A version of this story appeared in our The Decentralised newsletter on March 19. Sign up here.

GM, Tim here.

Here’s what caught my DeFi eye recently:

- Dencun lowers layer 2 fees by as much as 98%.

- A Kanye West-themed memecoin burns investors.

- Arbitrum just unlocked 1.1 billion tokens.

Ethereum layer 2 fees undercut Solana — but activity still lags

Ethereum’s Dencun upgrade has cut fees on layer 2 networks by up to 98% after it went live last Wednesday.

ZkSync, Starknet, Optimism, Arbitrum, and Base are among the networks that have already started offering lower fees.

Layer 2s built using Optimism’s OP Stack — namely Optimism and Base — have, at points, undercut fees on rival blockchain Solana.

And the low fees seem to already be having an effect. Base registered an all-time high of 855,000 active users in a single day on March 16.

Despite Base’s growth, it’s still behind Solana, which generated a whopping $6.3 billion in total trading volume over the weekend. Base handled only around $340 million of trades during the same period.

With Solana solidifying its position as the premier place to trade onchain, other blockchains with similarly low fees may find it hard to lure users.

The layer 2 transaction savings are all thanks to “blobs” — a novel transaction format for Ethereum that distinguishes between everyday user transactions and those initiated by layer 2 networks.

The concept can be likened to a highway system, where layer 2 networks enjoy the advantage of a dedicated lane, while other users navigate a shared main highway.

However, as more layer 2s start using blobs, fees on Optimism and Base will likely rise.

Many layer 2s have yet to launch their own upgrades that will allow them to make use of blobs. Linea, a layer 2 network built by MetaMask owner Consensys, is set to start offering cheaper transactions after its March 26 upgrade.

Not everyone is making money on memecoins

Solana’s memecoin mania has minted many new millionaires who placed early bets on tokens like BONK and WIF.

But for every winner, there are dozens or more traders who lose money.

Not everyone can make money by trading #memecoins on #Solana!

— Lookonchain (@lookonchain) March 17, 2024

This guy traded 11 #memecoins in 3 days, losing money on each one, for a total loss of 754 $SOL($147K).

He seems to be very #FOMO, always buying high and selling low.https://t.co/lxijIqGLZC pic.twitter.com/f7KfOf5i17

One recent case involves a memecoin themed around Kanye West. It soared and plummeted in a matter of hours late Friday after an Instagram account belonging to the rapper followed an account connected to the coin.

Hours after the coin’s launch, West’s Instagram account unfollowed the memecoin, and it plunged 95%, taking many traders’ profits with it.

West hasn’t commented publicly on the incident.

As long as there’s money to be made in celebrity-themed memecoins, expect more of the same.

Arbitrum unlocks 1.1 billion tokens with more on the way

Layer 2 network Arbitrum has just unlocked 1.1 billion ARB tokens in one of the biggest such events of the year.

The tokens, worth around $2.1 billion at the time of the unlock, were distributed to team members and advisors of Offchain Labs — the company behind Arbitrum — as well as to early investors in the company.

The tokens were given out when Arbitrum launched its ARB governance token in February last year. But the tokens were vested, meaning that they were locked in a smart contract for a predetermined period of time. Now that the tokens have unlocked, their owners are free to sell them on the market, if they wish to do so.

Most crypto traders view unlocks as bearish. That is because those who receive them — prominently early investors — often choose to sell their tokens to lock in profits.

And data backs that view. According to an October analysis by blockchain data platform The Tie, prices of tokens that experienced significant unlocks fell below their initial prices at the time of the unlock within two weeks.

In the case of ARB, it’s already fallen over 14% since the unlock. To what extent the drop was caused by the unlocks or broader crypto market weakness isn’t clear, though.

Another 92 million ARB tokens will unlock on April 15.

Data of the week

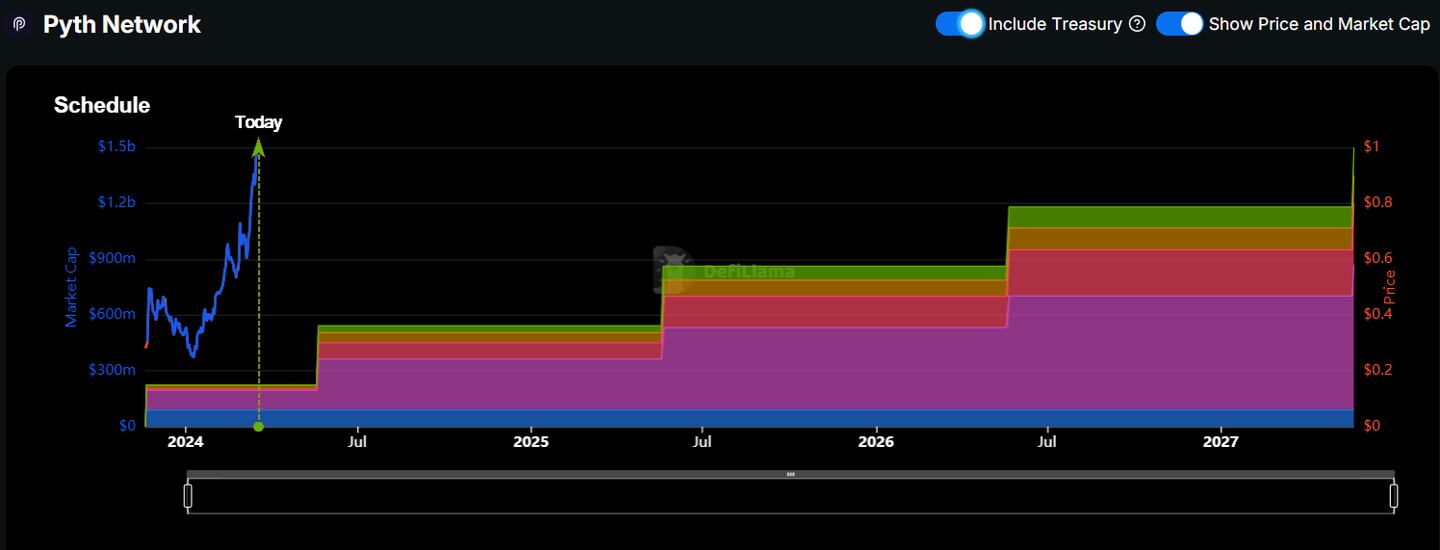

Big token unlocks don’t happen all the time, but when they do, they’re worth paying attention to.

Pyth Network’s 2.19 billion PYTH token unlock on May 20 is the next big unlock.

As always, DefiLlama’s token unlocks dashboard has up-to-date information on all upcoming unlocks, including PYTH.

This week in DeFi governance

VOTE: Gitcoin to use UMA’s oSnap for automatic grant distribution

VOTE: Arbitrum DAO supports 200 million ARB allocation for a Gaming Catalyst Program

VOTE: Lido DAO to add ‘simple onchain delegation’ for voting

Post of the week

X user Coingurruu puts the cost of using the Ethereum mainnet into perspective.

Token swaps now regularly cost users over $150 when the network is busy. With this being the case, it’s no wonder blockchains like Solana and Base are seeing increased use.

That'll be a porterhouse, side of creamed spinach and a high end glass of napa cabernet to sell that microcap shitcoin of yours pic.twitter.com/CzaQ4YwFW3

— 💐Guru 💐 (@CoinGurruu) March 12, 2024

What we’re watching

The UF just posted an update to our recent governance proposal.

— Uniswap Foundation (@UniswapFND) March 15, 2024

TL;DR: we are running additional audits on the protocol upgrade, and plan to post the final on-chain vote after those audits have been completed. This will likely be in mid-April. https://t.co/ZOtEXfxN5W https://t.co/92G1CqjjpO

Uniswap is inching closer to an onchain vote that will decide if the decentralised exchange turns on its fee switch, distributing protocol revenue to UNI token holders.

According to Uniswap Foundation executive director Devin Walsh, the vote is scheduled for mid-April.

Got a tip about DeFi? Reach out at tim@dlnews.com.