A version of this article appeared in our The Decentralised newsletter on June 4. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Layer 2 Linea pauses after $7 million Velocore exploit.

- Vitalik Buterin reflects on Ethereum’s early days.

- Uniswap gets called out after delaying fee-switch vote.

Linea pauses blockchain

Layer 2 network Linea paused transactions for an hour on Sunday after a protocol on the chain — Velocore — suffered a $7 million exploit.

In an X thread, Linea said it halted the blockchain to protect users.

Linea's team made a decision to halt block production by pausing the sequencer and censor attacker addresses to protect the users and builders in our ecosystem. Like other L2s, we are still in the "training wheels" phase of existence, giving us safeguards to use.

— Linea.eth (@LineaBuild) June 2, 2024

Linea’s actions likely prevented further losses from the exploit.

But the decision throws into question the industry’s founding principles: Immutability and user control.

Linea users, who have bridged almost $1.2 billion to the chain, couldn’t do anything with their assets while the blockchain was paused.

The network paused and censored the attacker’s wallet because it’s still centrally controlled by its creator, Consensys.

Bitcoin and Ethereum, are decentralised, and need a consensus of over 50% of their respective networks to do what Linea did.

The incident comes amid Linea’s Surge campaign, which rewards users with points for bridging assets to the layer 2.

Vitalik reflects on Ethereum

Ethereum co-founder Vitalik Buterin shared a list of things he would have done differently if he could go back to the blockchain’s 2014 inception.

Many things on Buterin’s list were technical changes to make developers’ lives easier.

But one had a much broader impact: Speeding up Ethereum’s switch away from the energy-intensive Proof of Work validation mechanism.

“We could have saved a huge amount of trees if we had a much simpler Proof of Stake in 2018,” Buterin said.

Buterin lamented that it took until 2022 to move to Proof of Stake, suggesting a “crappier” switch earlier in the blockchain’s life would’ve been better.

The Cambridge Centre for Alternative Finance estimates that Ethereum’s switch from Proof of Work to Proof of Stake reduced the network’s energy consumption by 99.9%.

If the change had come in 2018 as Buterin suggested, it could’ve saved over 80 terawatt-hours of electricity — about the yearly energy usage of Croatia.

Uniswap called out

A last-minute decision to delay Uniswap’s fee-switch vote ruffled feathers in the DeFi community.

“Over the last week, a stakeholder raised a new issue relating to this work that requires additional diligence on our end to fully vet,” Erin Koen, the Uniswap Foundation’s governance lead, wrote Friday in the Uniswap DAO governance forum.

Koen didn’t elaborate on the issue or the required diligence.

That didn’t stop Dan Robinson, a general partner at crypto venture firm Paradigm, accusing the Uniswap Foundation of caving to pressure from another, unnamed VC.

“It’s disappointing to see a large VC try to bully the token governance process and delay community proposals at the last minute in order to advance their own pet projects,” he wrote on X.

Robinson didn’t elaborate in his post and didn’t immediately return DL News’ request for comment.

Uniswap’s fee-switch vote is a long time coming.

The vote, which if successful would allow for a portion of the Uniswap protocol’s revenue to be awarded to UNI token holders, passed a non-binding “temperature check” vote earlier this year.

A binding, blockchain-based vote was set to begin Friday before it was postponed.

Uniswap Foundation CEO Devin Walsh declined to comment when contacted by DL News.

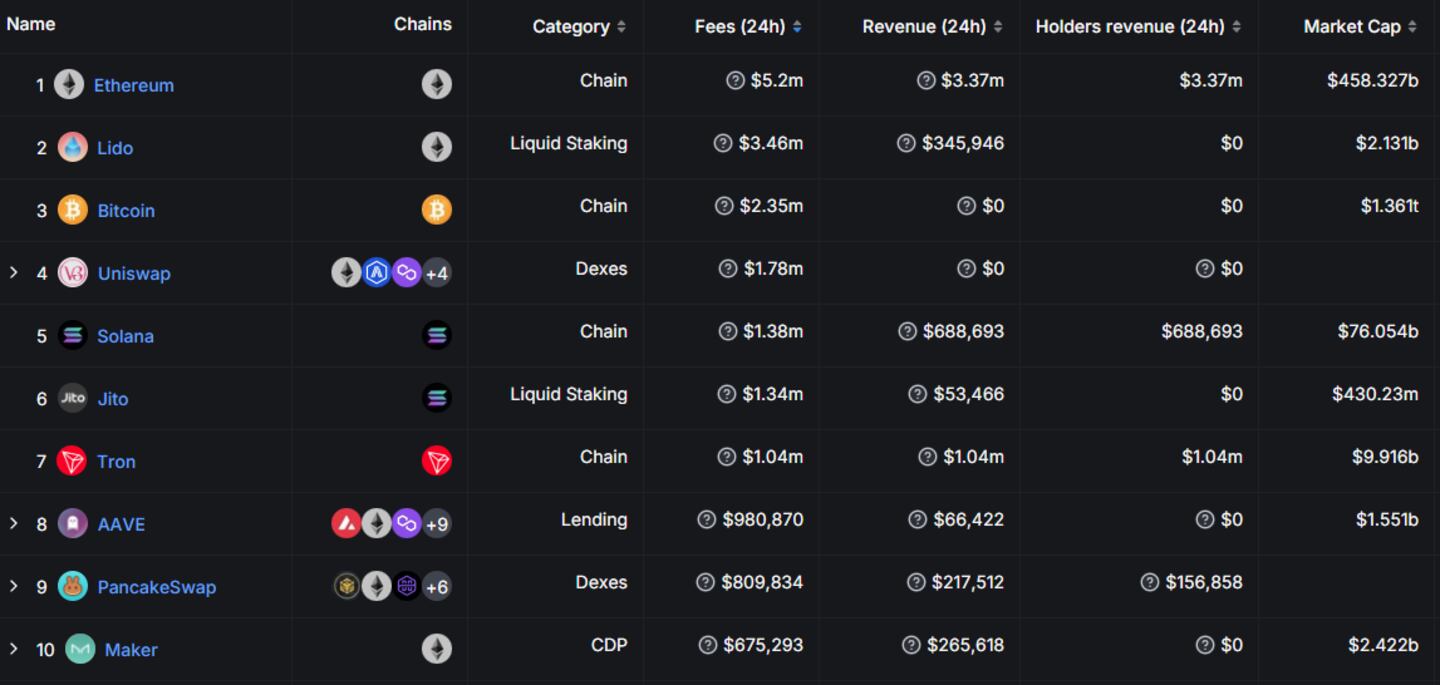

Data of the week

Uniswap’s fee-switch vote could provide a steady stream of income for UNI token holders, if it passes.

DefiLlama data shows the top decentralised exchange took in almost $1.8 million in fees in 24 hours. That’s some $649.7 million annually.

This week in DeFi governance

VOTE: Arbitrum DAO supports improvement proposal for Account Abstraction wallets

PROPOSAL: Stargate Foundation amends LayerZero token allocation process

VOTE: Aave to adjust interest rate curve for weETH on Arbitrum and Base

Post of the week

Pseudonymous crypto game studio founder Loopify sums up the current state of blockchain gaming with the timeless gold rush and shovels analogy.

blockchain gaming chains and games pic.twitter.com/N5PruOKLFO

— Loopify 🧙♂️ (@Loopifyyy) June 2, 2024

What we’re watching

Thank you to everyone who reached out following our post, offering ideas, support, and feedback.

— Matter Labs (∎, ∆) (@the_matter_labs) June 2, 2024

As a result of these conversations, we decided to drop all trademark applications for the term “ZK”.

These discussions came down to one important fact: it would be impossible to…

Matter Labs, the company behind Ethereum layer 2 zkSync, dropped its trademark applications for the term “ZK” after backlash from the crypto community.

Got a tip about DeFi? Reach out at tim@dlnews.com.