. EigenLayer. pic.twitter.com/OJ1fgKtbAm

— EigenLayer (@eigenlayer) January 9, 2024

Not to be left out, Maestro, a dApp developer platform for Cardano, is proposing cross-chain native swaps Between the Bitcoin, Ethereum, and Cardano blockchains.

The ability to send crypto assets between blockchains is a top priority for builders.

It reduces the friction involved in moving capital, and in some cases can even allow developers to build multi-chain DeFi protocols that users can interact with from numerous different blockchains.

With many new cross-chain protocols coming to market, and an existing one confirming a highly-anticipated token, 2024 is shaping up to be a big year for interoperability.

Data of the week

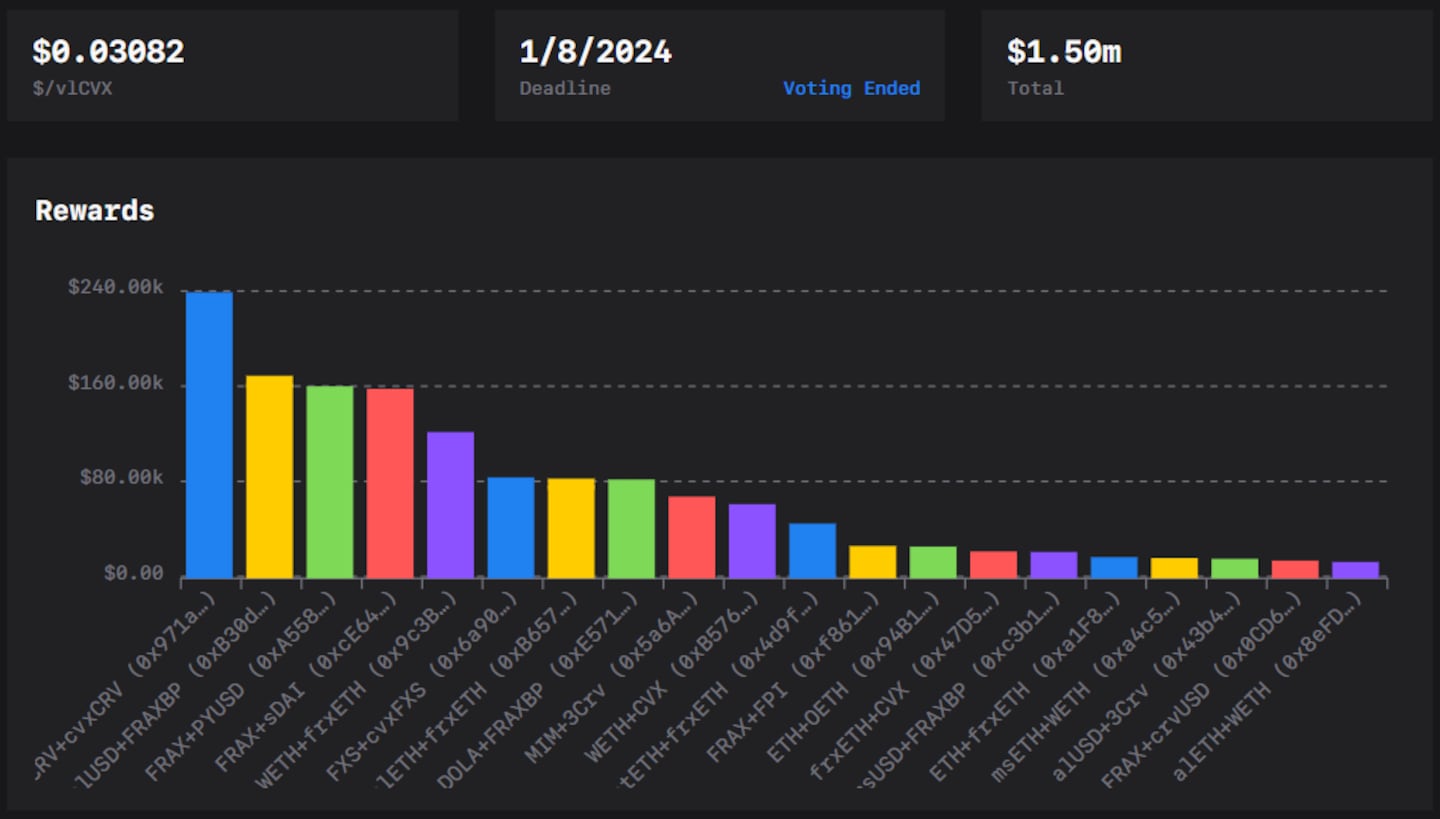

Launched on December 27, the FRAX+PYUSD pool on Curve Finance has quickly become the third-biggest pool on the protocol with over $135 million of deposits.

Helping the pool attract deposits are its lucrative bribes: incentives given out to those who provide liquidity. Last week, Frax supplied over $150,000 worth of its FXS token as bribes for liquidity providers.

This week in DeFi governance

VOTE: CoW Swap to embark on a 6-month period to test promising fee models

PROPOSAL: Aave mulls Solana deployment through Neon EVM

VOTE: Uniswap chooses members for its Deployments Accountability Committee

Post of the week

Celestia co-founder Mustafa Al-Bassam reminisces about his past exploits as a member of hacker group LulzSec.

In traditional finance, such antics might make investors think twice. But in crypto, they seem to add to a project’s appeal, or at least don’t seem to spook investors — Celestia’s TIA token just hit an all-time high of over $20.

my favourite hack was not CIA (which wasn't even a hack but a ddos), but the Westboro Baptist Church, which was a 0day in a shitty PHP CMS, which we hacked on a live radio show https://t.co/HFEihIVbVX

— Mustafa Al-Bassam (@musalbas) January 15, 2024

What we’re watching

Last week was the largest staked ETH redemption (Excl. Rewards) since the Shanghai Upgrade with 656.2k ETH (~$1.6B) being fully withdrawn

— Tom Wan (@tomwanhh) January 15, 2024

85% of the withdrawal is contributed by Figment + Celsius https://t.co/Xr8RWPWBPH pic.twitter.com/8yY4BE3RB3

Ethereum’s validator exit queue is back to normal after defunct crypto lender Celsius requested to withdraw over $1.6 billion worth of Ether on January 5.

Disclaimer: The two co-founders of DL News were previously core contributors to the Curve protocol.

Got a tip about DeFi? Reach out at tim@dlnews.com.