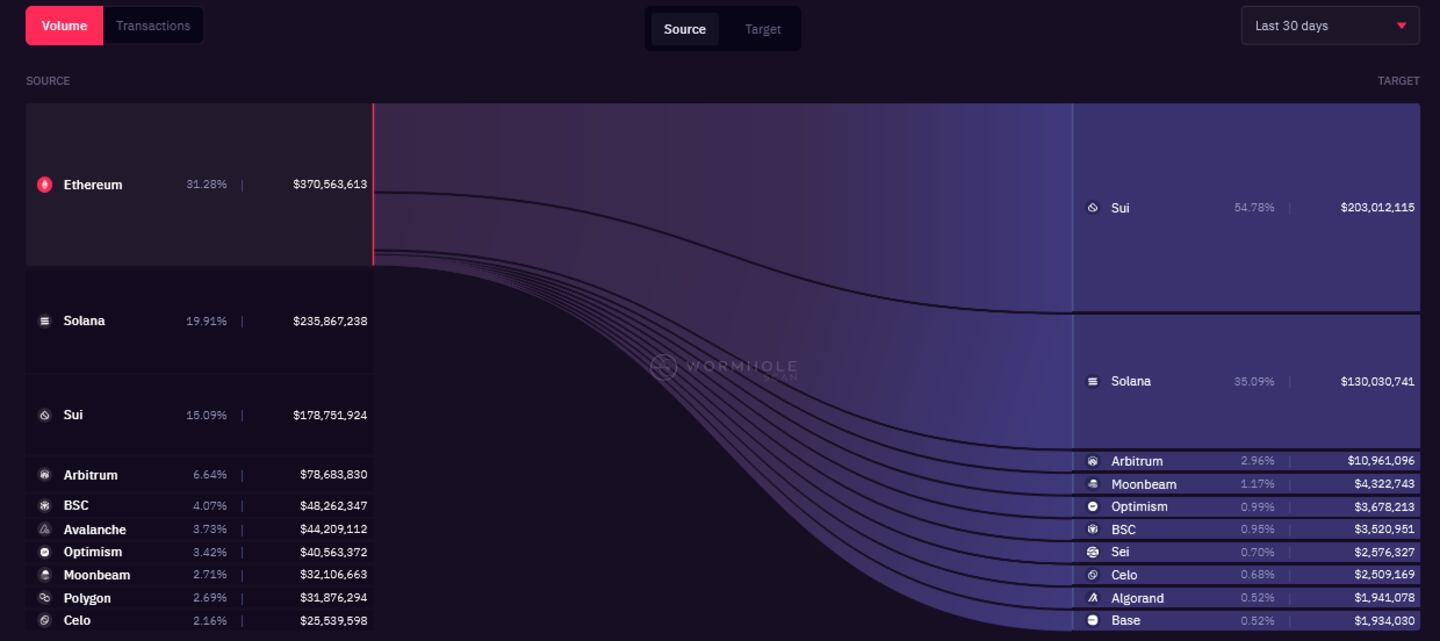

- Most of the $370 million liquidity outflow from Ethereum via Wormhole in the last month has gone to Sui and Solana.

- Outflows are possibly driven by memecoin and airdrop speculation.

- Sui’s TVL has spiked 10-fold since October.

Sui and Solana have sucked a lot of liquidity from Ethereum over the past month.

That’s according to data from crypto bridge protocol Wormhole that shows $370 million in liquidity has moved from Ethereum to other blockchains, with almost 90% going to Sui and Solana.

Wormhole’s operations head Dan Reecer told DL News that part of the appeal can be explained by Sui’s incentive programme within its ecosystem that is “driving a lot of DeFi activity.”

As for Solana’s popularity, he said it may be “related to people looking to earn points on different apps after seeing the recent community rewards from apps like Jito.”

Liquidity rotation

Crypto liquidity rotators are known for keeping in touch with the latest “meta,” or trend, to position themselves for possible rewards. They do so by quickly shifting liquidity to avenues likely to offer rewards for user deposits.

One of the recent metas is “points” — a system for acknowledging user participation in DeFi protocols that may qualify them for future airdrops.

NFT marketplace giant Blur popularised the points airdrop system and used it to great effect in capturing significant market share from OpenSea, the previous dominant player.

Now, the trend has spread across platforms, protocols, and blockchains, becoming even more commonplace on Solana.

Several Solana DeFi protocols including Kamino, MarginFi, Parcl, and Solend, have announced points systems of their own.

Sui announced a $50 million incentive programme in October. Such programmes are used to attract interest from developers and investors by funding grants for the former and user rewards for the latter.

Since the programme’s announcement, Sui’s total value locked, a measure of investor deposits, has risen 10-fold to $320 million, DefiLlama data shows.

Solend, Solana’s biggest DeFi lending app with $160 million in deposits, may further boost Sui’s total value following its expansion to Sui.

Despite the significant transfer of liquidity from Ethereum to both Solana and Sui, their combined TVL of $1.65 billion still falls far short of Ethereum’s $32.6 billion.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.