- Arbitrum is flexing its muscles not only with other layer 2s but with the Ethereum mainnet.

- Ethereum layer 2s have more locked deposits than other layer 1 networks.

- Growth milestones for layer 2s are bullish signals for Ethereum.

In yet another indication of ballooning adoption of Ethereum layer 2 blockchains, Arbitrum — the biggest of the lot in terms of market capitalisation — has achieved a major milestone, surpassing the Ethereum mainnet.

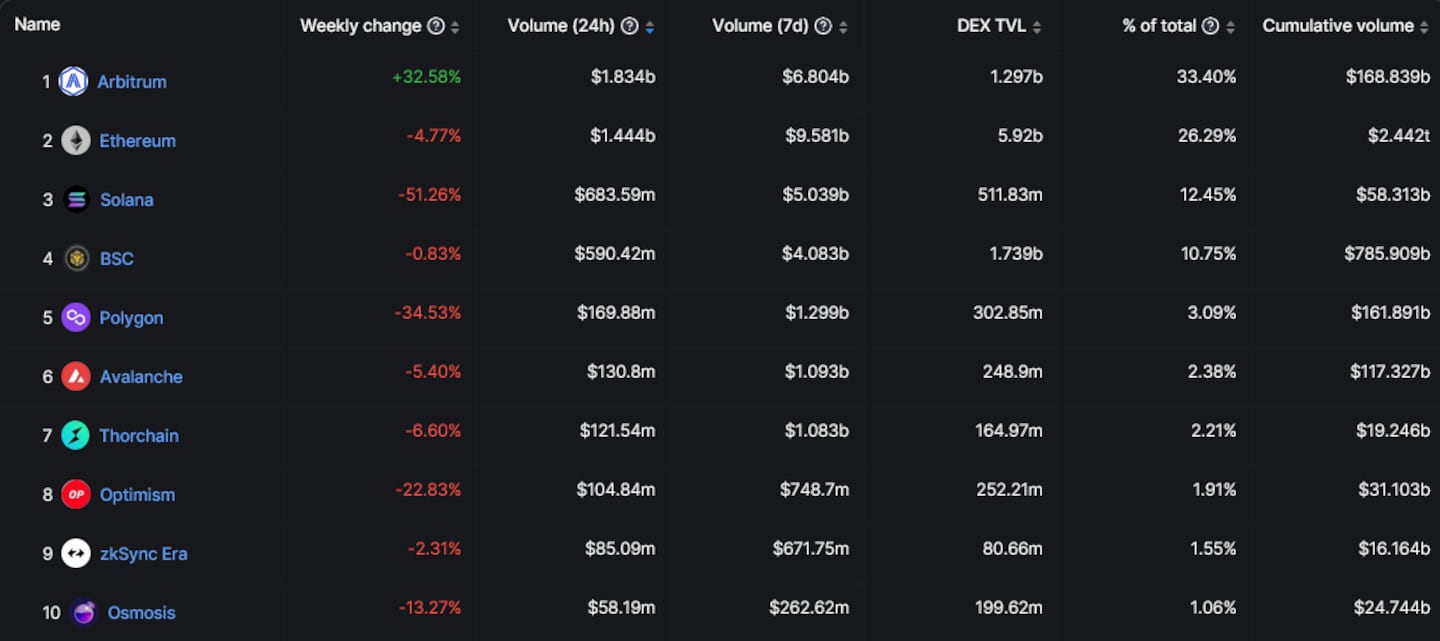

On Thursday, decentralised exchange, or DEX for short, trading volume on Arbitrum exceeded that of the Ethereum mainnet — a first for Arbitrum or any layer 2 blockchain for that matter. Arbitrum’s DEX volume totalled $1.8 billion, surpassing Ethereum’s by almost $400 million, DefiLlama data shows.

Ethereum layer 2 networks like Arbitrum help to scale Ethereum while relying on its mainnet’s security architecture.

For a layer 2 to surpass its mainnet in any metric is quite the feat, it comes amid a growth peak for the blockchain. Arbitrum has hit a trifecta of all-time highs in the last week — TVL, DEX volume and the spot price of its native token ARB have reached all-time highs.

TVL, or total value locked, is a measure of the investments locked in a blockchain or DeFi protocol.

Arbitrum’s TVL spike means the network leads the way in the net inflow of investor funds among all layer 2 blockchains with $365 million in the last seven days. Ethereum still leads the way in this metric with $705 million, according to DefiLlama.

While these milestones point to significant user-adoption gains, Arbitrum is not without its issues. The blockchain has suffered a few outages, the most recent of which occurred in December.

These outages have been caused by problems with the blockchain’s Sequencer — a part of the network used to verify, organise, and transfer transaction bundles to the Ethereum mainnet for finality.

Arbitrum’s Sequencer is not the only one of its kind that suffered a temporary failure. ZkSync, another Ethereum layer 2, faced a similar problem last Christmas.

Apart from Arbitrum’s recent gains, Ethereum’s layer 2s have been experiencing a period of significant growth. At $20.7 billion, their combined TVL is greater than that of all other layer 1 networks, excluding Ethereum, which stands at $19.7 billion.

Apples and oranges

There is, however, one important caveat with the TVL valuation as it compares figures from two sources — L2Beat for layer 2 networks and DefiLlama for so-called layer 1 blockchains.

L2Beat’s combined $20.7 billion figure includes not only investor deposits but the market value of the native tokens of these layer 2 networks. In comparison, the reported TVL for layer 1 networks — $19.7 billion — only encompasses the value of investments tied up in their respective decentralised finance markets.

ZkSync and Arbitrum have even managed to handle more transactions than Ethereum in the last 30 days, data from L2Beat, a layer two tracking portal, shows.

Blessing in disguise

While these achievements suggest some layer 2s are knocking Ethereum off its perch, this does not necessarily imply a negative impact on the mainnet. In fact, the opposite may be true, as these developments are contributing to positive economic outcomes for Ethereum.

For one, these milestones mean more money for Ethereum validators.

Layer 2 networks pay fees when rolling up their bundled transactions to the Ethereum mainnet for finality — the process of making transactions irreversible, which ensures the blockchain maintains immutability.

Apart from increased validator earnings, the layer 2 transaction uptick is also contributing to mechanisms designed to induce deflation for Ether token supply.

Ethereum also has a deflationary mechanism brought on by a network upgrade in August 2021. This upgrade, EIP-1559, made changes to Ethereum’s fee structure with a portion of the transaction fee burned, thus reducing net Ether token inflation.

Three of the top-10 fee burners are currently layer 2 networks, according to data from Ethereum explorer Etherscan.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.