DefiLlama developer 0xngmi shared seven notable charts that caught his eye in 2023.

0xngmi, who goes only by the pseudonym, collected and compiled data from DefiLlama for DL News.

Check out his charts, and reasoning behind them, below:

New Protocols

While DeFi market felt very much frozen and with no new activity during the past year, the number of new protocols that were joining has remained steady, although much lower than the peak during the DeFi boom.

See below:

You might think this is due to all the new layer 2s launching, which usually come with a bunch of new forked protocols being launched on each.

However, if we segment new protocols by forked/original we see that the ratio of original protocols actually increased significantly during the bear market.

That is, when market was slower and less hyped, the number of forked protocols that tried to ride the wave decreased, while the percentage of original protocols was high.

This might indicate that this is a good signal for froth.

Recently this ratio has dropped again.

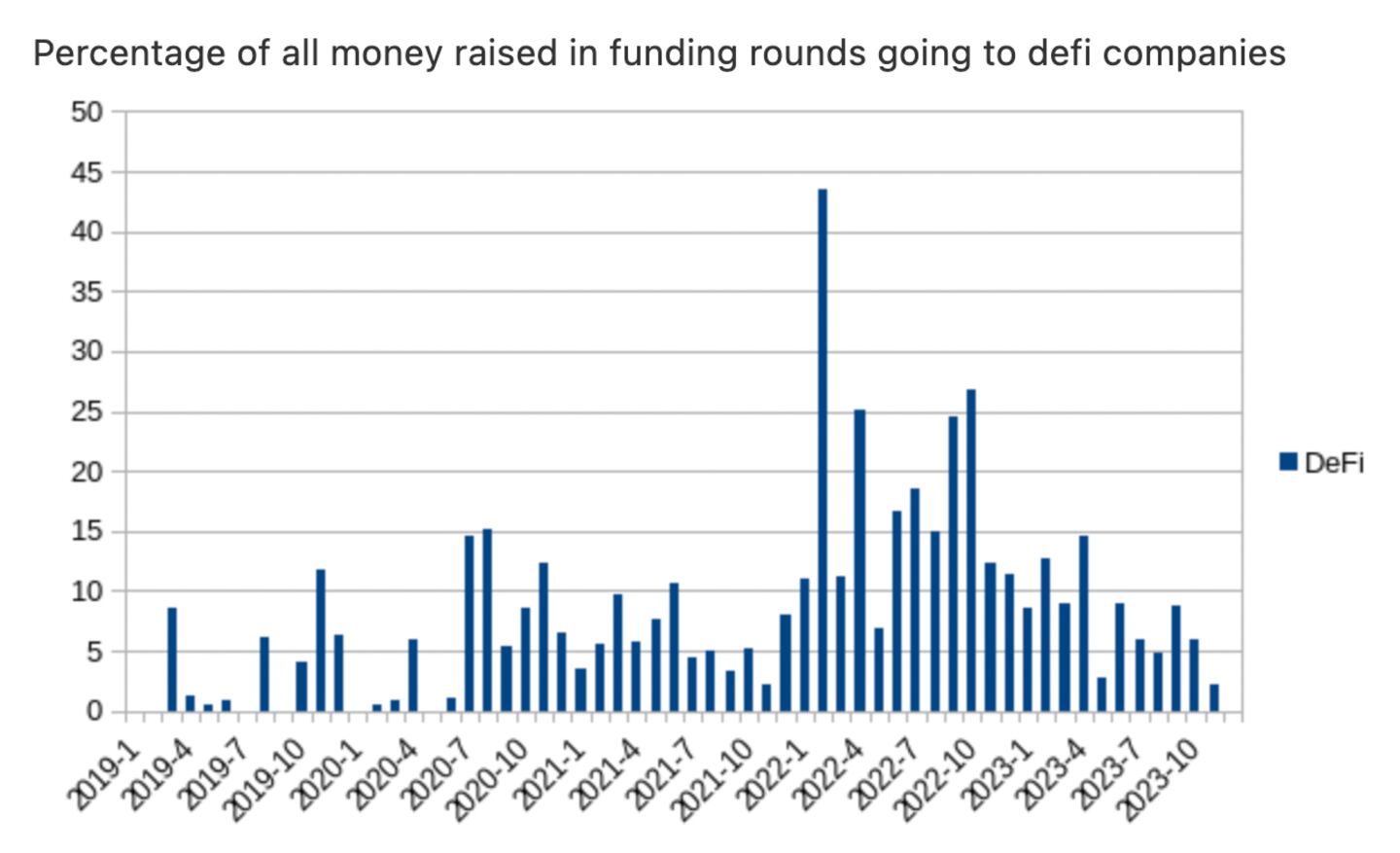

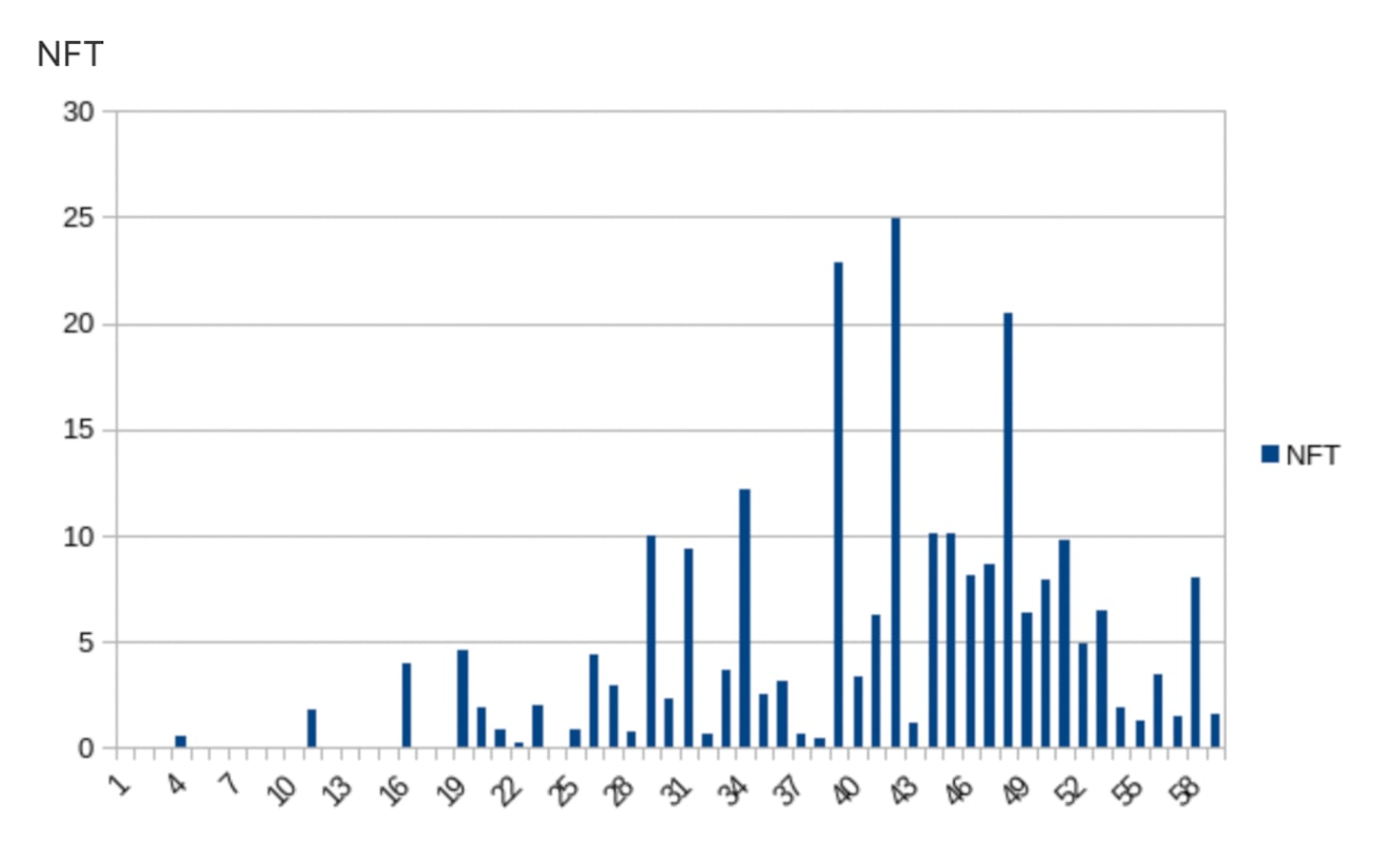

Funding

See below, the percentage of all money raised in funding rounds going to DeFi projects and companies ...

... and compare that with the percentage of raised funds going to NFTs:

Liquid Staking dominance

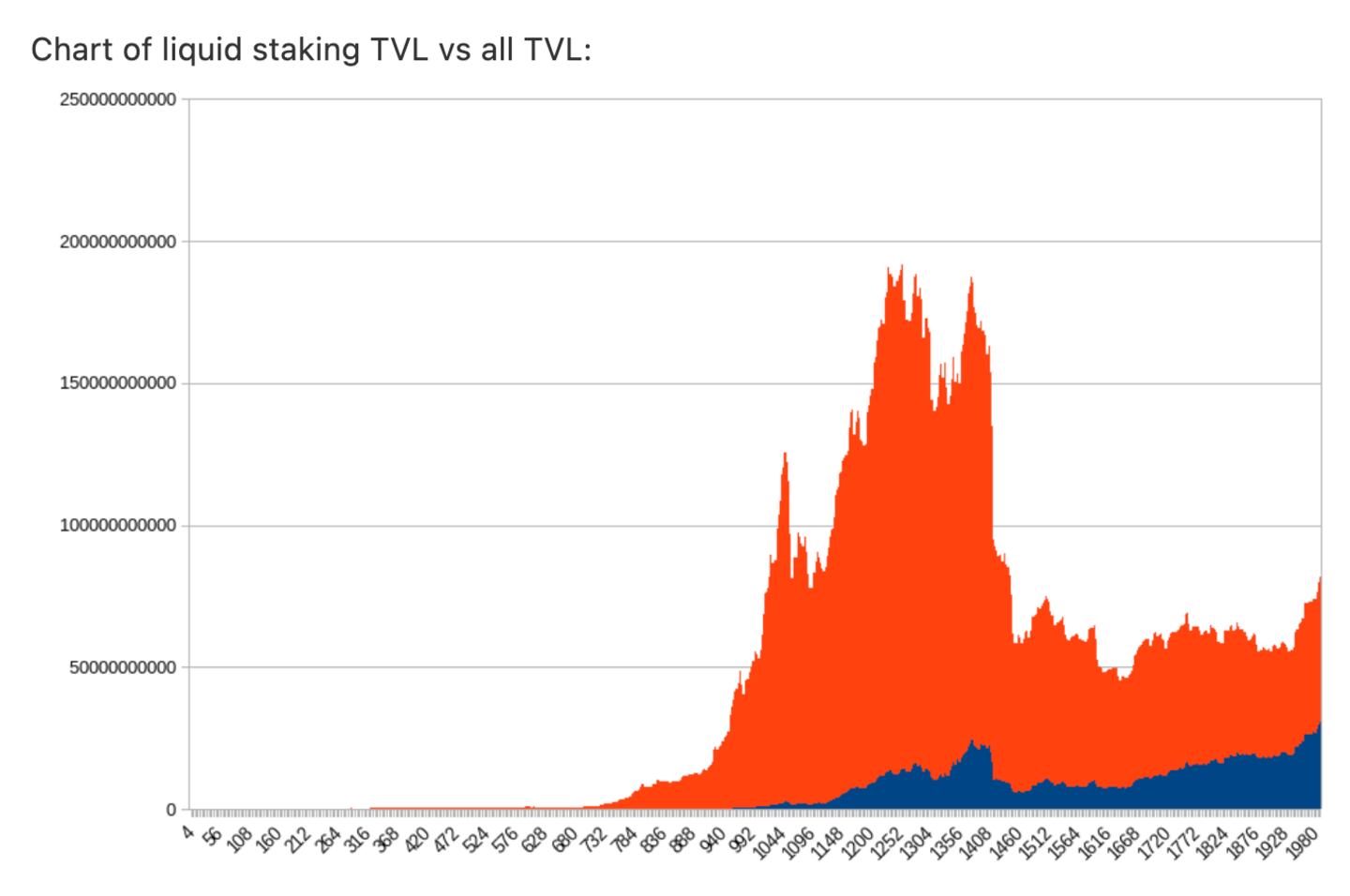

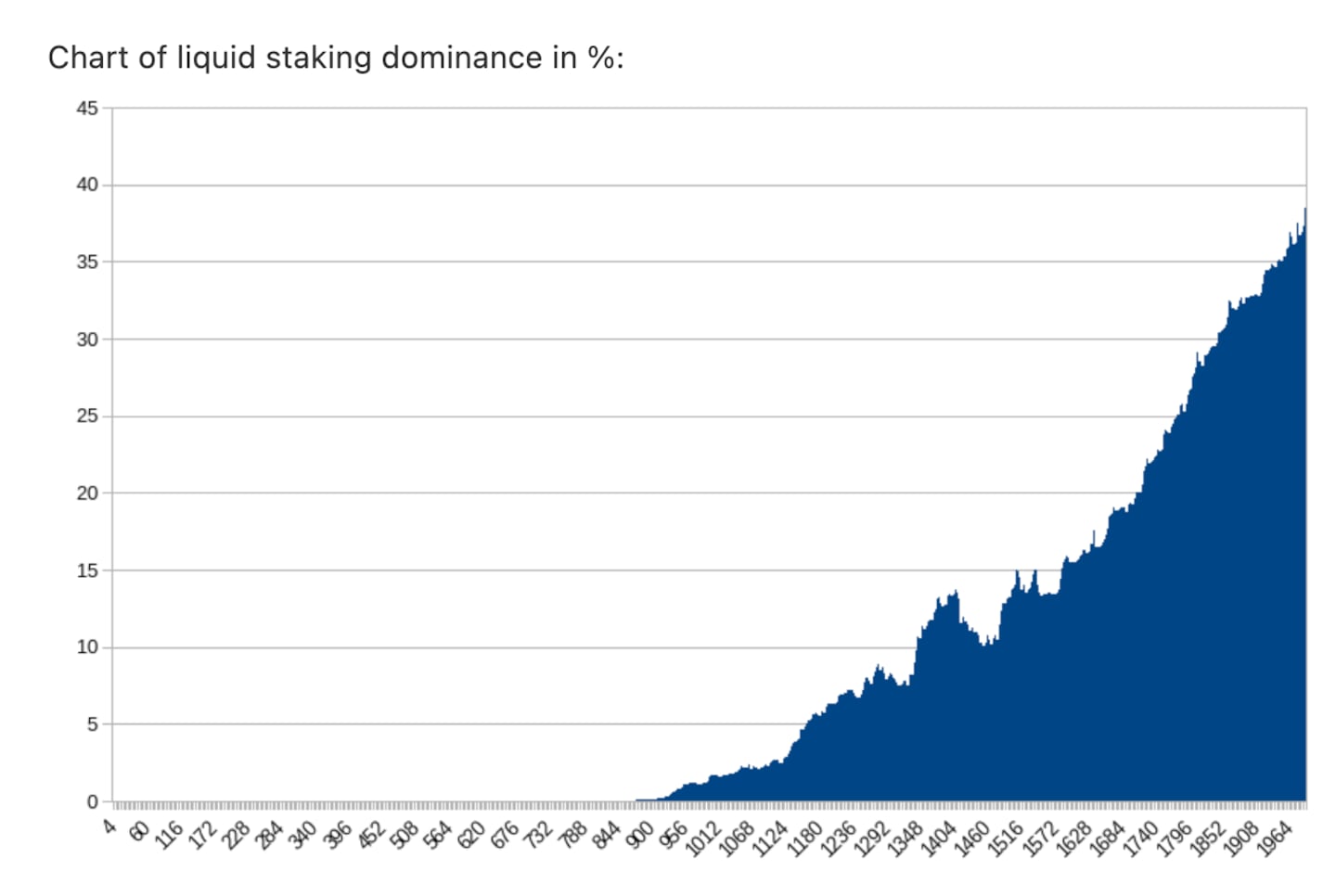

Liquid staking has completely dominated TVL rankings, completely displacing all other types of protocols, especially DEXs:

See the below chart chronicling the rise of liquid staking total value locked, in blue, versus all TVL, in red, since June 29, 2023:

Here’s that same data but charting liquid staking dominance in percentage terms, again since June 29, 2023:

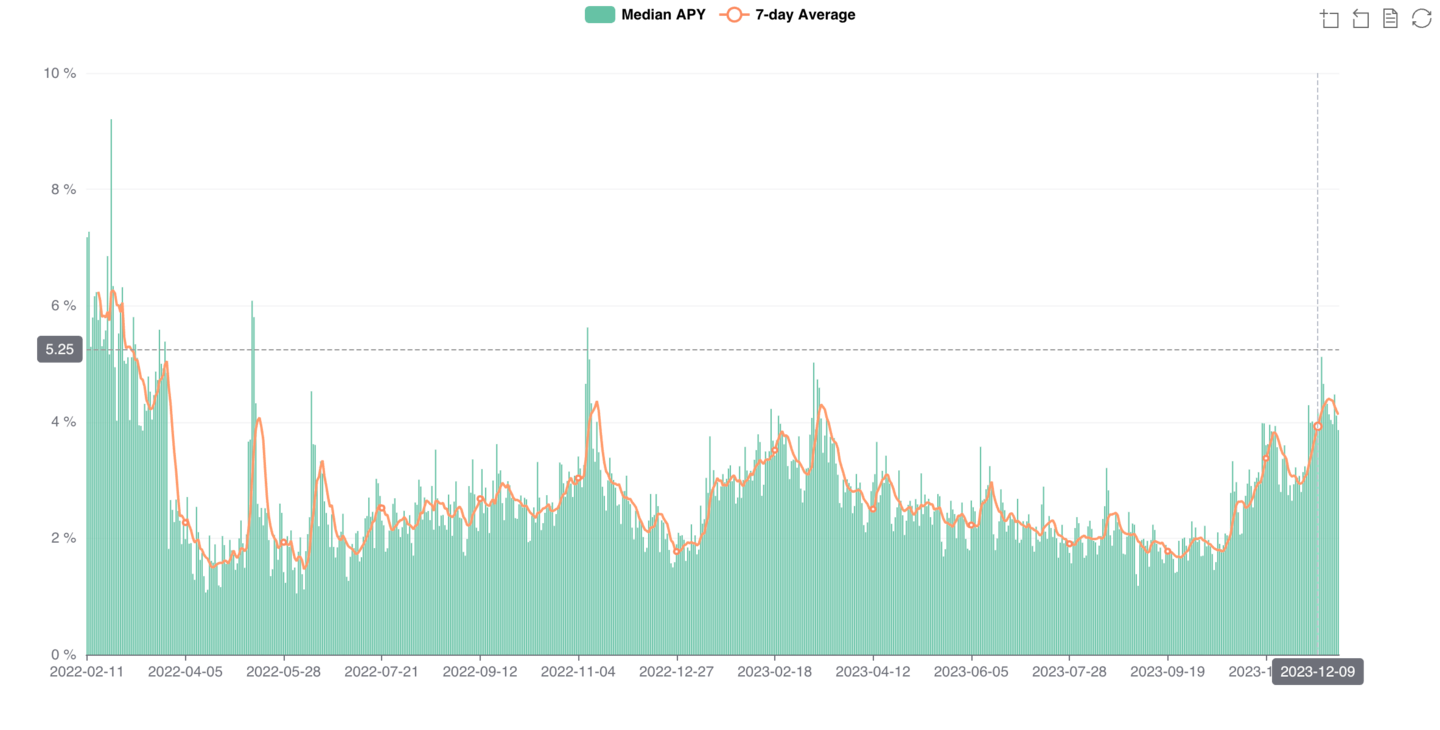

Yields

And notably, median yield is on the rise again.

Ana Ćurić contributed to this article.

Follow 0xngmi on X, @0xngmi. Find accurate DeFi data on our market aggregator defillama.com and tips on how to use DefiLlama at LlamaU.