- Increased optimism that Ethereum spot ETFs will be approved is driving users back to Ethereum.

- Traders on Ethereum generated over $3.3 billion in volume on Monday, the highest since April 13.

- The total value of assets deposited in Ethereum protocols reached their highest levels since May 7, 2022.

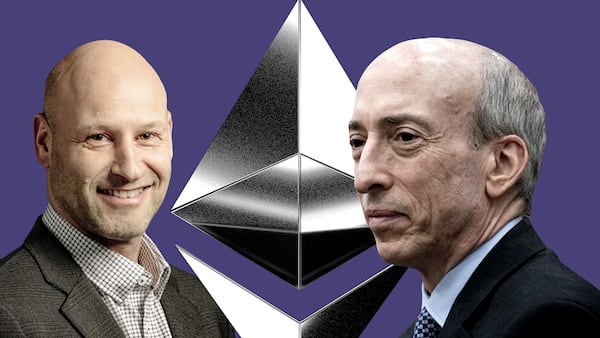

Traders appear to be anticipating approval of a spot Ethereum exchange-traded fund, after Bloomberg Intelligence analyst Eric Balchunas raised his odds of the Securities and Exchange Commission greenlighting the products to 75% from 25% on Monday.

The optimism has fueled a surge in activity on the Ethereum network as Ethereum trading volume skyrocketed to over $3.3 billion on Monday, the highest level since April 13 and a 157% increase from the day before.

Uniswap, the leading decentralised exchange on Ethereum by trading volume and total value of crypto assets deposited, saw its volume double on Monday from Sunday to $2.3 billion.

Similarly, on Curve Finance, the second-largest decentralised exchange, volume doubled to $576 million on Monday from the day before.

On Lido, a liquid staking platform, and EigenLayer, a restaking platform, the total value of crypto assets deposited rose by 21.6% and 22.7% respectively.

Increases or decreases in total value locked, or TVL, generally track the price of Ether, because a big portion of the TVL in Ethereum-based staking and restaking protocols is composed of Ether. Thus, as Ether’s price rises, the dollar value of the assets locked in these protocols increases.

However, looking at new inflows and outflows, Lido saw about $116 million worth of Ether exit the protocol, while EigenLayer benefited from $37 million in new deposits.

Overall, the total value of crypto assets deposited in Ethereum protocols reached $64.7 billion on Monday, its highest level since May 7, 2022.

Looking at volumes generated by bots on the messaging app Telegram, a rough proxy for memecoin trading, Ethereum marked its highest volume day since April 24 on Monday, generating $26.5 million in volume.

The average transaction fee on Ethereum, which hit its lowest level of the year at $1.70 on Saturday, spiked to $6.69 on Monday, marking a threefold increase.

Further underscoring the excitement around the Ethereum ecosystem, seven out of the top 10 protocols by revenue generated are predominately based on Ethereum in the last 24 hours.

Ethereum saw its largest daily USD increase on Monday, jumping $585. The momentum extended into Tuesday, with Ethereum recently up 3.2% to $3,777.

Adding to this optimistic outlook, the SEC indicated on Tuesday that it is leaning toward approving spot Ether ETFs, according to a report from Barrons. A decision from the regulator is expected to come on Thursday.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.