GM, Tim here.

Here’s what caught my DeFi-eye recently:

- The restaking rush continues with EigenLayer and Karak launches.

- Upgradable code costs Blast DeFi users $26 million.

- “Privacy is normal,” says Vitalik Buterin after using Tornado Cash alternative Railgun.

Karak challenges EigenLayer in restaking race

EigenLayer just hit a new milestone on its restaking road map, letting those who have deposited tokens to the protocol delegate them to node operators.

Node operators are individuals or organizations that let users delegate their restaked Ether to them. They then opt in to provide actively validated services, which earn delegates a boosted yield on their restaked Ether.

Delegated tokens will secure EigenDA, the first of many protocols expected to benefit from restaking on Ethereum. However, restakers will have to wait a few more weeks to start earning boosted yields.

And EigenLayer isn’t the only one. Karak, EigenLayer’s main competitor, has launched private access, letting those with an invite start to restake on the protocol.

So far, Karak has drawn in $195 million in deposits — still far below EigenLayer’s $12.6 billion.

Like EigenLayer, Karak has launched its own points system, called Karak XP.

Points systems usually indicate a DeFi protocol is planning to launch and airdrop a token.

With two restaking protocols offering potential airdrops, whichever one announces a token first should receive a big boost from the attention.

Pac Finance users lose $26 million in seconds

A sudden, unexpected code change at Blast lending protocol Pac Finance cost users $26 million, highlighting the risks of upgradable smart contract code.

“This was a result of the liquidation threshold being altered unexpectedly without prior notification to our team,” Pac Finance said on X.

Pac Finance is a fork of Aave, the biggest lending protocol in DeFi.

A fork is where a developer team uses the open-source code from an existing DeFi protocol to launch a similar protocol — often on a different blockchain or with minor changes.

“Fundamental problem with forking code is the lack of in-depth knowledge of the software and the parameters,” Stani Kulechov, founder and CEO of Avara, the company behind the Aave protocol, said in an X post.

The incident highlights the risk of upgradable code in DeFi protocols. If a protocol chooses to keep its code upgradable, those with permission can change the rules that govern the protocol at any time — often without warning.

Not all DeFi protocols allow for code upgrades. Uniswap, Curve Finance, and many other protocols make their code immutable, meaning once it’s deployed on a blockchain, it cannot be retroactively changed.

Vitalik on privacy protocol Railgun

“Privacy is normal,” Ethereum co-founder Vitalik Buterin said in an X post on Monday, responding to the fact that he had just transferred 100 ETH — worth about $310,000 — through privacy protocol Railgun.

Privacy is normal.

— vitalik.eth (@VitalikButerin) April 15, 2024

Railgun uses the privacy pools protocol ( https://t.co/DekkatsMR5 ) which makes it much harder for bad actors to join the pool without compromising users' privacy.https://t.co/MG0huDzpAu

Railgun is similar to sanctioned protocol Tornado Cash in that both allow users to break the chain of traceability between blockchain transactions.

However, Railgun uses the Privacy Pool protocol, an idea put forward in an academic paper co-authored by Buterin in September.

Privacy Pools tries to solve the issues with Tornado Cash — namely that it has facilitated an estimated $1.2 billion worth of illicit transactions for criminal organisations such as North Korea’s Lazarus Group.

It lets honest users create a cryptographic proof that shows the money they put into the protocol didn’t come from wallets associated with stolen funds or illicit activity, while at the same time keeping the origin of the money secret.

The hope is that if all honest users generate these proofs, bad actors attempting to launder money through the protocol will be the only ones left without them, letting crypto exchanges and law enforcement identify and exclude these users.

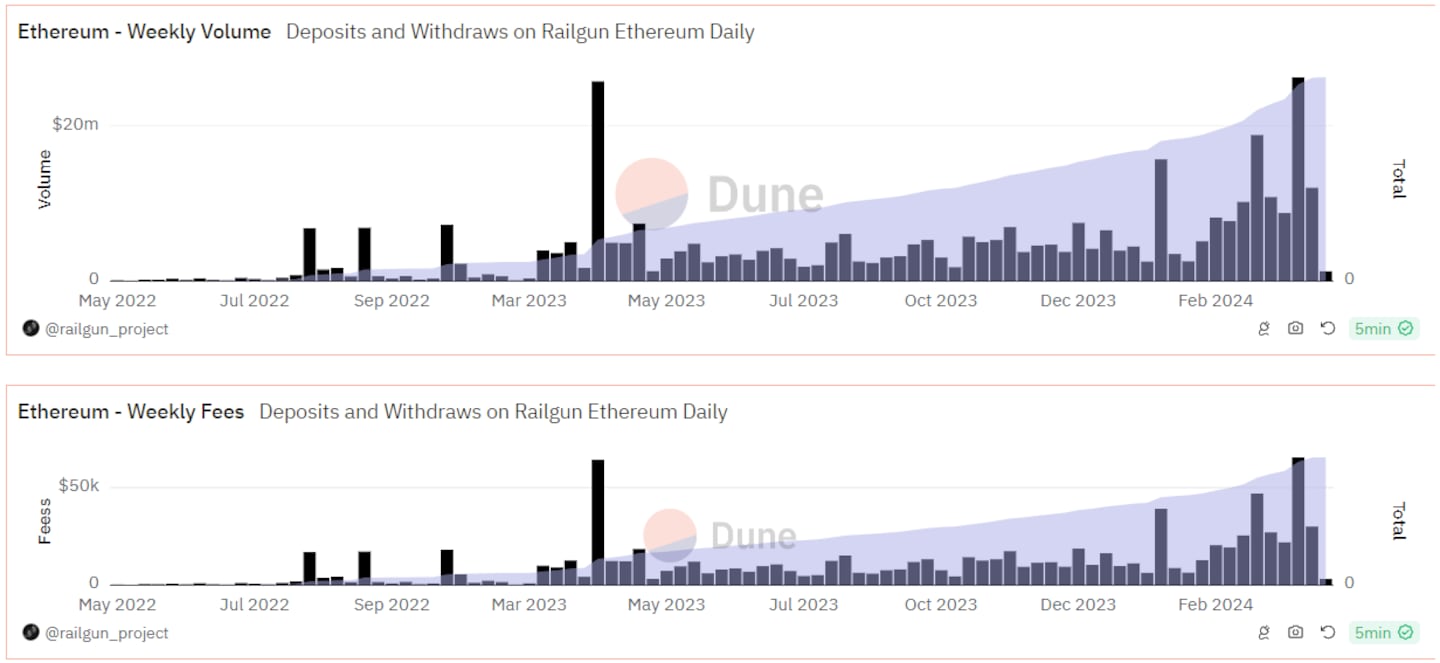

Data of the week — Railgun overview

Privacy protocol Railgun’s popularity has grown, even before Buterin mentioned it in his X post.

Railgun has facilitated almost $1 billion in transaction volume since its launch in May 2022.

This week in DeFi governance

VOTE: Uniswap DAO votes for Manta Pacific onboarding package

PROPOSAL: Arbitrum DAO wants to activate the blockchain’s Stylus upgrade

VOTE: SafeDAO votes to make its SAFE token tradable

Post of the week

Pseudonymous crypto trader GCR made their first X post in almost a year over the weekend as Iran’s drone attack against Israel jolted the crypto market.

GCR is one of the most revered crypto traders on X, building a strong reputation by making numerous accurate predictions.

Whether you buy into their takes or not, GCR’s posts have the power to move markets and sway sentiment — so they’re definitely worth paying attention to.

What we’re watching...

GM

— Paolo Ardoino 🤖 (@paoloardoino) April 14, 2024

Tether's tokenisation platform will soon be available to everyone.

A masterpiece.

Fully non custodial.

Multi chain.

Multi asset type.

Super customizable.

+T

Tether CEO Paolo Ardoino hints at his firm’s new tokenisation platform.

The move comes on the back of BlackRock’s tokenised fund BUIDL, which has attracted almost $300 million on Ethereum.

Got a tip about DeFi? Reach out at tim@dlnews.com.