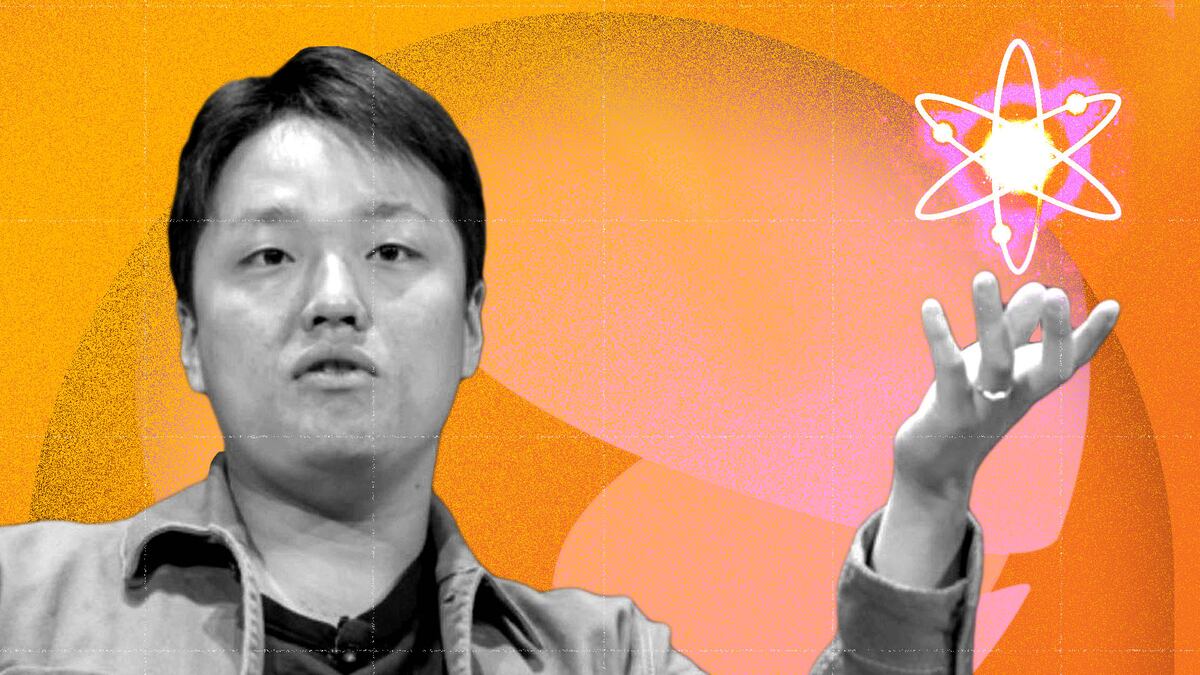

Do Kwon is staging a comeback after Terra’s $60 billion collapse. The disgraced CEO of Terraform Labs, whose stablecoin, Terra, collapsed last year, is working on several new products and bulking out his engineering department with new hires.

The CEO, wanted by his native South Korea while Interpol seeks his arrest, remains “actively involved in the day-to-day operations of the firm,” Zion Schum, Terraform Labs’ head of communications, confirmed to DL News.

This involves “all aspects of the strategy and direction of Terraform Labs across all products in development,” said Schum.

The rebound attempt from such a persona non grata in crypto is bold – even in an industry rife with second chances.

Terra’s implosion contributed to the bankruptcy of hedge fund Three Arrows Capital, as well as crypto lenders Celsius and Voyager. Terra relaunched its project shortly after the collapse of UST. The new blockchain used the same name but ditched the failed stablecoin – and prompted suspicions that Kwon could lead the market to yet another failure.

While Kwon’s whereabouts are unknown, South Korean prosecutors have said that Kwon has fled to Serbia. Schum declined to provide Kwon’s location and Kwon could not be reached for comment.

It’s an opportunity to work with ‘the most talented guy in DeFi’

To get the new chain going, the company is hiring for over a dozen roles, including a full-stack engineer and a smart contract developer.

Terraform Labs has posted several of these job vacancies after Terra collapsed last May. At least one developer has joined the company since, according to LinkedIn; the TFL spokesperson said that the company now has about 40-50 employees.

Earlier this month, Kwon personally discussed potential roles with an interested candidate, who told DL News that it was an opportunity to work with “the most talented guy in DeFi.” The TFL spokesperson declined to comment on Kwon’s involvement with hiring.

Terraform Labs’ grand vision

Despite the charges against Kwon, Terraform Labs’ grand vision rebuilds Terra as a multi-chain “layer 1″ protocol. The company is working on several projects in an attempt to grow the network.

In January, Terraform Labs launched an interchain wallet called Station, which has so far secured the support of about two dozen Cosmos-based blockchains.

TFL’s new wallet looks a lot like the wallet it produced for the old Terra network and adds support for other Cosmos chains. The TFL spokesperson said it plans to expand Station to Ethereum Virtual Machine chains in the near future.

In November, Terraform Labs said it was working on an economic module called Alliance. It allows holders of tokens from chains that have signed up to the Alliance to stake their tokens on another chain. This earns holders extra yields and secures both networks.

Participating protocols can choose, via a governance vote, which tokens to accept from other chains in the Alliance. Eligible tokens include native tokens and complex derivatives.

Tools from other networks, like Osmosis’s Superfluid Staking, perform somewhat similar services. Yet unlike Superfluid Staking, Alliance does not require stakers to become liquidity providers, sparing them from what’s called impermanent loss.

TFL’s purported innovation is that Alliance automates this process, and provides an economic incentive to split yields across blockchains. The ability to trade yields should “attract users, liquidity, and talent from other ecosystems,” said Schum.

The company plans to start rolling out Alliance next month. So far, five projects have said they will implement Alliance at launch.

Kwon’s third protocol, Feather, makes it easy to spin up new blockchains. These blockchains are backed by validators on the Terra blockchain that opt into Feather, and come with tools like a blockchain explorer and interchain wallet.

After this month’s spate of announcements, the price of Terra’s coin, LUNA, shot up from $1.29 to highs of $2.50, data from CoinMarketCap shows. The coin is currently worth about $2.05.

Part of the hike could be explained by the rising price of Bitcoin, which rose from $16,669 to $23,282 in the same period.

But few people are using Terra, even after the announcements. A dashboard on Flipside Crypto counts just 12,868 users.

And after Terra collapsed because of its poor design, of concern is whether TFL’s new tools are any good.

Hyungsuk Kang, who worked as a software engineer for Terraform Labs in the second half of 2020 before setting up his own stablecoin protocol, told DL News that TFL employees at the time were inexperienced in blockchain development.

Kang said many TFL employees internally discussed the likely failure of their project. That was under Kwon’s leadership, sparking concerns about his return to the TFL, Kang said. Schum declined to comment on the level of experience of TFL employees in the early days of the company.

‘I don’t think he can repair his image’

Terra may have been Kwon’s second attempt at an algorithmic stablecoin. Kang and other former TFL employees allege that Kwon was behind Basis Cash, a resurrection of a failed algorithmic stablecoin called Basis that had raised $133 million before closing in 2018. The TFL spokesperson declined to comment on these allegations.

Alongside running TFL, Kwon must navigate his legal troubles. Serbia does not have an extradition treaty with Kwon’s native Korea but both have previously agreed to requests under the European Convention on Extradition.

If Kwon were extradited, legal experts say he could file a legal complaint against Serbia, potentially giving him several years before he has to return. At least two Terraform Labs employees live in Serbia. Neither responded to requests for comment from DL News.

That could give Kwon enough time for another bull run – and another chance to attract novice investors who are unaware of the industry’s prior failures.

“I don’t think he can repair his image,” Doo Wan Nam, Korean co-founder of blockchain node validation company Stable Node, told DL News. “It’s not that [Koreans are] forgiving. It’s more that they are forgetful.”