- Coinbase will integrate decentralised exchanges into its app.

- Users will be able to trade any crypto token.

- CEO Brian Armstrong had previously complained the company couldn’t keep up with the proliferation of crypto tokens.

Coinbase will integrate decentralised crypto exchanges into its mobile app, letting traders buy and sell virtually every crypto asset, rather than the hundreds it currently offers.

Coinbase’s long-running centralised exchange — owned and managed entirely by the company — only lists tokens that pass a “rigorous vetting/review process that evaluates assets against legal, compliance, and technical security standards,” its website states.

As of Friday, Coinbase listed 299 different crypto assets for trading, from major cryptocurrencies such as Bitcoin, Ether, and Solana, to volatile memecoins such as Peanut the Squirrel, Gigachad, and Dogwifhat.

But creating new tokens requires little effort, and millions exist in the world of decentralised finance.

Decentralised exchanges operate automatically, without human intervention, and use blockchains for settlement of transactions. They have no listing standards, and any user can create a trading pair featuring any two digital assets.

“We’ve seen millions of assets get created and traded on decentralised exchanges, but only few people have been able to navigate those decentralised exchanges to access and trade the assets that they want,” Max Branzburg, Coinbase’s head of consumer and business products, said at a company conference in lower Manhattan Thursday.

“Coinbase will be going from one asset 13 years ago in Bitcoin to hundreds of assets today to soon having every asset onchain available to trade in the Coinbase app by default.”

Coinbase will begin with decentralised exchanges on its in-house blockchain, Base, but will eventually expand to other blockchains, Branzburg added.

Decentralised exchanges on Base include Aerodrome and Uniswap.

Allowing users to trade virtually any token in the Coinbase app presents a potentially lucrative opportunity for the company.

At one point during last year’s memecoin craze, Pump.fun, a meme coin generator on the Solana blockchain, took in more daily revenue than the entire Ethereum blockchain.

“We will apply our standard simple trading fees on DEX to match trades on our centralised exchange. No additional network or gas fees will be charged for DEX trading at launch,” a company spokesperson told DL News.

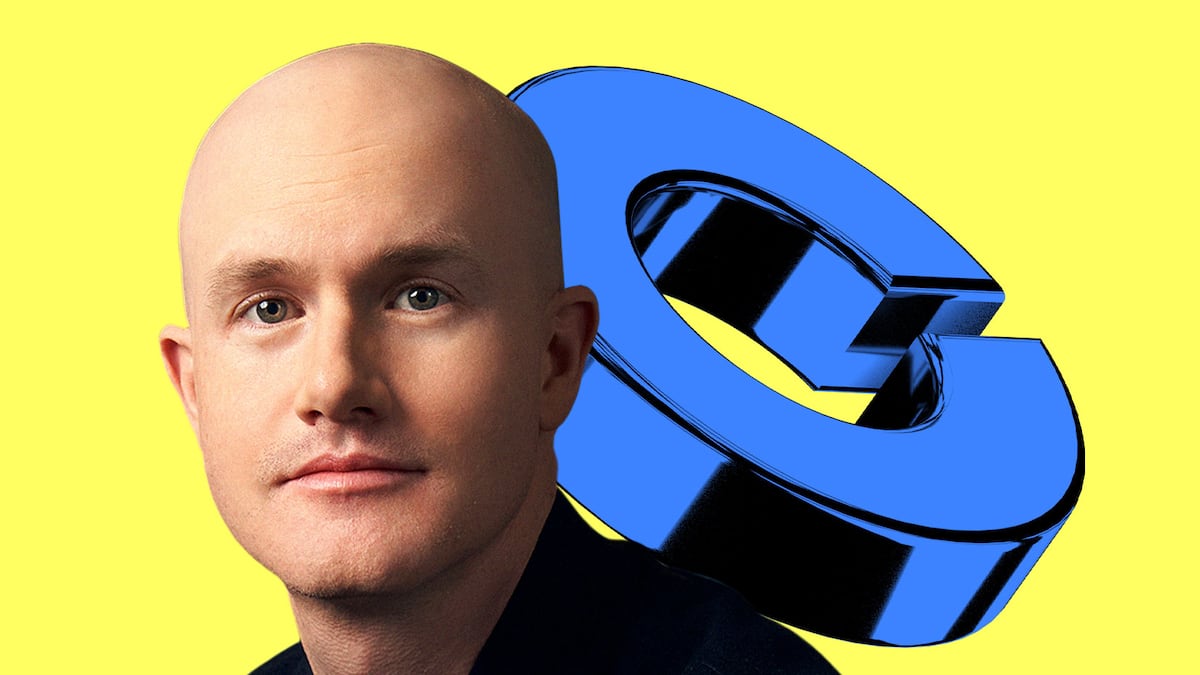

Earlier this year, Coinbase CEO Brian Armstrong called for a radical overhaul of the exchange’s token listing process, citing the overwhelming pace of new token creation.

About one million tokens are being created each week, Armstrong said, making Coinbase’s evaluation process unsustainable.

“We’ve listened to your feedback on how late we can be to list an asset on Coinbase, which is where the speed of listings on DEX will empower both builders and traders with the trust and efficiency of our CEX alongside quicker turns based on market demand,” the spokesperson said.

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.