A version of this article appeared in our The Decentralised newsletter on July 2. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Crypto’s biggest names pile into MegaETH.

- Why Lido rallied after Jump Crypto’s leadership switch.

- A Solana DePIN project is challenging Google Maps.

MegaETH’s mega raise

You’ve heard of ETH, but what on earth is MegaETH?

That’s what many — myself included — thought when hearing the little-known project had just raised $20 million.

MegaETH is a new blockchain (yes, another one) that says it’s the first to operate in real-time.

This, it claims, means it can achieve “100,000 transactions per second with millisecond-level responsiveness.”

Proud to announce MegaETH's $20M Seed Round

— brother bing / 饼兄 Σ: (@hotpot_dao) June 27, 2024

MegaETH is the first Real-Time Blockchain, streaming transactions at 100,000 TPS with millisecond latency

Our mission is to turn cutting-edge ideas into everyday reality with fully onchain, interactive & sophisticated apps

✨Story… pic.twitter.com/aaWaNSqxNx

It can take up to 13 seconds to get transactions processed on existing blockchains like Ethereum.

Dragonfly Capital led MegaETH’s seed round.

I don’t know if MegaETH will live up to the hype. But a lot of well-respected industry figures certainly thought it was a good investment.

Angel investors include:

- Ethereum co-founders Vitalik Buterin and Joe Lubin.

- EigenLayer founder Sreeram Kannan.

- Crypto personality Jordan Fish, known online as cobie.

Some onlookers have compared MegaETH to Monad, another project promising speed and throughput improvements compared to the current generation of blockchains.

In April, Monad Labs raised $225 million in a round led by Paradigm.

Lido’s token rallies

Jump Crypto president Kanav Kariya’s resignation was a good thing for Lido’s LDO, apparently.

After Kariya announced his departure on June 24, LDO jumped some 7%.

The reason, onlookers said, is that under Kariya, Jump Crypto sold off more than five million LDO tokens in 2022 and 2023, depressing the asset’s price.

It is not clear whether Kariya was personally involved in Jump’s sale of LDO. He didn’t immediately respond to a request for comment.

“It’s a mix of a joke and somewhat true,” Will Sheehan, founder of crypto data platform Parsec Finance, said.

“Jump was selling Lido through 2022 and 2023, and sometimes in crypto a [crypto Twitter] joke becomes an actual negative narrative.”

Hivemapper’s token problem

Hivemapper, a Solana-based mapping project, has big ambitions.

It wants to overtake Google Maps, and it’s using token incentives to do so.

Like many so-called DePIN projects, short for decentralised physical infrastructure network, Hivemapper issues a token, called HONEY.

Those who use a dashcam to contribute to the project’s mapping service can earn HONEY.

Hivemapper CEO Ariel Seidman told DL News this incentive setup “can produce street-level imagery 20 to 100 times fresher than Google’s.”

But there’s a hitch.

Hivemapper is struggling to generate demand for its product — and thus demand for HONEY.

The token’s price is down 85% from its December peak.

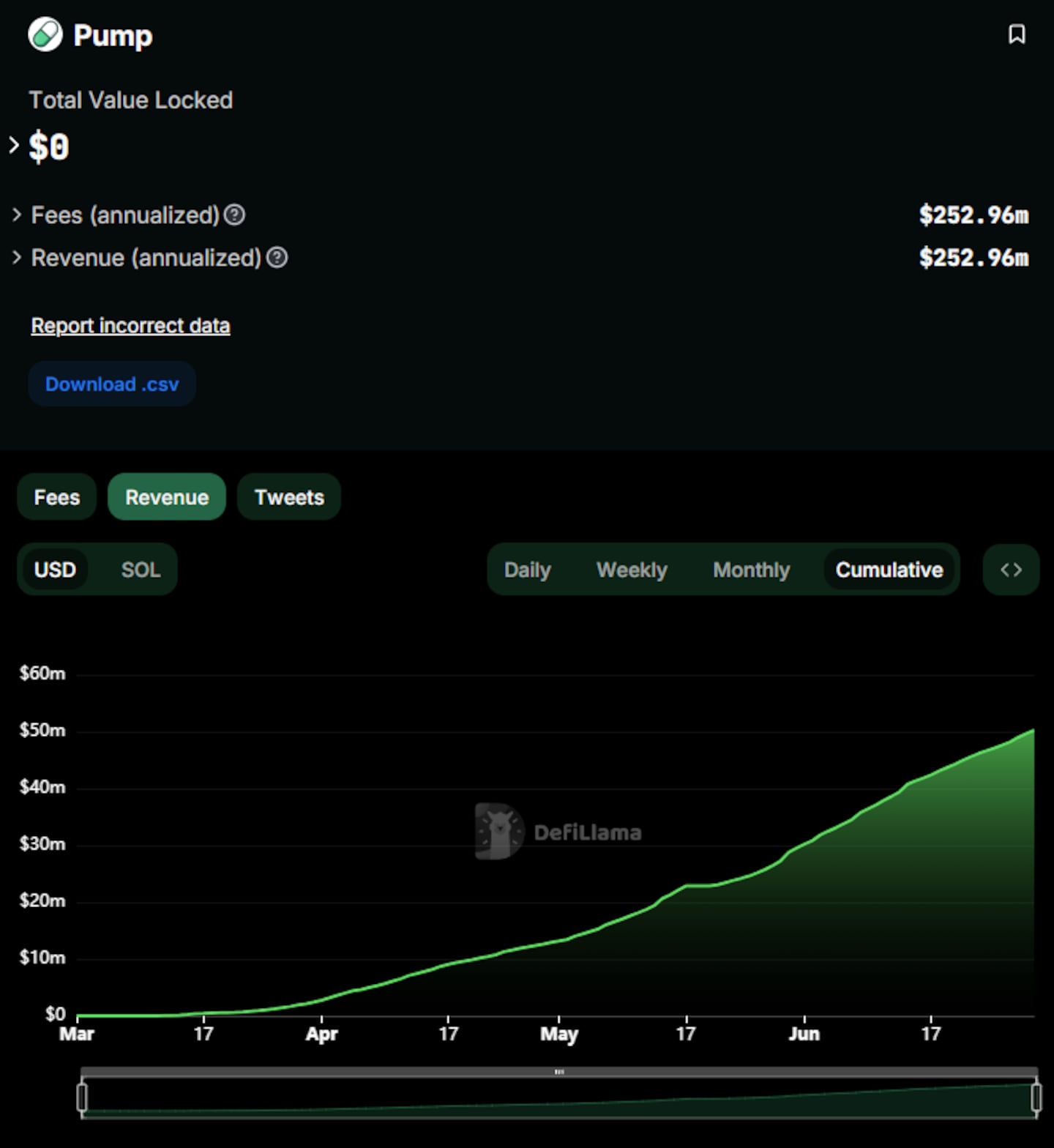

Data of the week

Solana memecoin launchpad Pump.fun crosses $50 million in cumulative revenue.

This week in DeFi governance

VOTE: GnosisDAO to finance new GnosisVC venture fund

VOTE: Lido takes next step in bringing stETH to Ethereum layer 2s

VOTE: Compound votes to launch USDT market on its v3 version

Post of the week

Ethereum co-founder Buterin pens a blog post on how to speed up transaction confirmation on Ethereum.

Epochs and slots all the way down: ways to give Ethereum users faster transaction confirmation timeshttps://t.co/lfCXrFm6A1

— vitalik.eth (@VitalikButerin) June 30, 2024

What we’re watching

We're currently witnessing the largest aggregate flow of LRTs to date

— Kairos Research (@Kairos_Res) June 27, 2024

Today/Yesterday we've had 396k ETH ($1.3bn+) outflows from Pendle alone.

The majority of this has just gone to EOAs + Multi-Sigs.

With all major protocols having their airdrop incentive programs coming to an… pic.twitter.com/b0Y00QGbM3

DeFi users are withdrawing Ether liquid restaking tokens from protocols at an unprecedented rate.

Got a tip about DeFi? Reach out at tim@dlnews.com.