A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here,

Here’s what caught my DeFi-eye recently:

- More and more projects are incentivising users with points.

- Inscriptions are breaking blockchains.

- Ledger suffers another security breach.

DeFi projects tease airdrops with points systems

As Aleks Gilbert writes today, the number of DeFi projects pushing points systems is reaching a fever pitch.

And if posts like the one below are any indication, DeFi users are getting pretty tired of them.

In crypto, points systems award users points for interacting with a protocol. The goal is to incentivise users to trade or provide liquidity, and hopefully kickstart a virtuous cycle of activity.

Users are happy to earn points because they believe, or are explicitly told, they will convert into valuable tokens at a later date.This strategy has worked well for NFT marketplace Blur, and more recently its affiliated Ethereum layer 2 Blast.

But gamification is not the only reason projects are churning out points systems.

Recent regulatory action from agencies such as the US Securities and Exchange Commission has made many DeFi projects wary of issuing tokens. The fear is that if a project issues a token — even a free one — it runs the risk of having that token classified as a security under US law.

But at the same time, DeFi projects don’t want to miss out on all the current excitement over airdrops.The solution? Launch a point system that signals that your project will launch a token eventually, while waiting for more regulatory clarity.

With this in mind, I suspect we’ll continue to see projects launching points systems over the coming year.

But unless the US provides regulatory clarity soon, new projects will likely opt to establish themselves away from the reach of the US legal system.

Inscriptions are out of control

Inscriptions, a relatively new way to create NFT-like assets, have just taken down multiple blockchains.

On Friday, Ethereum layer 2 Arbitrum was knocked offline for over an hour when users clogged the blockchain with inscriptions transactions.

The next day, another layer 2, zkSync Era, suffered a similar outage caused by inscriptions.

Layer 1 blockchain Avalanche also experienced sky high transactions fees over the weekend due to thousands of inscriptions transactions. At points, Avalanche became so congested that transactions cost users over $1,500 in fees.

That's why aliens don't use crypto.

— Junko Suzuki (@Junko__Suzuki) December 18, 2023

$1,600 gas fees on AVAX pic.twitter.com/2vozA5mW1Q

Inscriptions have surged in popularity for two reasons.

First, they’re new, and users are rushing to create and own the first inscriptions created on every major blockchain.

Second, some view inscriptions as superior to NFTs as all the data they contain is written onto the blockchain. Most NFTs, on the other hand, just link to data hosted offchain on decentralised file storage platforms like IPFS.

The blockchain outages caused by inscriptions lend themselves to the position among some Bitcoin developers that inscriptions should be classed as a vulnerability.

Ledger suffers another blow to its reputation

The crypto community has little love for hardware wallet provider Ledger this week after a hacker gained entry to the company’s systems and user malware to steal $600,000 from DeFi users.

The hacker phished a former Ledger employee then used the employee’s account to install a malicious version of software that helps Ledger wallet owners connect to DeFi apps.

When unsuspecting users were prompted to sign a blockchain message from the malicious software, it gave the hacker permission to drain tokens from their wallet.

Thankfully, the losses pale in comparison to other hacks this year.

However, the incident reflects badly on Ledger because of its position as a hardware wallet provider. It’s like a security company falling victim to the exact kind of attack its entire business is designed protect users from.

And it’s not the first time crypto users have rallied against Ledger this year.

In May, the firm drew public backlash over a new feature that would let its hardware wallets share encrypted and compressed versions of a user’s private key with three companies, Ledger, Coincover, and EscrowTech.

At the time, security researchers criticised the move and said it presented a potential security vulnerability.

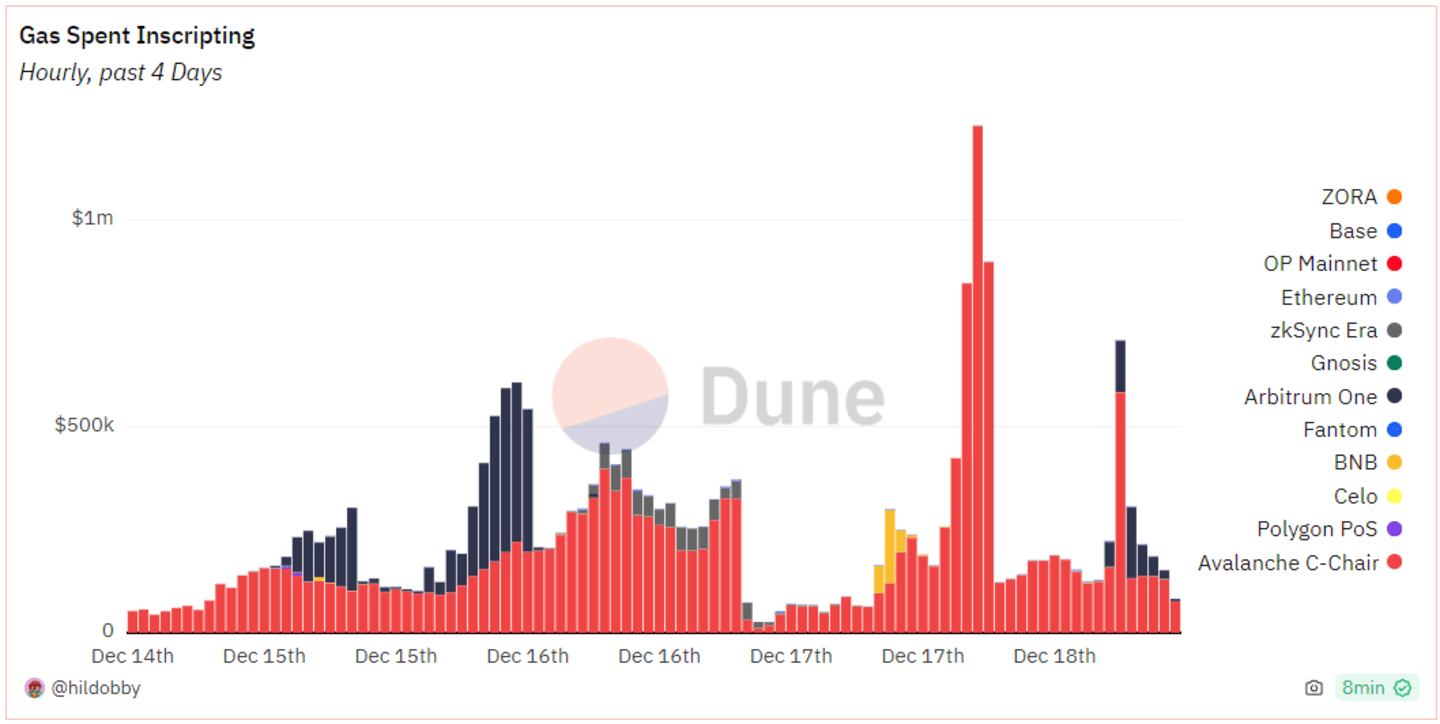

Data of the week

DeFi users are spending an absurd amount of money to create inscriptions. Over the past week, inscriptions transactions, at points, dominated activity on Avalanche, Arbitrum, zkSync Era and BNB Chain.

This week in DeFi governance

VOTE: Arbitrum funds new research and development collective

PROPOSAL: Aave to limit flashloans to governance-enabled entities

VOTE: 1inch funds services to help grow its ecosystem

Post of the week

DefiLlama builder @0xngmi expresses how ridiculous the current points meta is getting with a sardonic “Wolf of Wall Street” meme.

With so many projects launching points systems, the suggest one might try to launch vote-escrowed points isn’t as far-fetched as it should be.

vePoints pic.twitter.com/lQ0CoUWYZt

— 0xngmi (@0xngmi) December 13, 2023

What we’re watching

📣 Attention, restakers!

— EigenLayer (@eigenlayer) December 18, 2023

Global LST caps raised to 500k ETH! Exciting news as 6 LSTs join the EigenLayer ecosystem. pic.twitter.com/y4RNUH6zXL

Restaking protocol EigenLayer just raised the caps how many staked Ether tokens users can deposit. Last time EigenLayer raised its caps they were filled in less than 24 hours.

Got a tip about DeFi? Reach out at tim@dlnews.com.